State of the Cloud 2020

Cloud macro trends, growth strategies for founders, 2020 predictions, and why we believe the future is forged in the cloud.

In 1998 when Netsuite was founded, and then in 1999 when Salesforce first launched, many experts in tech believed the cloud was just a fad. Even leaders like Larry Ellison and Steve Ballmer were early skeptics. How could a business with significant development and sales costs upfront, and payment terms on the backend, ever work?

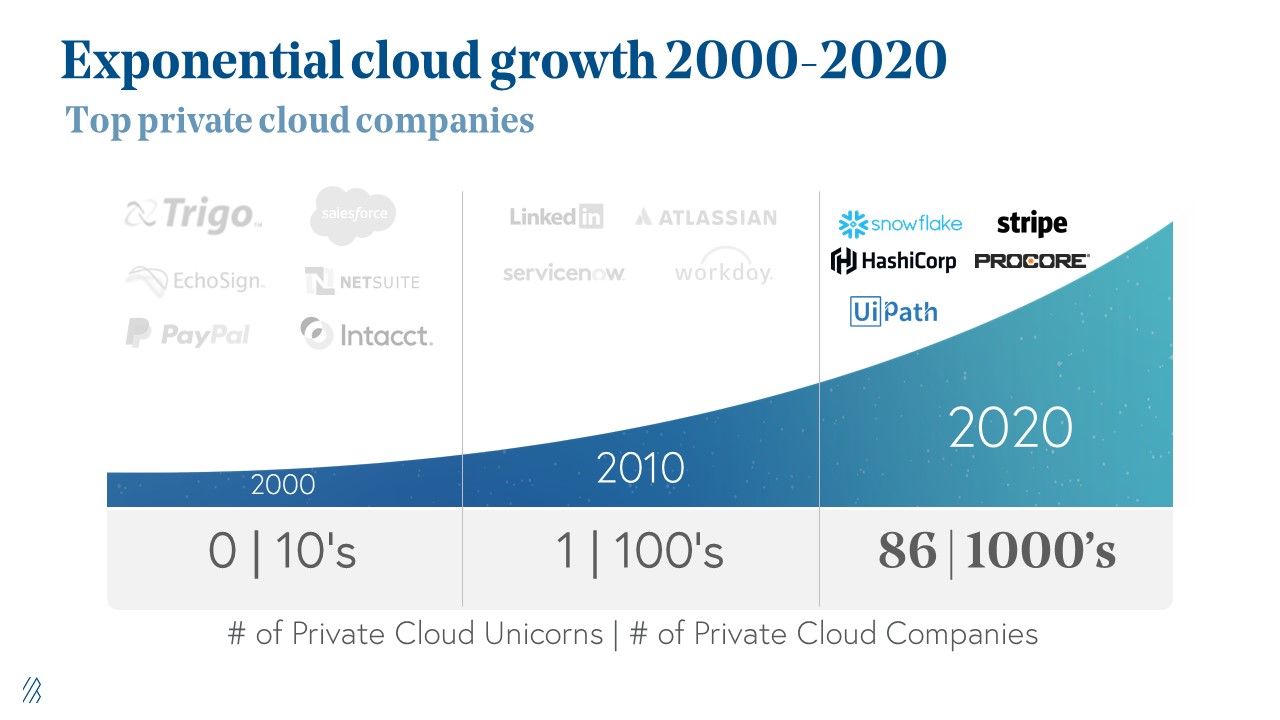

Since the early 2000s, the industry has seen exponential growth, both in private and public spheres. Many companies have cloud strategies in place, but they are amidst their digital transformations.

We believe the future of technology is forged in the cloud, and after two decades of growth it’s just the beginning.

When founders and investors are faced with unprecedented market volatility, it is clarifying to step back and look at the long arc of technology, and the cloud computing revolution. In Bessemer’s State of the Cloud 2020 Report, we distill twenty years of data on the private and public cloud market trends, dive into the time tested tenets that early-stage cloud founders need to prioritize for growth, and of course, share our predictions that capture the emerging categories we’re exploring to spot promising new companies.

The cloud industry from 2000-2020

In 2000, emerging private cloud companies included, Salesforce, Netsuite, and Paypal, but there were zero private companies that were valued $1 billion. It wasn’t until 2008 that the industry saw a privately held cloud company, LinkedIn, reach a $1 billion+ valuation.

So much has changed in just 20 years. As of February 2020, there are more than 86 private cloud unicorns, including companies like HashiCorp, UiPath, Snowflake, Stripe, Toast, Procore, and more.

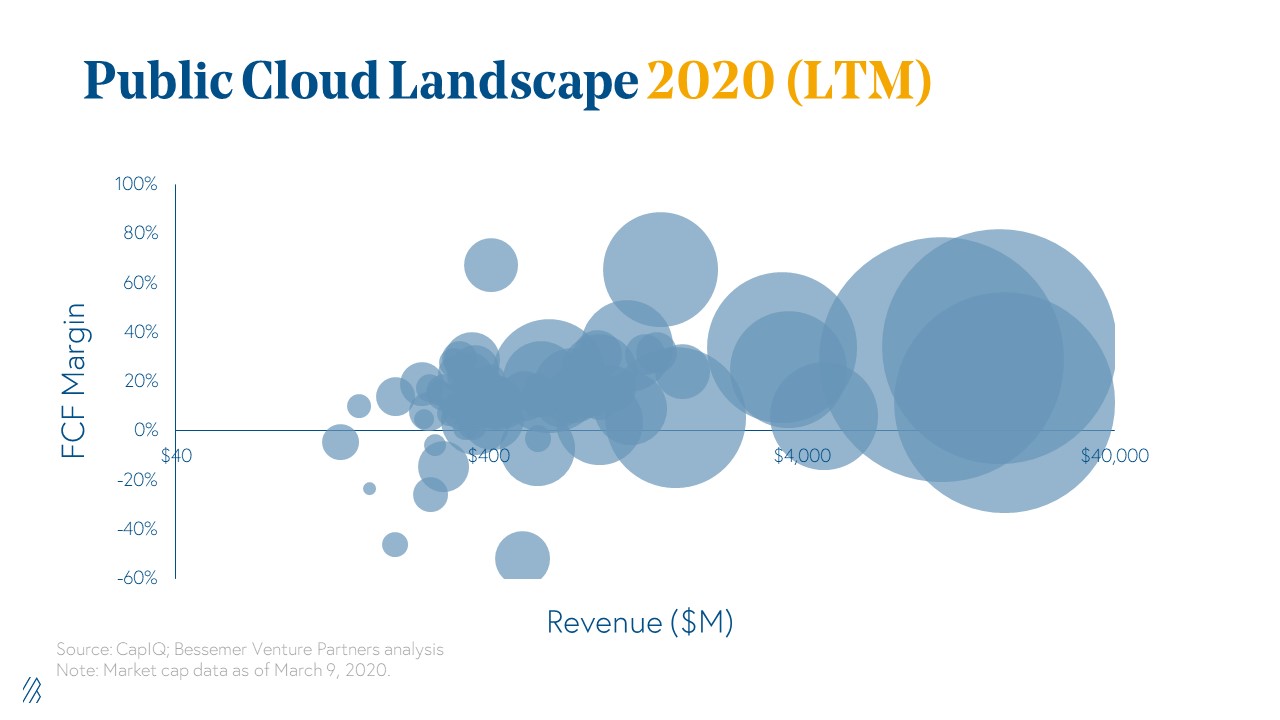

While there were zero public cloud companies valued at $1 billion+ at the turn of the 21st century, public cloud companies with a $1 billion+ market capitalization gained significant velocity after 2007, as Netsuite went public in that same year and cloud adoption rates increased.

In 2010, there were 12 public unicorns, and as of the beginning of 2020, there are 54. Of these 54 public companies, five familiar tech giants—Salesforce, Paypal, ServiceNow, Shopify, and Adobe—are all worth over $50 billion market cap.

