Roadmap: Defense Tech

Technology is transforming national security. More so than ever before, the United States is collaborating with startups to help protect its citizens and allies, and drive innovation within the U.S. Department of Defense.

For years, people thought defense was not a viable market for startups. The prevailing belief was that the Department of Defense (DOD) was limited to the realm of the major primes, including names such as Boeing, Lockheed Martin, Northrop Grumman, Raytheon, and General Dynamics. But the future of defense in the United States is undergoing massive technological transformation.

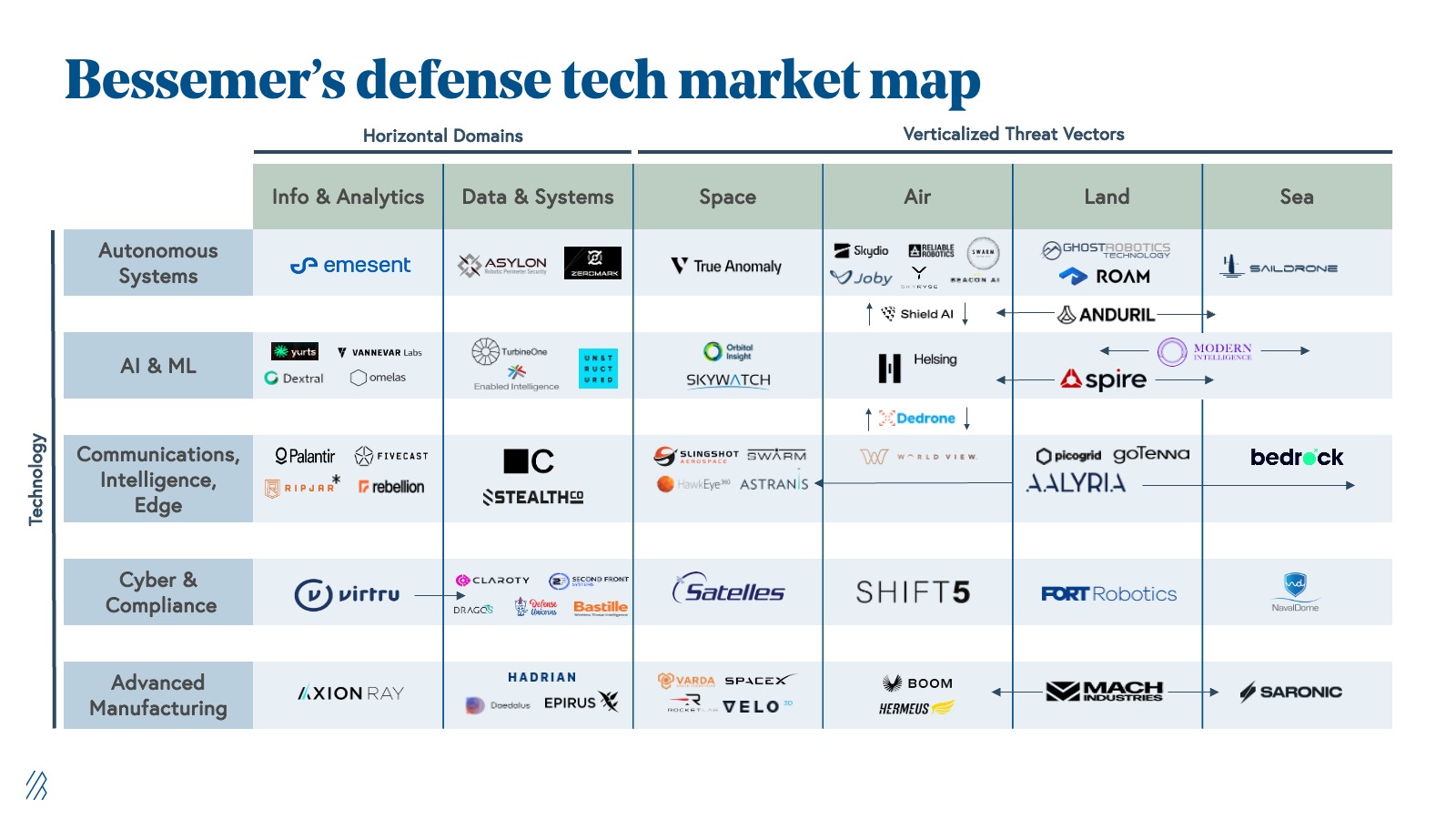

So what’s changed exactly? Mainly, the DOD now contracts with startups in all technology areas impacting national security, including horizontal domains (e.g., info & analytics, data & systems) and vertical threat vectors, across space, air, land, and sea.

