The Rise of Cloud AI in India 2024

As the generative AI era unfolds, India’s software market has new growth opportunities––including AI-enabled services and cybersecurity––where it is positioned to win on a global stage.

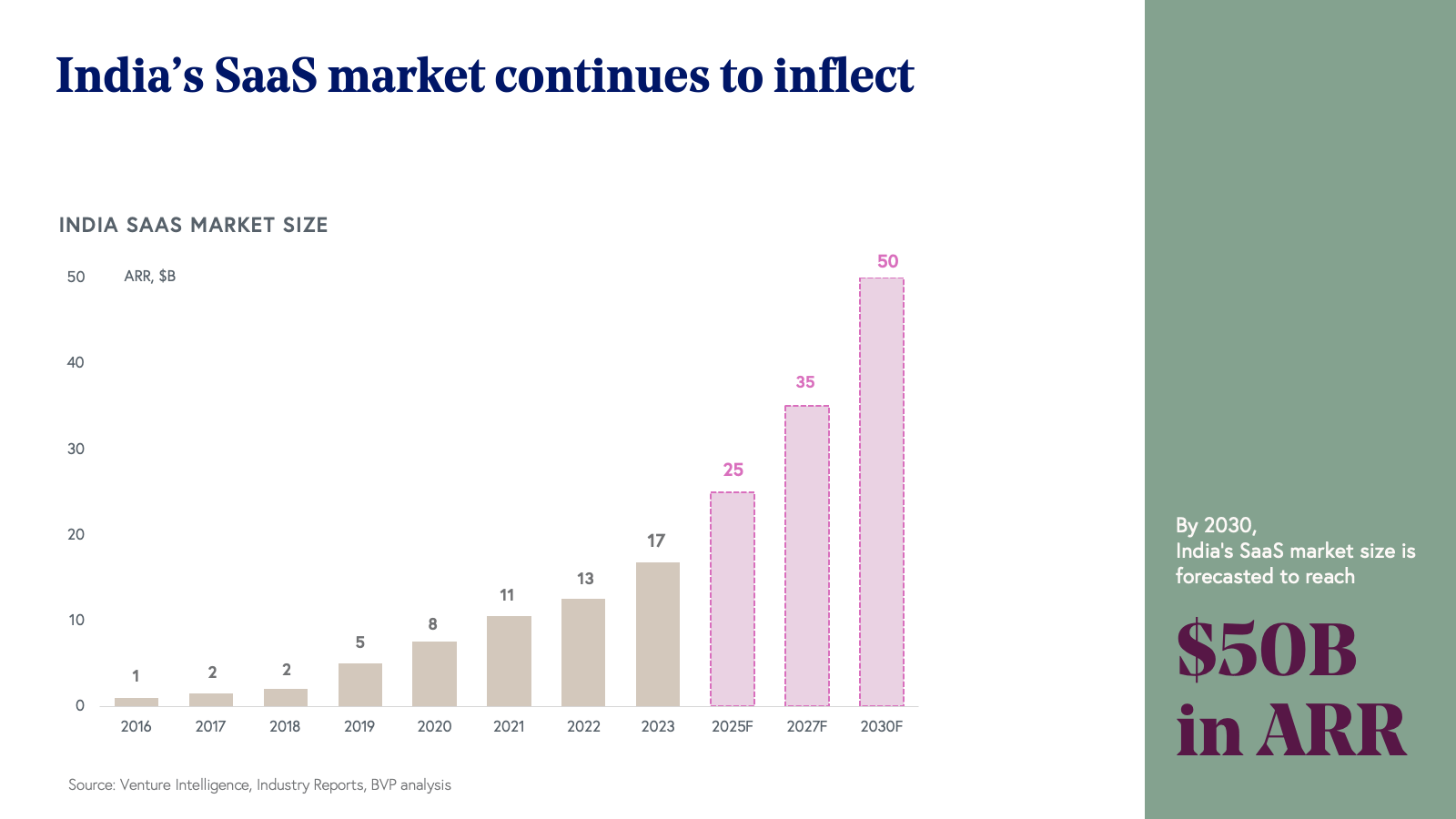

India’s SaaS market has reached a critical juncture in its growth trajectory. Last year, we predicted that the India software-as-a-service (SaaS) ecosystem would reach $50 billion of annual recurring revenue (ARR) by 2030; this estimation now seems conservative in light of the rapidly developing artificial intelligence (AI) era. We believe the India SaaS market is well positioned to generate 3x as much revenue by 2030 as it does today, largely driven by the rapid acceleration of AI technology.

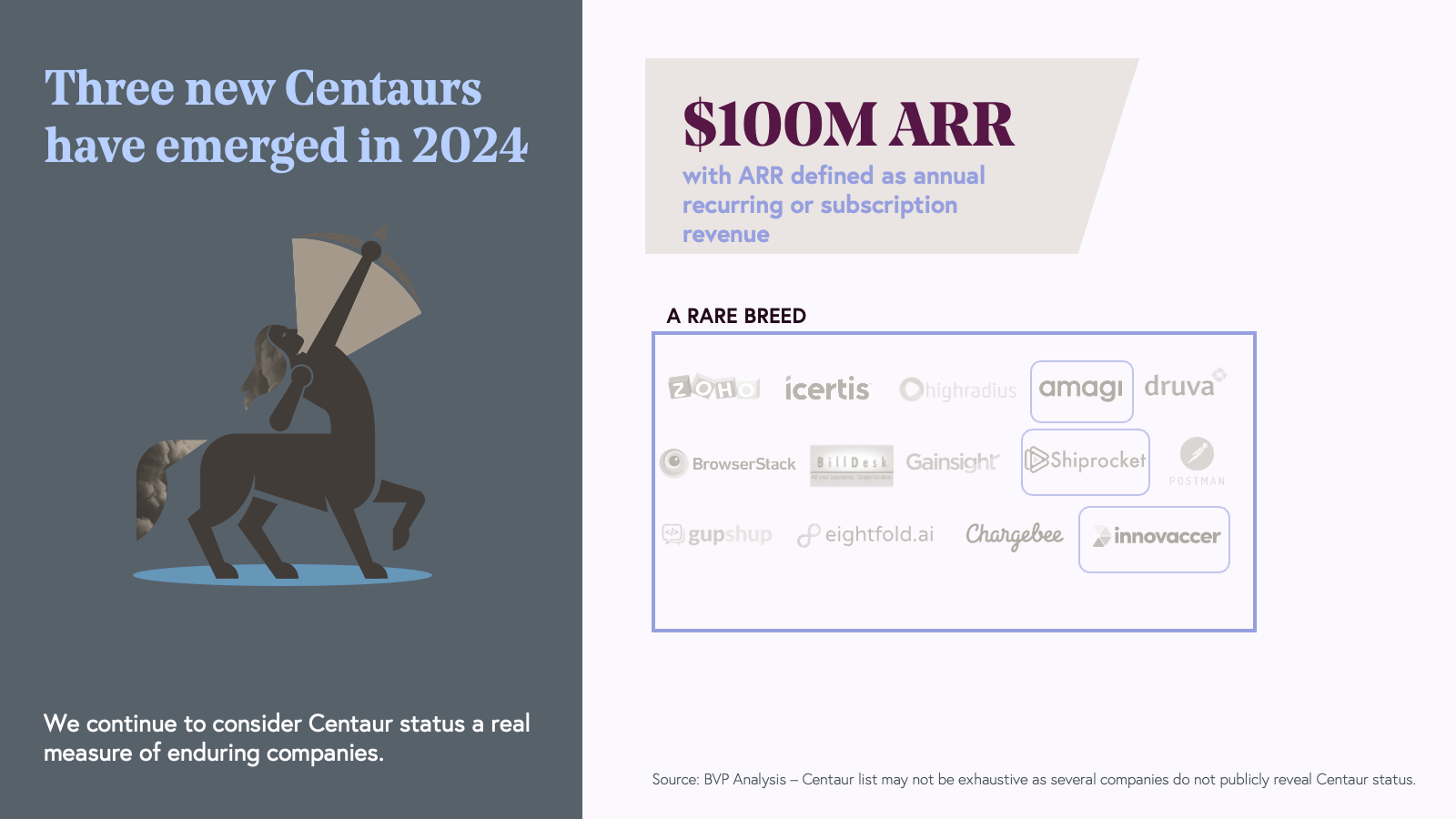

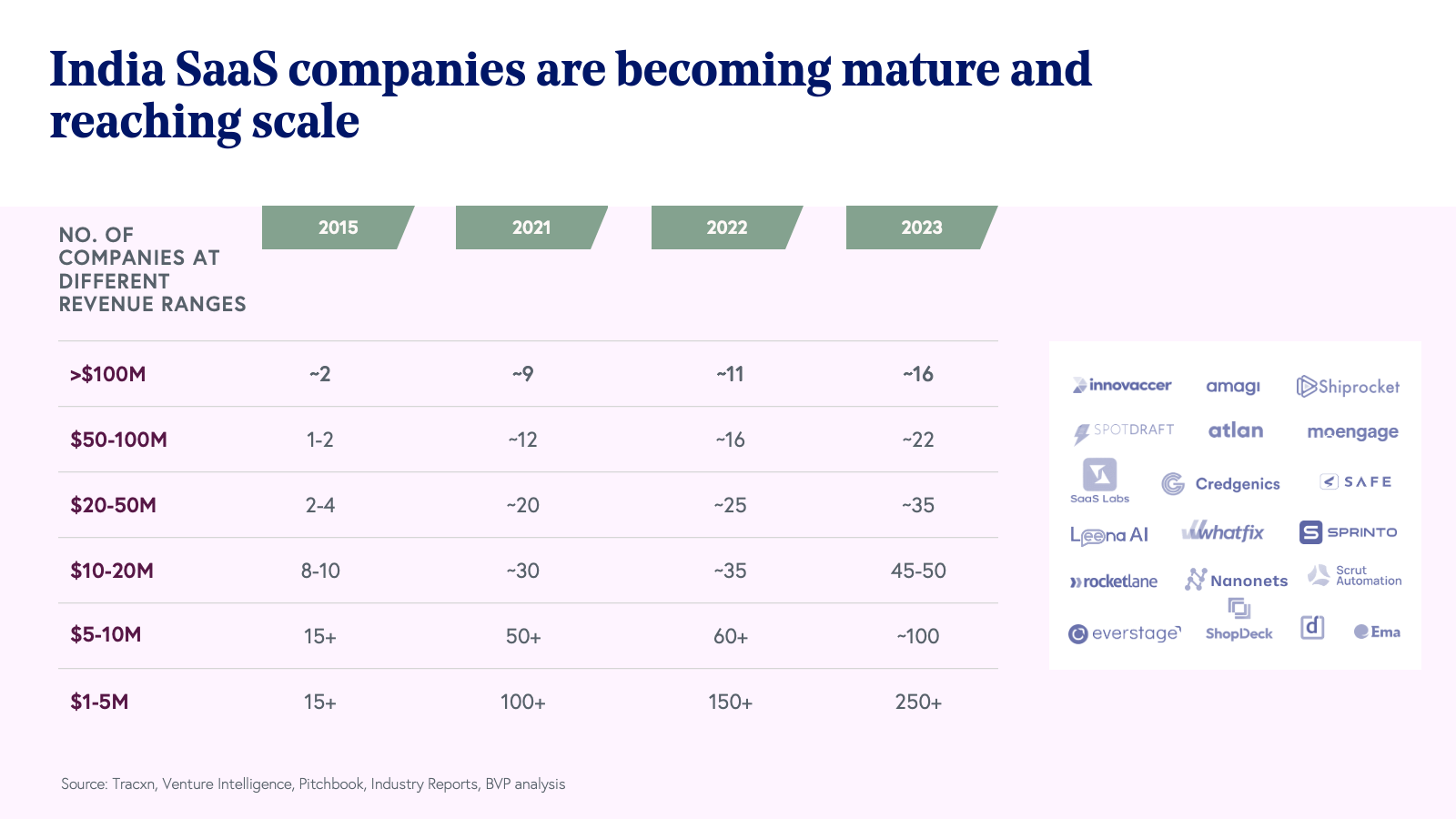

We see two major signals supporting this 2030 goal: Indian Centaurs, businesses that reach $100 million ARR, and unicorns, businesses with $1+ billion valuations, are well-positioned to add $20 billion to $25 billion in new revenue by 2030, based on our analysis. As AI technology makes rapid advancements, it’s possible India SaaS entrepreneurs building with AI will surpass this figure, ushering in an era of unprecedented growth and innovation for the region’s cloud economy.

