State of the Cloud 2019

How to build a resilient business with G.R.I.T.

A decade ago there weren’t any private cloud companies valued at $1 billion. Today, there are 55 private cloud unicorns. If we include the additional 44 public cloud companies, there are 99 cloud players valued over $1 billion. What’s truly remarkable about the cloud ecosystem isn’t just the sheer size of the market, but also its interdependence.

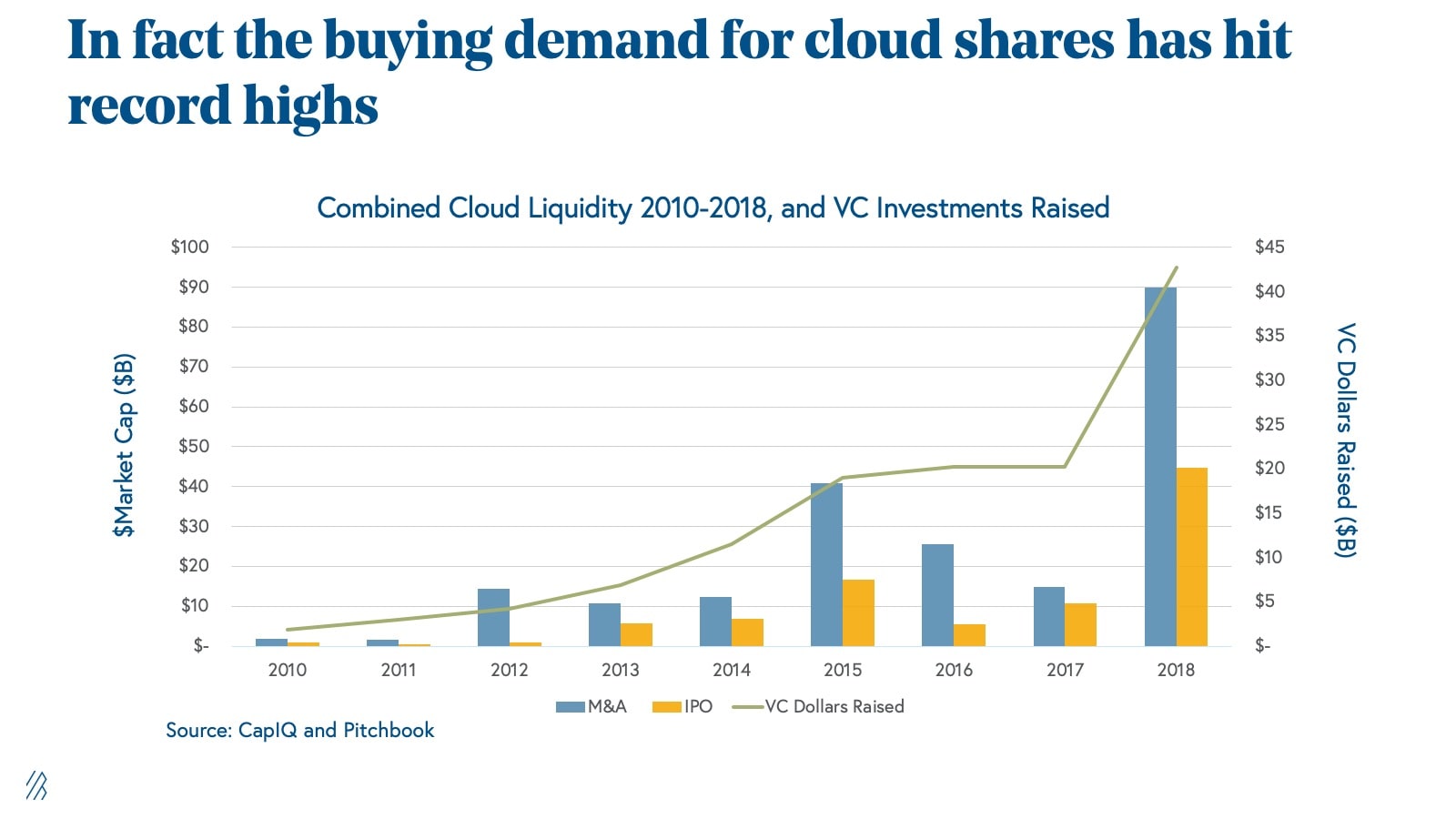

When a cloud company scales it often signals the growth of others, but there are a number of other signals to the cloud sector’s velocity. For example, this year, the demand for cloud shares and cloud liquidity hit record highs, outpacing 2015, which was the last record-breaking year.

With IBM’s purchase of Red Hat ($33B), Microsoft’s acquisition of GitHub ($7.5B), and SendGrid joining forces with Twilio ($2.9B), there was more than $90 billion spent in large mergers and acquisitions. More than $50 billion was also added to the market cap through cloud IPOs, including DocuSign, Dropbox, Elastic, and Carbon Black.

For more than a decade, we’ve had the longest bull run in U.S. history. At $175 billion, the top 100 private cloud companies have never been worth more. At this point, many founders are probably wondering how they can protect their companies from volatility.

While uncertain times are still ahead, cloud founders don’t have to thwart their aspirations of growth. Developing a new level of operational rigor by following the G.R.I.T. framework is one way for founders to understand their growth and build an enduring business along the way.

Operate with G.R.I.T.

Operational rigor is what separates early stage companies from the most influential cloud leaders. But take comfort in the fact that it’s possible: Twilio’s Jeff Lawson and Shopify’s Tobias Lütke are just two examples of the many first-time founders who were running cloud businesses during and post-recession.

At Bessemer, we recommend cloud founders operate on G.R.I.T.— a critical set of metrics that resilient, enduring cloud companies use as yardsticks of success.