In this roadmap, we outline how we view the defense tech landscape, why and how entrepreneurs can serve this massive customer, and promising areas for entrepreneurship.

Defining defense tech

As an umbrella category, defense tech is much broader than rockets, tanks, and aircraft carriers. Defense tech includes everything that the DOD and the broader national security infrastructure touches—including the systems infrastructure, communications and intelligence technology, cybersecurity, advanced manufacturing, as well as the innovation leveraged on the battlefield and beyond.

At Bessemer, we define defense tech as any business that requires the DOD and defense as a core pillar of growth for the company.

This assumes the product can be dual use, government only, or currently commercial only but will expand to also be government-focused in the future. Ultimately, this involves a defense-specific product and defense specific go-to-market and sales teams. Read more on our theses here.

So why now?

The DOD has new ambitions to overcome the proverbial “valley of death”—the long gap between when a technology is first developed and tested to the time when funds are available in the budget to produce and acquire it. As U.S. Defense Secretary Lloyd Austin said The Pentagon has great potential to become “a true innovation ecosystem.” Defense technology plays a core role in this generational paradigm shift and so technology businesses should seriously consider adding the DOD as a potential new customer.

Startups can play a role in protecting democracy.

In 2024, it’s a clear imperative that as geopolitical conflicts around the world intensify, promoting greater innovation within the DOD is an intrinsic part of protecting our country and its allies. Collaborating with emerging startups to gain new solutions is a strategic way for our nation to escape the perilous tendency toward all-out war when a dominant power is challenged by an emerging one (a.k.a. the “Thucydides Trap”). Emerging startups play a significant role in keeping the U.S. clear of this trap, as innovation has historically played an inextricable role in protecting democracy.

Five market opportunities for defense technology startups

Many of the incumbent defense industry businesses need no introduction. They are household names like Boeing, General Dynamics, Lockheed Martin, Northrop Grumman, and Raytheon Technologies. Several of these primes have dominated the industry for decades, some even for close to a century, and currently bring in tens to hundreds of billions in annual revenue.

However, within the last decade, a string of trailblazing startups have risen to challenge the prime incumbents. Several of these newcomers have successfully attained public as well as M&A exits for their venture investors including the likes of Palantir and Rocket Lab. Both make the case that younger defense technology businesses can scale effectively to achieve strong fundamentals and attain robust valuation multiples.

Following in the footsteps of these examples, a diverse ecosystem of defense tech startups has cropped up in recent years, fueled by strong market demand and visionary founders excited to make an impact on national security.

Bessemer’s defense tech market map

As we interviewed founders and experts navigating the massive transitions happening in the defense industry, we have identified five key theses we are particularly excited about investing behind:

1. Cutting-edge AI/ML solutions will be the next frontier of national security

The defense community is not sitting idly by as the AI revolution sweeps the consumer and commercial industries by storm. The DOD mapped and released its formal AI adoption strategy last year. Advancements and applications of artificial intelligence and machine learning will be essential for the national agenda and the defense community’s day-to-day work. This could look like:

- Productivity gains from automation of manual tasks

- Higher quality output documents and work products

- Faster speed to assessment which is critical in real-time situations

- More accurate insights to drive decisions

Internal DOD champions acknowledge that startups are not only driving the best innovations in the space, but are also the ones with the willingness and courage to disrupt the status quo in order to drive meaningful improvement. Across the department, we’ve already witnessed the embrace of AI/ML applications across various use cases such as Vannevar Labs for foreign text workflows, government sales automation Dextral.ai for government procurement and sales automation, Axion Ray for automation of engineering and quality analytics, and Yurts.ai for enterprise AI across search and documentation.

2. The DOD is embracing the modern data and AI infrastructure stack alongside new network infrastructure innovations

The success of any modern organization, commercial or federal, is tied to the insights gleaned or products built from its data. The modern data stack is fundamental in the emerging realm of defense tech since intelligence is derived from data of all modalities (video, image, text, speech, etc.).

Various branches of the government are making major investments to modernize their data and AI infrastructure stack with key requirements across both cloud as well as on-premise deployments. Startups such as Enabled Intelligence for data labeling, Unstructured.io providing ETL for LLMs, and TurbineOne’s MLOps platform are at the frontlines of equipping the defense community with the foundation to leverage the most cutting-edge tools to unlock the most value from their data troves. Similarly, on the network infrastructure side, startups such as Aalyria are pioneering new ways to deliver, connect, and orchestrate networks across different entities.

