Close Info Window

Dinii

Dinii is a software company that designs digital ordering platforms for restaurants and local take-out shops.

Bryan Wu is a partner based out of Hong Kong. He primarily evaluates software, internet, and technology companies in Asia.

Prior to joining Bessemer, Bryan spent over a decade as a managing director at CPE, an alternative asset manager with an extensive presence in China. During his time at CPE, Bryan focused on investing in technology, software, and internet companies including Didi, JD Health, Ganji, Ele.me, WeBank, Bytedance, Jing-Jin Electric, AsiaInfo, Tencent Music, and many more.

Bryan started his career at Startec Global Communications and has since held various positions at the intersection of technology and investing at companies like Globespan Capital Partners, McKinsey, and Legend Holdings.

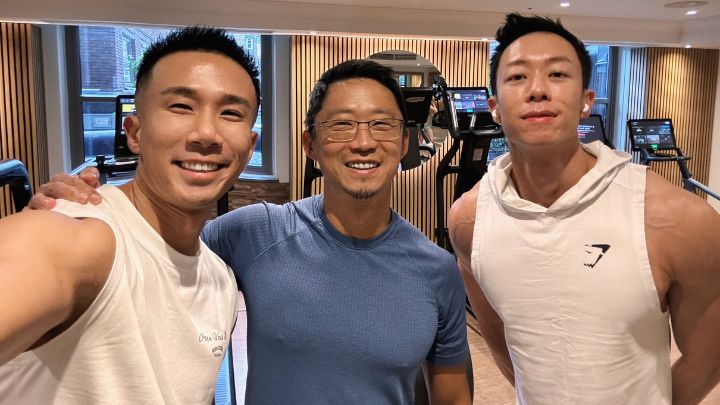

Bryan earned his bachelor’s in economics from the University of International Business and Economics and an MBA from Harvard Business School. He religiously exercises everyday, likes to snowboard, and absolutely loves tennis.

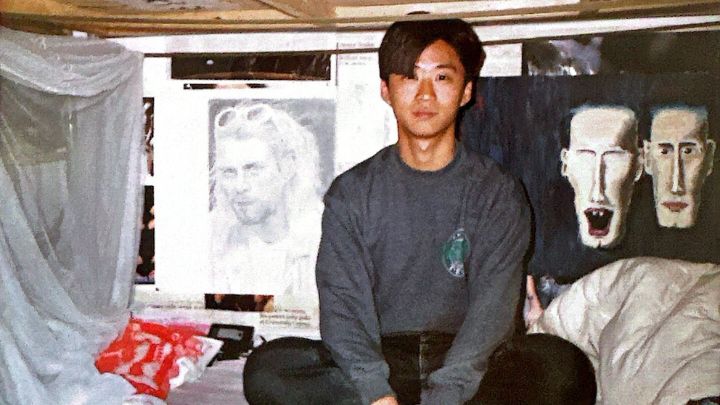

Growing up in China, Bryan wasn’t your typical high school student and often skipped afternoon classes to meander through Beijing’s biggest music trade shows. There, amidst the booths of international labels, Bryan would watch hours of music videos, soaking in the sights and sounds of Madonna, Bon Jovi, and Guns N’ Roses in a place where few people had heard of them. It was Bryan’s way of satisfying a deep-seated curiosity about the world beyond China’s borders.

Bryan is drawn to atypical thinkers who challenge the status quo. Known for his analytical rigor and outspokenness, he’s not afraid to ask challenging questions or offer dissenting opinions when it comes to important business decisions. With his endless curiosity, Bryan thrives when exploring new areas and forming personal relationships with founders who are changing the world.

Bryan saw early potential in Didi, the Chinese equivalent of Uber back when it was still pre-revenue and doing only about 100,000 taxi rides a day. Despite the regulatory uncertainties and skepticism about the market size, Bryan believed in the founder’s vision and the platform’s potential to unlock significant economic and social value, and decided to become the lead investor in Didi’s Series C. Bryan helped advocate for Didi’s merger with competitor Kuaidi, recognizing the long-term benefits of the opportunity despite the short-term dilution concerns. Today, Didi has grown into a global mobility platform facilitating over 30 million rides daily and has fundamentally changed how people get around in cities across China and South America.

Klook, an online travel experience booking platform in Asia, not only survived but thrived through COVID-19 lockdowns under the guidance of its founders. Bryan recognized the untapped potential in the travel booking vertical, which was still largely offline and ripe for digital disruption. His personal experience as a customer of Klook, which he used to book his family’s New Zealand trip activities, further solidified his belief in the company’s value proposition. He led Klook’s Series E2 in 2023.

Bryan is obsessed with tennis, finding fascinating parallels between its strategic elements and his work as an investor. For Bryan, tennis isn’t just about physical prowess; it’s a mental challenge that involves probability and decision-making, much like evaluating investment opportunities. Despite being a beginner, his competitive spirit shines through as he embarks on a friendly crusade to compete against his neighbors and friends on the court.