State of Health Tech 2024

In this second annual report, we examine the health tech sector's resilience and recovery across public and private markets, with a focus on scaling early stage companies in the age of AI.

Introduction: The year of resilience

As we reflect on the health tech landscape in 2024, one word stands out: resilience. Like a phoenix rising from the ashes, the sector has shown remarkable adaptability and strength in the face of ongoing market challenges. In our State of Health Tech 2023 we covered in-depth the public and private market hype-cycle and steep market correction, as well as the heightened scrutiny of business models. This past year, we've witnessed the emergence of a new cohort of companies that are not just surviving but thriving in this new environment.

The bar for success has undoubtedly risen. Investors are demanding clearer paths to profitability, more efficient growth, and a differentiated path to value creation. Yet, amidst these challenges, we've seen encouraging signs of recovery in private market deal-making, particularly companies that have achieved product-market fit and are scaling efficiently.

Perhaps the most exciting development of the past year has been the explosion of interest and innovation in artificial intelligence within healthcare. Rock Health estimates that venture capitalists are allocating 38% of new investment dollars in healthcare to AI-enabled technology. This new "era of cognition", driven by advancements in AI and machine learning, is set to transform the way we deliver and manage care. We’ve seen hundreds of new companies emerge at the intersection of health and AI, with more than 20 startups rapidly achieving product-market fit and growing from $1 to $10 million in annual recurring revenue (ARR) in record time.

In this report, we'll discuss the current state of the health tech market, examine the performance of public and private companies, and publish for the first time benchmarks of health AI companies emerging as a new category. We'll also explore emerging trends and offer our predictions for the future of health tech.

Where have we been? 2024 market review

Health tech public market performance

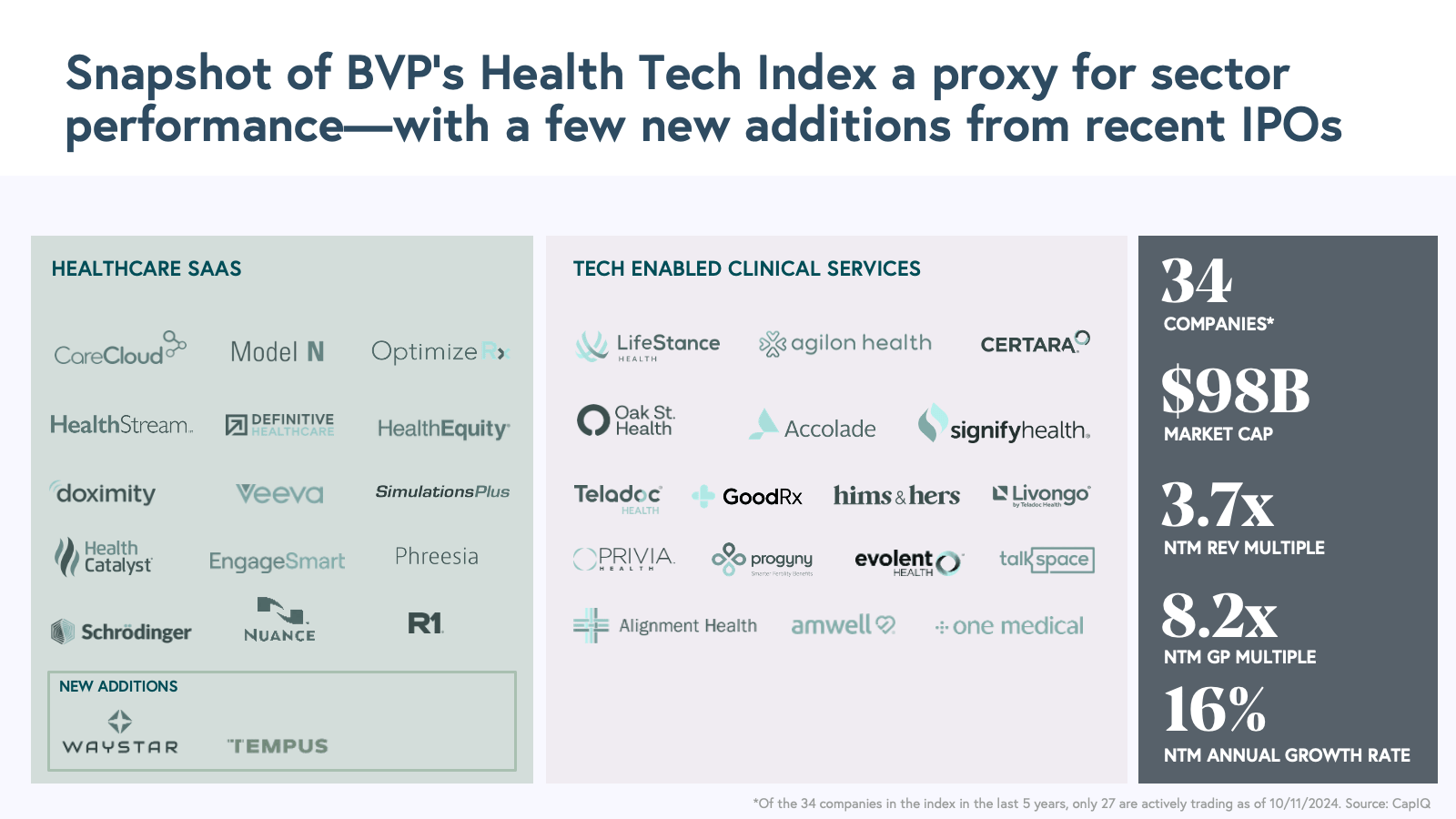

To gauge the overall performance of the sector, we've updated our health tech index, which serves as a snapshot of public market performance. This year, we're excited to introduce two new companies to our index: Tempus and Waystar, both of which completed their initial public offerings (IPOs) in 2024. Our expanded index now includes 34 companies, representing a total market capitalization of $98 billion, which is just the tip of the iceberg compared to the underlying value of the health tech industry in the private market.

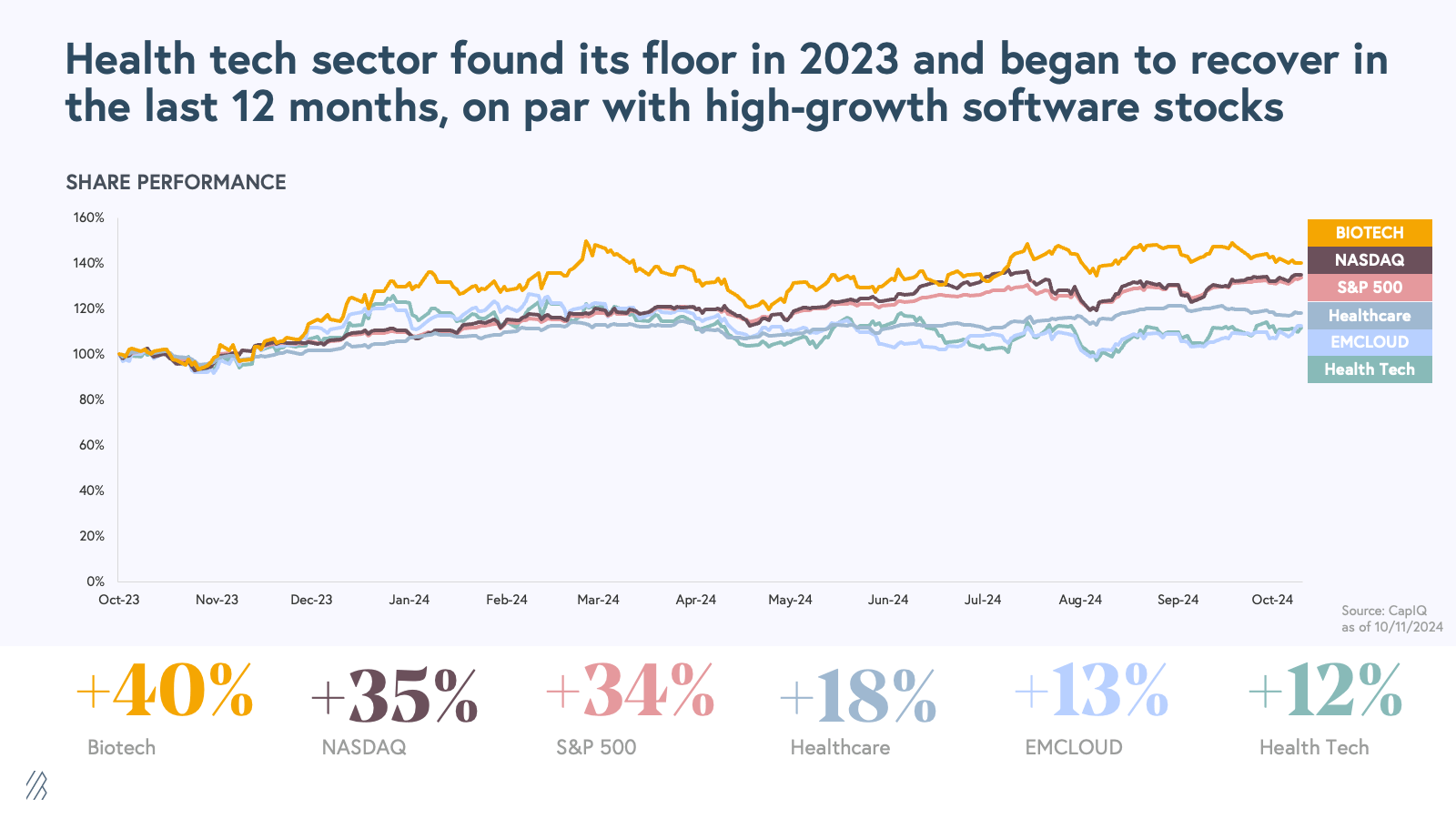

While the sector's performance over the past five years remains below its 2021 peak, we've seen notable improvements compared to last year's report. In the last 12 months, we see encouraging signs of recovery:

Last year, we predicted that the health tech sector had hit a trough. Since then, we have indeed seen public health tech stocks increase in value by 12%. Health tech performance is in line with high-growth software stocks [e.g. the BVP Nasdaq Emerging Cloud Index (EMCLOUD)] and the incumbent healthcare index.