India SaaS in 2024

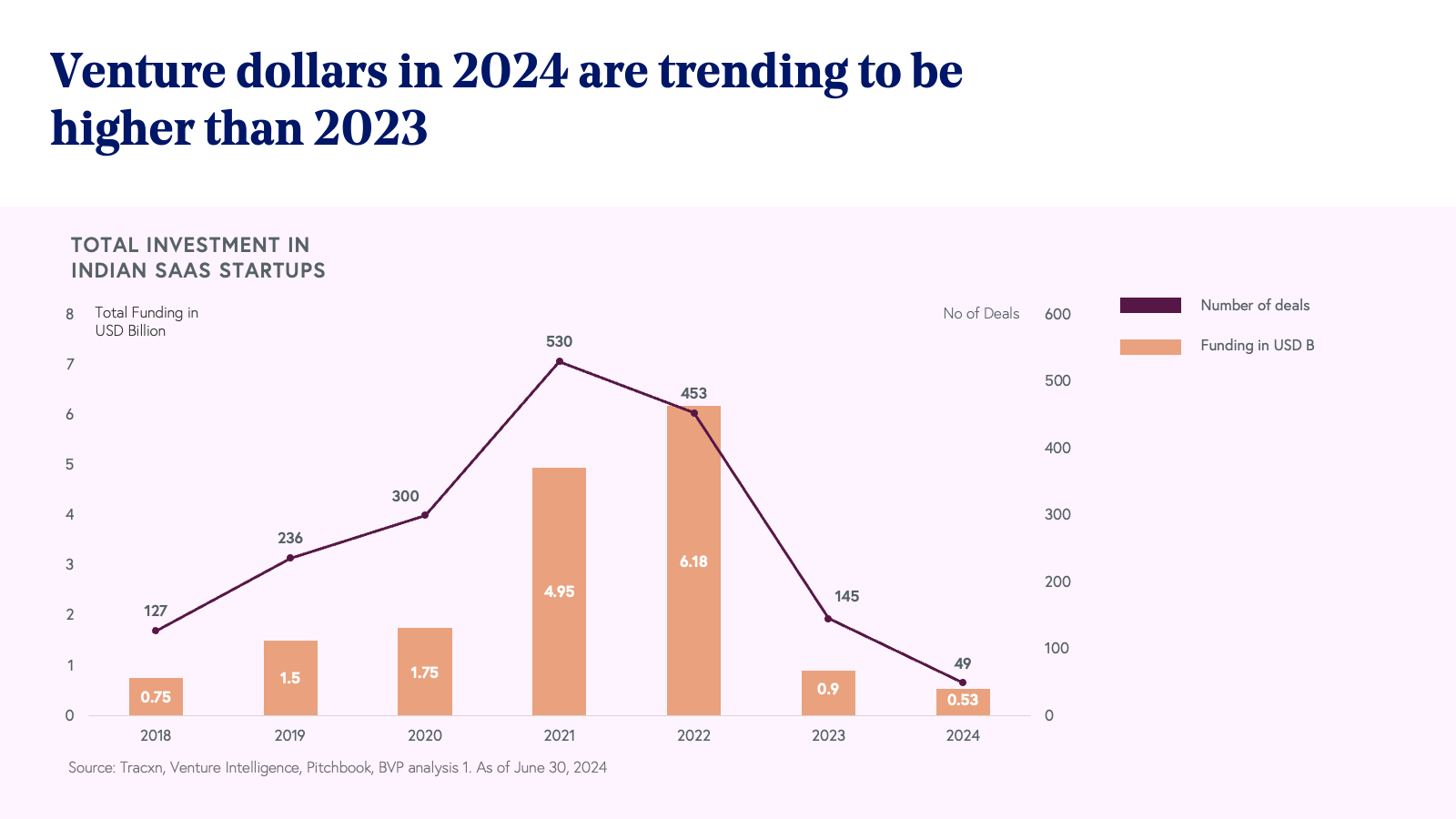

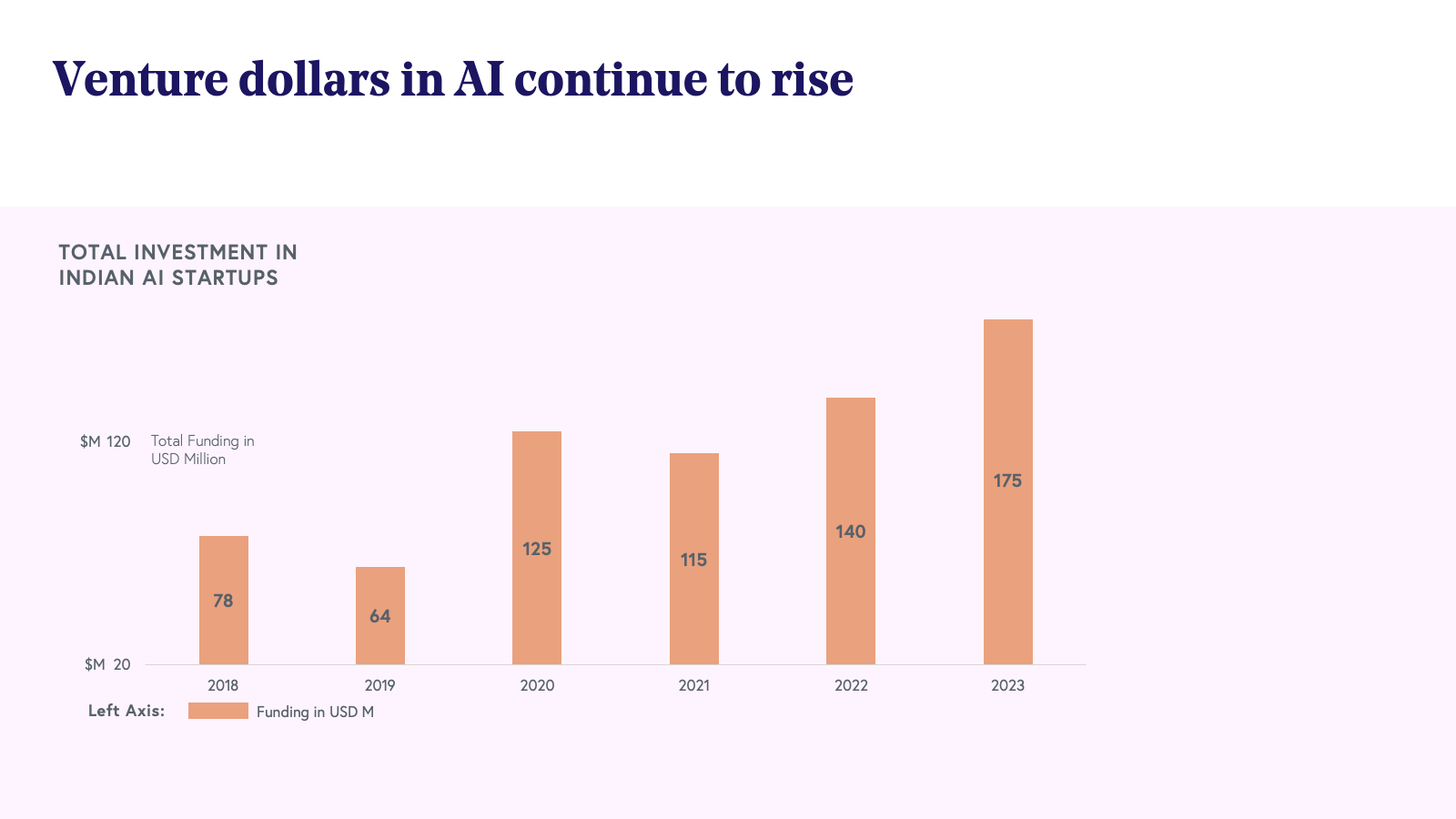

The global venture landscape has significantly recalibrated since its 2021 peak and subsequent reset. While global funding levels have moderated from the historical high of $6 billion in 2021, we're seeing encouraging signs of recovery. 2024 is poised to exceed 2023's figures by approximately 25%, with nearly $1 billion in new venture funding flowing into Indian startups. Notably, AI-focused companies are capturing a significant portion of this investment, with approximately $175M flowing into IndAI startups in 2023.