3. Renewed focus on best-in-class cybersecurity solutions as table stakes

Best-in-class cybersecurity has become synonymous with strong national security in the digital age and the imperative to advance cybersecurity given novel threats continues to grow. But significant headway has been made. For instance, early in 2022, the Office of Management and Budget issued a White House Memorandum setting forth a Federal zero trust architecture (ZTA) strategy, requiring agencies to meet specific cybersecurity standards and objectives by the end of 2024. That same year, the Biden Administration issued Executive Order 14028 on Improving the Nation’s Cybersecurity.

Protection across all potential legacy and new attack surfaces cannot be understated and we see several technology leaders step in to help. From Bastille Technologies for wireless threat intelligence and Claroty for industry cybersecurity, to Defense Unicorns providing DevSecOps software for air-gapped networks and Virtru for zero-trust data-centric security, numerous startups are driving innovation, reinforcing the Government's defenses against increasingly sophisticated and persistent threat campaigns.

4. The next generation of defense tech giants will be built upon the foundation of verticalized solutions

At Bessemer, we’ve seen the impact of vertical software transforming every industry, having spent over a decade investing in vertical SaaS leaders such as Procore, Shopify, Toast, among many other leaders. Every commercial industry has specific requirements that may not be fully served by horizontal solutions. With this in mind, we see a similar pattern emerging within the DOD ecosystem. Each branch has specific needs and unique hardware and software stacks, which invite emerging defense tech startups to enter the market by providing purpose-built solutions for vertical threat vectors before leaping across to new verticals and teams. From ShieldAI for AI-piloted aircrafts, to Modern Intelligence providing an all-platform all-sensor maritime awareness solution, to Picogrid offering land-based solutions to connect fragmented defense systems, we expect to see verticalized solutions for different slices of the DOD grow in the coming years.

5. We’re in the early days of autonomous systems reaching its full potential in the defense industry

As highlighted earlier, autonomous technologies have emerged as a key paradigm for competitive advantage during warfare, and it’s still very early days within the defense tech industry. As the DOD continues exploring this technological paradigm, we expect more interest in startups innovating within the autonomous robotics and technology space.

The rise of defense tech decacorn Anduril is a testament to the adoption of unmanned aerial vehicles (UAVs), and we see many startups following suit, such as Skydio providing autonomous AI-powered drones, Saildrone for uncrewed surface vehicles, and Primodial Labs building voice-controlled autonomy software.

These aforementioned businesses are just a few examples of how the defense industry is adopting autonomous technology for the battlefield and beyond. As another example, Hadrian is redefining modern manufacturing and Varda is the world’s first orbital manufacturing and reentry platform.

Case study: Evolving defense technology in Ukraine

Rapid deployment of advanced technology onto battlefields during conflicts between countries (rather than non-states) represents a revolution in the conduct of military operations. Ukraine illustrates this new reality and how the systems of defense have evolved in recent years. Ukraine is a case study showcasing three areas of defense tech that will need significant and immediate attention: 1) UAVs, 2) cybersecurity, 3) and mass communications and social media.

- UAVs: Drones have proven essential for reconnaissance, targeting, and conducting strikes. They can attack one another if needed, and also assist in the movement of supplies and soldiers. Ukraine's armed forces have lost 10,000 drones each month due to Russian electronic warfare (EW). Clearly, today’s conflicts use huge numbers of unmanned aerial systems.

- Cybersecurity: In Ukraine, cyberspace has also emerged as a crucial battleground for offensive operations. This was exemplified by a recent cyberattack on the country's largest telecom provider, Kyivstar, which marked one of the most significant cyber events in European history. The attack severely disrupted Internet and mobile communications for millions of people, highlighting the growing importance of digital domains in modern conflicts.

- Mass communications: Social media and news platforms have become fiercely contested arenas too, where the very rapid spread of misinformation and disinformation are menaces to society. How information spreads, and ensuring that it is factual, impacts democracy on a fundamental level. We see an opportunity for entrepreneurs to build solutions that address social and as well as financial fraud, which includes preventing and mitigating social engineering, cybercrimes, including propaganda and novel threats of modern war.

Over 30 U.S. startups have already deployed products in Ukraine, but the need for better technical solutions only grows in the evolving world of military operations. As the nature of conflicts changes, the government must stay on the cutting edge. In this period of rising geopolitical tension and conflict, it seems inevitable that U.S. defense spending will rise significantly in the years ahead.

Our guiding principles on how we will invest in defense technology

As we survey the landscape of defense tech, there are five qualities and dynamics we look for when investing in these founders and their businesses.