Growth (ARR)

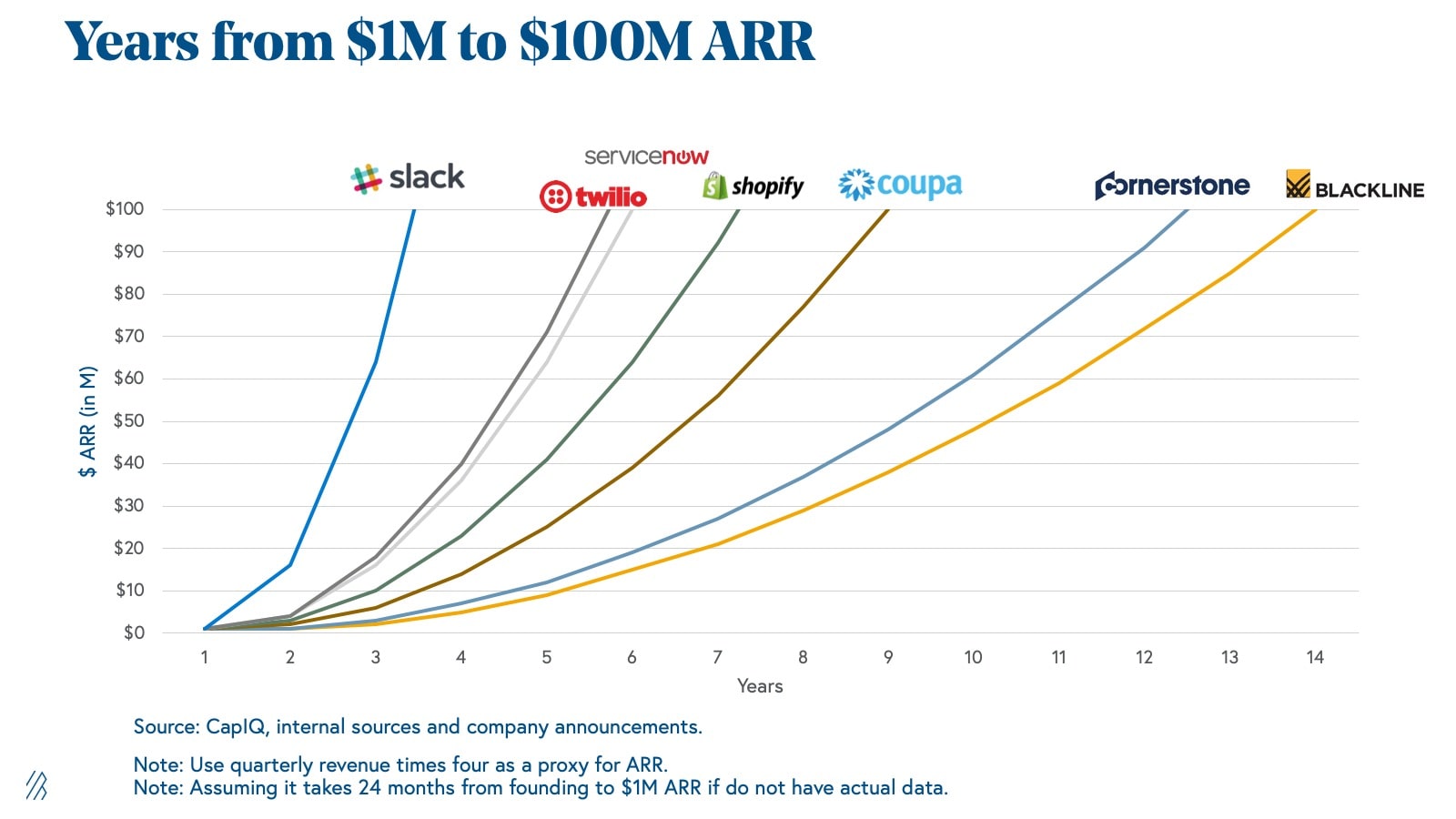

The first operational metric is annualized recurring revenue (ARR) growth. While companies such as Slack, Twilio, Shopify, and more are all considered successful in their own right, each one had their own path to earning its first $100 million in ARR.

Here’s a breakdown on how long it took for companies to go from $1 million to $100 million AAR:

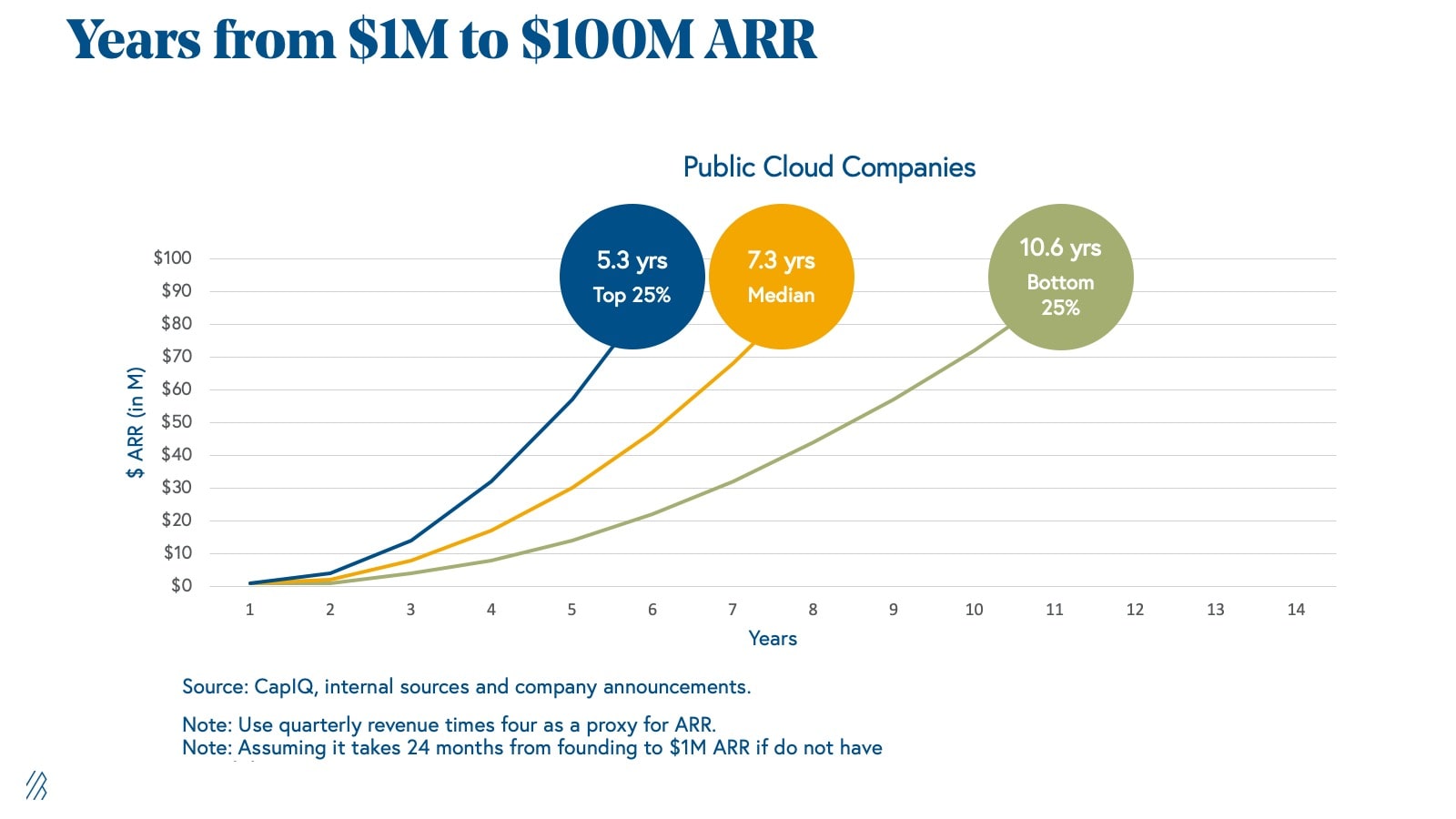

- The top 25 percentile of public cloud companies spends 5.3 years on average to reach the $100 million milestone.