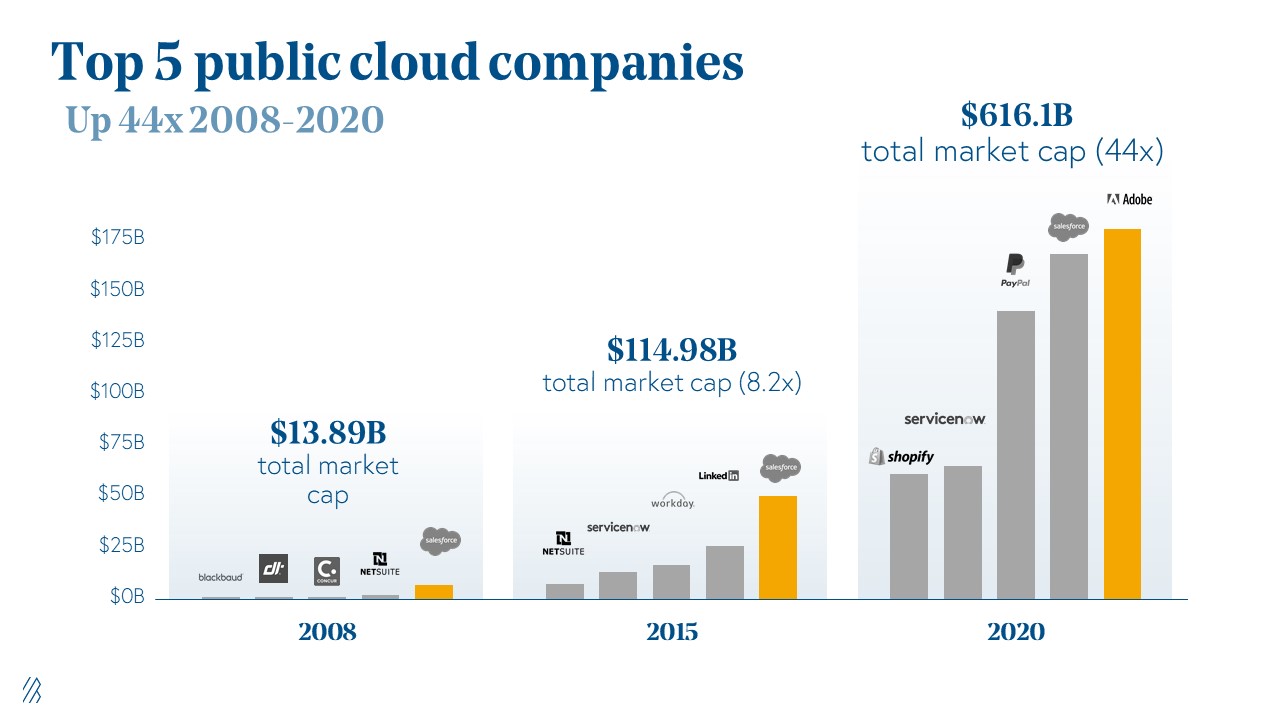

From 2008 to 2020, the value of the top five public cloud companies increased by 44X.

In 2008 the total market cap of Salesforce, Netsuite, Concur, Blackbaud, and Dealertrack totaled $13.89 billion. By 2015, the market cap increased by 8x with the addition of LinkedIn, ServiceNow, along with Salesforce and Netsuite, as the top five public cloud companies.

By February 2020 the market cap of the top five public cloud companies hovered just around $616 billion. With the recent economic downturn induced by the COVID-19 global pandemic, we did see massive volatility in the top five public cloud companies in the month of March and April. Though the cloud is feeling the impact of the recession, and we expect much more volatility ahead, public markets reflect the cloud’s relative resiliency. In fact, The Wall Street Journal recently reported: “The 52 stocks on the BVP Nasdaq Emerging Cloud index have averaged a gain of 15% this year compared with the S&P 500’s 11% drop.”

Despite the world economy being in one of the most volatile times since 1929 and seeing a rapid and significant drop in the public markets, the cloud computing industry in its two-decade history has experienced truly exponential growth. As one of the first institutional investors in cloud computing, we always believed in the cloud and its potential but we have been surprised on how quickly it has surpassed our wildest expectations.

Three recent milestones in the public cloud markets illustrate the industry’s momentum

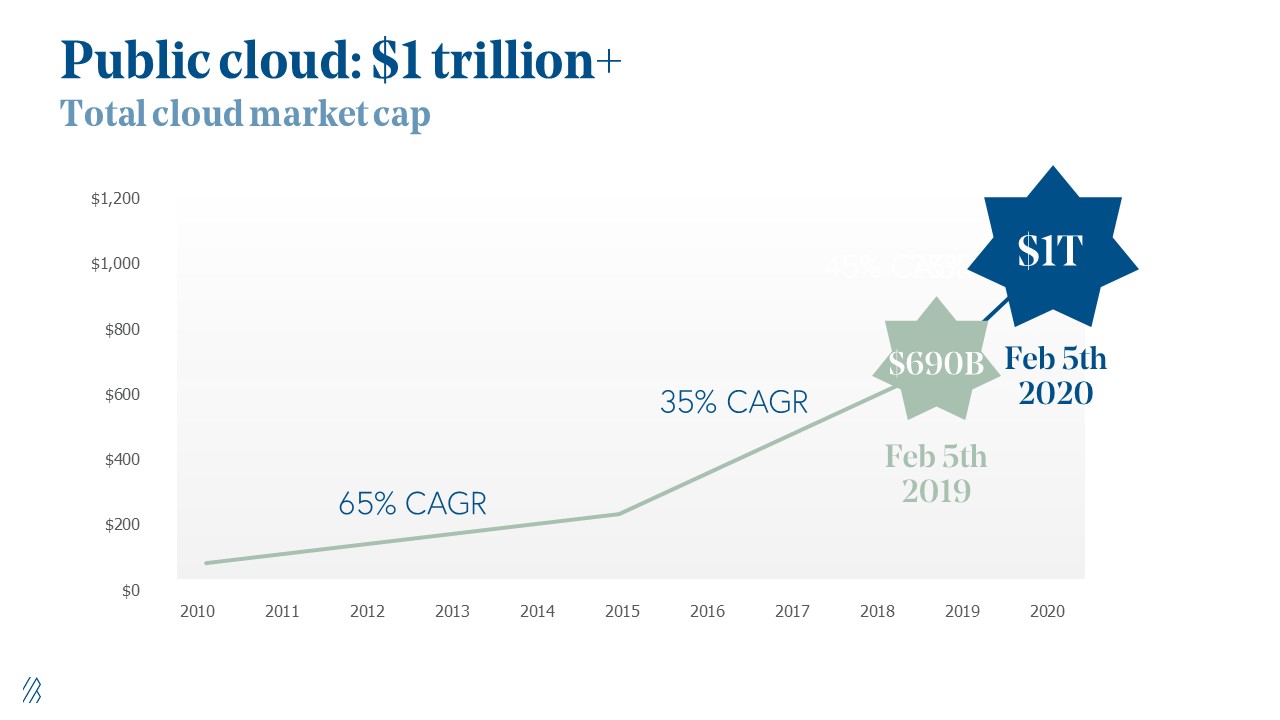

Milestone 1: The public cloud hit $1 trillion in 2020.