1. High “defense IQ”—While investors have traditionally preferred to invest in dual-use technologies, we are excited to back the frontier of entrepreneurs monetizing mostly (or even solely) via the government. Empirically, higher levels of government concentration demand a higher ability to navigate the complexities of government procurement processes. What this means is that the founding team should have a high “defense IQ” — it earns the company respect and enables federal salespeople to speak the language of contracting officers. A high defense IQ can look like a number of different things, from prior military service in active duty, to career service on the civilian side, to relations with defense agencies from outside the government (e.g., from a prior defense-focused investing role).

Defense IQ earns a startup respect with contracting officers.

2. Expansive TAM—The US defense budget for 2024 is $886 billion, so capturing even a small slice of this market would represent massive potential for the new wave of defense tech startups. That said, the defense budget is sliced and diced across a number of different technological focus areas and shared among the dozens of agencies in the DOD. We’re excited to back companies that can sell technologies solving needs shared across multiple branches of the DOD. Many of these companies can also sell to other liberal governments across the world. For instance, the AUKUS (Australia, UK, and US) partnership involves strategic cooperation on technologies like cybersecurity and AI.

3. Contracts as sticky, large sources of revenue—The holy grail for startups is to get on a DOD Program of Record (PoR). A PoR is an explicit line item in the DOD budget earmarking funds (often on the order of tens of millions of dollars, at least) for the startup’s technology. A PoR is also incredibly sticky, meaning that the funds are typically renewed year-after-year. Beyond the immediate financial windfall, however, being on a PoR also provides unparalleled validation and credibility. Such recognition not only signifies a strong vote of confidence from a defense agency but also opens the door to substantial, sustained funding for other agencies and partners. The fastest time to a PoR is roughly three to four years.

Another type of contract attractive to startups is the Indefinite Delivery, Indefinite Quantity (IDIQ) contract. Unlike traditional fixed-price contracts, where the government specifies a set quantity of items or a precise scope of work, an IDIQ contract allows for variations in the amount and timing of orders over a specified period. Under an IDIQ contract, the government agrees to purchase goods or services as needed, up to a predetermined maximum value or quantity. Startups under an IDIQ essentially have a hunting license over the duration of the IDIQ to find defense agencies that suffer from the problems outlined in the IDIQ and serve those needs without initiating a new procurement process each time. IDIQs can be awarded exclusively to one vendor, or to many qualified vendors.

PoRs and IDIQs are merely two types of contracts that DOD awards. Others include cooperative research and development agreements (CRADAs) and OTAs (discussed above). Alternatively, companies might not sell directly to the DOD at all, choosing to act instead as a subcontractor to the large defense primes.

4. Non-dilutive funding—The government is also a great source of non-dilutive funding for startups. The most prominent are Small Business Innovation Research (SBIR) grants, of which there are three “phases.”

- Phase I: The goal of a Phase I is to prove the feasibility of a proposed innovation. It typically involves a relatively short-term effort to conduct research and demonstrate the concept's viability. Phase I SBIRs typically last for less than 1 year and award less than $250K.

- Phase II: If a company successfully completes Phase I and demonstrates a technology’s feasibility, Phase II SBIRs aim to further develop the innovation through more comprehensive R&D, testing, and prototype development. More mature technologies and companies can go Direct to Phase II (D2P2), without first having to go through Phase I.

- Phase III: Only about 5% of companies graduate from Phase II to Phase III SBIRs, posing another “valley of death” in selling to defense. However, unlike the previous phases, Phase III is technically not a direct part of the SBIR program. Instead, it represents the transition of the technology into the commercial market. Funding for Phase III is actually expected to come from sources other than the SBIR program (e.g., government contracts or private investment).

Some defense agencies also have their own specific programs, too. For example, the Air Force has its Strategic Funding Increase (STRATFI) and Tactical Funding Increase (TACFI) programs, which allocate up to $15 million to companies hoping to cross the valley of death from Phase II to Phase III SBIRs.

5. Early traction in selling to the DOD—As mentioned, selling to the government is hard, and the level of difficulty can vary across companies. For example, while all companies need FedRAMP certification, companies that are munitions-adjacent must also comply with the International Trade in Arms Regulation, a more onerous process. Some companies may need federal salespeople or forward-deployed engineers who have Secret / Top-Secret clearance from the FBI. Bessemer does not rule out investments based on these types of sales friction; we especially like teams who have made significant headway in wading through the thicket of regulations and processes required to sell their products.

Selling to the government

There are complexities and potential risks when selling to the government; many businesses don’t want to take on that additional baggage. However, we think that might be a short-sided approach — the rewards can greatly outweigh the risks.

For defense tech founders, here are three cons and five pros to adopting a business-to-government (B2G) go-to-market model —

Cons of a B2G model

- Long sales cycles: Making a deal can take a long time, years even, to land a large, multi-million-dollar contract.