- The median 50 percentile spends 7.3 years to reach $100 million in ARR.

- The bottom 25 percentile spends 10.6 years to reach $100 million in ARR.

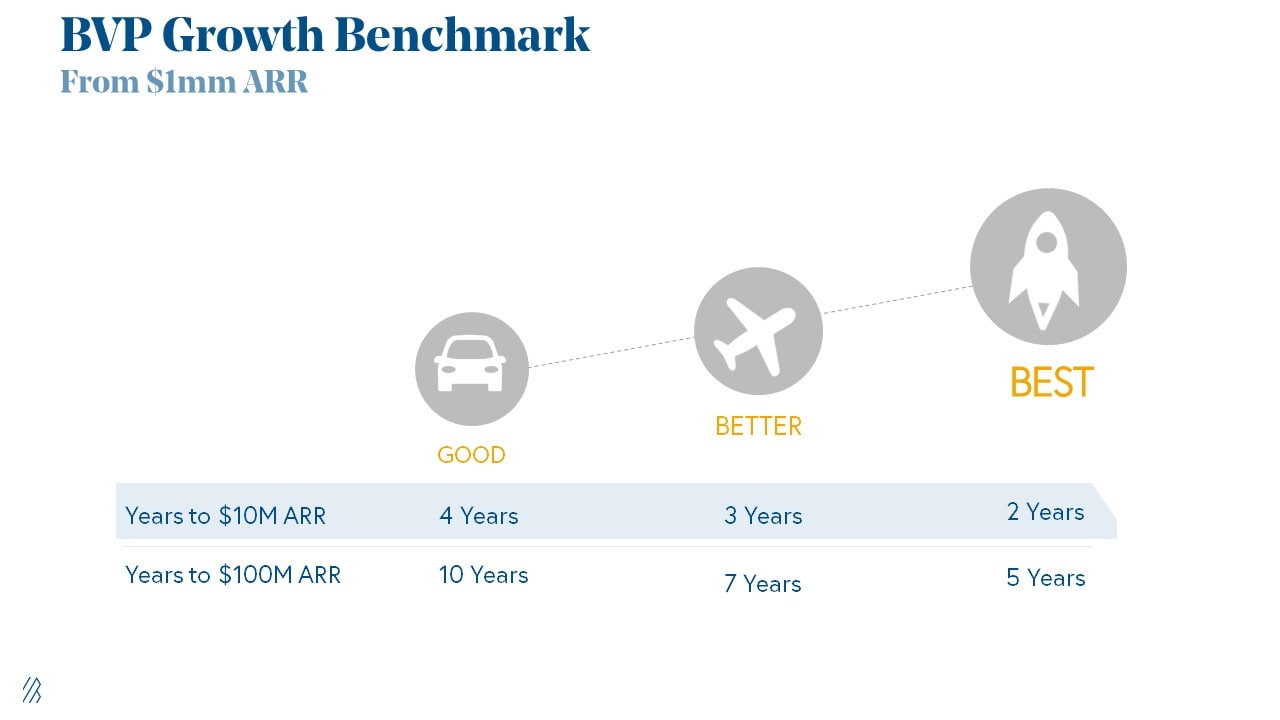

If you want to build the next big cloud company, here’s our Good, Better, Best framework for ARR. A cloud founder should aim for one of these timeframes:

- Good: Cloud companies operating on “good” ARR growth models earn the first $10 million in four years, and reach $100 million ARR in ten years. (e.g. Cornerstone On Demand)

- Better: Those that are better positioned earn the first $10 million ARR in three years, and reach $100 million ARR in seven years. (e.g. Shopify)

- Best: The best performing cloud companies reach $10 million ARR in two years and reach $100 million ARR in five years. (e.g. Twilio, ServiceNow)

Enduring companies don’t just have contingency plans for when a recession hits. They set these goals and figure out how to achieve them based on the expectation that there will eventually be changes in the market.

Retention is your best friend

Retention, the amount of revenue accrued over a period of time, including upsells, is one of the most influential levers for cloud and SaaS businesses to pull when growing ARR. Some of the best performing SaaS businesses we’ve seen in the past decade have higher than 100 percent net retention rate because they’ve built a metered business that sells more to a customer as its business scales.