India’s rise of unicorns and Centaurs

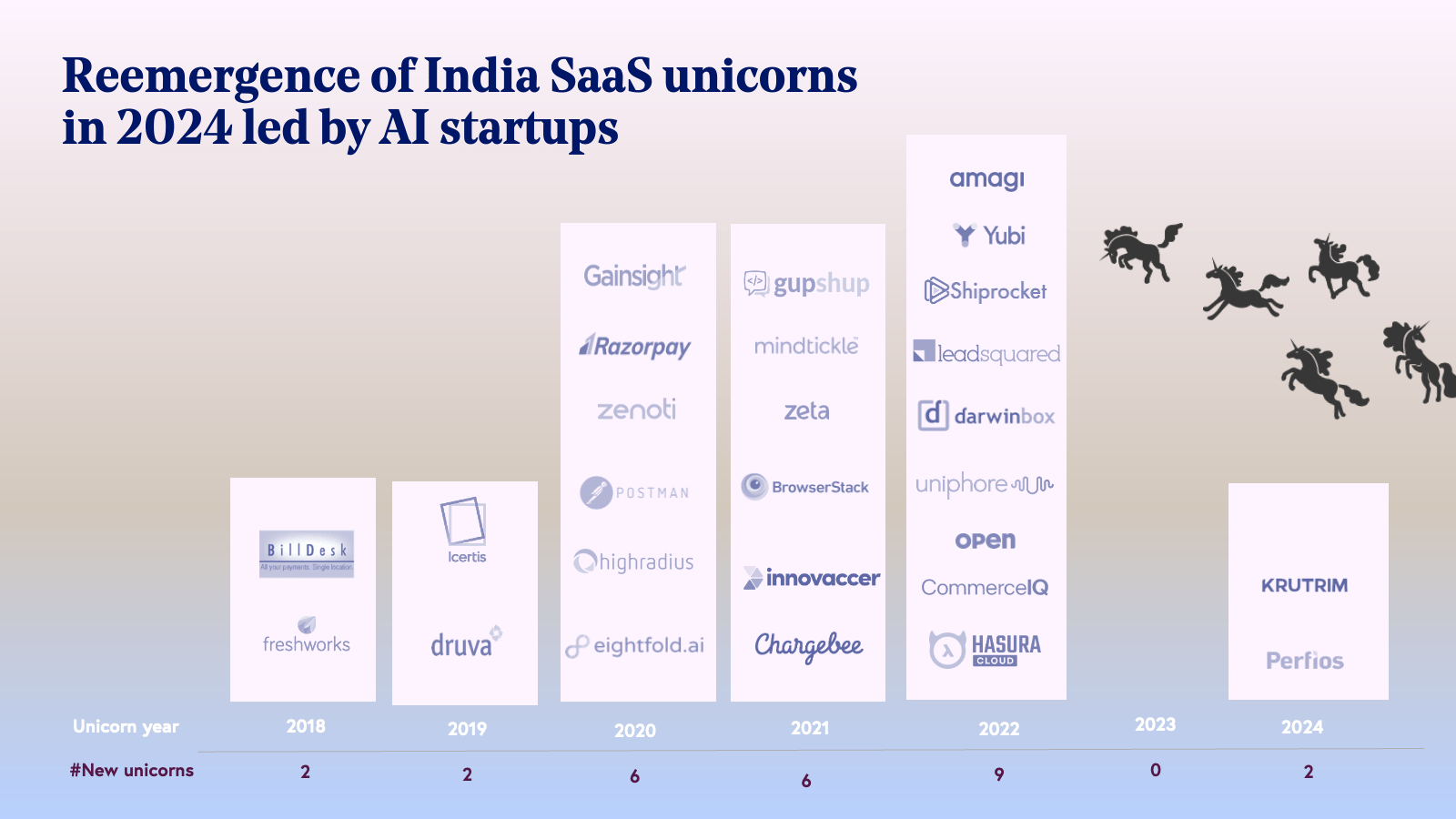

Despite the challenging market conditions with ongoing high interest rates, we've witnessed the emergence of new SaaS unicorns this year, including Krutrim AI and Bessemer portfolio company Perfios. The past year has also seen the addition of three new Centaurs in India—Amagi, ShipRocket, and Innovacer—further solidifying India's position as a global SaaS hub. In 2023 alone, this total of 27 Indian unicorns and 14 Indian centaurs collectively added $5.9 billion in revenue, showcasing the robust growth and maturity of the ecosystem.

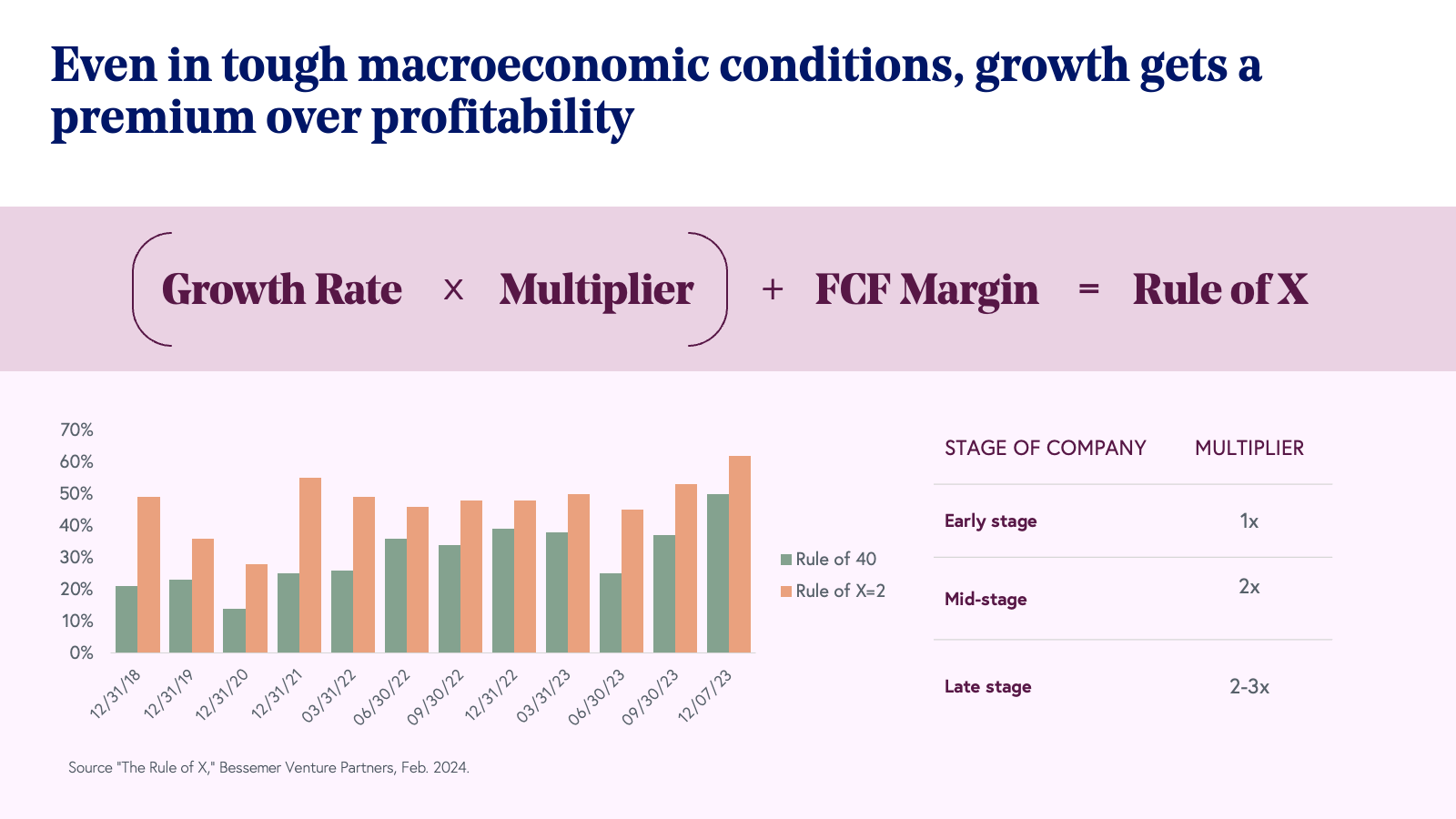

Earlier-stage startups are consistently growing, too— companies like Amagi, LeenaAI, Everstage, Rocketlane, PepperContent, and Shopdeck have continued to demonstrate strong growth year-over-year. Our recommendation for early-stage startups in the ecosystem is to appropriately balance growth with profitability by following the Rule of X.

Five trends shaping the future of India SaaS

As we look ahead, five key trends are emerging that will define the next phase of growth for India's SaaS ecosystem:

1. India SaaS will transition to IndAI SaaS

The lines between traditional SaaS and AI-enabled software are blurring rapidly. Our survey of early-stage software startups in India revealed that a staggering 90% have launched at least one AI feature in the past year. More than 60% of these startups, previously pure SaaS companies, are now evolving into AI-enabled SaaS providers.

This transformation is not just superficial—it's reshaping business models and value propositions. A third of the companies surveyed are now allocating more than 25% of their total spend towards AI initiatives. Venture investments in Indian software are expected to reach $1B in 2024, year-to-date about 25% of venture dollars have gone to AI startups in India. While most enterprises’ AI spend currently flows to software vendors outside of India, we anticipate a shift towards Indian AI software providers in the coming years, mirroring the trajectory of the SaaS industry in the late 2010s.

Prediction 1: AI-enabled SaaS opportunity will dwarf traditional SaaS.

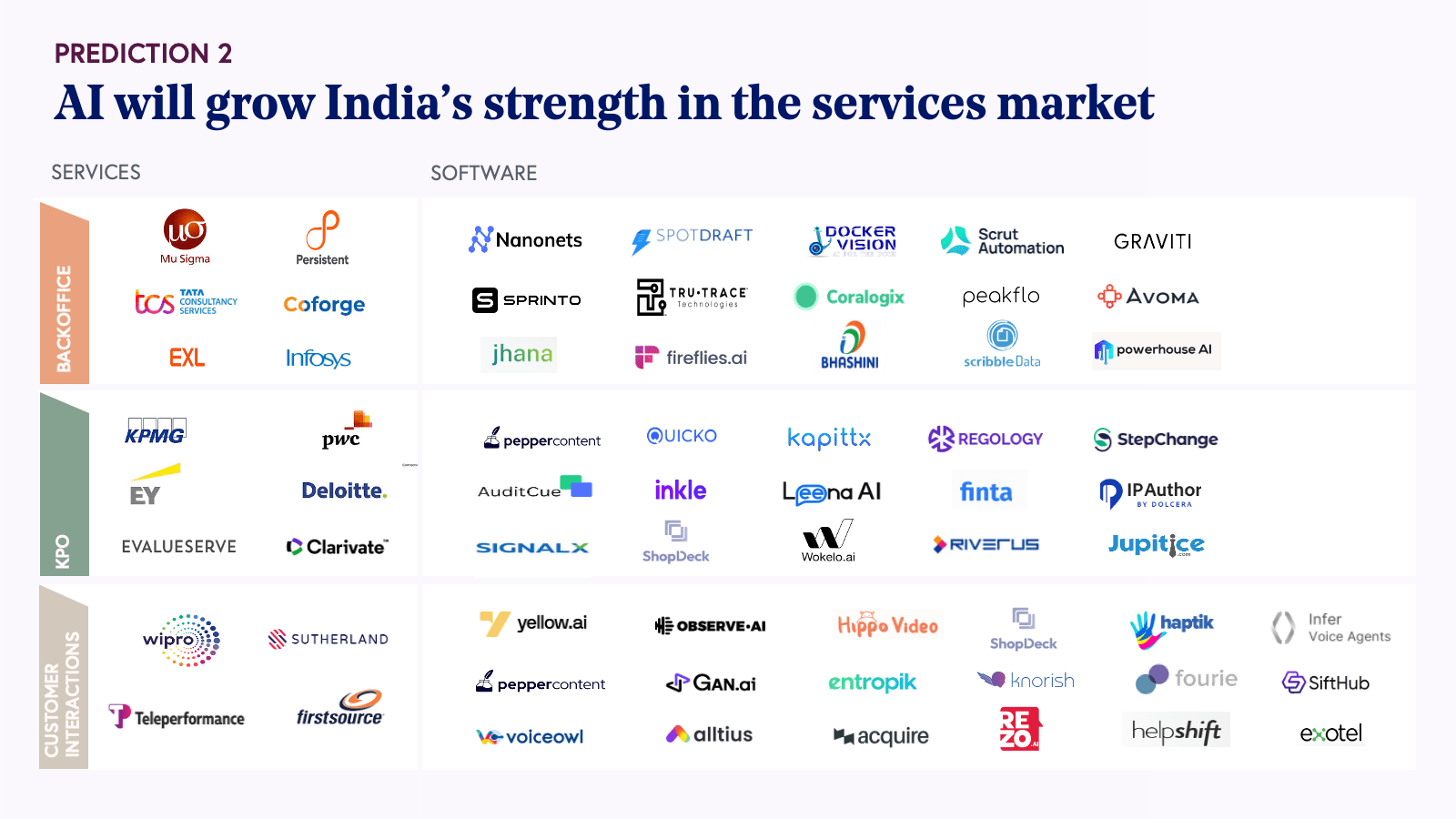

2. The line between software and services is blurring with the rise of AI-enabled services

India's pivotal role in the global services market, contributing 19% of the $400 billion industry and nearly 60% of global worker hours, is on the cusp of transformation. Customer service and back office tasks dominate in terms of hours, and knowledge-intensive fields such as financial services, healthcare, and legal contribute to half of Indian services revenue. This landscape presents a unique opportunity for AI to enhance efficiency in labor-intensive tasks while augmenting human expertise in specialized domains.