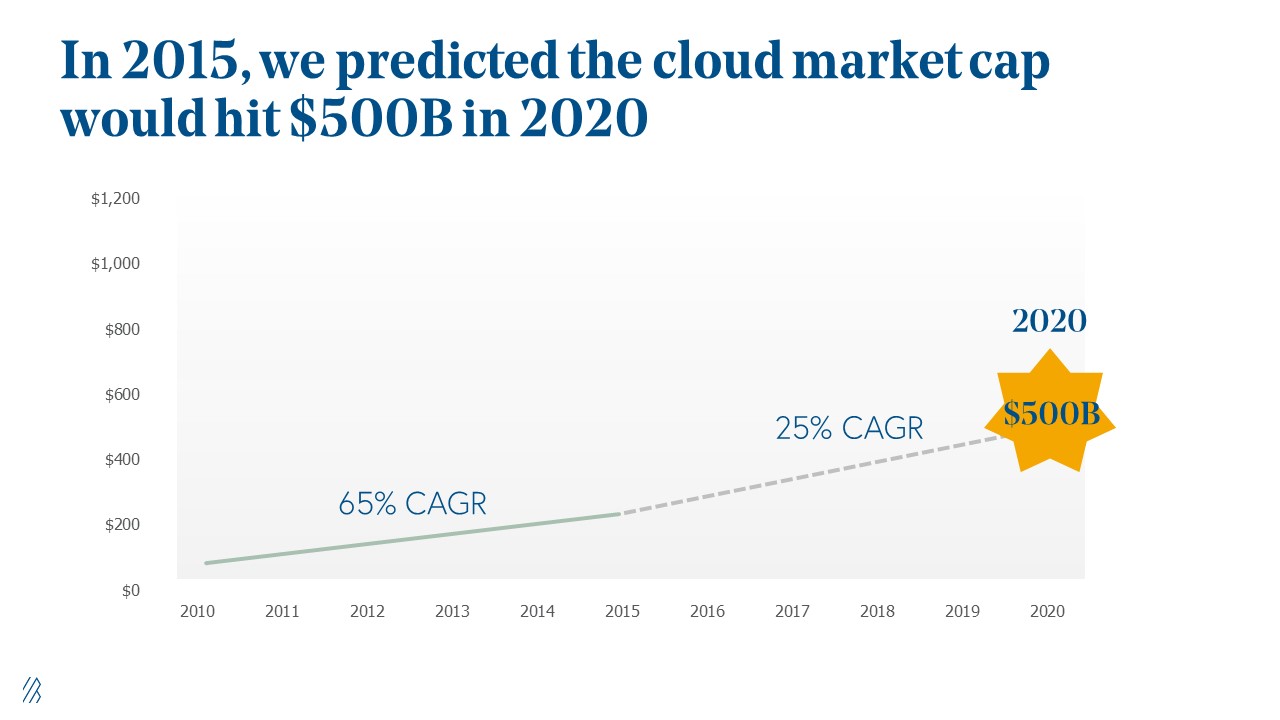

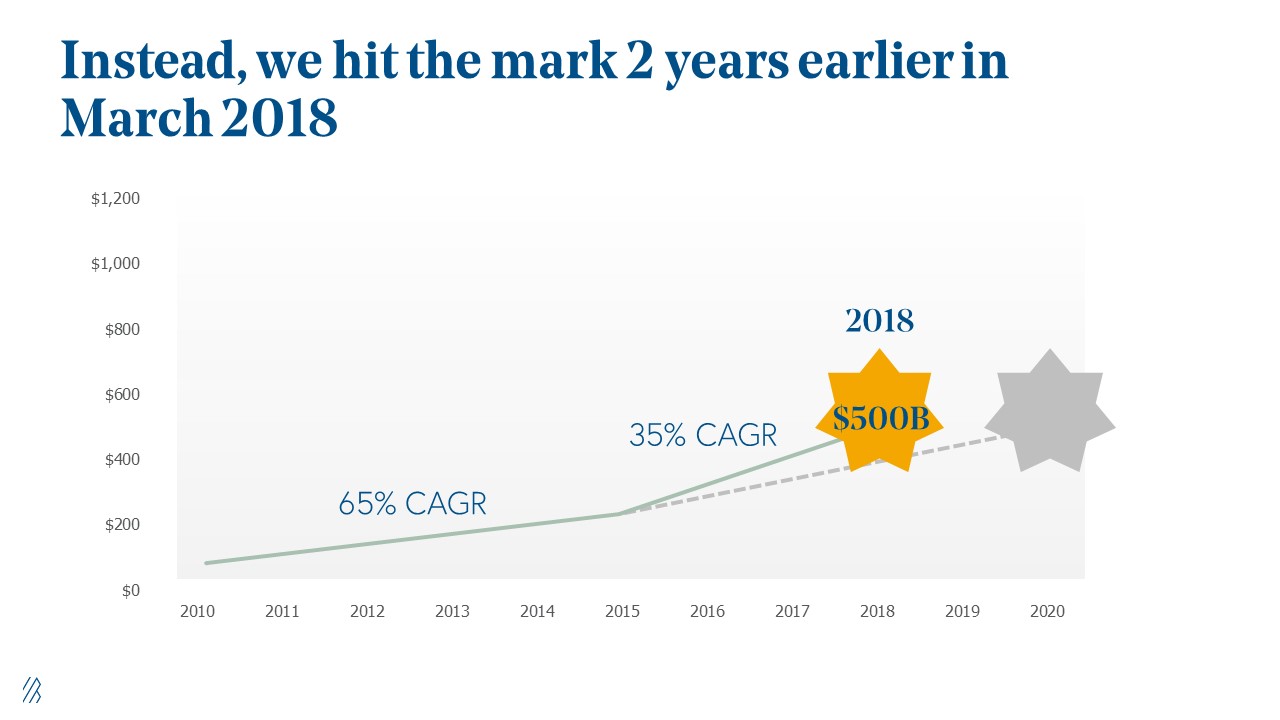

In 2015 with our very first State of the Cloud, we predicted that the public cloud industry would reach $500 billion by 2020.

Growing at an average of 35% Compound Annual Growth Rate (CAGR), the public cloud markets hit that $500 billion milestone two years earlier than we expected in March 2018. (We were delighted to be wrong.) Assuming that the industry would continue to grow at that same 35% CAGR, we predicted at Bessemer that we’d reach $1 trillion in a couple of years. (After all, at State of the Cloud 2019 we hovered around $690 billion.) But we were wrong again! In a weird twist of fate, exactly one year later on February 5, 2020, we surpassed the $1 trillion market capitalization of the public cloud market, with a 45% growth rate.

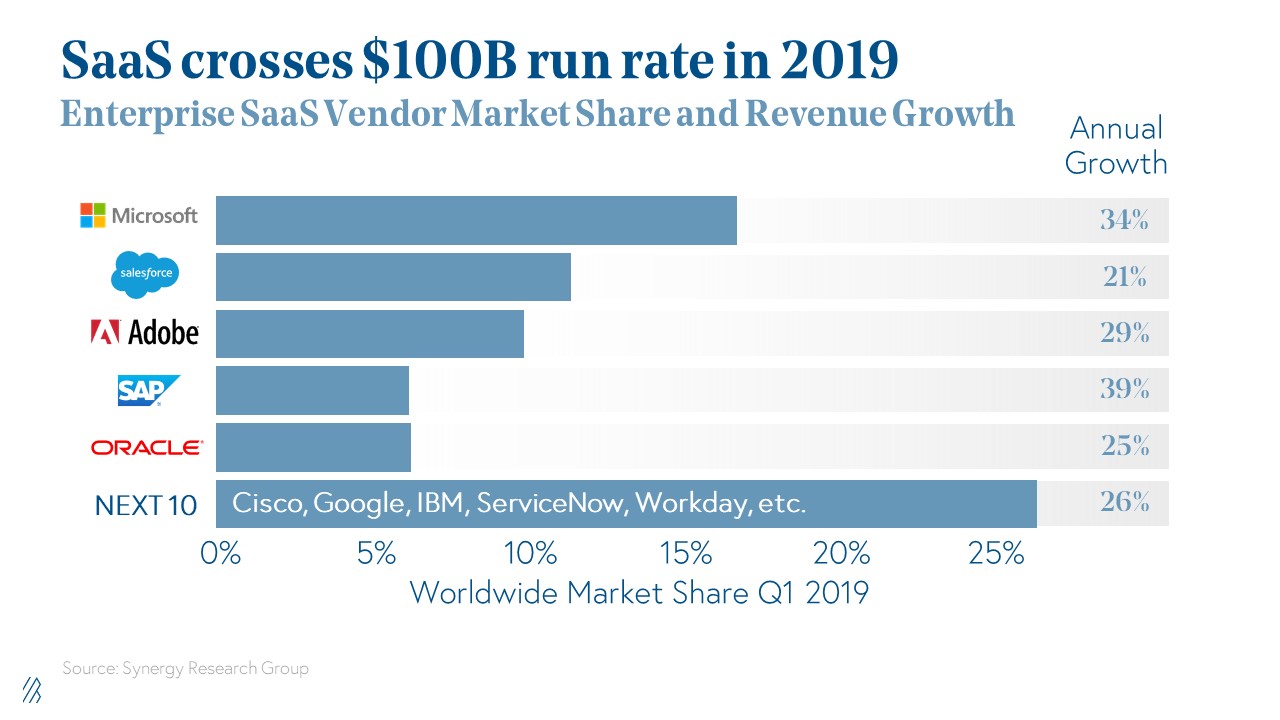

Milestone 2: SaaS crosses $100 billion run rate in 2019

Enterprise SaaS vendor market share was led by Microsoft, Salesforce, Adobe, SAP, Oracle. While SaaS revenue accounts for just 20% of the overall enterprise software market, this indicates a massive opportunity for growth.