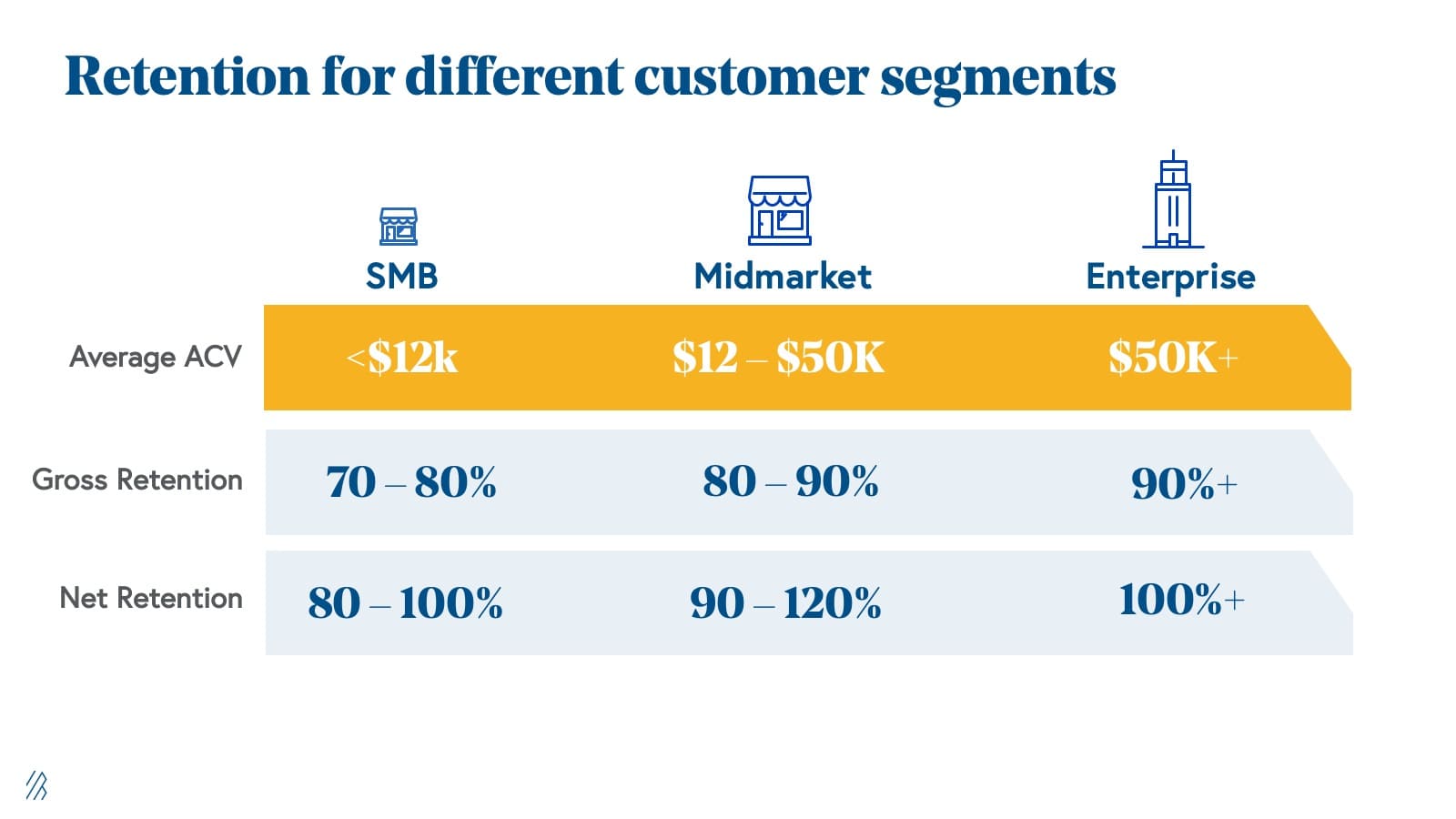

However, retention rates have different meanings depending on customer segments.

Here are the retention benchmarks a cloud company should aim for, by customer segment:

- SMB customers that have an average account contract value less than $12K see a gross retention rate between 70-80 percent and net retention rates between 80-100 percent.

- Mid-market companies that have an average account contract value between $12-50K should aim for a gross retention rate between 80-90 percent and net retention between 90-120 percent.

- Enterprise businesses that have an average account contract value $50K+ should aim for more than a 90 percent gross retention rate and more than 100 percent net retention.

If a company’s retention rate doesn’t fit within these bands, it’s time to investigate the culprit behind the “leaky bucket.” Churn is always a symptom of larger problems. By identifying and addressing the root cause of churn, a company can directly impact top line ARR growth by just retaining its current book of business.

In the bank

For early-stage cloud founders, the cash you have in the bank reigns Queen (or King). Also known as “runway,” cash is the fuel to build your product, acquire new customers, hire employees, and invest in growth opportunities.

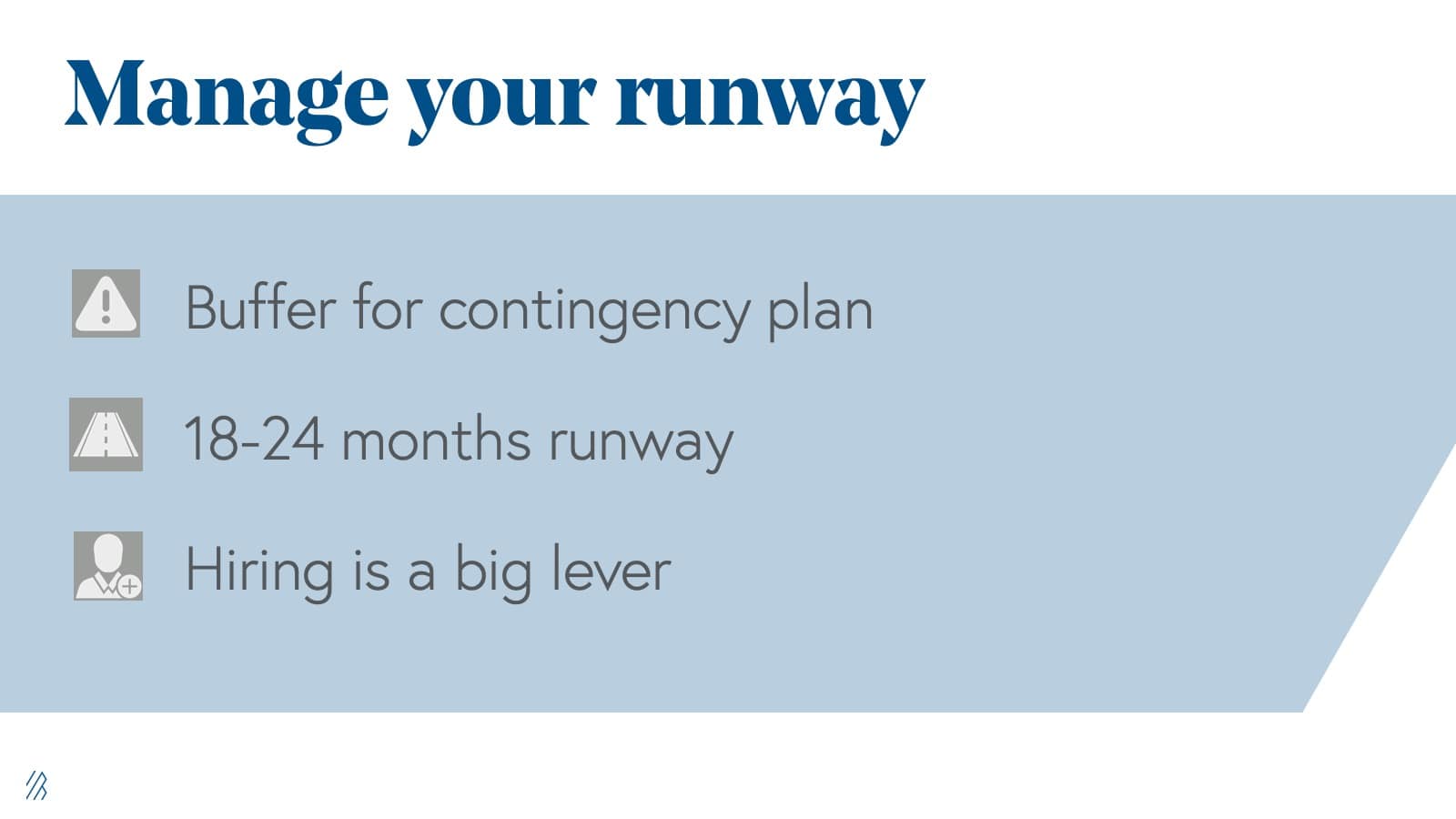

Efficiently managing runway is the lifeblood of an early-stage company’s longevity, and it begins with three critical rules:

- Buffer your budgets for a contingency plan;

- Target for 18-24 months of runway, at a minimum;

- Be as judicious as possible when expanding your team.

Hiring is an effective way to grow a business, but it’s also the most expensive. When in doubt, hire slow and release fast when a new team member cannot drive forward the company’s goals. The way cloud founders allocate their runway will ultimately determine their destination.

Targeted spend

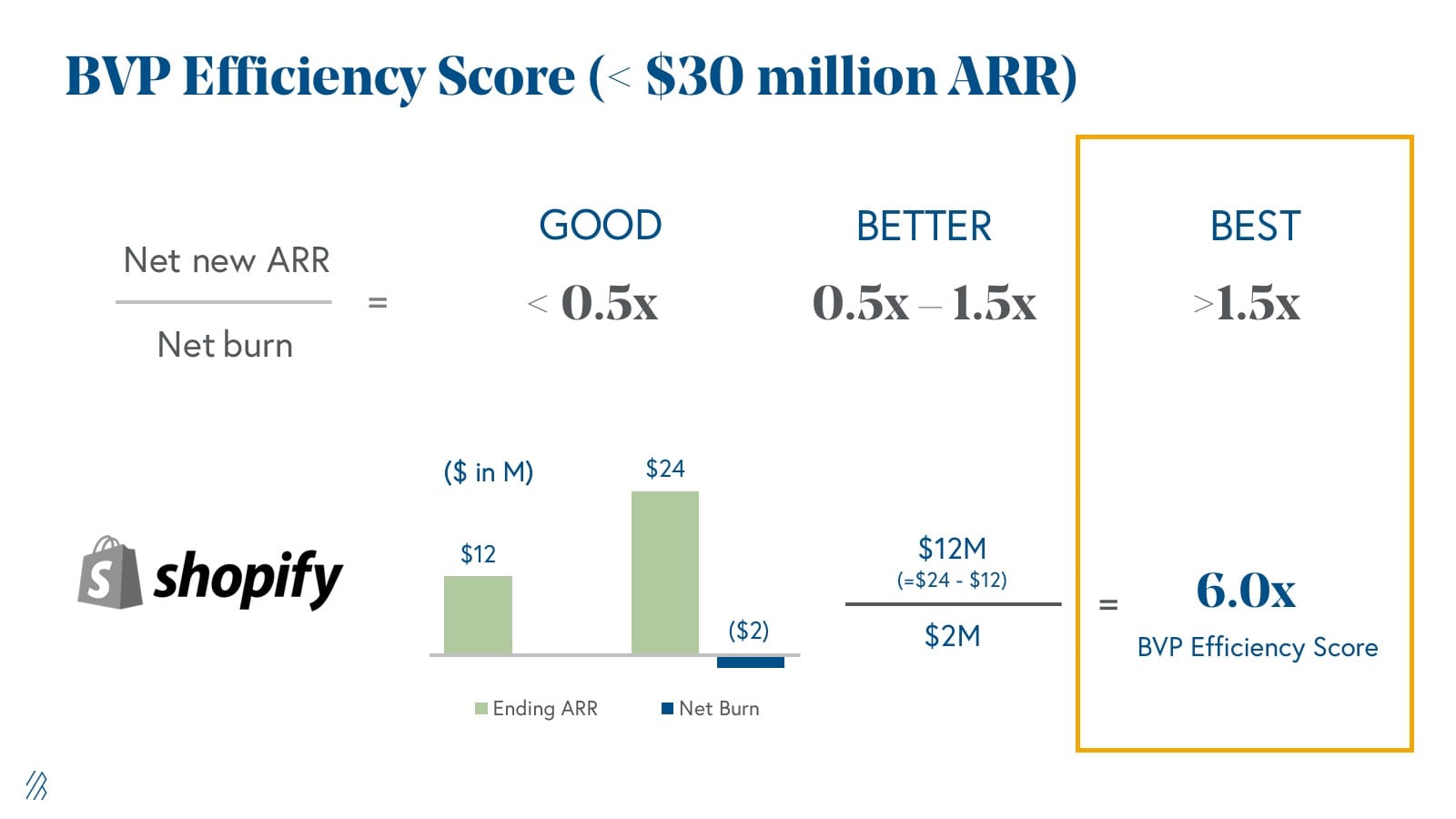

Cloud founders must always spend wisely to fuel growth. In 2017, Bessemer created a way to measure wise spending by coining the Bessemer Efficiency Score, which is defined in two ways, depending on the size of the company.

For startups earning less than $30 million ARR, the efficiency score is defined by net new ARR over net burn. In the Good, Better, Best framework when evaluating efficiency, the "best" score for a company at this stage is greater than 1.5x.

This metric is different than ARR growth because it measures a company’s spending habits. It’s great if a company grows 3x, but if it’s spending crazy amounts to get there, this rate wouldn’t be considered efficient growth.

In a bull market, startups can get away with less efficient growth by acquiring new customers at a higher cost than necessary. However, this approach reflects a lack of discipline and doesn’t make for resilient companies. The good news is that when you do develop more efficient businesses, they are rewarded in all markets.