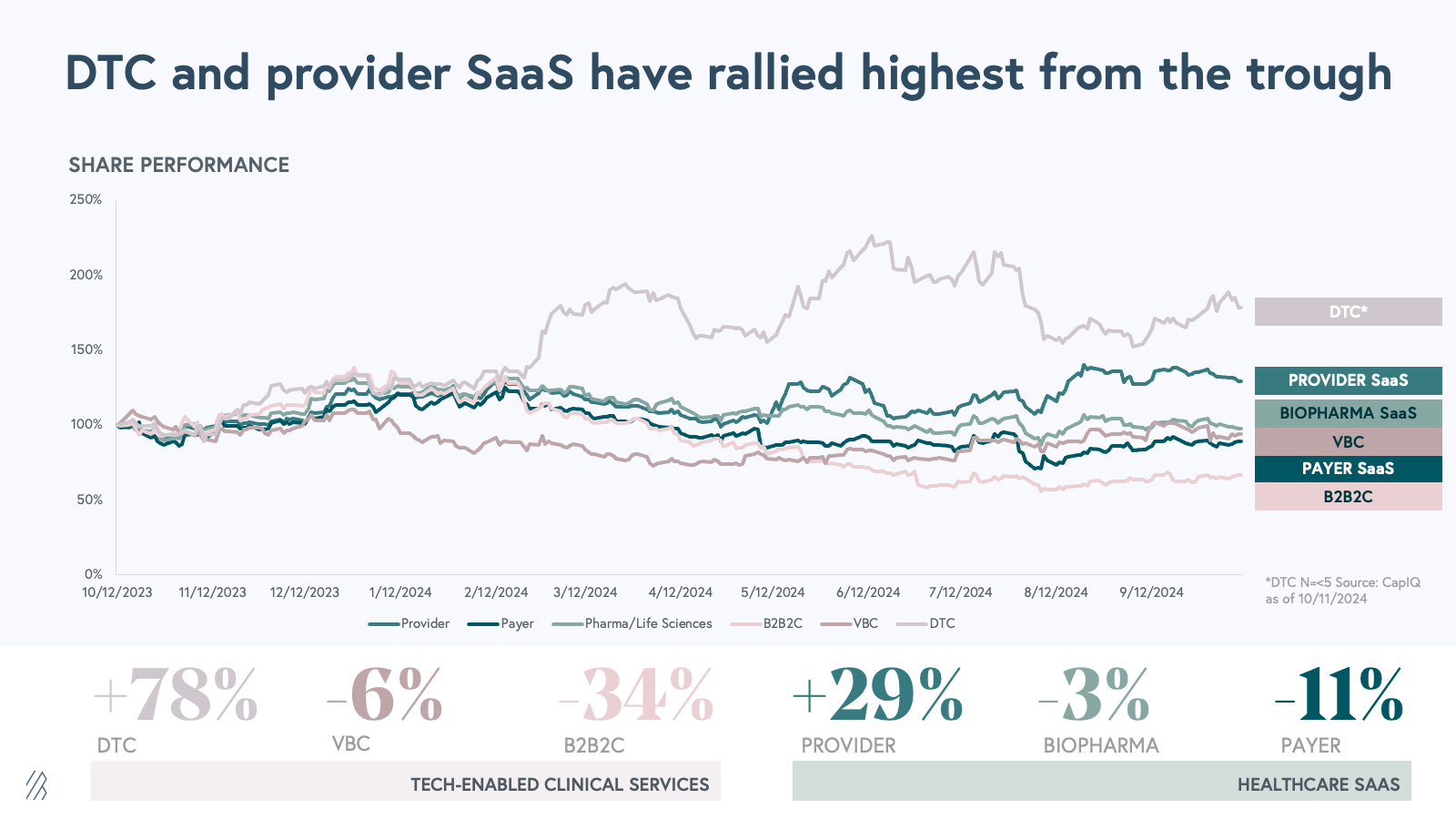

The direct-to-consumer (DTC) subsector showed the strongest rebound from its low in 2022. DTC gained ~25% in 2024, led by exceptional performance from companies like HIMS. Generally, investors have been wary of DTC companies in Healthcare due to the fickle nature of consumer behavior and lack of differentiated distribution channels. However, the recent performance of this sector calls into question whether consumer demand and large market tailwinds (including GLP-1, longevity, etc.) will open up a renaissance for this model.

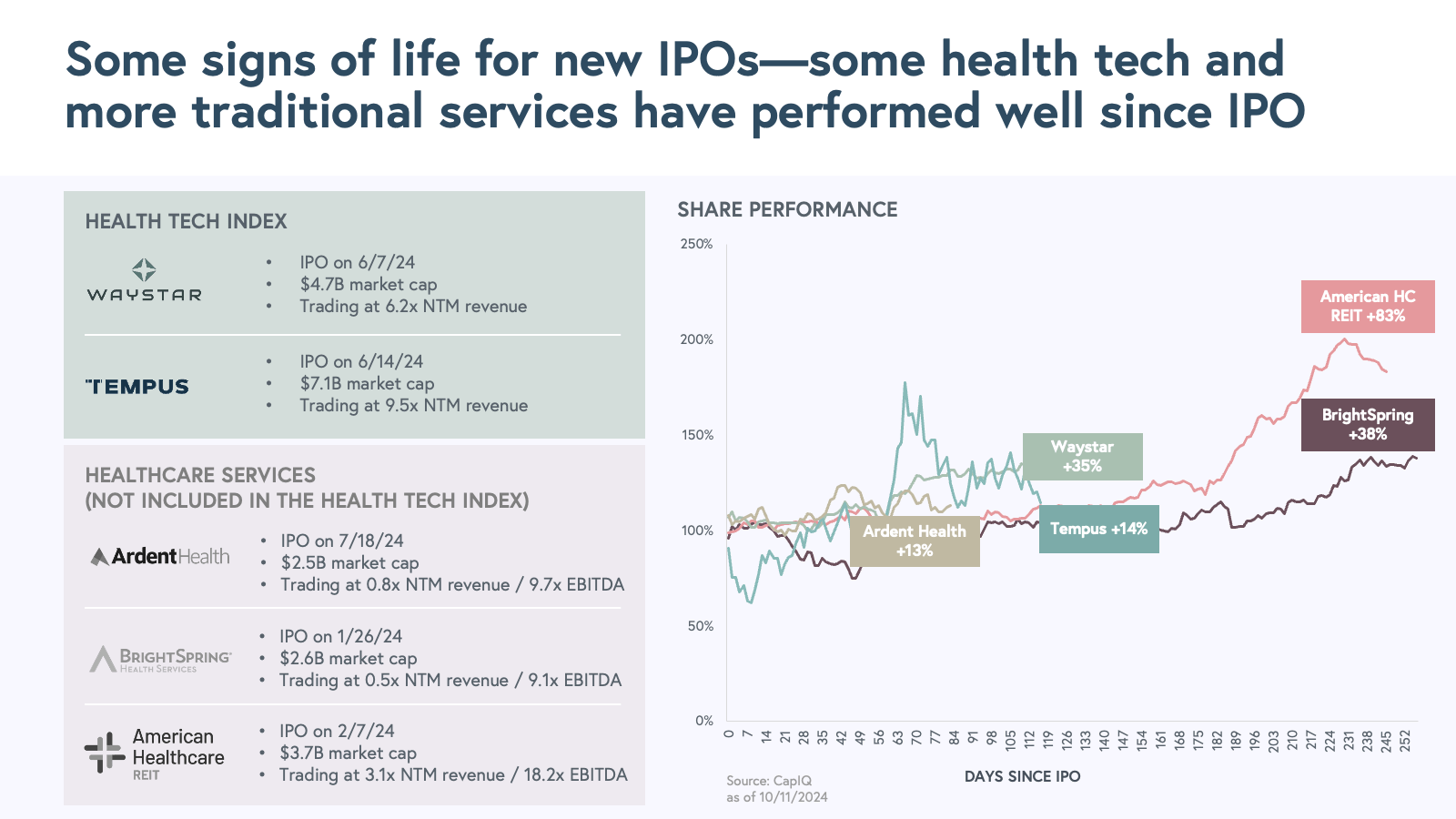

On the healthcare software side, provider SaaS has also seen significant improvement, bolstered by the addition of Waystar and Tempus to our index. This showcases a clear need for a new cohort of IPO that will serve as new oxygen to reinvigorate the "flames" of the sector. In addition to the solid post-IPO performance of Waystar and Tempus, we have seen early signs of the IPO window opening with a few other healthcare services companies going public (note: these are not included in our health tech index).

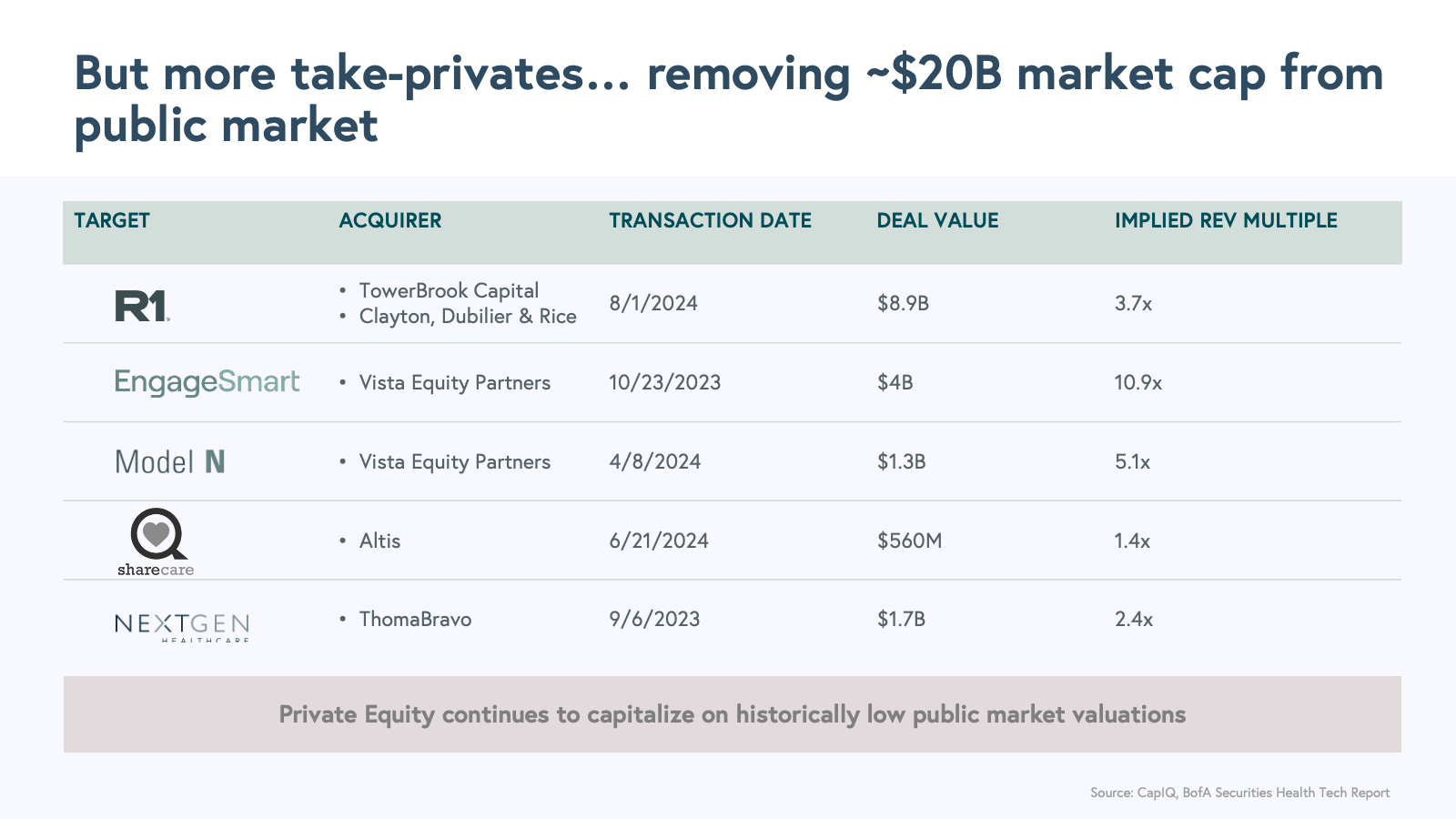

These debuts have injected some much-needed energy into Health Tech’s public cohort. However, this positive momentum has been partially offset by the loss of $20 billion in market capitalization due to take-private transactions.