We anticipate the rise of new-age service firms characterized by:

- Software-equivalent gross margins: AI-first service companies achieving 65%+ gross margins, rivaling traditional software firms and far surpassing the 30-40% margins typical in traditional services.

- Outcome-based pricing: A shift from labor-based to outcome-based pricing models ensures clients pay for results rather than hours worked, aligning costs with actual value delivered.

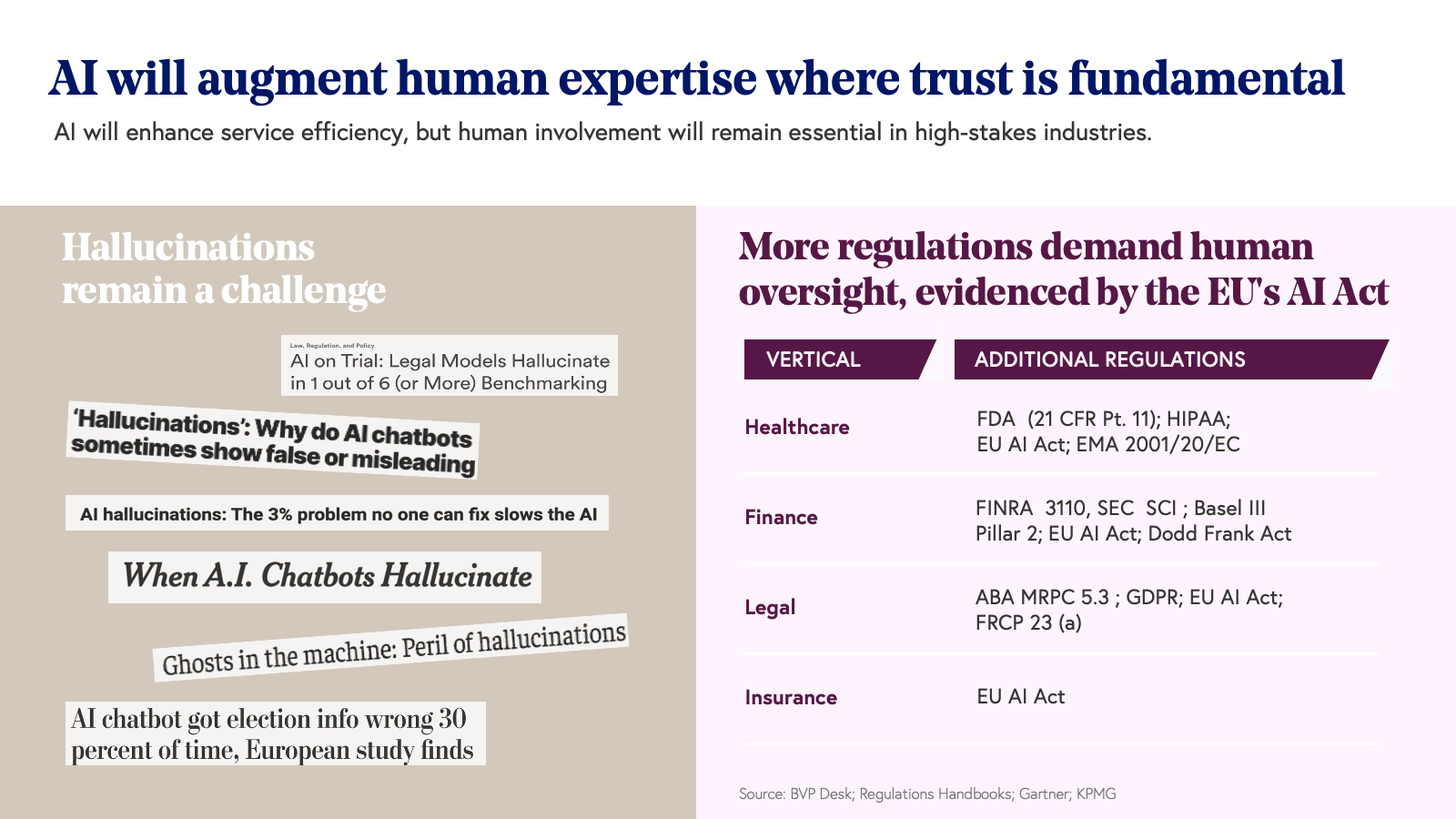

- AI accuracy assurance via human oversight: Combining AI's data processing capabilities with human judgment enhances efficiency, reduces hallucinations, and improves service quality.

- Accelerated innovation: With AI handling routine tasks, human professionals can focus on creative problem-solving and strategic decision-making, driving faster innovation cycles.

This convergence of AI and services is poised to solidify India's dominance in the global services market, creating new categories of high-value, technology-driven offerings.

Prediction 2: AI will grow India’s strength in the services market.

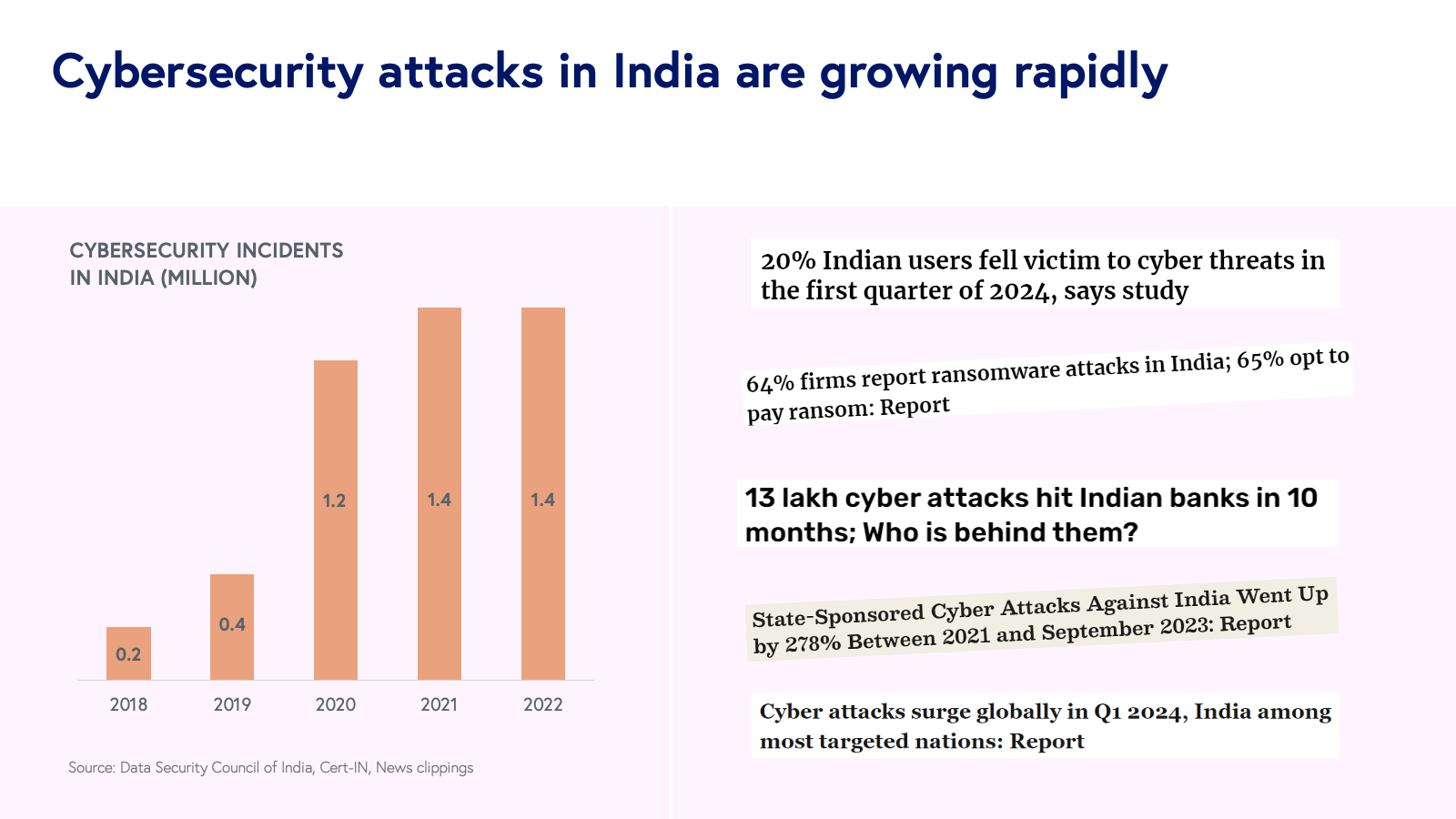

3. Cybersecurity is gaining prominence in India’s technology growth journey

Cybersecurity has emerged as a critical component of India's technological growth journey. The alarming rise in cyber attacks—with 1.4 million incidents in 2022 alone, a sevenfold increase since 2018—has catapulted cybersecurity to the forefront of enterprise priorities.

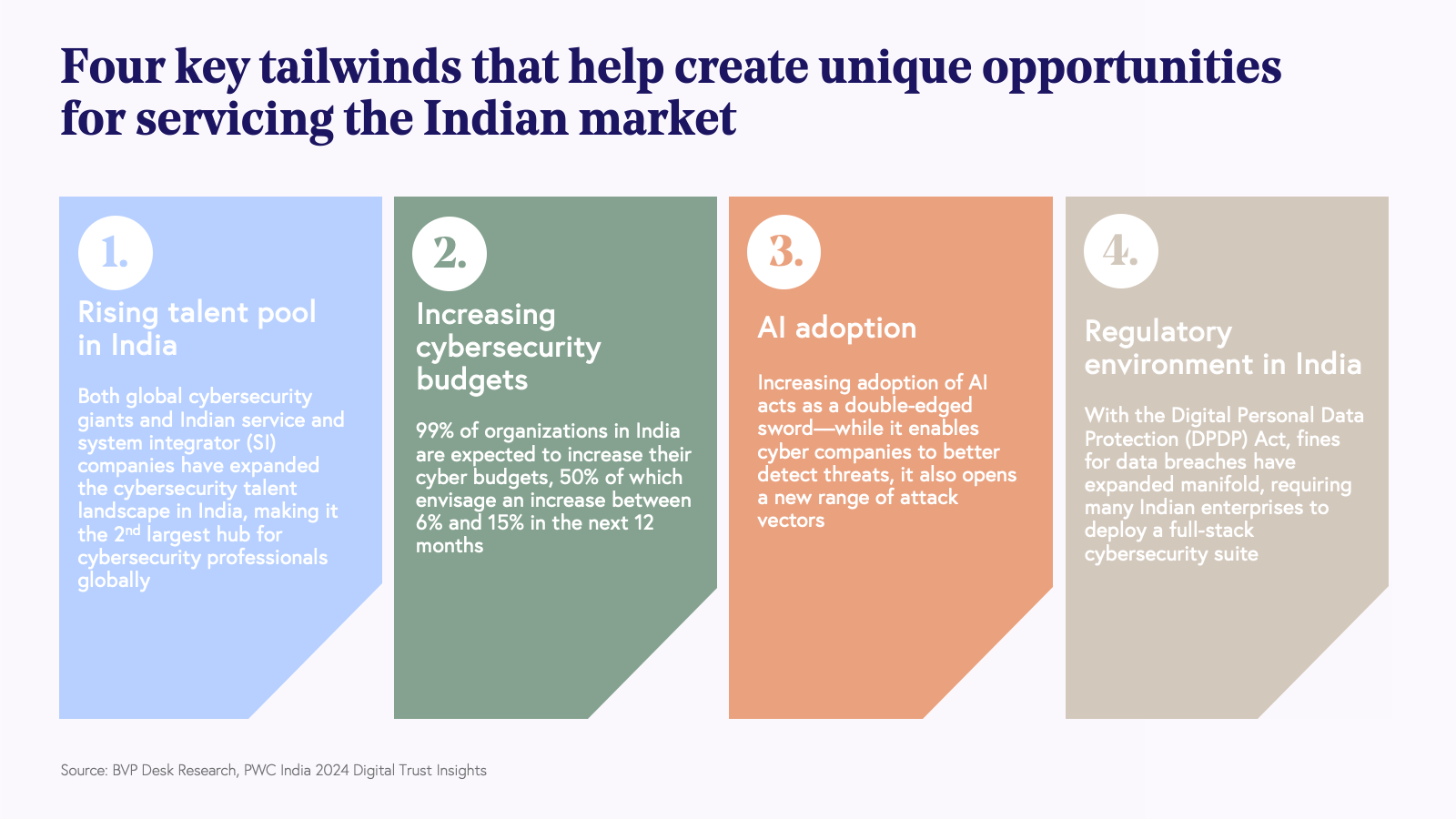

Key factors driving the cybersecurity market in India include:

- Expanding talent pool: India now boasts 10% of the global cyber talent, up from just 3% in 2021, with the number of cybersecurity professionals tripling in recent years.