How to calculate your score

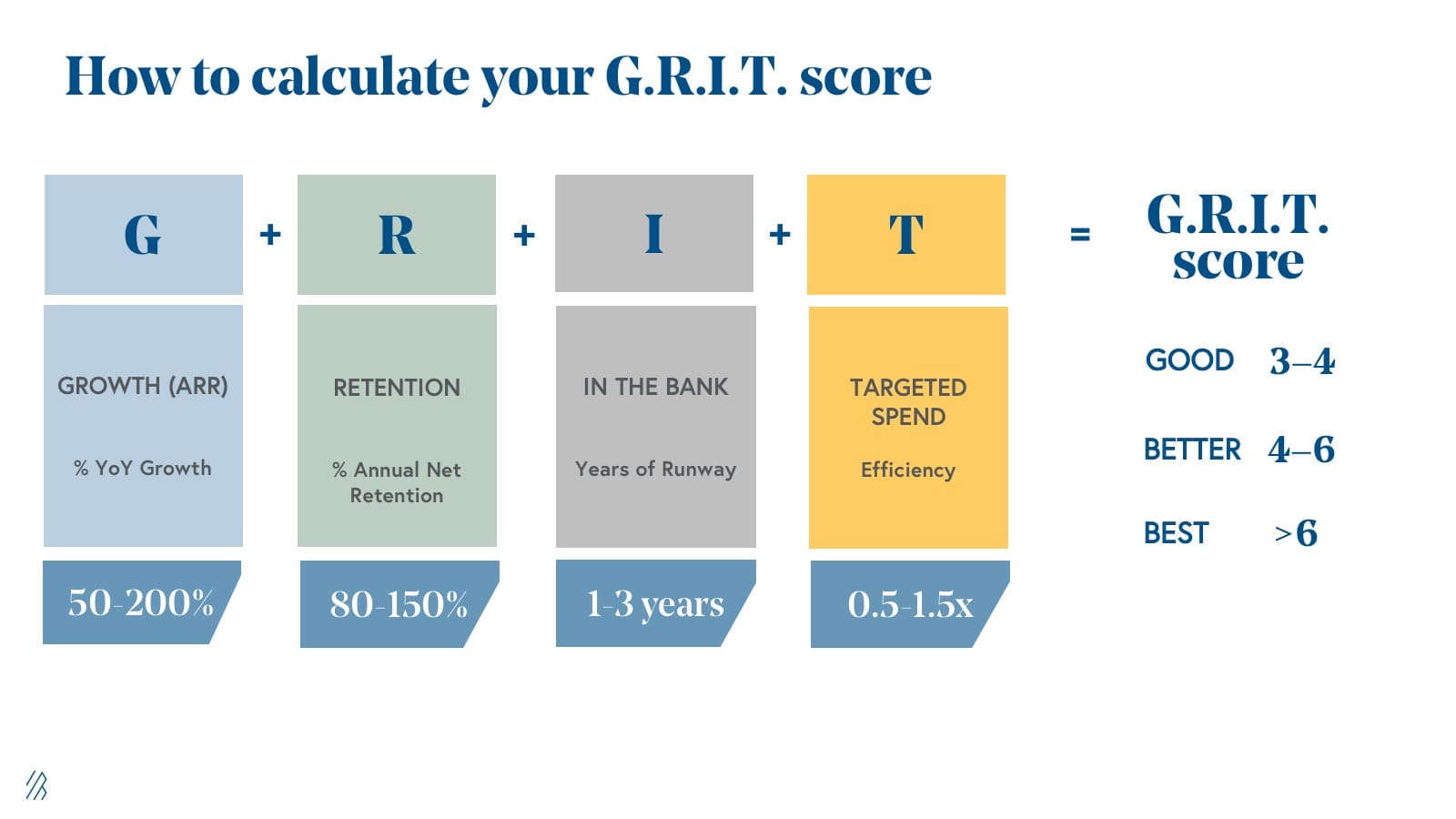

The G.R.I.T. framework highlights critical metrics when evaluating resiliency. By tracking ARR growth, retention, years of runway, and efficiency, the G.R.I.T. framework also translates into an equation.

Here we illustrate how to turn each metric into a variable and calculate a company's G.R.I.T. score.

Based on Bessemer's research and the most resilient companies in the industry, we provide another Good, Better, Best benchmark so any cloud founder can see where they fall and how they can improve overtime.

What's your G.R.I.T. score? Once a cloud founder equates where they land within this framework, they'll have a clearer idea of where their business can improve, or if it's time to celebrate (and maintain) a high G.R.I.T. score.

30,000-ft view of The Cloud

Since Bessemer penned the canonical laws of cloud computing more than ten years ago, our investors continue to explore how cloud businesses evolve over time and how these ten laws have aged with time. G.R.I.T. is a new framework for founders to build an enduring cloud business.

A few short years ago, we predicted that the public cloud market would reach $500 billion by 2020. We were happily proven wrong when we hit the mark two years earlier in March of 2018.

Less than a year later, the total cloud market cap sits right around $690 billion. Now, it’s time to set our sights on the next major milestone for the cloud industry, and see how new companies will innovate with emerging technologies.

2019 predictions

Every year at Bessemer, we share our top cloud predictions, which we believe will impact how enduring companies change the way we live, work, and engage with software.