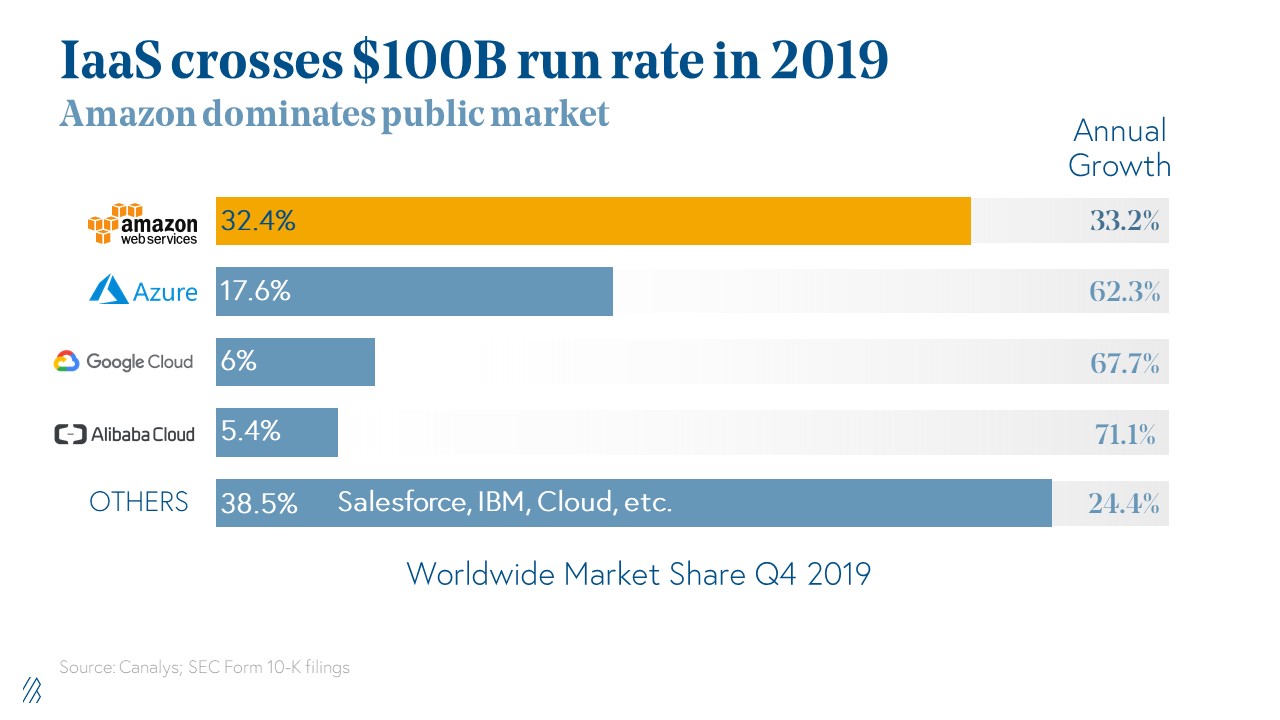

Milestone 3: IaaS crossed $100B run rate in 2019

As the cloud wars over Infrastructure-as-a-Service (IaaS) heat up, Amazon continues to dominate the public markets. In fact, AWS is now north of a $40 billion annual revenue run rate (growing at a CAGR in the mid-30%’s), while generating billions of dollars of profit and roughly 30% operating income. But it’s important to note that Microsoft’s Azure is gaining significant ground—with 17.6% of the market, up from 14.2% in 2018– and continues to grow even faster.

In the IaaS race, the gap between AWS and Azure is closing.

What this means is that legacy and tech giants continue to grow their cloud businesses as they become profit centers for large tech enterprises.

However, among all these statistics about the public cloud markets, this one remains the most impressive: Across all enterprises, 94% already use a cloud service.

The compounding power of cloud has been building for 20 years, and this is the most powerful force in all of technology right now.

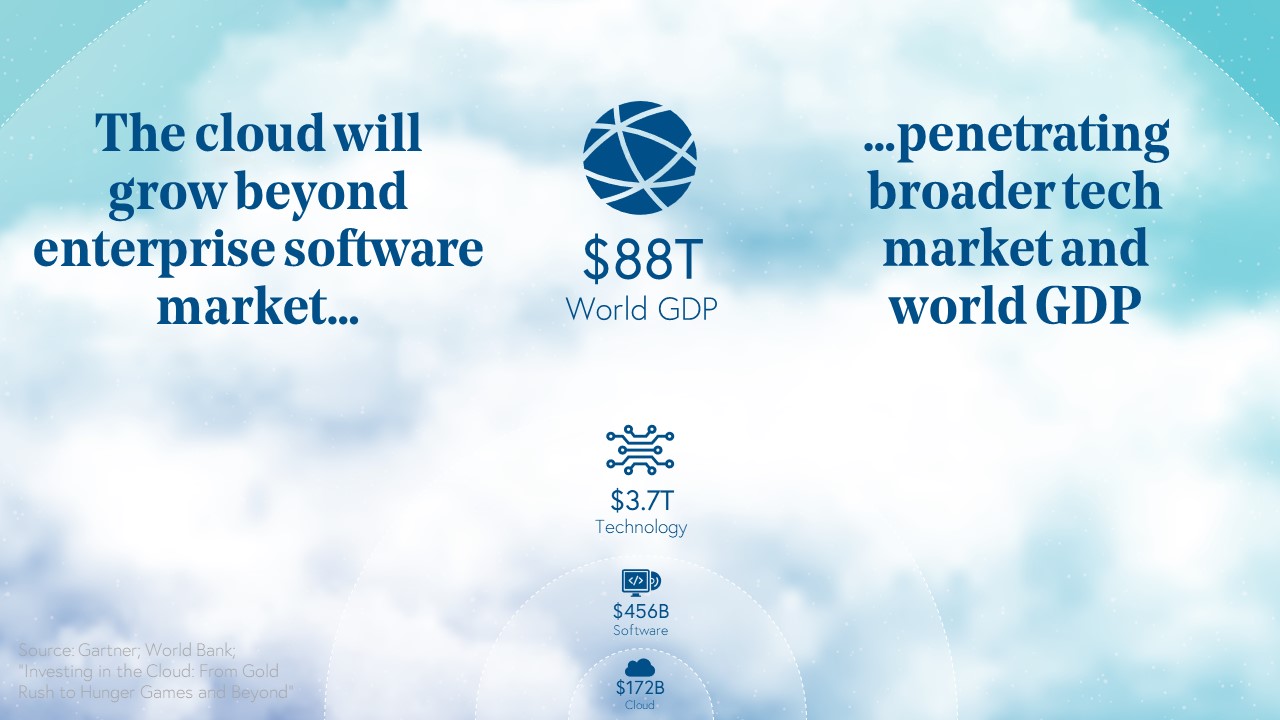

We’re living in a cloud-first world. While many would say software is eating the world, we think that’s only half the story. Cloud is powering the future of software. At current growth rates, cloud could penetrate nearly all enterprise software in a few years.

By 2025, we expect the cloud to penetrate 50% of enterprise software. At the same growth rate, we predict that cloud will power over 75% of software by 2030.

Aaron Levie, CEO of Box, a Bessemer portfolio company, recently said, “The cloud is becoming as fundamental to how the world runs as the electric grid, telecom network, or the railroad,” and we couldn’t agree more.

The question remains: Is this a good or bad thing for us as cloud investors and for cloud founders? For those of you starting today, did you just miss the single biggest enterprise tailwind of your lifetime? There’s still opportunity ahead for us all.

If the global economy has learned anything during this extreme public health crisis it’s that digital transformation, largely powered by the cloud, is no longer an option but an absolute imperative.

We believe that the cloud industry ($172 billion), and the cloud delivery model, will transform and grow beyond enterprise software ($456 billion) and technology ($3.7 trillion).

The cloud has already moved beyond the enterprise software market and will continue to as we turn toward the cloud for transportation, healthcare, education and more.

Now that we’ve seen how the industry has grown, we’ll talk about the strategies and laws that build powerful cloud businesses that grow into category-defining companies.