Private equity firms, continuing to seize the opportunity on historically low valuations, have been actively acquiring public health tech companies. Notable transactions include revenue and billing services company R1 RCM’s $8.9 billion take-private in August, and provider software and payments company EngageSmart’s $4 billion take-private in October 2023. While these deals reflect the underlying value in the sector, they've also reduced the overall public market capitalization of health tech companies. This is not necessarily a negative, but rather showcases a turning point, where investors see a lot of value in overhauling these businesses with new technology like AI.

Looking ahead to 2025, we're cautiously optimistic about a new cohort of companies that could potentially go public and revitalize the sector. An influx of fresh market capitalization and new public listings will breathe life into health tech’s public market cohort, helping it rise like a phoenix from the ashes and driving its next phase of growth. A few factors that could make this possible:

- Improving macroeconomic conditions and the Federal Reserve easing interest rates.

- The uncertainty of a presidential election outcome left behind.

- A few examples of IPOs in other markets including high-growth cloud, biotech and fintech.

A cohort of private companies across tech-enabled clinical services and healthcare SaaS companies await their debut.

We are confident these prospects are showing continued strong profitable growth, untapped market opportunity, and proven outcomes and ROI to their customers. These companies have the potential to serve as bellwethers for the next generation of public health tech firms. It’s a matter of when, not if, these companies go public. As you’ll see below, there has been plenty of recent private market investment into great growth stage businesses. The success of these upcoming IPOs will be crucial in attracting investor attention to health tech and spurring a new wave of innovation and growth.

Private market investment activity

The private health tech market in 2024 shows resilience and adaptation. After a period of market correction, we’re seeing signs of recovery.

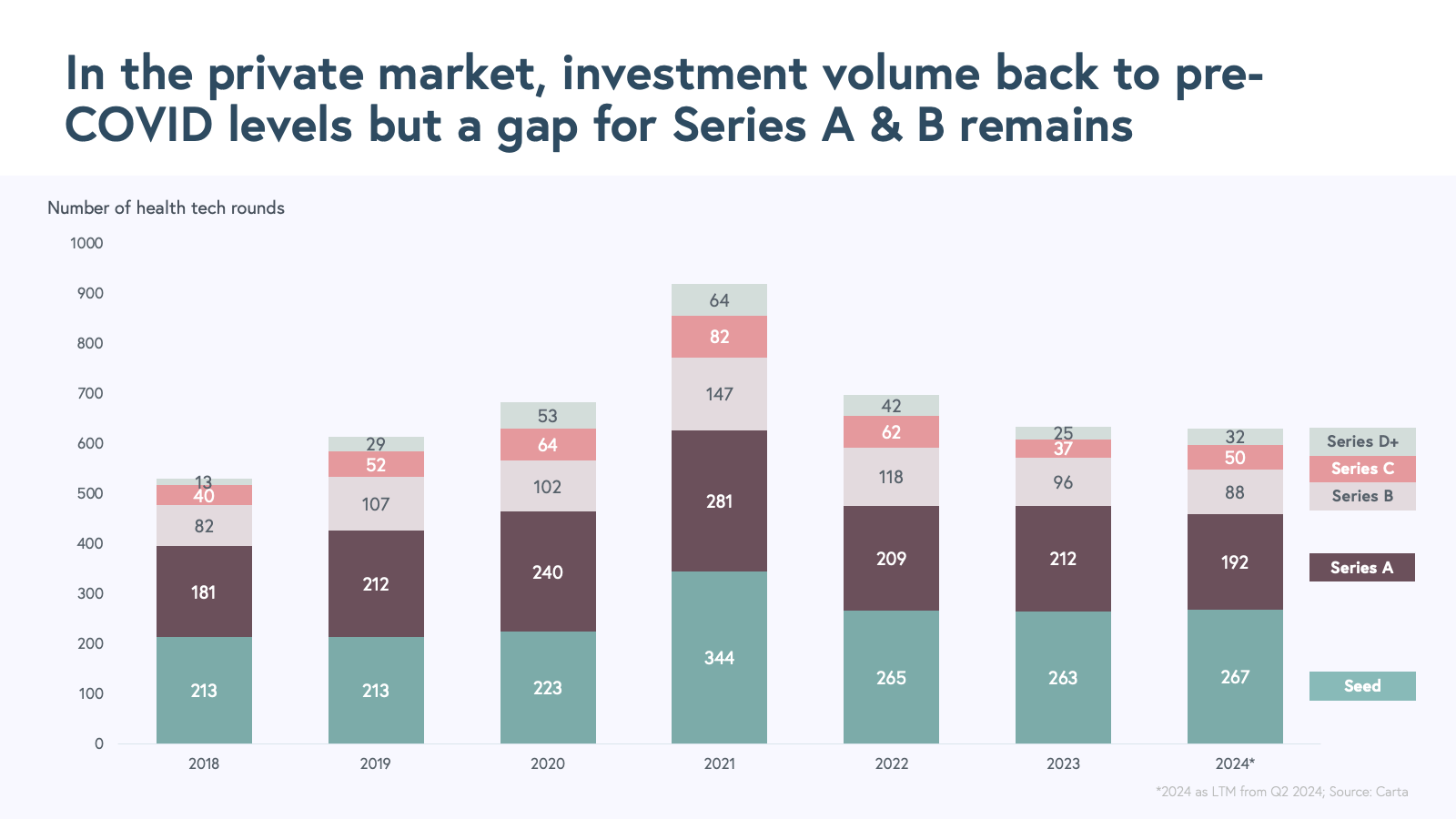

Private market investments have rebounded to pre-COVID levels, according to Carta data, with Seed and Series C+ nearing 2020 deal volume. Among Seed deals, we have witnessed a bustling scene of new companies sprouting at the intersection of AI and healthcare. On the Series C+ side, we have seen established businesses with scale that have honed their focus on growth and profitability over the last two years, and have successfully secured later-stage rounds in 2024.

The Series A and B crunch

Yet, amidst this recovering landscape, a gap remains—fewer Series A and B financings. This underscores the challenges that early-stage ventures continue to face in this evolving market.

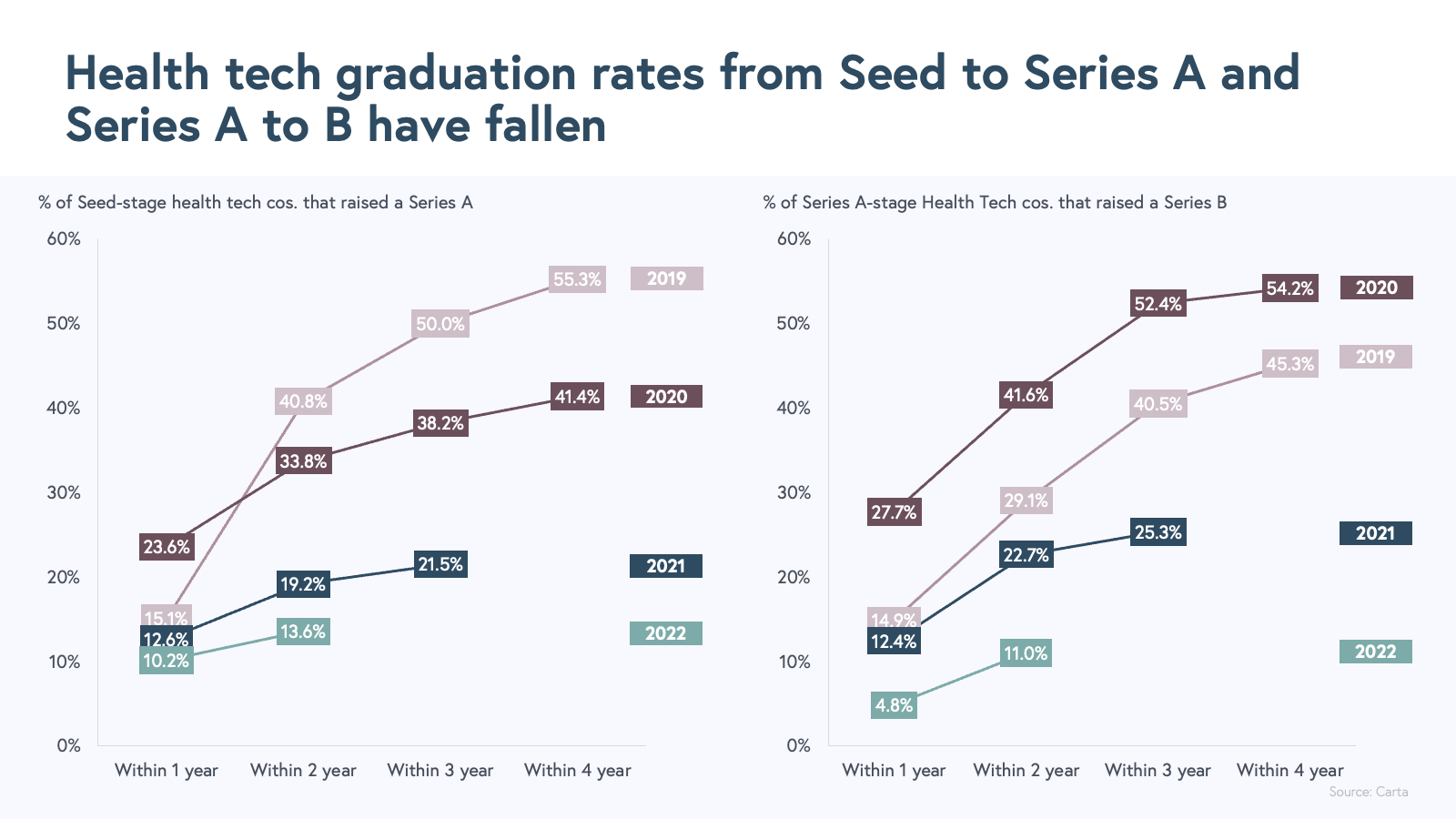

Our analysis of cohorts based on their Seed and Series A funding year reveals a cautionary trend:

- The rate at which Seed-funded companies progress to Series A within one, two, or three years has significantly declined for recent cohorts.

- Companies that raised Series A financings in 2021 and 2022 are facing challenges in securing Series B funding.