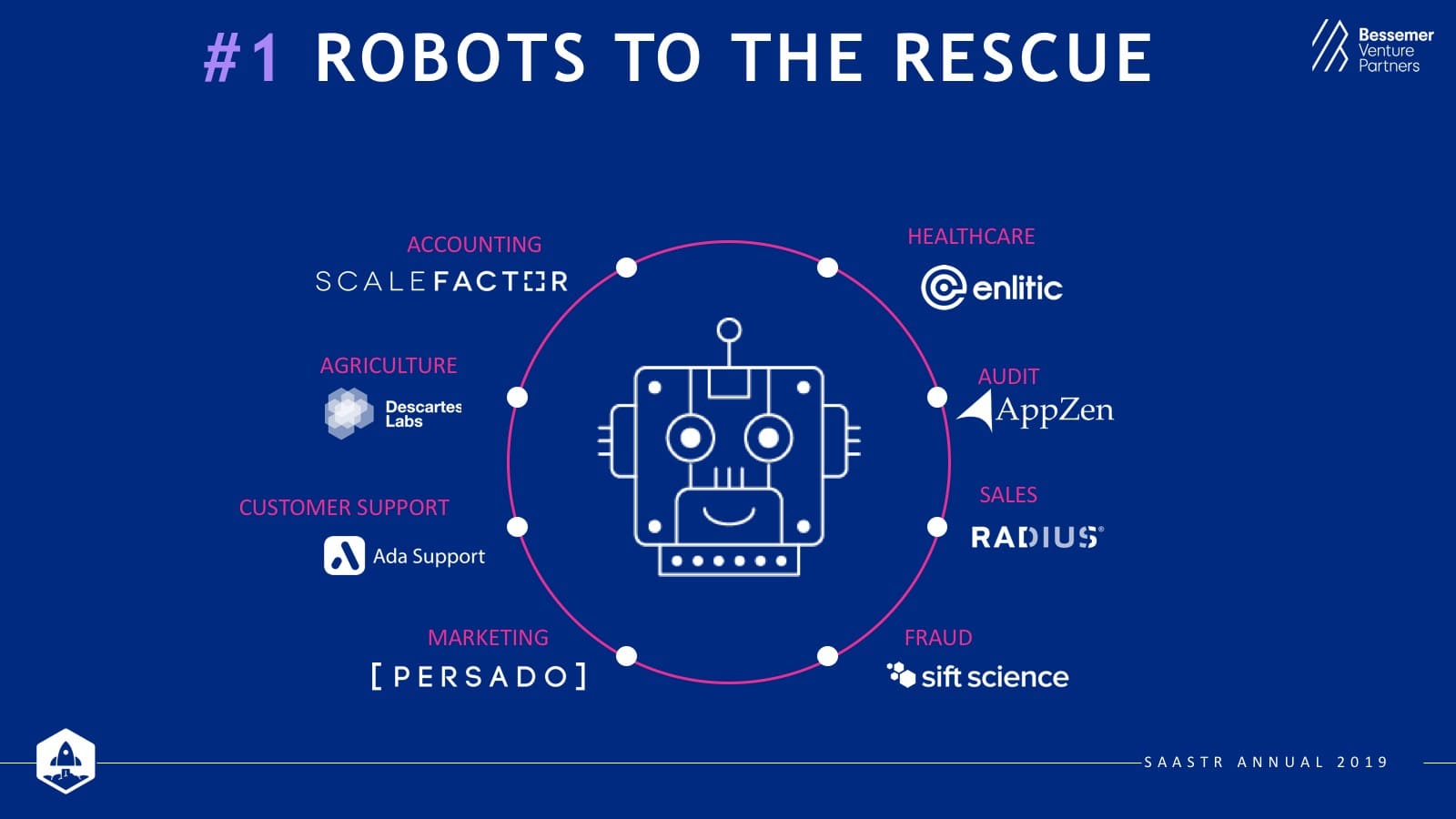

1. Robots to the rescue

We see “robots” as the change agents of the world. Machine learning and artificial intelligence will be instrumental technology for all the apps, platforms, and services cloud founders are building, particularly in industries where people deal with massive amounts of data like healthcare and agriculture.

Robots are especially exciting when they free up human time to work on value-based thinking rather than automated tasks. We see this particularly in business areas like fraud, customer support, and accounting, with companies, such as ScaleFactor or Ada Support.

2. Product has purse strings

Product is foundational to any software company– it’s what you build and sell. However, in the past, product teams were not the traditional, target decision-makers and buyers when businesses evaluated software purchases. They had unlimited budget for headcount, but not software. We think this may have been shortsighted.

If product is the center of the organization and touches all areas of the company (sales, marketing, engineering, and customers), there should be platforms that help people manage, measure, and build the designs, plans, and roadmaps behind products.

We’ve seen entrepreneurs realize this gap and build exciting tools, like Gainsight. There are many more solutions to come since product-centricity gives teams a deeper understanding of every aspect of the software, customer lifecycle, and business.