Business fundamentals for cloud founders

Today there are more than 140 private and public cloud companies worth over $1 billion dollars. We’ve been privileged to work with many of the best leaders and companies throughout the last two decades, which has helped us author Bessemer’s 10 laws of cloud, the core fundamentals to building a strong enduring business.

From our 10 laws of cloud, we drill down into three vital areas early stage cloud founders must focus on, no matter if it’s a bull or bear market:

- Scale and positioning your company for market leadership

- Nailing your go-to-market strategy

- Building a culture of values

Law 1: In the cloud economy, scale wins

As Law 1 and Shopify’s CEO and co-founder Tobias Lütke explains, the best cloud companies build products that set the pace of innovation. To be a market leader, you have to own at least 50% of the market, while second and third place often owns 30 and 20%, respectively. Geoffrey Moore called this concept Gorilla Economics.

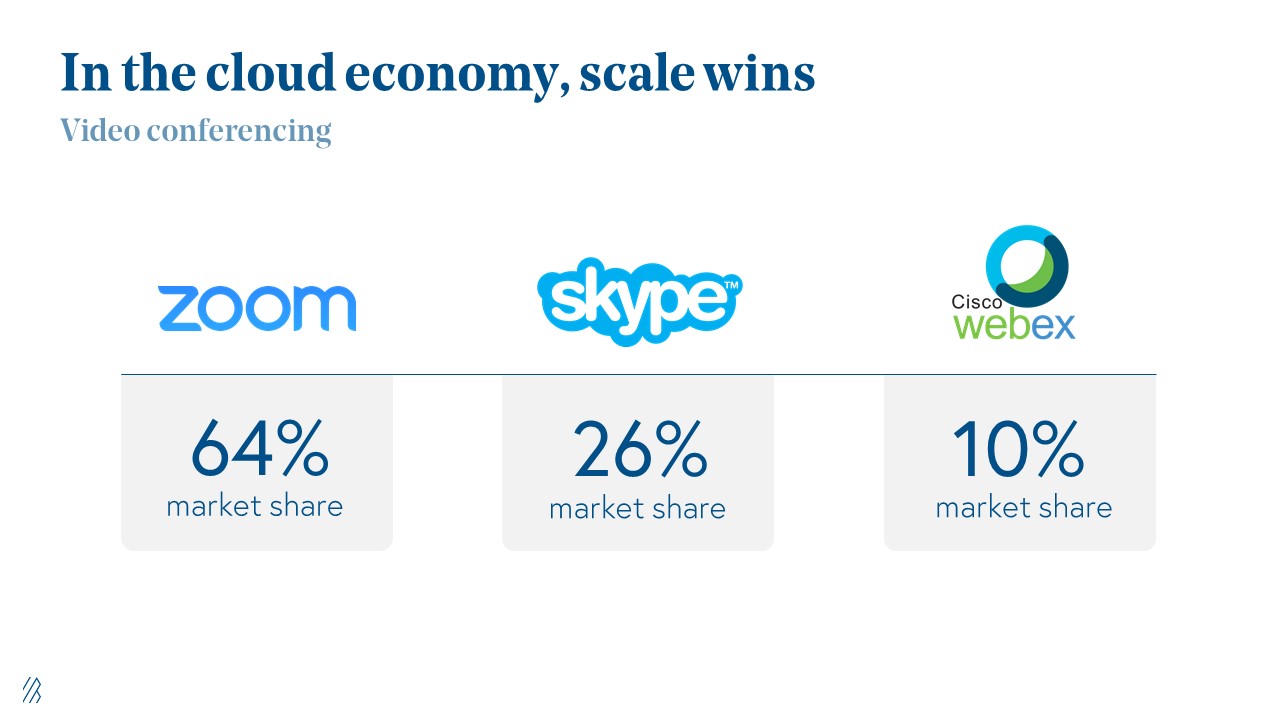

When applied to different categories of business you can see these dynamics play out. For example, when we look at the unified communications and video conferencing category the three major players are Zoom (64% market share), Skype (24% market share), and Webex (10% market share).

While there are multiple pathways to scale, cloud category leaders are scaling more rapidly than ever before because they’re not facing the same headwinds as their predecessors. Twenty years ago, it took Cornerstone OnDemand more than a decade to grow from $1 million to $100 million in ARR, but today we’re seeing emerging giants like Slack, UiPath, HashiCorp, and Twilio and more, do it in record time.

A company’s ability to grow revenue and expand its total addressable market is connected to what we call the “Second Act”. This concept represents your next product extension or new offering that can both be sold into your existing customer base and expand the number of new customers you can reach.

To find your next act, take a customer-led approach to product development. Talk to your customers, understand their problems, and understand where you can use software to drive value. If you can build a product that grows revenue, reduces expenses, or replaces existing spend with better functionality, you will find success with your next act. As co-founder and CEO of Twilio, Jeff Lawson said, “No matter where you’re at as a company, focusing on your customers is the right path.”

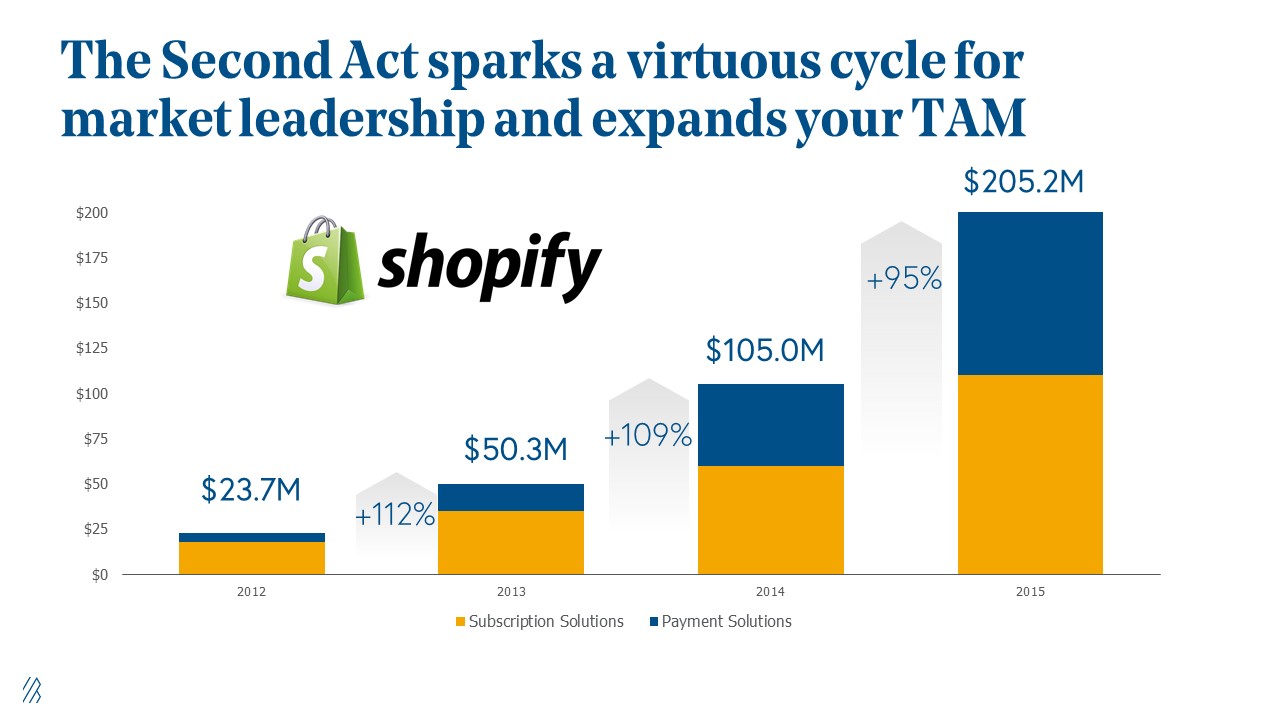

Shopify is a textbook example of how powerful the Second Act can be. For example, Tobi founded the e-commerce tool platform in 2011. In 2013, they reached $50 million ARR when they launched Payments. Layering on payment solutions for merchants and customers created a virtuous cycle that strengthened Shopify’s market leadership as a platform and increased customer retention over time. In 18 months after launching Payments, Shopify 3x their ARR, hitting $150 million, and by 2015, the company went public. As of April 20, 2020, Shopify’s market cap is $68.74 billion.