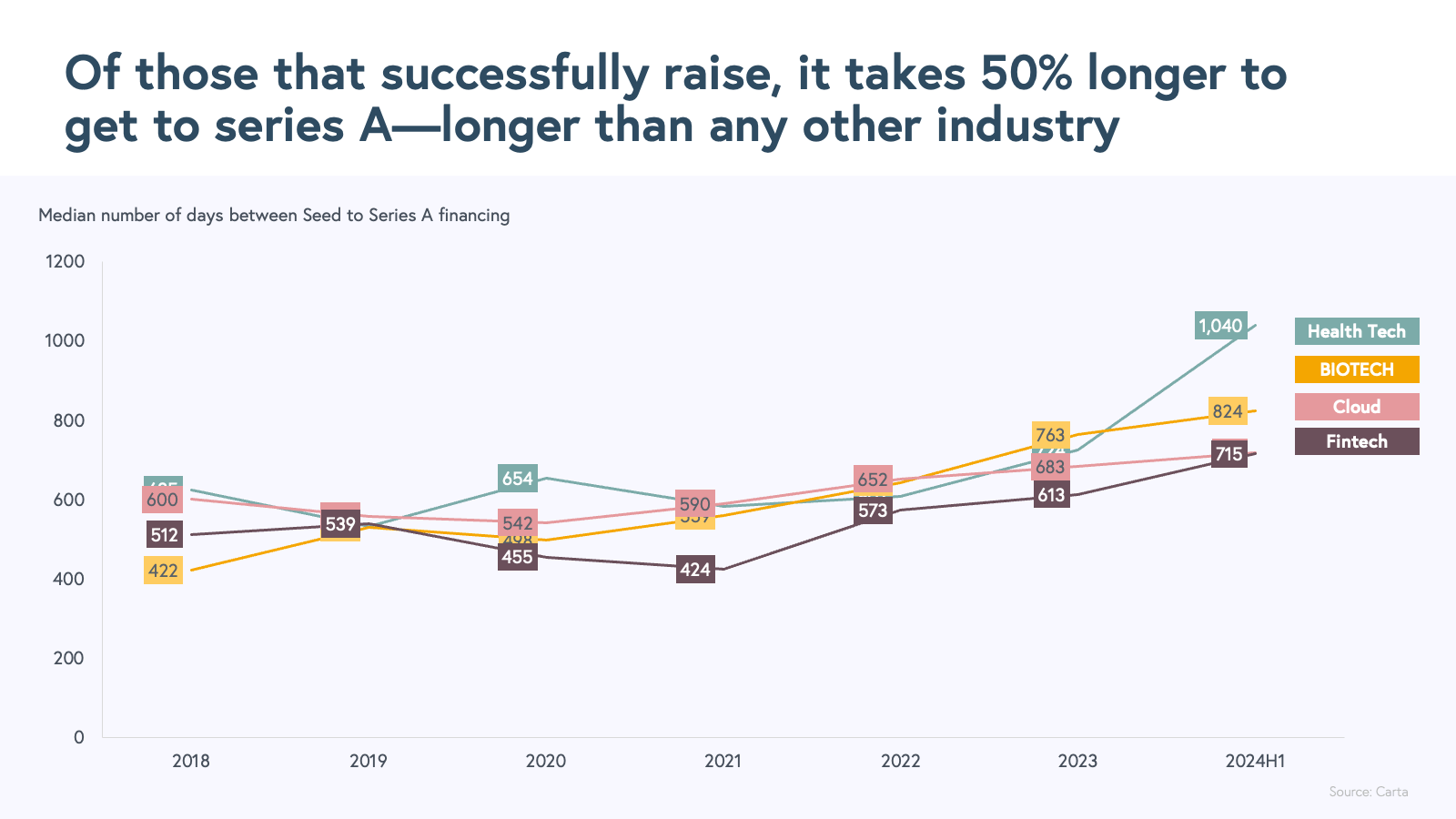

Of the companies that are successful at raising a Series A, the median number of days to reach that milestone is 50% greater in 2024 than prior years, and is longer in health tech than in any other sector. This makes it more critical than ever for companies seeking to raise their first institutional rounds to grow efficiently, preserve cash, and focus on proving product-market fit.

Given the challenges at the Series A and B stages, with tougher financing conditions and a rising bar for early-stage startups, we’ll be releasing a Series A and B playbook for $1-10 million ARR businesses in the coming months. This article will help entrepreneurs position themselves for success in today's market depending on their business model and will include a refreshed version of our benchmarks initially published in our April 2023 Scaling Health Tech Businesses report.

Valuation dynamics

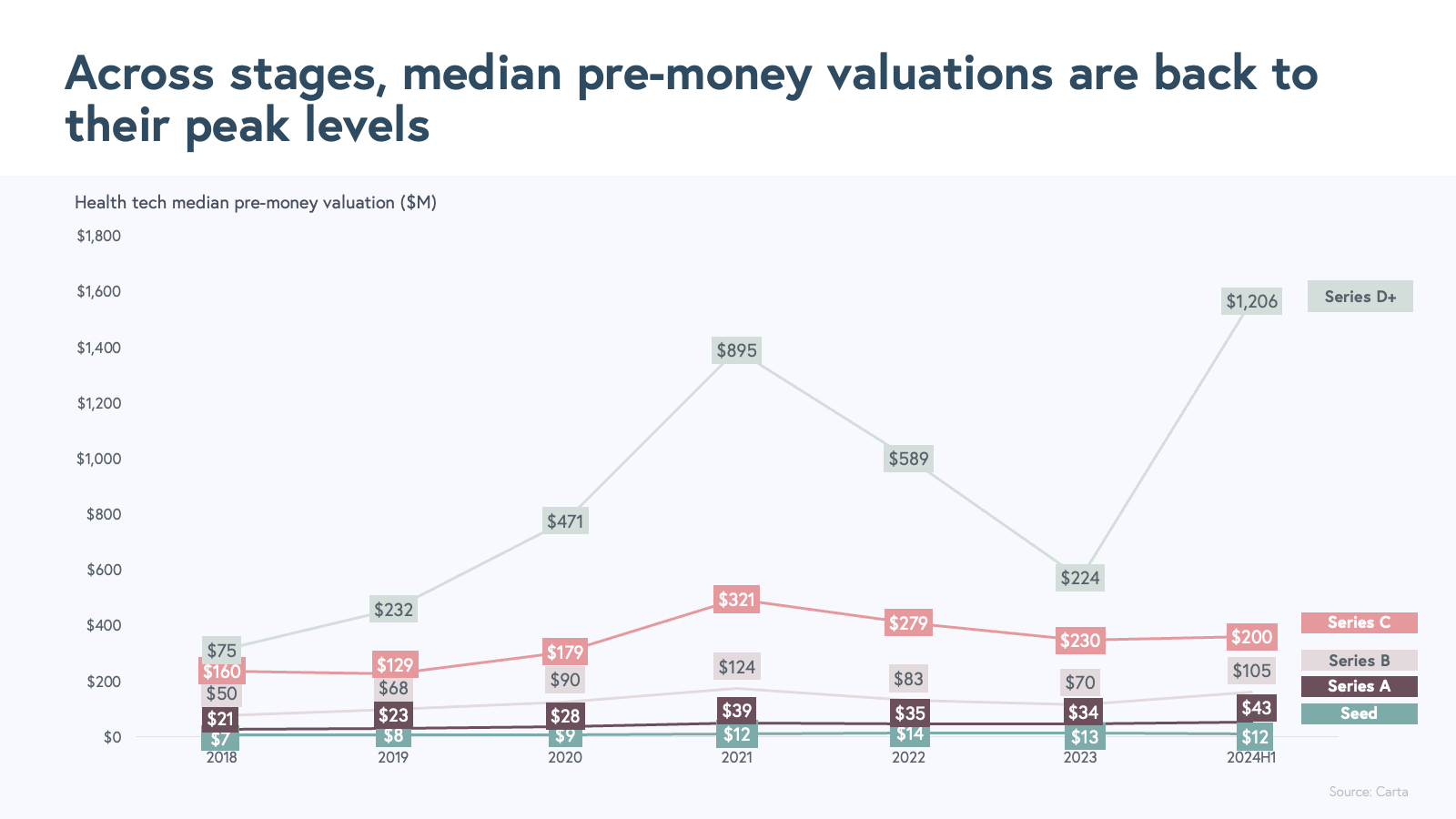

The good news for those able to raise capital is that valuations have rebounded to peak levels. 2024 health tech companies are garnering their highest median pre-money valuations across stages in several years, following a dip from 2022 to 2023.

We hypothesize that there are several driving factors for the digital health valuation rise:

- For Series D+ rounds, we’re seeing “Phoenix” companies––those that have risen from the metaphorical ashes of the market correction––commanding premium valuations. These companies, such as Grow Therapy, Equip, and Maven, have demonstrated high growth, significant scale, and strong unit economics and efficiency.

- At the Seed through Series C stages, frothy investments in AI-focused startups are driving the rise in early-stage valuations.