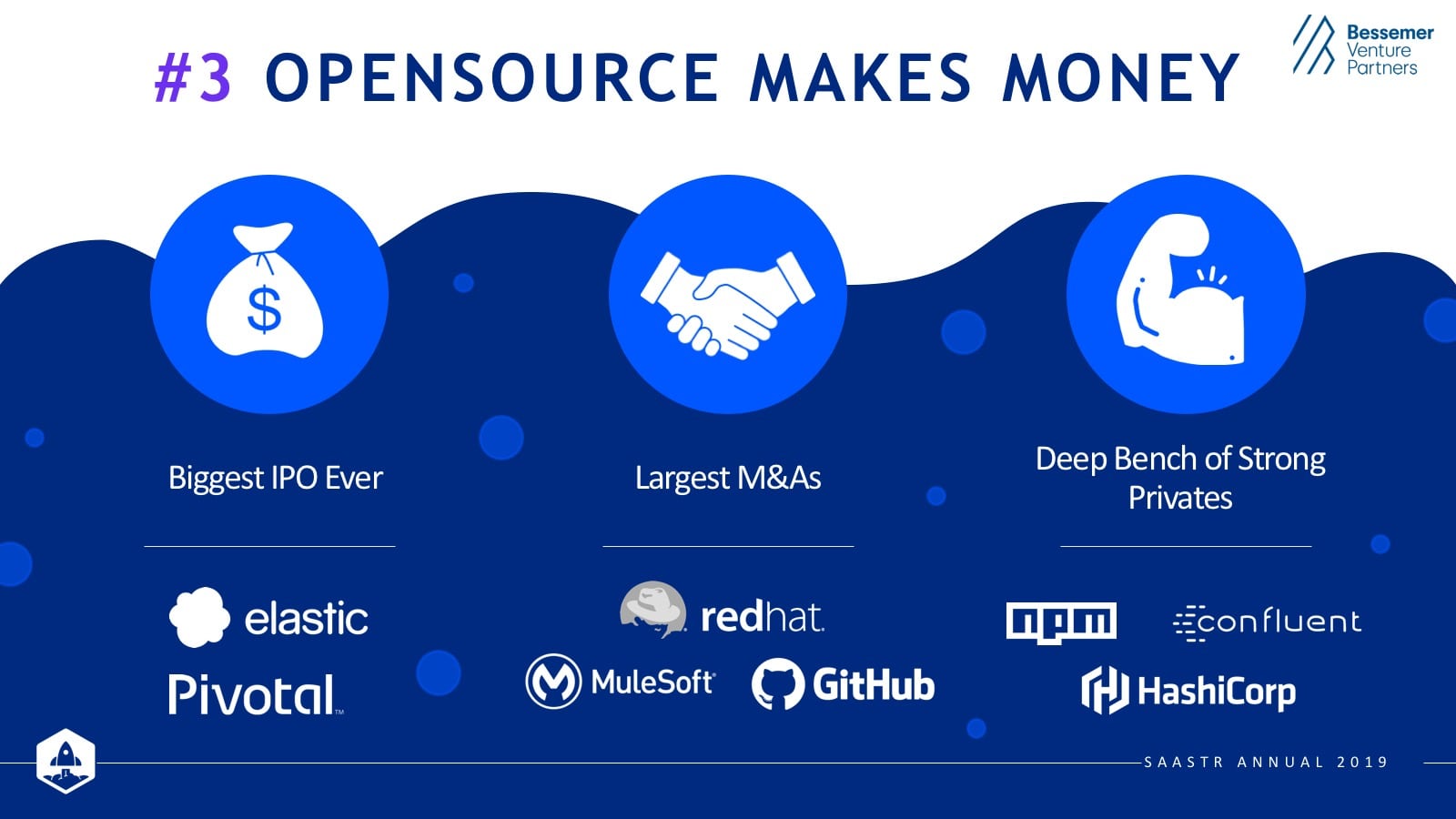

3. Open source makes money

Open source communities have always been beloved in the Valley – they are tight-knit, full of brilliant engineers, and at the cutting edge of innovation. But in the past, finding commercialization or liquidity has been a challenge. In 2018, there were two record-breaking IPOs for the open source community with Elastic and Pivotal.

We also had three of the largest M&As in history with Red Hat at $33 billion, MuleSoft, and GitHub. Private companies like npm, Confluent, and Hashicorp are developing and innovating open source for the enterprise.

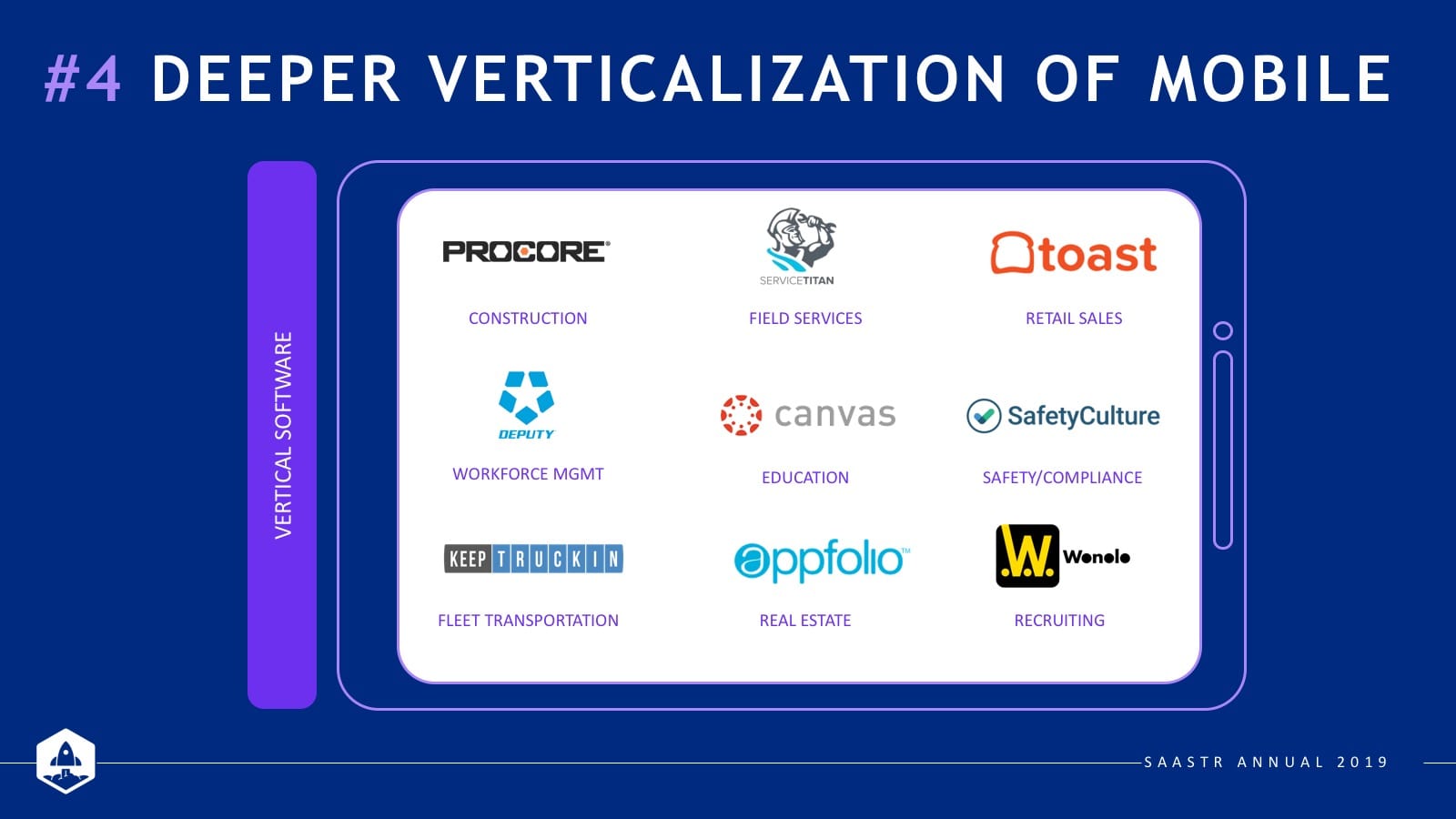

4. Deeper verticalization of mobile

We thought the mobile channel would manifest across both horizontal and vertical sectors, but on further reflection, mobile development is progressing rapidly in vertical sectors like construction, HVAC, etc.

ServiceTitan, for example, offers software and mobile solutions for businesses in field services, and their technicians.

Just think about people you know and how they work. There will certainly be more deskless workers who are always on the move and need access to technology, so we expect to see significant change in the vertical category.

Technical roles such as product, data science, SREs, QA, and others within an organization are prime, underserved buyers. As every company becomes a software company, these technical roles will have growing budgets and purchasing power to make decisions about what types of software they want to use to help them do their jobs better.

PagerDuty, for instance, makes the lives of IT Ops and SRE teams much simpler by providing a reliable alerting system to guarantee alerts are sent when needed.

Periscope Data empowers data analysts to very quickly visualize their SQL queries and create beautiful dashboards.

5. Low code/no code

The Low Code/No Code movement will provide technologies with amazing DX (developer experience) and offload smaller tasks so engineers can focus on more complex problem sets with the help of companies like Twilio and Auth0. No code solutions also give knowledge workers powerful functionality without requiring engineering resources. This includes easy automation, such as Zapier and UiPath, and business apps within the Salesforce and Workday ecosystem.

These are only five of the many trends we’re excited about at Bessemer, and we look forward to seeing how these ideas continue to contribute to the Cloud ecosystem.