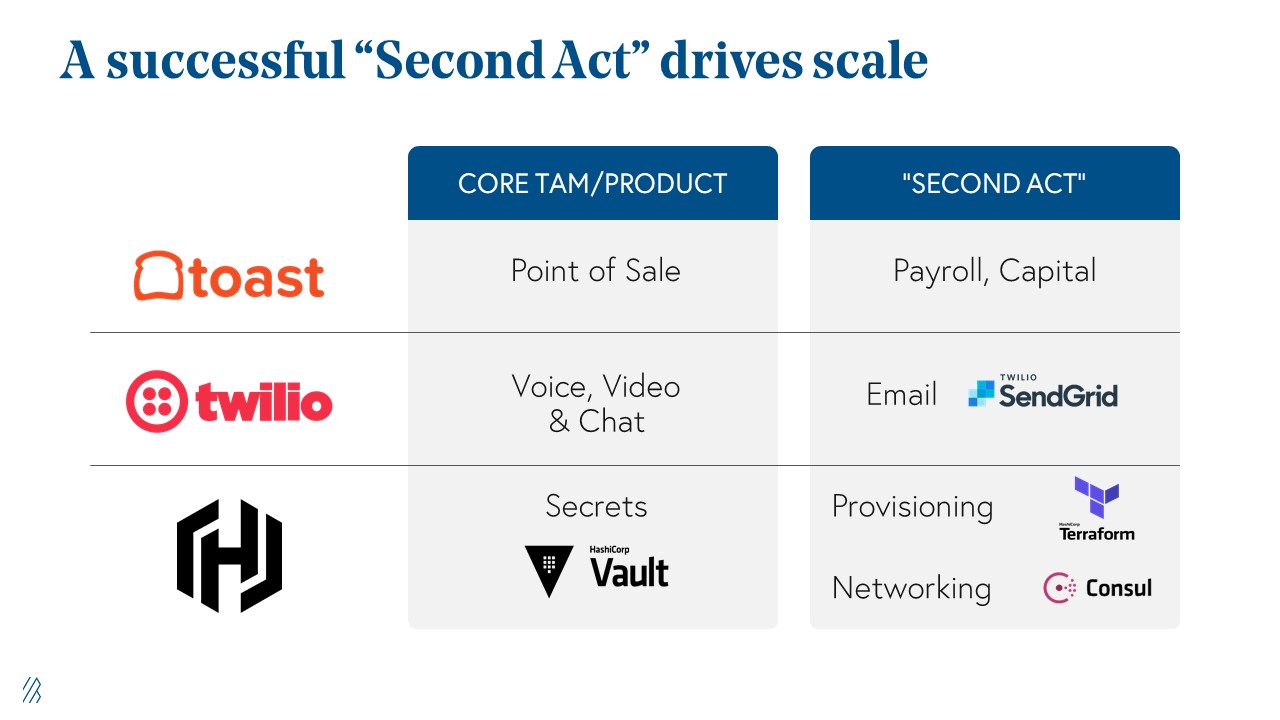

We’re seeing other category-defining companies emerge as leaders through their unique approach to Second Acts. For example, Toast, the restaurant management platform for restaurants, launched the company with their point-of-sale (POS) product. They launched their Second Act in the form of Payroll and Capital. Twilio had a series of additional acts with Video, Flex, and email when they acquired SendGrid.

As for HashiCorp, it initially commercialized primarily on Vault, but with customer penetration they were able to upsell Terraform and Consul, expanding its addressable market. Now that the HashiCorp product suite is well-known, it is able to fully commercialize all three products.

A Second Act is just a pipe dream if there isn’t a successful GTM strategy, which is why we need to address Law 3.

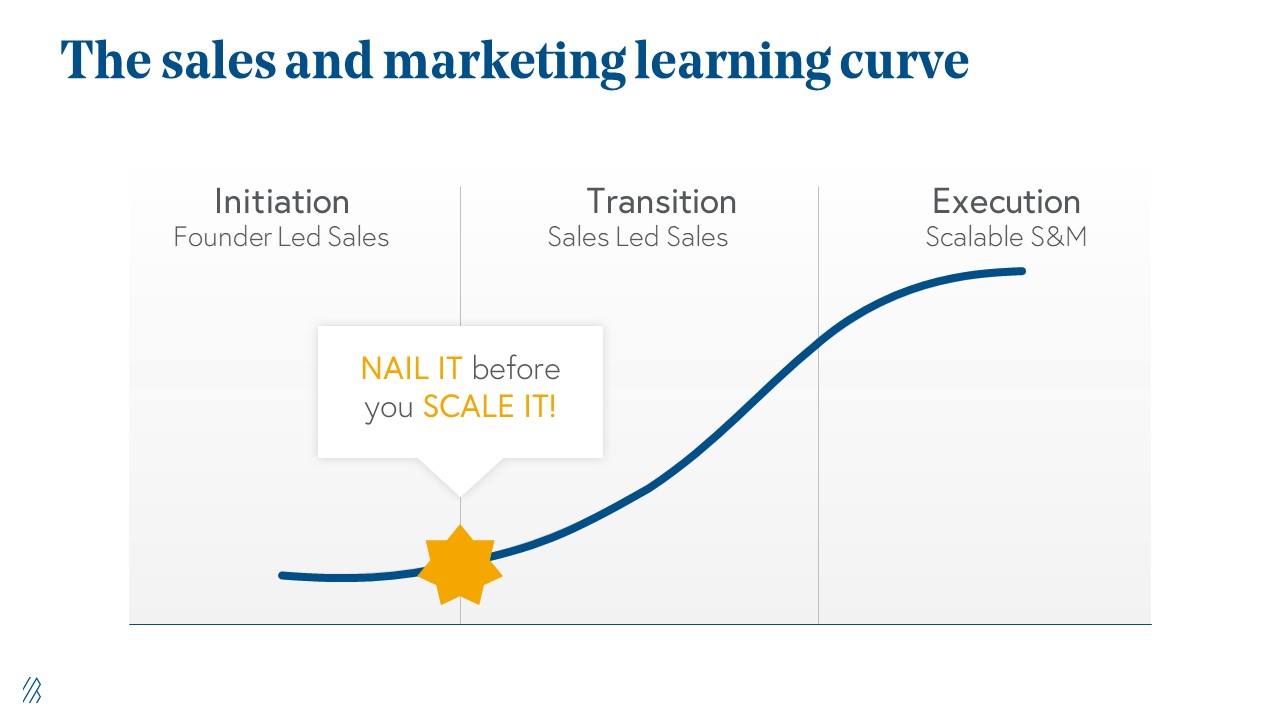

Law 3: Invest in the sales and marketing learning curve.

The first rule of running a sales organization is to ramp only what works. “Be cautious with investments as you test and iterate. Fail fast and be aggressive and scale your go-to-market when something is really working,” Tooey Courtemanche, Procore’s CEO and co-founder shared with Bessemer.

Many founders can probably remember the initiation phase or what it was like to be the sole sales rep. The transition point is when you start bringing on more reps. In traditional outbound sales, we recommend that you only hire more salespeople once you have two or three account executives hitting their quota without much support. For inbound sales, align hiring to match your company’s inbound lead velocity rate.

At that point, you can bring on more people, but remember to always “nail it before you scale it,” as Ann Miura-Ko coined.

Companies that invest in sales and marketing too early will see headcount burn increase without the associated topline growth, and sales rep quality will drop as company targets and quotas are missed.

Law 9: Tone starts at the top

Finally in Law 9, we address how, time and time again, leadership often drives a culture of values and innovation. “It’s important for leaders to address talent and culture like any company would address churn or competitive differentiation,” said Jennifer Tejada, CEO of PagerDuty.

Culture and values not only inform what a company goes out to build but also the talent they hire. Increasingly, we’re seeing companies present culture and employee engagement metrics in board decks. Software solutions like Glint, HiBob, and Culture Amp also help companies successfully gauge culture, measure benchmarks, and help inclusion numbers over time.

Across our portfolio companies, we recommend the following as initial best practices for early-stage founders:

- State your company’s mission and vision clearly

- Define your values

- Report on employee engagement at the senior leadership and board level

- Designate a board member to facilitate 360 feedback to the CEO

Many of our portfolio companies also extend company culture out into supporting the greater community. For example, Pledge 1% is a global movement where company CEOs are committing 1% of their equity, time, and product to give back to their community.