The AI factor

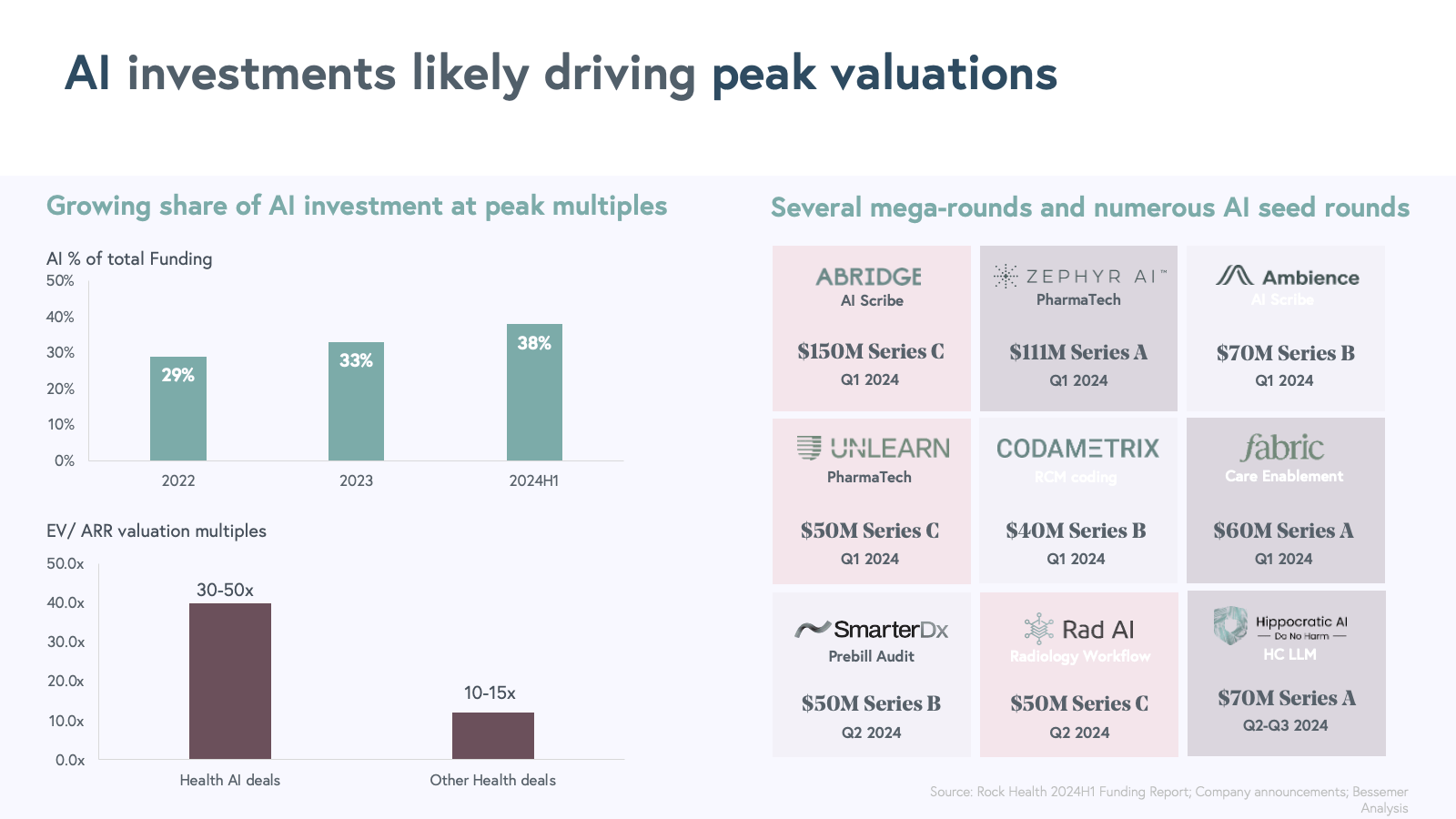

The influence of artificial intelligence on health tech investments cannot be overstated: the share of health tech dollars invested in AI-focused companies has increased by nine percentage points in just two years, reaching 38% in 2024 to date. At 30-50x EV/ARR multiples, the valuations that some of these AI companies are commanding can range 2-5x higher than their non-AI counterparts. These high valuation multiples showcase the private market excitement for new business models, market, and technology category creation.

We’re seeing multiple “mega rounds” of >$50 million invested capital in exciting categories like AI-scribes, revenue cycle management (RCM), and back-office admin automation. Many of these companies have seen strong commercial market pull as providers, payers and pharma stakeholders are focused on developing AI strategies and are more willing to experiment with products that drive measurable ROI.

Scaling in the age of AI: Benchmarks for a new business model

Over the last year, we have witnessed a group of Series A and B companies rapidly reach scale with a new breed of business model we call “AI Services-as-Software”. We have closely studied this group, and for the first time, we are excited to publish a new set of benchmarks for these companies in the $1-10 million ARR range.

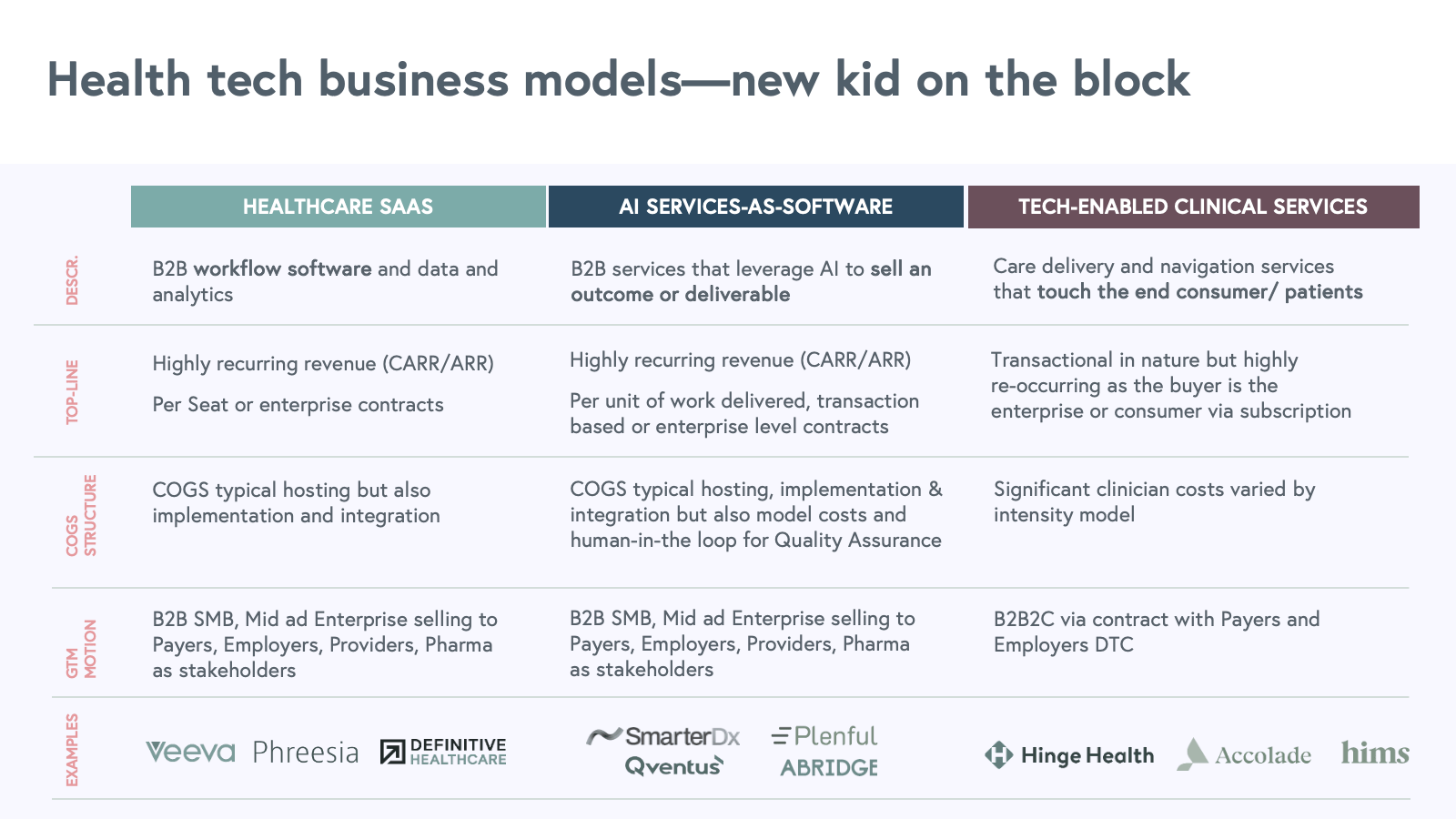

Let’s first revisit the Health Tech business models:

- Healthcare SaaS: Traditional B2B workflow software and data and analytics businesses. These businesses sell to SMB, mid and enterprise customers at payer, provider and pharma stakeholders.

- Tech-enabled clinical services: Care delivery and navigation services that touch the end consumer or patient. This category includes companies that leverage technology to deliver care more efficiently and effectively, often incorporating elements of value-based care.

- AI Services-as-Software: B2B services that leverage AI to sell an outcome or deliverable for SMB, mid and enterprise customers at payer, provider and pharma stakeholders. These businesses use AI capabilities and agentic workflows to autonomously perform tasks that have typically required human intervention.

AI services-as-software: A new paradigm

In last year's report, we predicted the rise of AI-powered "Services-as-Software," and 2024 has proven this model's rapid adoption. Unlike traditional software companies, these businesses use AI capabilities and agentic workflows to autonomously perform tasks that have typically required human intervention. By leveraging AI capabilities—such as large language models (LLMs), optical character recognition (OCR), and agentic workflow automation—they streamline processes and handle work for B2B customers across providers, payers and pharma.

Examples in our portfolio with this model include:

- Abridge: Automates medical documentation and clinical note generation. Provides a scribe in the pocket of every physician.

- SmarterDx: AI-powered clinical review and quality audits of complex medical claims. Provides a highly trained auditor to review every claim.

- Qventus: Automated surgery scheduling and surgical operations. Conducts routine pre-surgical workup with patients on behalf of nurses.

- Plenful: Back-office automation and data management for specialty pharmacies.

These companies aim to relieve operational teams from routine, time-consuming tasks like medical scribing, coding, and back-office operations; others are enabling new ways of conducting work and behaviors. This approach is particularly valuable in light of the ballooning $1 trillion administrative spend and growing healthcare labor shortage. AI Services-as-Software companies allow organizations to better allocate their workforce to areas where human expertise is most critical.

But let’s be clear: not every company “using AI” falls in this category. Leveraging AI and machine learning has become table stakes for entrepreneurs today—these technologies are no longer optional but a fundamental part of any successful toolkit in today's competitive landscape. We will see healthcare SaaS businesses leveraging AI to enable different features within existing workflow products, and tech-enabled clinical delivery businesses leveraging ML and AI to stratify patient risk, enable admin workflows and even triage patient interactions.

In contrast, AI Services-as-Software companies are enabling a new category where service is delivered as a product. For example, SmarterDx is an AI-powered clinical audit layer for complex medical claims. The SmarterDx product reads through tens of thousands of data points (labs, medications, notes) per patient chart and proposes changes and edits to a claim. Traditionally, this work is done by humans: by both clinical documentation integrity (CDI) nurses within the hospital and highly-specialized physicians within outsourced services companies, utilizing workflow software where a nurse reads and reviews the selected charts. Now, the entire review is performed by SmarterDx and validated by CDI teams, delivering a completed service as opposed to a tool that accelerates existing bespoke processes.