- Rising cybersecurity budgets: Despite economic headwinds, nearly 99% of Indian enterprises envisage to increase their cybersecurity spend.

- AI-driven threats: The emergence of AI has introduced new attack vectors, from sophisticated deepfakes to AI-powered phishing attacks, necessitating advanced defense mechanisms.

- Regulatory impetus: The introduction of the Digital Personal Data Protection (DPDP) Act has set new standards for data security and privacy, compelling companies to bolster their cybersecurity practices.

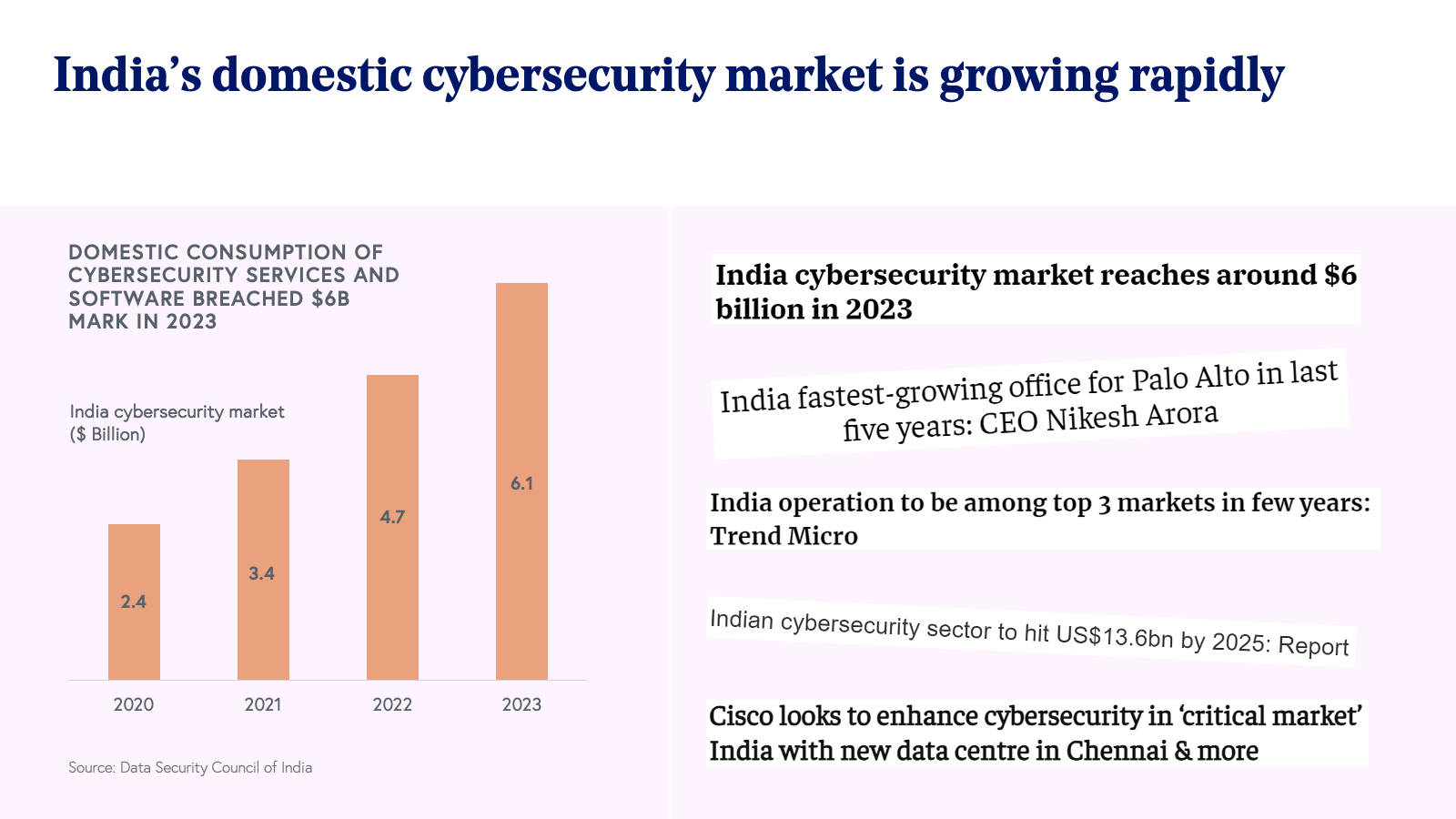

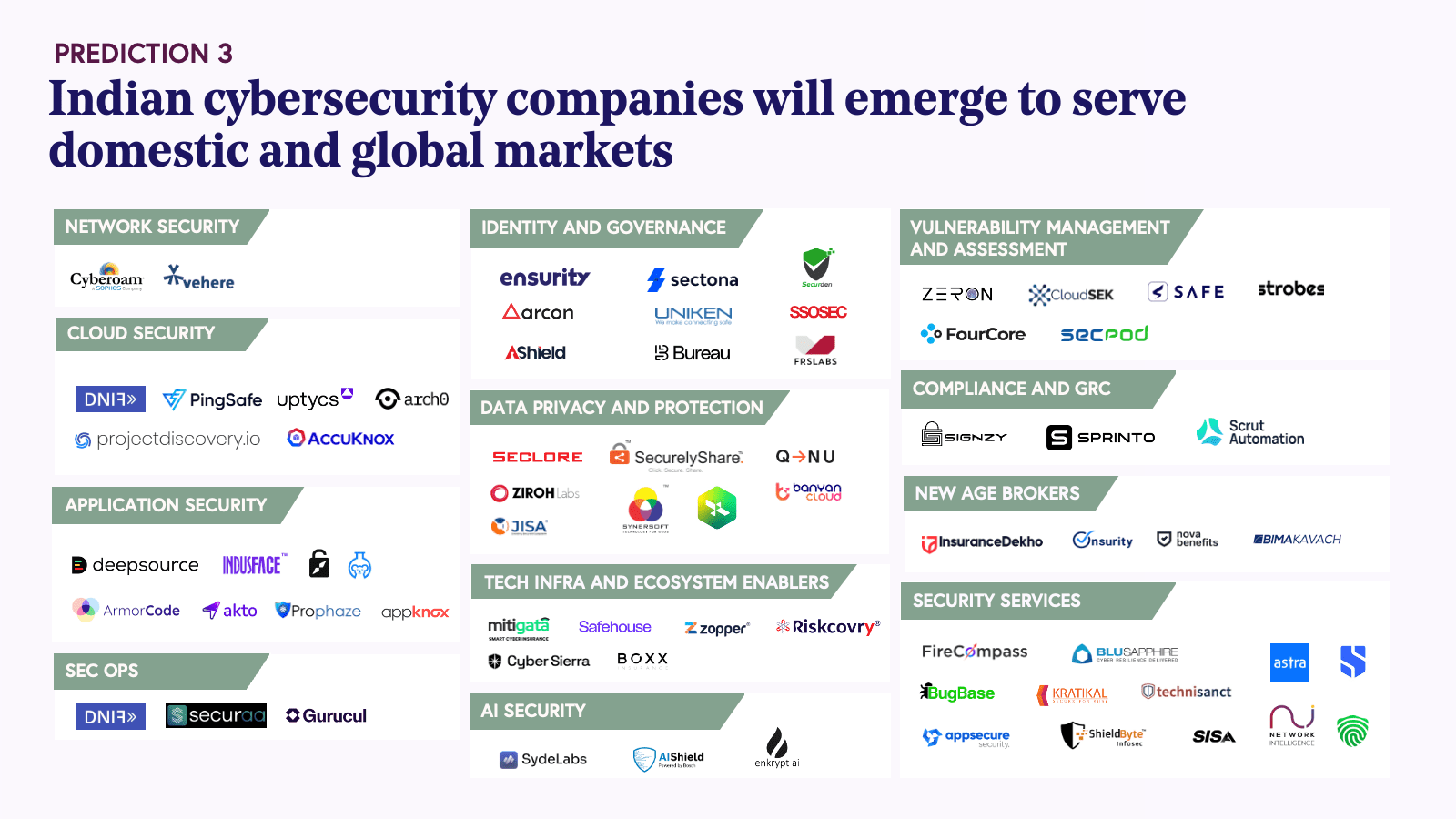

The domestic cybersecurity market in India, valued at $6 billion in 2023, is projected to reach $13.6 billion by 2025. This growth presents a significant opportunity for Indian cybersecurity firms to serve both domestic and global markets.