We only highlighted three of our laws, but we believe they are key pillars to becoming a market leader. Now we’ll discuss where we’re seeing some of the most promising companies in a few emerging categories.

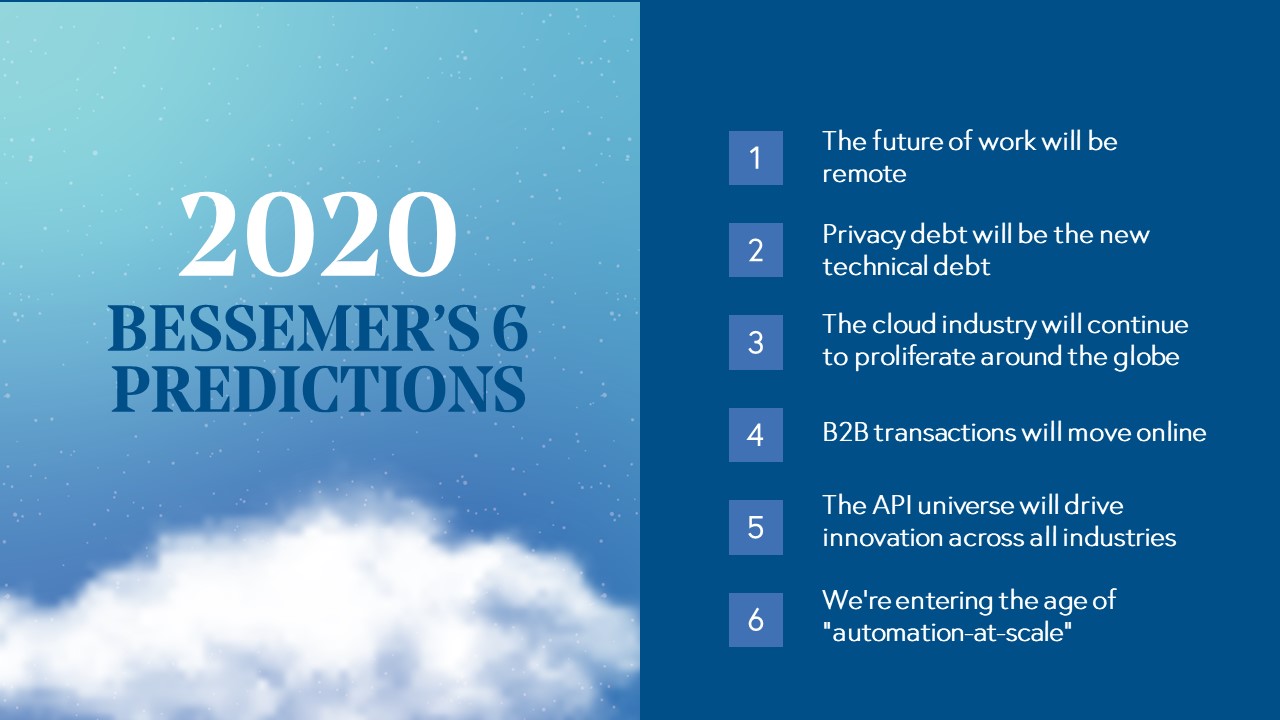

2020 Predictions

Every year, we identify the primary and emerging categories we believe provide the largest opportunities for early-stage cloud founders.

Prediction 1: The future of work will be remote.

With the existential threat of COVID-19 on the rise, we’ve seen a surging demand for remote and virtual conference platforms such as Zoom while companies adopt remote work practices. But this macro trend has been in the works for years.

“Increasingly, the knowledge economy is built on a decentralized workforce. Businesses are already retrofitting team architectures to match this future state,” wrote Partner Talia Goldberg in her Remote Work Roadmap. “As these changes begin to crest and companies reshape how teams are built and what ‘work’ entails, a mega wave of business software and tools will support this new generation of knowledge workers. We are excited to partner with companies fueling remote and distributed teams.”

The opportunities are expansive in this category with global HR & Payroll companies such as Papaya Global, Pilot, Velocity Global, Immedis, Deel, and Globalization Partners and management software, including Fellow, OfficeVibe, and Jell. As for Onboarding, Training and Culture Platforms, we’re seeing companies like Rippling, Hronboard, Everwise, Talmundo, Donut, Sli.do, Peakon, Hone, and Glint. Knowledge Sharing is its own category now, too, with Notion, Guru, Slab, Miro, and Loom.

If you’re a company building solutions for the future of remote work, you can reach Talia Goldberg at talia@bvp.com.

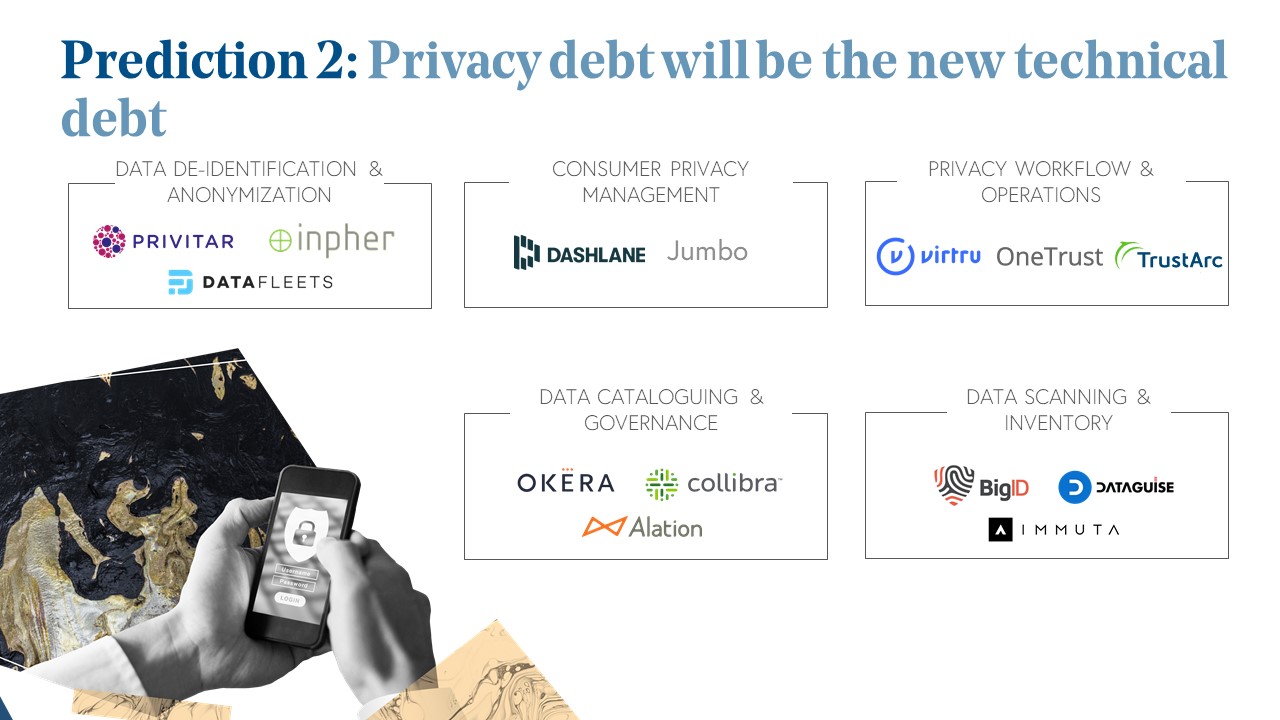

Prediction 2: Privacy debt is the new technical debt.

By 2020 it’s estimated that the average cost of a data breach will be over $150 million, with the global annual cost forecast to be $2.1 trillion. New laws such as GDPR and CCPA are creating the demand for enterprises to tighten their data privacy practices.

“While many tech companies were architected to collect data, they were not necessarily architected to safely store data. Today there’s not just a rift, but a chasm between where data privacy technology, processes, and regulations should be and where they are, thus creating massive amounts of “privacy debt,” wrote Partner Alex Ferrara in his Data Privacy Engineering Roadmap.

“Like technical debt, privacy debt requires reworking internal systems to adapt and build to the newest standards, which will not only make consumers happier but also make companies better.”