- Unpredictability: Government contracts are lumpy, bumpy, and unpredictable. This leads to revenue streams that are hard to forecast, with often very large Q3 results, since the US government fiscal year ends in September.

- Red tape: Every three letter government agency has cumbersome levels of bureaucracy. In addition, its political headwinds and various partisanship impacts deal flow and sales cycles.

Think of the DOD as the best beta customer you’ve ever had.

Pros of a B2G model

- Market size: From a financial perspective, the U.S. military/intelligence complex is the world’s largest customer with a $886 billion defense budget for 2024 with dozens of branches each acting as independent Fortune 100 companies.

- Strong retention: The DOD is a strong brand and a high-retention customer with no credit risk and a high resilience to economic cycles. And once you’re in, it’s straight-forward to expand your contract (high net dollar retention).

- Product innovation: Think of the DOD as the best beta customer you’ve ever had. The government can help you develop and refine your product with unique sources of funding—usually in the form of non-dilutive grants.

- GTM distribution advantages: As the DOD budgets become more receptive to working with startups, businesses building out cutting edge technology with defense applications can benefit from securing government contracts as a means to gain market leadership and elbow-out the competitors.

- Procurement breakthroughs for startups: Emerging defense startups like SpaceX and Palantir have challenged traditional Defense Department contracting, leading to greater competition and innovation. SpaceX sued the U.S. Air Force in 2014 over exclusive contracts awarded to ULA for national security launches, resulting in policy changes that ended ULA's monopoly. Palantir also sued the U.S. Army in 2016 for excluding commercial solutions in its procurement process, winning the case and forcing the Army to revise its acquisition strategy. These actions have opened doors for more startups to engage with the Department of Defense.

Defense contracting has become more startup-friendly due to new government initiatives and technologies simplifying the process.

Other Transaction Agreements (OTAs) have been key, especially since their expanded use post-2015, in enabling nontraditional contractors to more easily sell to the government. Additionally, initiatives have led to the creation of organizations like the Defense Innovation Unit, AFWERX, and NAVAL X, starting from 2015 onwards, which foster collaboration among private companies and the DOD, streamlining startup engagement with the defense sector.

So founders, considering these points, could a B2G model be your next avenue of growth?

The next generation of defense technology

The recent headway Silicon Valley upstarts have with the DOD does not change the fact that building an enduring defense tech business does not come without significant challenges and pitfalls. Indeed, as the Pentagon and even other investors have recently noted, the influx of capital into defense tech startups must come with realistic expectations. We remain intellectually honest that building an enduring defense tech startup is very hard. R&D obstacles, commercialization challenges, friction in scaling a go-to-market strategy, financing risks, and beyond — what defense tech founders face, at times, can still seem Sisyphean.

What defense tech founders face can seem Sisyphean.

Yet, as investors in this complex ecosystem, we know how important it is for defense founders to have proper resources and a network of support to drive innovation, secure contracts, and contribute to our country’s agenda.

This is why we’ve created Bessemer’s Defense Tech Advisory Board including renowned experts such as:

- Dr. Ray Johnson (CEO, Technology Innovation Institute, and former SVP and CTO, Lockheed Martin Corporation)

- Ret. Major General Kim Crider (former Chief Technology and Innovation Officer for the United States Space Force and former Chief Data Officer of the United Space Air Force)

- Ret. Lt. Gen. S. Clinton Hinote (former Deputy Chief of Staff, Strategy, Integration, and Requirements for the United States Air Force)

- Forrest Underwood (Founder, United States Space Force Reservist, and former Chief Growth officer of True Anomaly)

- Matthew J. Kohler (former 3-Star Vice Admiral, former Director of Naval Intelligence, Director of Navy Information Warfare, Deputy Navy Chief Information Officer, Deputy Commander, 10th Fleet/Fleet Cyber Command)

- Joshua Marcuse (Director of Strategic Initiatives & Responsible AI Lead for Google Public Sector, and former Executive Director of the Defense Innovation Board, Department of Defense)

Given our long track record of partnering with companies at the intersection of defense and deep technology, including Skybox Imaging, Rocket Lab, Endgame, Spire Global, Claroty, and Virtru, we have various sales playbooks as well as metrics benchmarking reports specific to defense tech to help go-to-market teams navigate the federal sales landscape. In addition, we can offer a unique talent network for startups to leverage when building out their teams.

We’re eager to partner with and support mission-driven founders innovating in national security. Please don’t hesitate to reach out to David Cowan, Tess Hatch, Janelle Teng, Christopher Wan, and Jason Scheller by emailing us at defense@bvp.com.