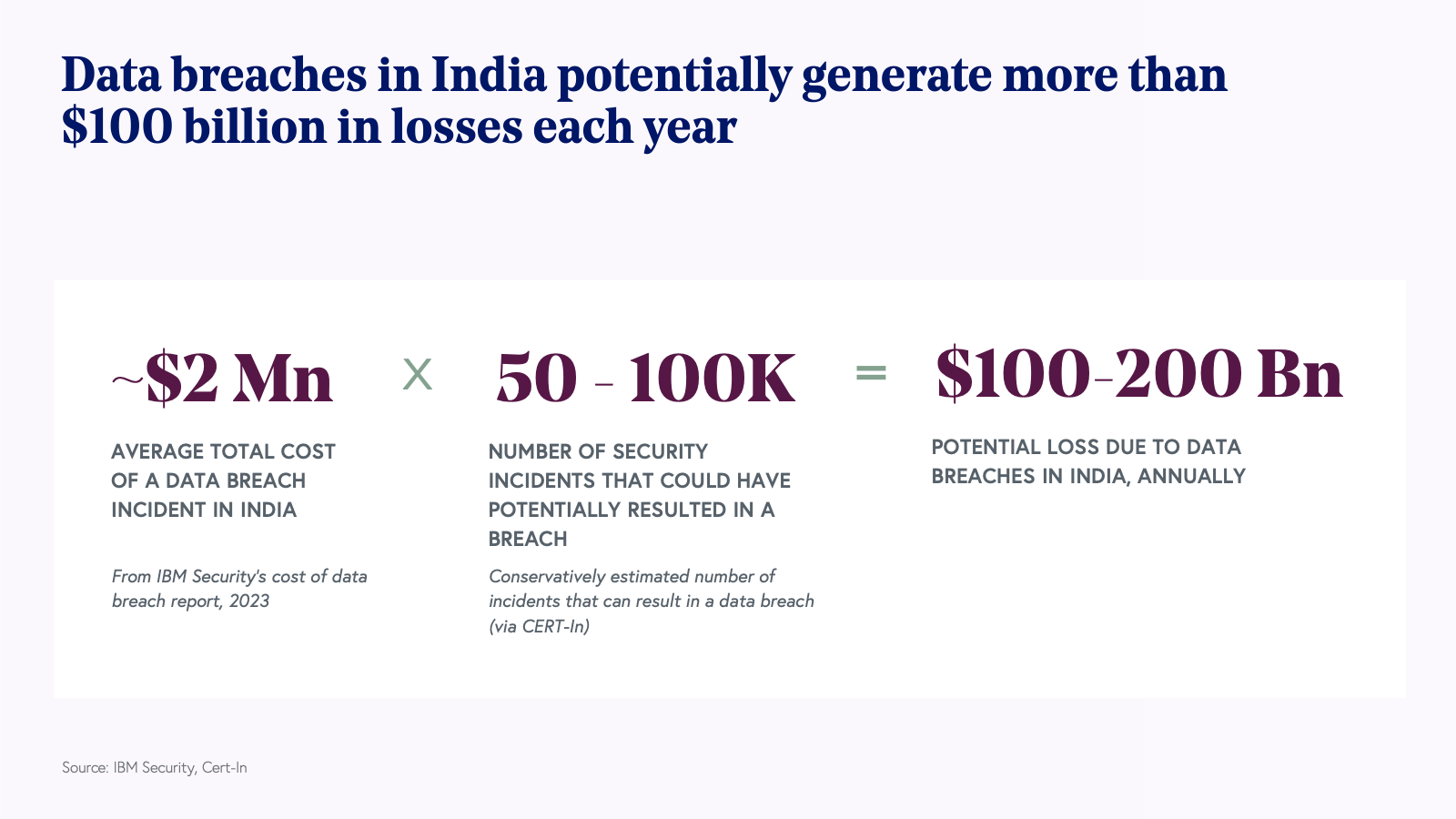

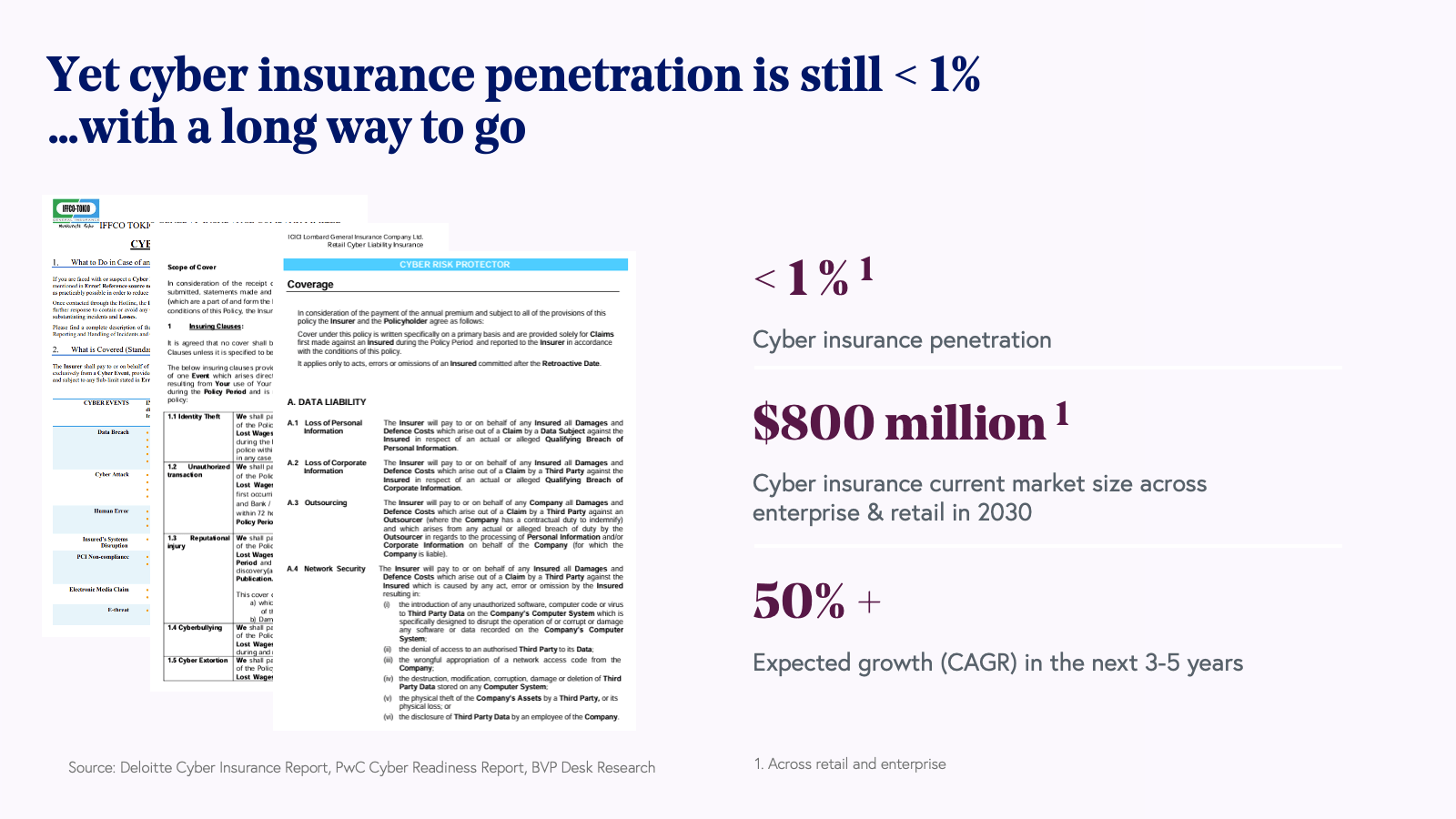

As company budgets place a greater emphasis on cybersecurity readiness, one of the first products we think they’ll purchase is cyber insurance. Based on conservative data breach assumptions—at an estimated $2 million cost per breach and at least 50,000 large cybersecurity incidents per year—it’s possible that India-based data breaches could generate $100 billion in losses each year. At the same time, the penetration of cyber insurance is less than 1%, indicating large potential to continue to grow.

With traditional insurance brokers ill-equipped to underwrite cyber insurance, we think the current cyber insurance market of <$100 million is bound to grow rapidly in the coming years.

As India continues to advance toward a digital economy, cybersecurity infrastructure, services, and insurance will all need to grow in tandem, creating an opportunity for Indian cybersecurity firms to emerge and serve domestic and global markets

Prediction 3: Indian Cybersecurity companies will emerge to serve domestic and global markets