We’re seeing a new category of technology dedicated to helping enterprises, large and small, comply with global privacy regulations and help protect consumer data. For example, last year Bessemer invested in BigID’s Series C, a data intelligence platform that finds, analyzes, and de-risks identity data, allowing enterprises to understand where their sensitive data lives, at scale.

Other notable companies in this emerging category include DataFleets, Privitar, Inpher, Dashlane, Jumbo, Virtru, OneTrust, TrustArc, Okera, Collibra, Alation, DataGuise, Immuta, and many more.

Bessemer’s Data Privacy team Alex Ferrara, Jules Schwerin, and Mary D’Onofrio would love to hear from companies who are building software against this opportunity (alex@bvp.com, jschwerin@bvp.com, mdonofrio@bvp.com).

Prediction 3: The cloud will continue to proliferate around the globe.

Silicon Valley doesn’t have a monopoly on innovation. And with the adoption of the cloud and its maturation as an industry, we’re seeing incredible cloud-first companies built not only in North America, but throughout EMEA, APAC, and beyond.

Promising cloud companies have been founded across countries and continents such as Adyen and Elastic in The Netherlands, Productboard in the Czech Republic, UiPath in Romania, DarkTrace in the United Kingdom, Pipedrive in Estonia, Intercom in Ireland, Collibra in Belgium, Choco, Mambu, and Celonis in Germany, Canva in Australia, and Sisense, Monday.com, Lightricks, and Wix in Israel.

At Bessemer, we believe entrepreneurship is borderless, and we’re excited to continue to back cloud entrepreneurs around the world.

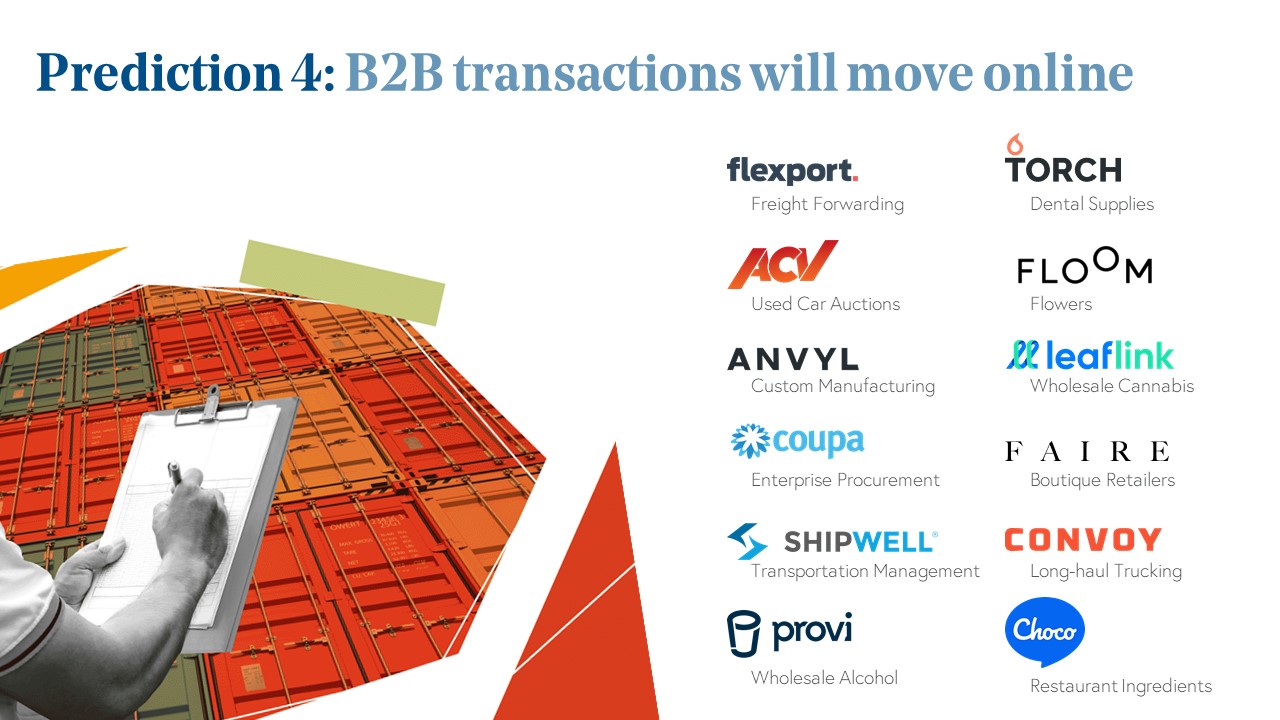

Prediction 4: The future of B2B transactions is moving online.

Digitally-savvy entrepreneurs have given more attention to B2C commerce than to B2B commerce. However, B2B markets are many times bigger than B2C markets (annual global B2B spend is more than $100 trillion), and they’re much more offline. Indeed, massive B2B markets like wholesale and logistics remain opaque and intermediary-driven, with orders and payments flowing via email, SMS, fax, and paper check.

“We’re on the cusp of a B2B purchasing renaissance that will spawn dozens of $1 billion+ companies with winner-take-most dynamics,” wrote Partner Kent Bennett in his B2B Marketplaces Roadmap. “We’re seeing a new generation of founders who are using new technologies and business models to digitize B2B spend; most of these founders come from large, antiquated industries where they discovered offline purchasing workflows firsthand.”

Recently, Bessemer hosted a B2B Marketplaces Summit where leaders from companies like ACV Auction, Stripe, Flexport, Coupa, Provi and more came together to discuss the future of B2B spend. We believe that next-generation B2B Marketplaces will be transformed by the cloud and help other businesses become much more efficient.

If you’re a company building solutions for the future of B2B Marketplaces you can email Kent Bennett (kent@bvp.com), Connor Watumull (cwatumull@bvp.com), and Mike Droesch (mdroesch@bvp.com).

Prediction 5: The API universe will drive innovation across all industries.

From web hosting to collaborative developer docs to shipping logistics, there are tens of thousands of APIs on the web, creating a multi-trillion dollar API market economy. From e-commerce shipping logistics (Shippo) and web hosting (Netlify) to payments (Stripe) and communications-as-a-service (Twilio) and even KYC and bank fraud prevention (Alloy) to collaborative dev documents (Coda), we expect to see nearly every industry be reinvented by an API.

For example, over the past few years, we’ve seen companies like Plaid skyrocket into success, changing banking and online transactions. This year Plaid was bought by Visa for a whopping $5.3 billion.

We believe there are massive API companies worth billions of dollars in every industry that will further drive digital transformation.

Prediction 6: We’re entering the age of “automation at scale”

In a world where software platforms, data, and applications are proliferating, companies are moving towards using software to reduce operational complexity. The automation of workflows, business processes, and even application development itself allows companies to reduce error rates and increase productivity.

We think that we are in the beginning stages of automation and there’s a new breed of more sophisticated automation platforms to come.

Approaches to this are taking multiple forms. One of the most well-known is Robotic Process Automation, by which software “bots” are programmed to complete low intelligence tasks. Companies including UiPath and Automation Anywhere are leaders in this space.

Companies like Unqork and Instabase are taking another approach, building low/no code application development platforms for the citizen/developer that encourage self-service.

Integrated Platform as a Service companies like Zapier and Unito also encourage workflow automation by enabling data flows between discrete applications through pre-built integrations.

A final approach is Software-Defined Management, championed by the company HyperScience, which automates entire business processes via application building blocks in order to increase labor efficiency and to trigger enhanced human-machine collaboration.

Founder resources

A new addition from previous State of the Cloud reports, we’ve curated resources for cloud founders. There, you will find the six accounting metrics that measure the health of a cloud business, along with other reports and articles on the cloud industry.

The cloud industry has never been more promising after two decades of growth. Today there are 140 private and public cloud unicorns, and we expect this number to continue to rise every single year. (One day, we expect to be celebrating decacorns in our annual Cloud 100 List!)

To learn more about how to build cloud-first companies from their humble beginnings to billion-dollar exits, subscribe and listen to Bessemer’s latest podcast Cloud Giants, hosted by Byron Deeter where he shares never before heard stories with some of the best leaders in technology.

Don’t miss an episode! Subscribe to Cloud Giants today:

For more insights on building cloud businesses, subscribe to Atlas to get the latest insights and benchmarks on the cloud from Bessemer.