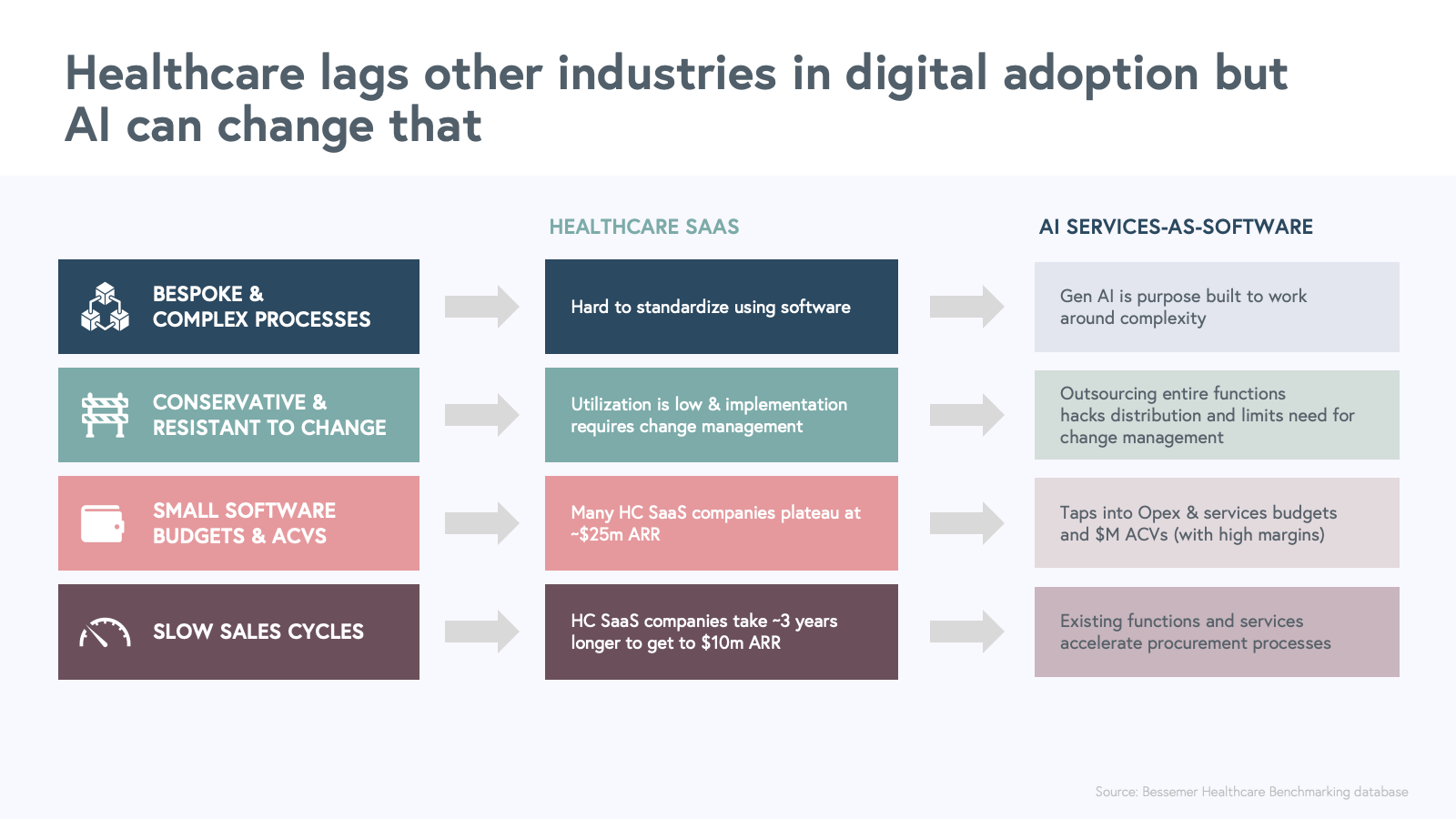

Healthcare has traditionally lagged behind other industries in digital adoption. However, we believe AI Services-as-Software companies are well-positioned to change that narrative. Healthcare SaaS ventures often face extended sales cycles, cumbersome integrations, and challenges enforcing adoption among end-users. As a result, many companies pivot towards tech-enabled services or bespoke software point solutions that are purpose-built for a particular customer’s workflow and therefore easier to adopt.

Instead, AI Services-as-Software businesses can build around complexity by taking on large portions of these complex processes themselves—either as an outsourced business process or a semi-autonomous agent. By taking on entire end-to-end chunks of work, they are able to “hack” distribution by allowing B2B customers to outsource entire functions, which limits the need for change management, or to provide an internal admin staff with machine super-powers “doing the work in the background.” By selling the end outcome, rather than software, these companies tap existing procurement processes with large operating expenses (OpEx) and services budgets rather than small IT and software budgets.

Investors and buyers are closely assessing new AI solutions based on their potential for adoption and the business value they deliver. Regardless of the quality of underlying AI models, it's critical to differentiate on distribution, effective monetization strategies and stickiness as a new system of “control” or function “orchestration.” We are early in the journey to adopt AI and the ways great entrepreneurs are building defensibility and durability is evolving.

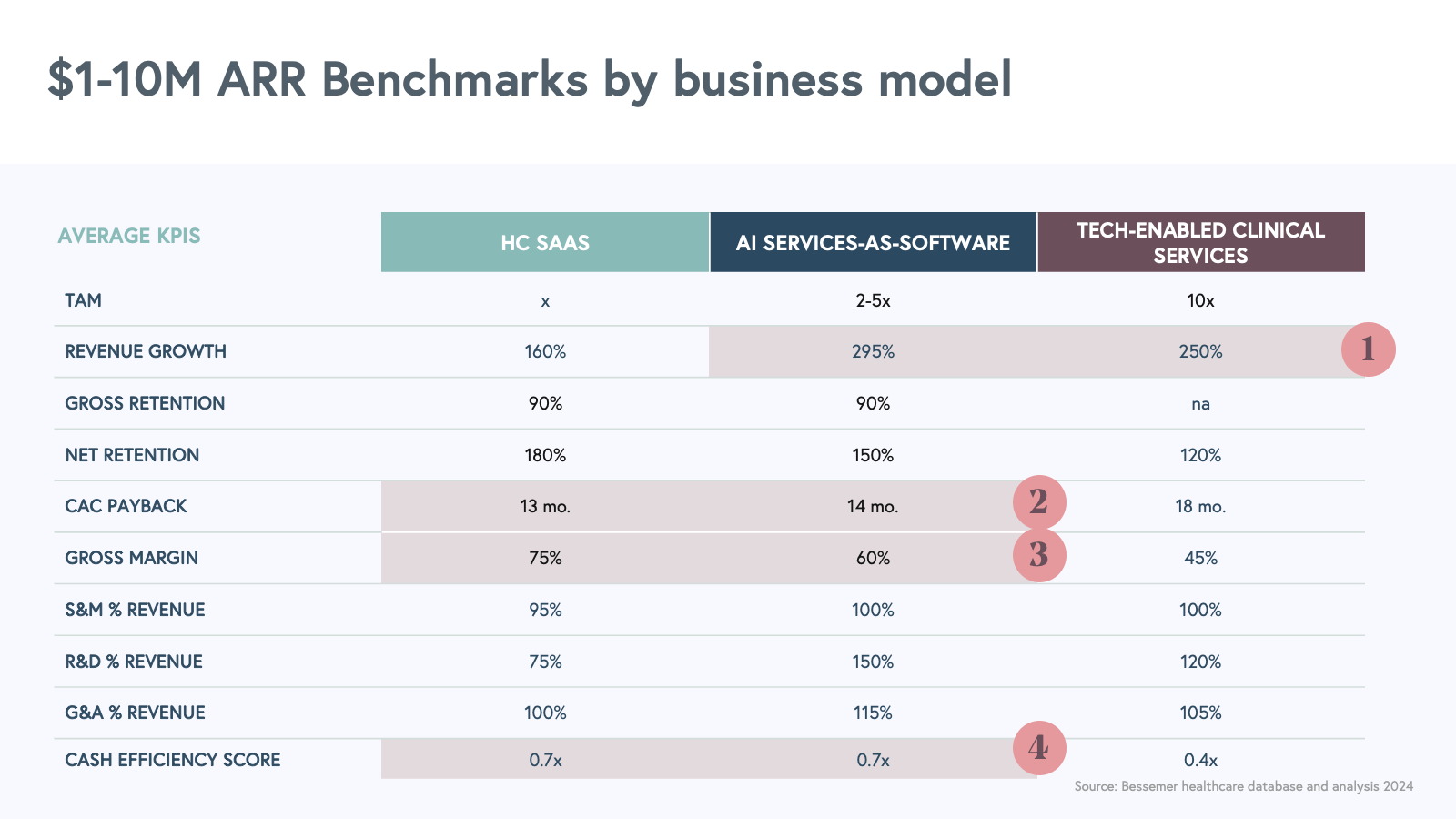

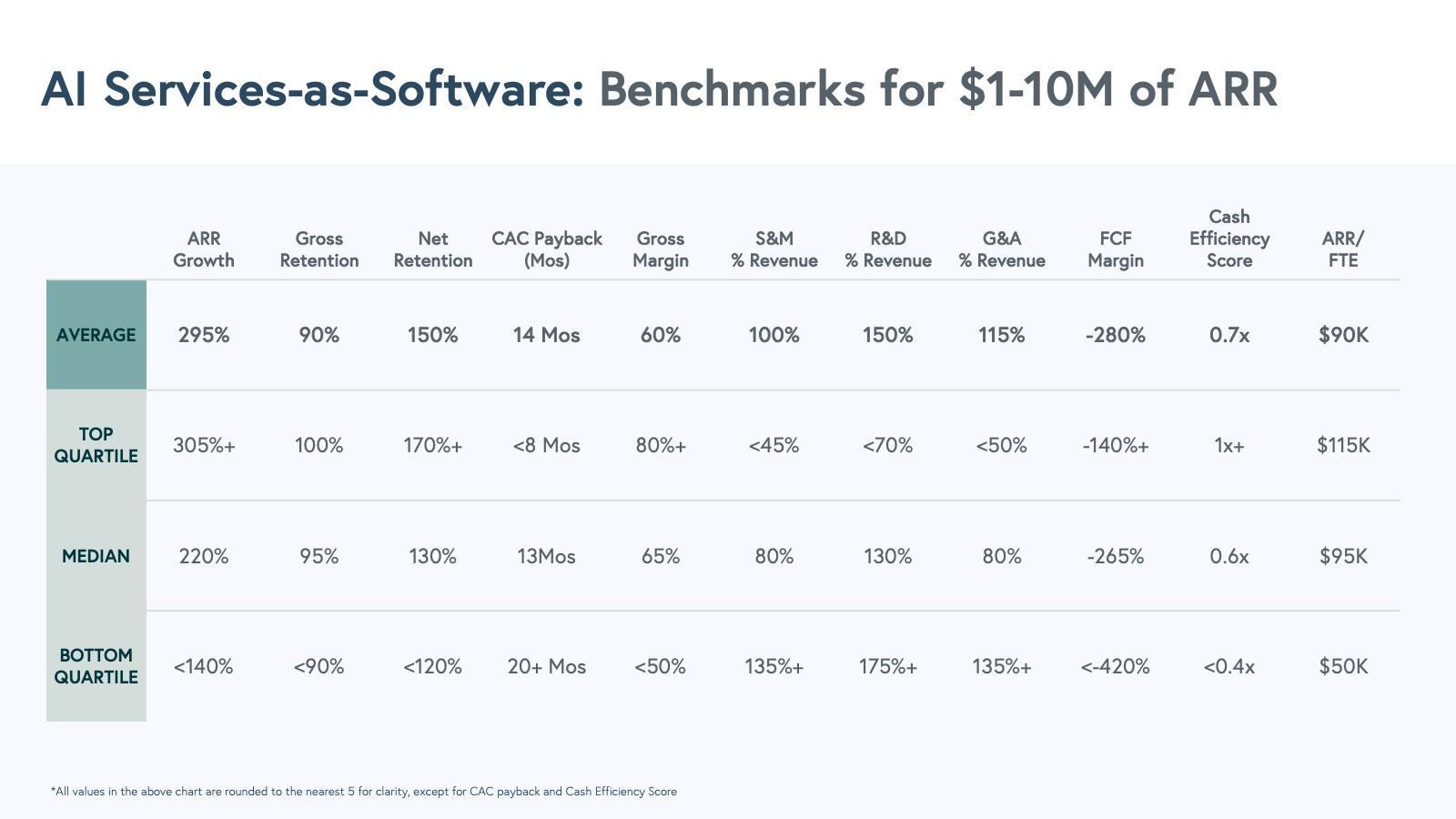

Early benchmarks from a cohort of ~20 companies that fall in this business model suggests an accelerated go-to-market trajectory compared to traditional SaaS models. Here are the benchmarks we're seeing for AI Services-as-Software companies compared to prior business models:

AI Services-as-Software average KPIs borrow from the best metrics across Healthcare SaaS and Clinical Services. We particularly want to highlight four learnings:

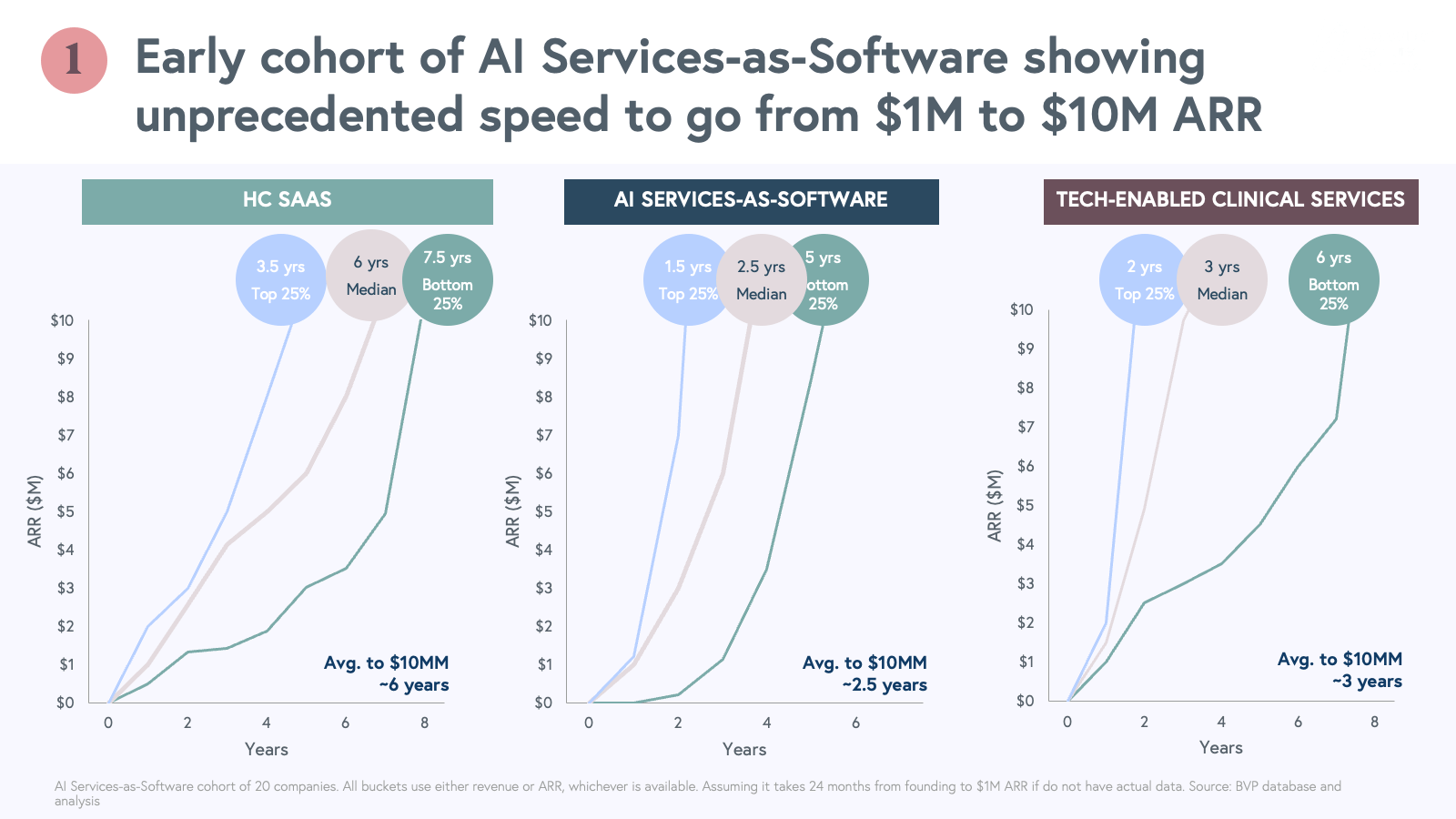

- AI Services-as-Software companies are showing unprecedented speed to hit $10M ARR and on average grow equally as fast, or faster, than tech-enabled clinical services. We hypothesize that the higher growth and faster sales cycles are driven by urgency from buyers to test and buy AI-enabled solutions, with these companies tapping into larger budgets and larger average contract values in categories that have more white space. We’re aware that this speed to market may not sustain over the longer term as categories become more saturated.

It's important to note that many companies early in the commercialization path start by quickly acquiring "experimental revenue”—pilot, trial, or project-specific revenue to automate certain tasks—rather than true ARR. It is crucial for these companies to get past the experimental phase by demonstrating clear ROI and time-to-value, ideally selling to stakeholders with established budgets.

We are hyper-aware these companies may not get paid per seat or a “recurring” software license but we think that is a good thing—instead get paid for the unit of value provided. This can pose an opportunity for startups, as incumbents may be limited on how they incorporate and capture value of AI given their existing seat-based business model. However, it’s important to measure the quality of the revenue by measuring the re-occurrence of the transactional or services revenue. During a Series A or B fundraise, as investors, we look to customer feedback and other leading indicators like utilization and ability to meet SLAs as guidance to the quality, durability and re-occurrence of the revenue.

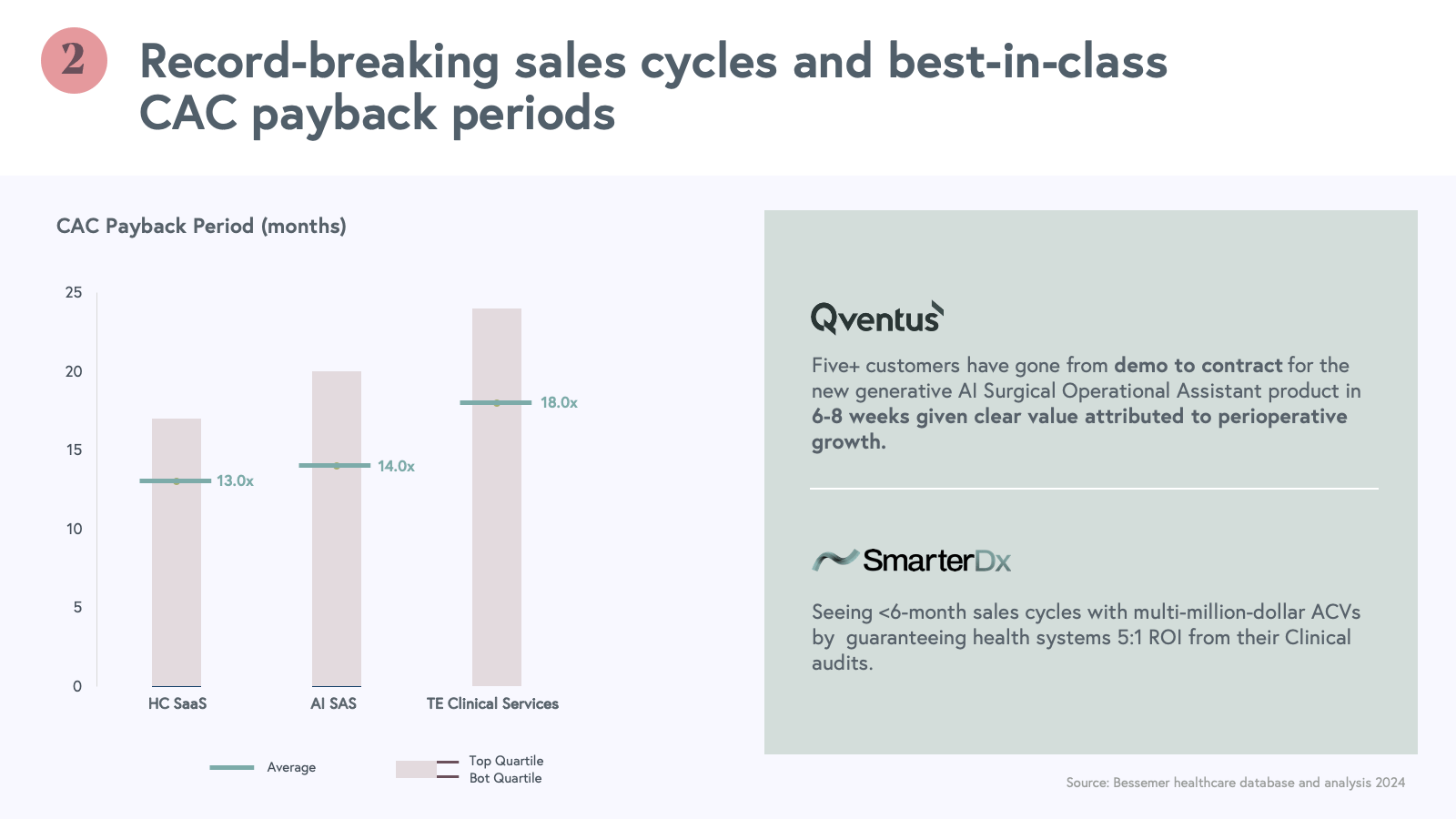

2. AI Services-as-Software companies are experiencing record-breaking sales cycles due to high industry demand and are seeing customer acquisition cost (CAC) payback periods similar to those of SaaS. Several of our portfolio companies have seen <6 month sales cycles, much faster than traditional Healthcare sales cycles of 12-18 months.