4. A wealthier nation will be catalyzed by software

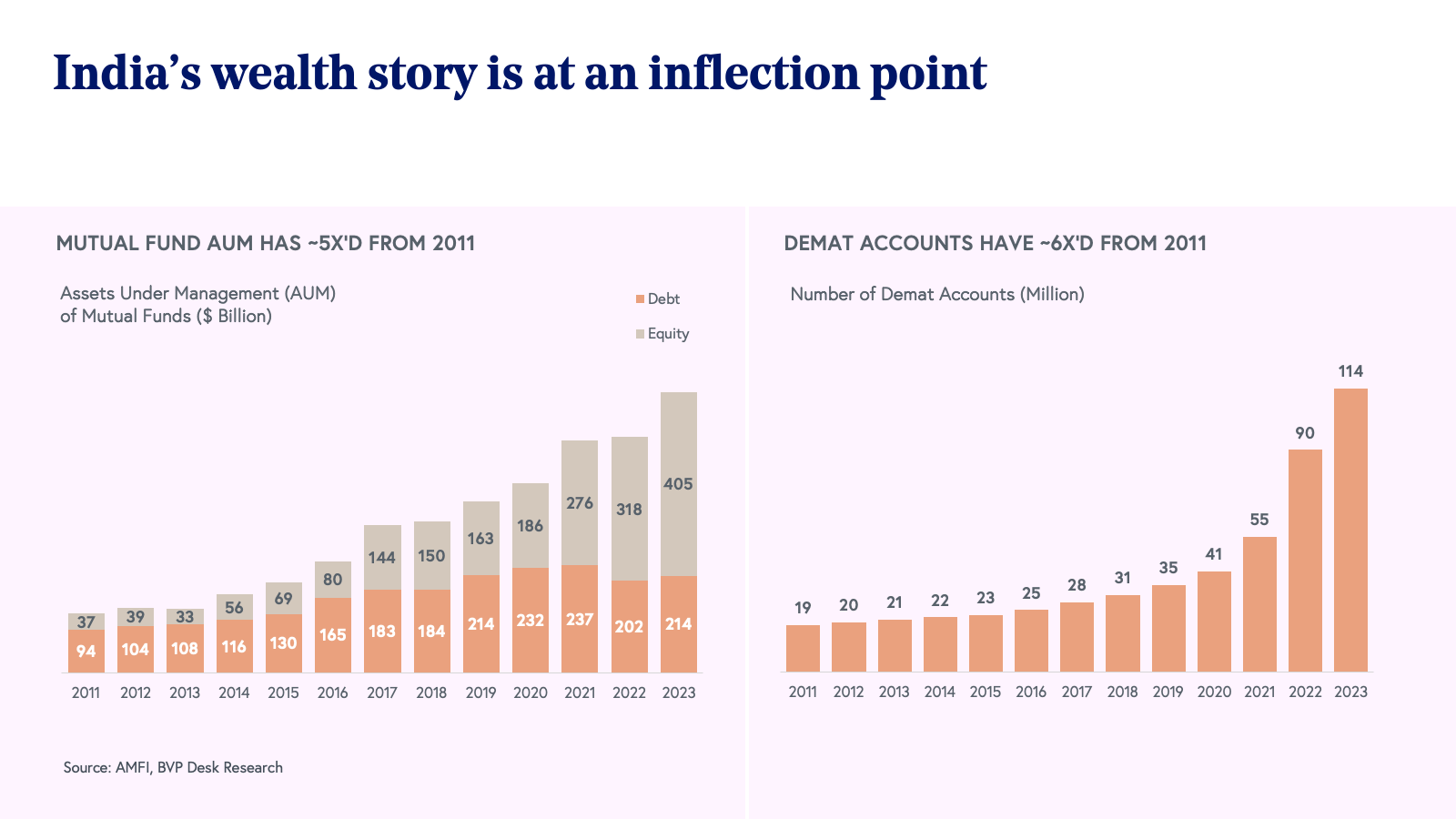

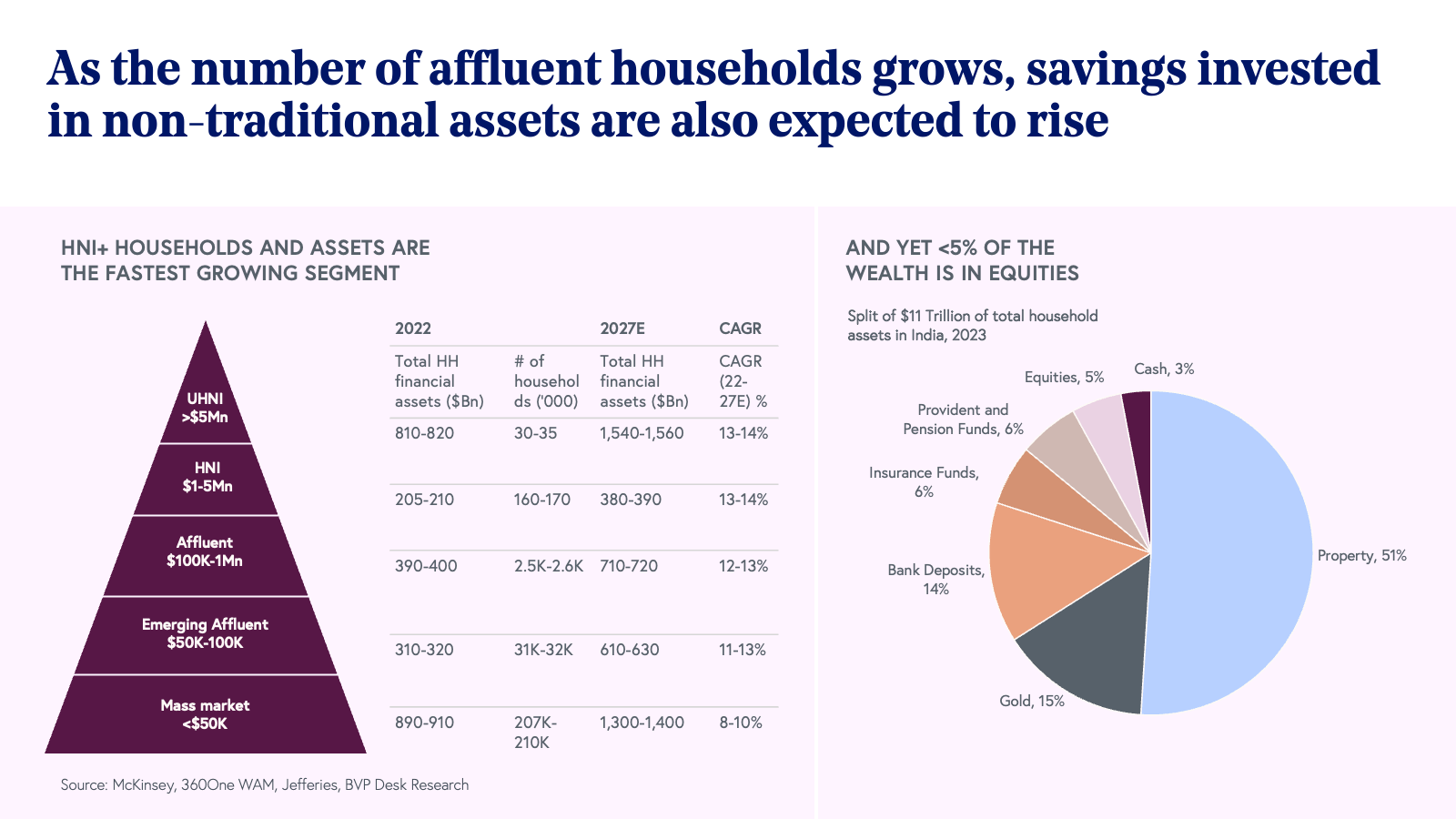

India's wealth landscape is at a pivotal juncture. Mutual fund assets under management (AUMs) surged to ~$620 billion at the end of CY2023, a remarkable 4.4-fold increase from a decade ago. Concurrently, the number of dematerialized (demat) or online brokerage accounts has nearly tripled from 41 million in 2020 to 114 million by 2023, largely driven by post-pandemic digital acceleration.

Despite this growth, only five percent of total household wealth is currently invested in equities, indicating significant potential for a shift from traditional assets like real estate and fixed deposits to more dynamic financial products.

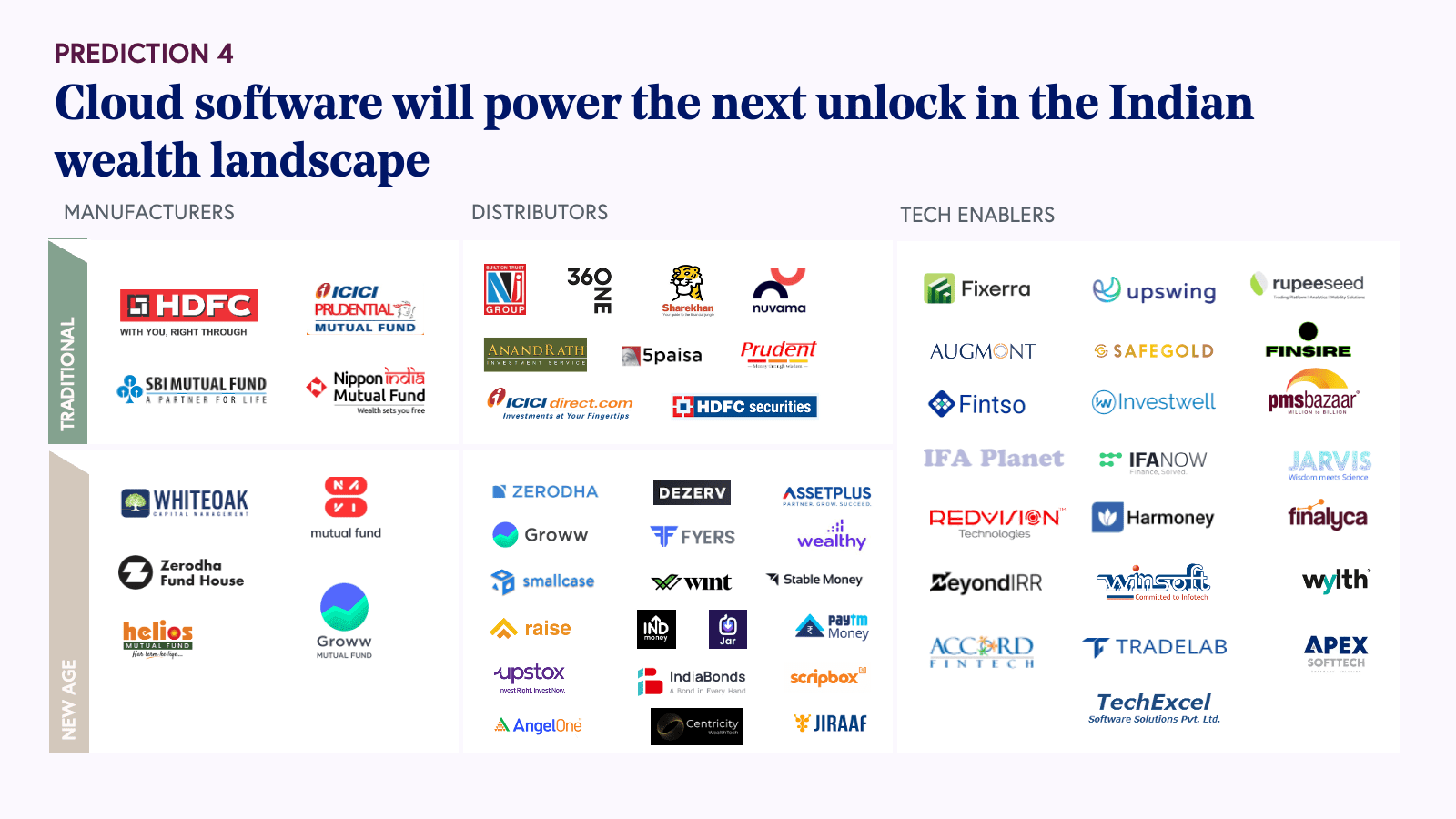

A complex ecosystem of distribution platforms, asset managers, banks, depositories, exchanges, and brokerages, are facilitating this transition, all interconnected through sophisticated API and software stacks. As India embraces digital platforms for wealth management, we anticipate a surge in transaction volumes, necessitating state-of-the-art cloud software solutions to manage billions of digital transactions securely and efficiently.

Prediction 4: Cloud software will power the next unlock in the Indian wealth landscape.

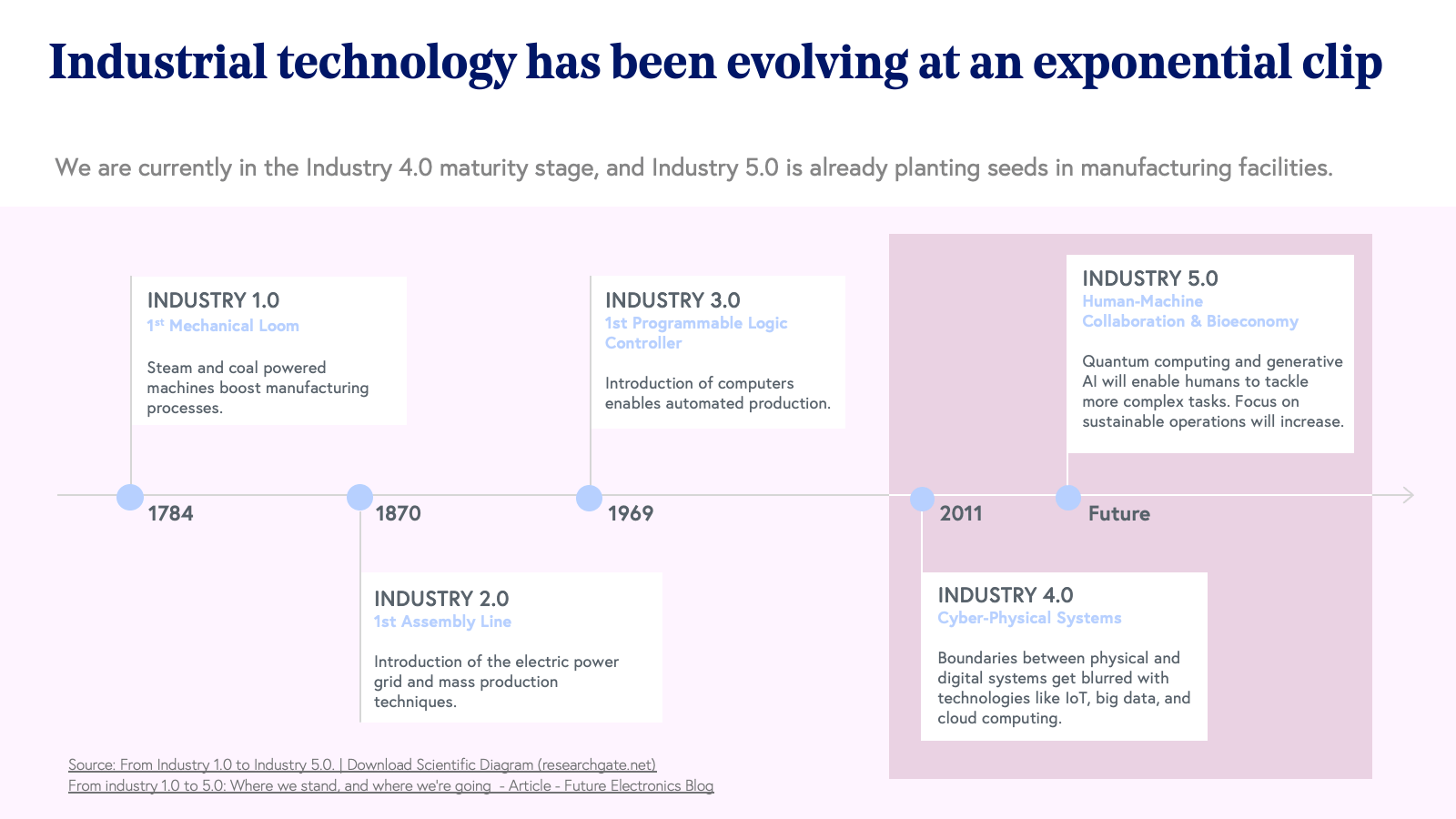

5. Industrial SaaS will start scaling as Industry 4.0 matures and Industry 5.0 arrives

The industrial sector, traditionally under-digitized, is rapidly adopting cutting-edge technologies to enhance productivity, safety, and quality. This evolution is driven by several macro trends:

- Make in India manufacturing schemes: Between 11 new sectors open to upto 100% Foreign Direct Investment (FDI) under government route, 14 potential National Investment and Manufacturing Zones (NIMZs), new free trade agreements, and multinational corporations increasing their “China + 1” manufacturing site policies, we anticipate increased demand for automation and software solutions in manufacturing. With these shifts, we expect factories will grow in size and number, eventually needing more automation and increased adoption of software including enterprise resource planning (ERP) software, digital twins, quality vision inspection, and safety software, among other categories.