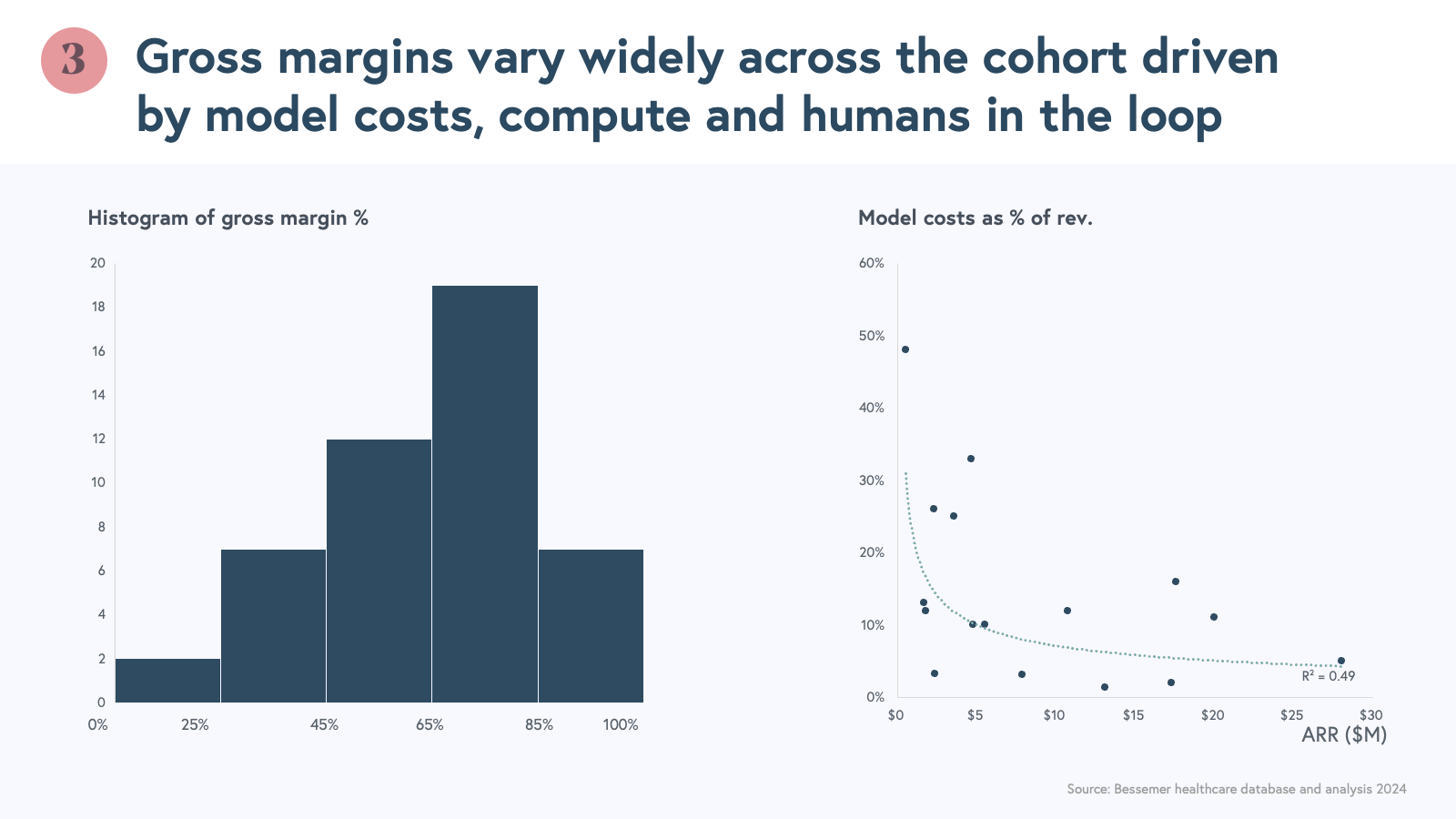

3. Gross margins vary within subcategories of AI Services-as-Software companies. Borrowing from our Vertical AI team framework, we see three types of AI Services-as-Software companies depending on the use case, end user involvement and human-in-the-loop feedback for reinforcement learning.

-

- Copilots: AI tools that supercharge workers by automating tasks and workflows.

- AI-first services: AI native services that automate and enable a service to be fully outsourced to the company. Most likely involves a human in the loop who is typically employed by the startup that checks output of models to ensure accuracy and provides feedback for reinforcement learning.

- Agents: AI tools that replace workers by automating end-to-end workstreams. While most AI agents don’t yet operate reliably enough to function autonomously in complex use cases, progress on agentic workflows is moving quickly. While we don’t have great examples of fully autonomous agents in Healthcare yet, in the meantime these semi-autonomous agents can either serve as copilots to inhouse staff at customers, or look like AI-first services with a human in the loop for reinforcement learning and quality assurance employed by the companies.

There are three major drivers of cost of goods sold for these AI companies: model costs, compute, and humans in the loop for quality assurance and reinforcement learning. Gross margin for AI Service-as-Software companies vary widely from 10% to 90% across the three subcategories. Despite this, the average and median are 60% and 65% respectively across all sub-types.

While it’s early, we see the companies with strong product-market-fit and growing scale able to get some economies of scale for model costs. They achieve this by commanding a premium for their service but also optimizing model batches, and data pipelines versus running everything through expensive models. We expect the same for human-in-the-loop costs as models become better over time and be a source of differentiation on quality. As investors, we are comfortable with lower gross margins than traditional SaaS businesses as we expect those companies with higher model costs or humans in the loop to be attacking more complex use cases requiring higher accuracy. We believe this will enable companies to command premiums, differentiate from competition and create moats over time.

However, it’s important to be aware of these gross margin differences and make sure companies are not masquerading a service with “some” tech with low margins forever. It is also important to think about valuations in connection with quality of revenue and ability to improve gross margins over time. Let’s not make the same mistakes we made in COVID-era with tech-enabled clinical services.

4. Last but not least, these AI Services-as-Software businesses have similar efficiency scores as traditional software despite the variety of gross margins. We are encouraged by this profitable growth.

These early benchmarks are encouraging for a new way of digitizing the complex world of administration of healthcare. We are closely tracking companies as they scale beyond the first $10M and move towards $100M and beyond. We will be publishing our learnings as the number of companies and their scale changes. We can’t wait to see more use cases and companies built with this new business model, and see the adaptability and agility of founders to build defensible category-defining businesses.

AI Services-as-Software Benchmarks:

Where are we going? Emerging trends and predictions

As we look to the future of health tech, several key trends and opportunity areas are emerging. Here are our top predictions and "mini-roadmaps" for the coming year:

1. Payer administration insourcing: Services-as-Software adoption accelerates

We have seen most AI Services-as-Software companies establish early category leadership focused on provider workflows - health system and SMB practices alike. Many of these use cases are driven by advancements in AI-powered copilots and agentic services. We expect this coming year to see new companies arise focused on other stakeholders, such as payers and third-party administrators (TPAs).

Ballooning premiums are putting employers at a crossroads and we see this as an opportunity to disrupt payer, TPA and employer links with new offerings. Historically, Plans and TPAs have outsourced many workflows to legacy tech-enabled services providers. We see an appetite to leverage AI and technology to reduce costs, improve quality and maintain greater control with new AI-first services - an insourcing wave of sorts. For example, we're seeing increased adoption of AI-powered solutions for utilization management, contact-center benefit navigation and streamlined direct contracting with providers.

2. Transparency tooling in pharmacy: Navigating the evolving landscape

The rising costs and complexity of distribution of prescription drugs have become a central focus of bipartisan efforts aimed at enhancing transparency and streamlining drug channels. Pharma manufacturers are facing pressure as the "gross-to-net bubble"—the difference between the list price and what manufacturers give up to middlemen in fees—has grown by about 40% in the last four years, squeezing margins. Payers and employers are facing financial strain with the approval of new and costly therapeutics, such as GLP-1 agonists, Alzheimer’s treatments, and gene therapies. For the first time in history Medicare negotiated its own prices and is capping copays for seniors. Pharmacy benefit managers are facing scrutiny by the FTC for more rebate transparency.

These factors are raising critical questions about how our healthcare system can sustainably fund and manage access to innovative therapies. We see significant opportunities for companies that can provide:

- Tools for rebate transparency and management

- Solutions for compliant implementation of new pricing policies, including re-insurance and outcomes-based contracts

- Analytics tools to help stakeholders navigate the complex pharmaceutical pricing landscape

We expect to see increased investment in companies that can bring clarity and efficiency to the opaque world of drug pricing and reimbursement. We are particularly excited about platforms that can align incentives and cater to multiple stakeholders.

3. AI-Assisted clinical services: Empowering independent providers

While the notion of AI replacing doctors remains a distant prospect, we're excited about the potential for AI to augment and enhance clinical capabilities. We envision AI as a tool to give healthcare providers "superpowers," enabling them to deliver more efficient and effective care.

Key areas of opportunity include:

- Risk stratification, triage and care navigation: AI-powered systems can help prioritize patients, direct them to appropriate care settings, and optimize healthcare resource allocation.

- Symptom tracking and analysis: Advanced AI can serve as a "front door" for healthcare, allowing patients to submit symptoms, track flare-ups over time, and receive guidance on resources and information, potentially replacing "Dr. Google" with more reliable, personalized health information.

- More tech-first Managed Services Organizations: Business-in-a-box platforms focused on empowering independent clinicians to focus on care and delegate administrative tasks

We're particularly excited about companies that can seamlessly integrate these AI capabilities into existing clinical workflows and payment models, enhancing rather than disrupting the patient-provider relationship.

4. Value-based care system of record: Enabling the shift to risk-based models

The Centers for Medicare & Medicaid Services (CMS) has set an ambitious goal to move all Medicare lives and most Medicaid lives into risk-based programs by 2030. This shift, coupled with profitability headwinds in Medicare Advantage (including V28 model changes and Risk Adjustment Data Validation audits, declines in Stars ratings and increased MLRs), is creating a pressing need for more streamlined processes in value-based care models.

We believe technology, data, and AI will play crucial roles in enabling this transition. Opportunities in this space include:

- Risk stratification, last-mile risk adjustment and gap closure and patient management

- Platforms for managing and adjudicating value-based contracts

- Data capture and better systems of record to scale value-arrangements, measure impact and attribution of lowering the cost of care

We acknowledge this is a challenging problem with disparate data sources, many patient touch points and diverse programs, but there should be no better ‘why now’ than technical breakthroughs to leverage unstructured data, regulatory push for transparency and data reporting, and the threat for need of survival of many players to adopt technology and better infrastructure.

Embracing the future of health tech

The trends and predictions we've outlined here represent just a few of the many exciting opportunities we see in the health tech space. We acknowledge the uncertainty of the coming election and the potential opportunities that may arise as a result. As always, we remain committed to supporting innovative entrepreneurs who are working to solve healthcare's most pressing challenges and improve outcomes for patients, providers, and the healthcare system as a whole, no matter which party sits in the White House.

As we look toward 2025, we remain optimistic about the future of health tech. The resilience demonstrated by digital health companies over the past year, coupled with the transformative potential of AI and other emerging technologies, sets the stage for a new era of innovation in healthcare. While challenges remain—from regulatory hurdles to the ongoing need for sustainable business models—we believe the health tech sector is well-positioned to drive meaningful improvements in healthcare delivery, outcomes, and cost-effectiveness.

To the entrepreneurs, investors, and innovators working tirelessly to reshape the healthcare landscape: your perseverance and creativity continue to inspire us. As we move forward, let's embrace the lessons learned from both our successes and setbacks, leveraging them to build a healthier, more equitable future for all.

Footnotes

Thanks to Karen Jiang for her invaluable help evolving our Healthcare Benchmarking database.

We've renamed our "Tech-Enabled Services" category from prior reports to "Tech-Enabled Clinical Services" to better reflect the nature of these businesses.