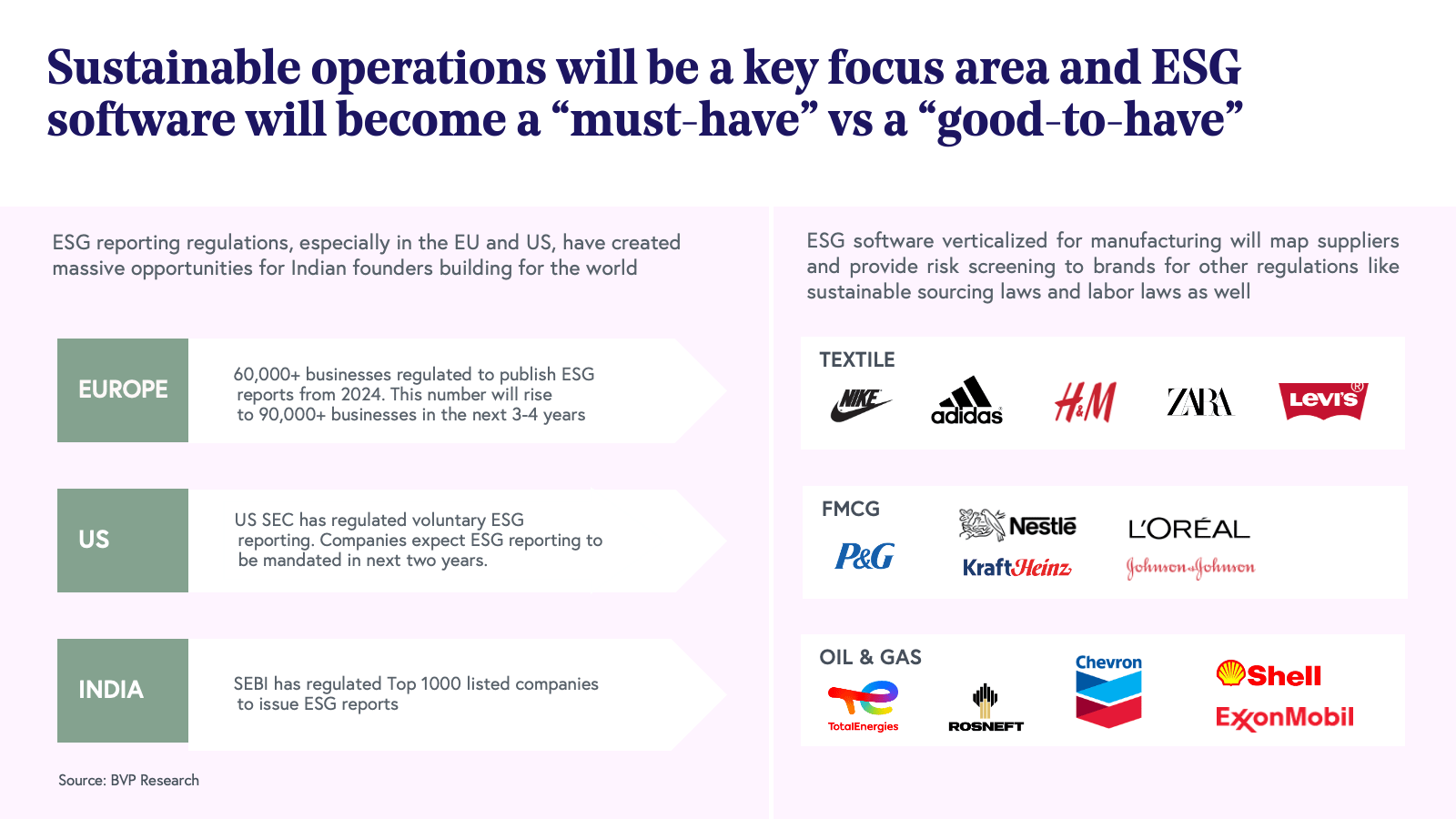

- Global ESG regulations: ESG regulations are strengthening across three large economies—the European Union (EU) is requiring its top 60,000 businesses to publish annual ESG reports; the Securities and Exchange Board of India (SEBI) has mandated its top 1,000 companies to publish annual ESG reports, and the United States Securities and Exchange Commission (SEC) has recently introduced voluntary ESG reporting. Stronger ESG reporting mandates are creating robust demand for decarbonization reporting software. We are particularly bullish on companies that take a verticalized approach across the supply chain.

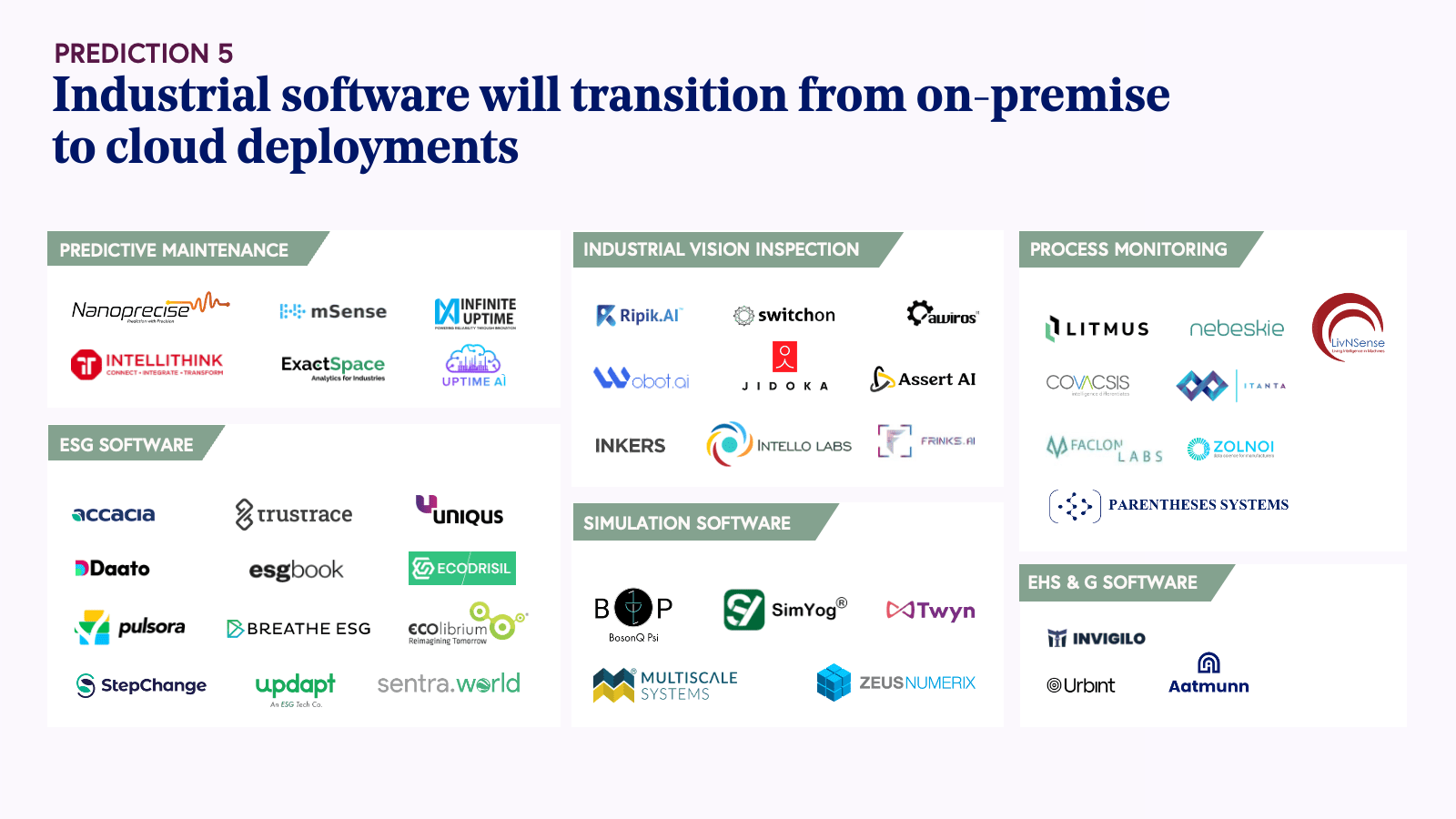

We're seeing three primary use cases emerge in the AI adoption journey for industrial settings:

- Inspection: Self-learning AI models have significantly increased the accuracy of vision-based quality inspection systems. Legacy incumbents in the industrial vision inspection space such as Cognex, Keyence, and Omron are actively adding AI features to their existing offerings and manufacturing companies are actively looking to take advantage of this. Our portfolio company ANYbotics helps companies conduct inspections through autonomous, legged robots.

- Compliance and safety: With increased regulation from government bodies, we think companies will look to AI to help automate annual compliance and safety workflows that directly impact workers’ lives, company morale, and brand reputation. AI-powered environment, health, safety and quality system (EHS&Q) software now provides factories with real-time, sensor-enabled safety platforms, video analytics, and AI-based risk prediction on factory worker tasks.

- Production efficiency: Traditionally, companies have used a combination of manual processes and ERP systems to track production efficiency on the factory floor. We expect that companies will augment their current processes by adopting predictive maintenance software to improve machine productivity; process and energy optimization software to improve cost-efficiency and factory floor productivity; and introduce digital twins to test changes before implementing high-cost change processes across factory floors.

Prediction 5: Industrial SaaS will transition from on-premise to cloud deployments

Toward a secure, AI-enabled Indian economy

As we navigate the transition from SaaS to IndAI, India's software ecosystem is uniquely positioned to capitalize on emerging opportunities in AI-enabled services, cybersecurity, wealth management, and industrial automation. The convergence of India's engineering talent, entrepreneurial spirit, and experience in scaling software globally creates a fertile ground for innovation and growth.

In the coming years, we anticipate the emergence of dominant players in AI software, AI-enabled services, domestic cybersecurity, wealth management software, and Industry 5.0 solutions. These companies will not only serve the burgeoning domestic market but also compete on the global stage, further cementing India's position as a technology powerhouse.

As investors, we remain committed to supporting visionary entrepreneurs who are shaping this exciting future. If you're building innovative solutions in these spaces, whether for the domestic or global market, we'd love to hear from you. Reach out to us at IndiaSaaS@bvp.com.