Linear, volumetric, or bundling: Which type of usage-based pricing is right for you?

Usage-based pricing is more than what meets the eye—learn which of the three subtypes is best suited for your business.

In recent years, usage-based pricing has gained a reputation for being trendy, especially among the SaaS cohort. Also known as consumption-based pricing, the model’s adoption has jumped from 30% in 2019 to 45% in 2021. And it’s projected to hit 79% in 2023, if you count software businesses that are either adopting or testing out the model.

Far from a passing fad, usage-based pricing is well on its way to becoming standard practice for SaaS businesses. As an alternative to traditional subscription models, usage-based pricing offers attractive advantages that let software companies grow as their customers grow—a win-win for all.

But it’s important to remember this: Usage-based pricing is not right for every type of business. Along with its advantages, it also carries risks—and it’s more compatible with some business models than others. (And if you’re wondering if the pros of usage-based pricing outweigh the cons for your business, start with this guide.)

If you decide usage-based pricing is right for your business, there is still a lot of nuance to consider with regards to how you want to structure your model. One of the main aspects to consider is which of the three subtypes of usage-based pricing—linear, volumetric, and bundling—will be the most appealing to your customers and, of course, the strongest revenue generator for your business.

As SaaS businesses strive to build efficient business models to drive recurring revenue with optimal unit economics, we break down the additional options leaders can consider along their pricing and packaging journey this year.

A closer look at the three types of usage-based pricing models

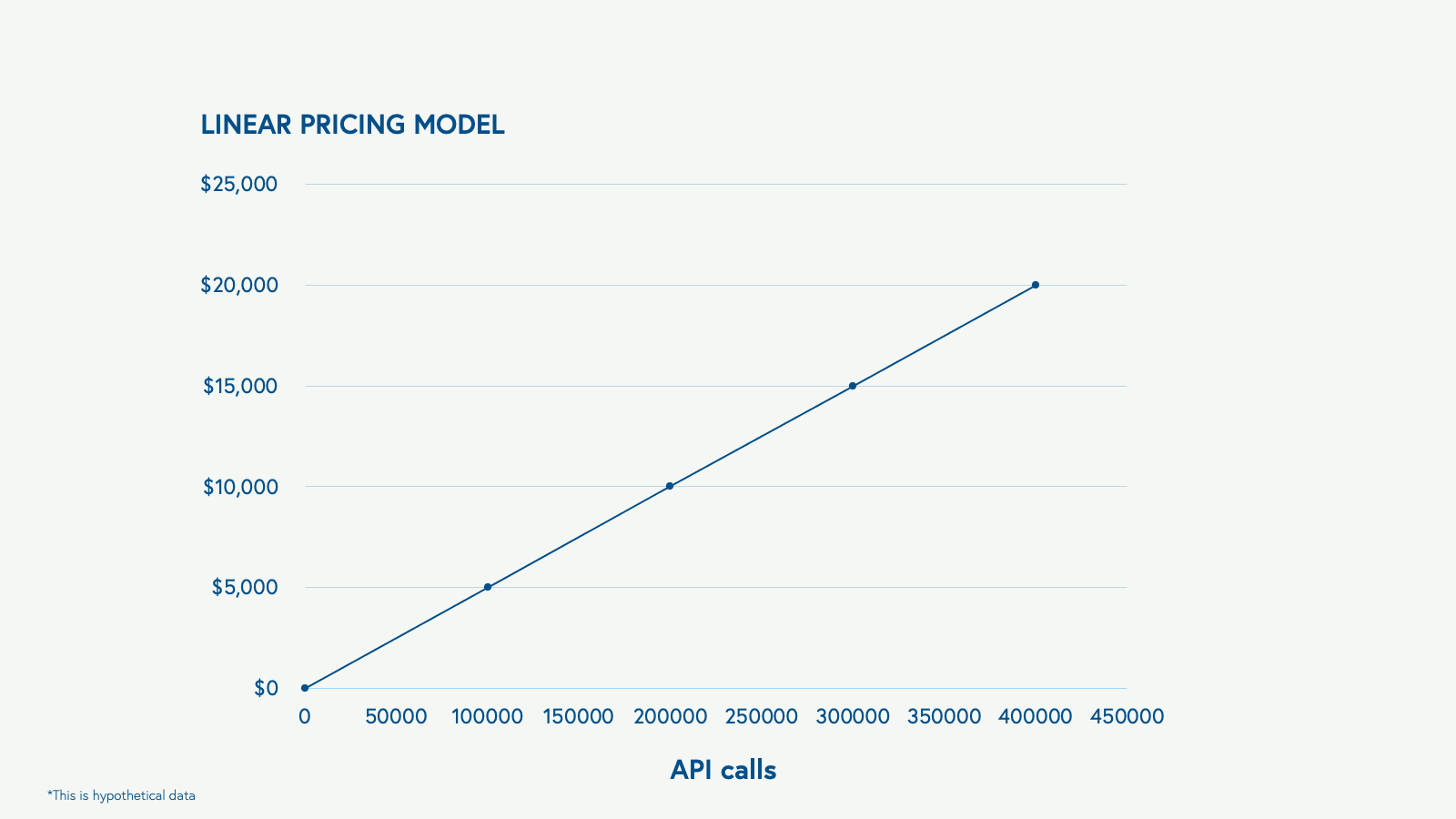

1. Linear usage-based model

A linear usage-based pricing model bills per unit, whether that unit is an API call, active user, or download. Customers are billed for their usage at the end of the period.

Examples of pricing units

- API calls (e.g. Courier)

- Active user (e.g. Slack)

- Document / per case (e.g. CS Disco)

Advantages and disadvantages of a linear model

Customers like that a linear usage-based model is simple to understand—there are no surprises when billing time comes. Plus, a linear model is easier on your billing software and won’t require some of the complex custom integration of more elaborate billing models.

Another advantage of a linear usage-based model is preserving gross margin for each unit delivery. With a linear model, margins don't shift and the business charges the same amount per unit, regardless of the volume of units. Linear pricing is also advantageous when usage is correlated with value. For example, if a product experience gets better with every additional user, then a linear model makes sense (e.g. Asana). This is commonly seen in productivity and collaboration tools where network effects influence group usage. In many cases, freemium and product-led growth businesses leverage this linear pricing strategy; offering a free starter plan (e.g. first “X” number of users are free) is an ideal way for one user to test out a product and then get their team members to join them driving network effects.

However, a linear model can present challenges. For one, revenue can vary so widely with the seasonality of customer needs. Where a usage-based volumetric model has a guaranteed minimum spend, a linear model means low usage can mean a tough quarter for revenue. It may also be more difficult for customers to budget using your tool since the price can vary so widely from month to month. As a result of the variability in a pure, pay-as-you-go model, investors often value those revenue streams less than predictable ARR. For example, the AdTech space often falls victim to seasonal usage, leading to inconsistent and “lumpy” revenue trends quarter over quarter. According to Bain research, over 90% of users who prefer subscription models feel that a lack of predictability is the main downside of usage-based pricing. Lastly, a linear model might disincentivize using the tool more fully. If each additional active user costs extra, customers are more likely to be sparing assigning accounts to employees—limiting the revenue you can generate from each account.

2. Volumetric usage-based model

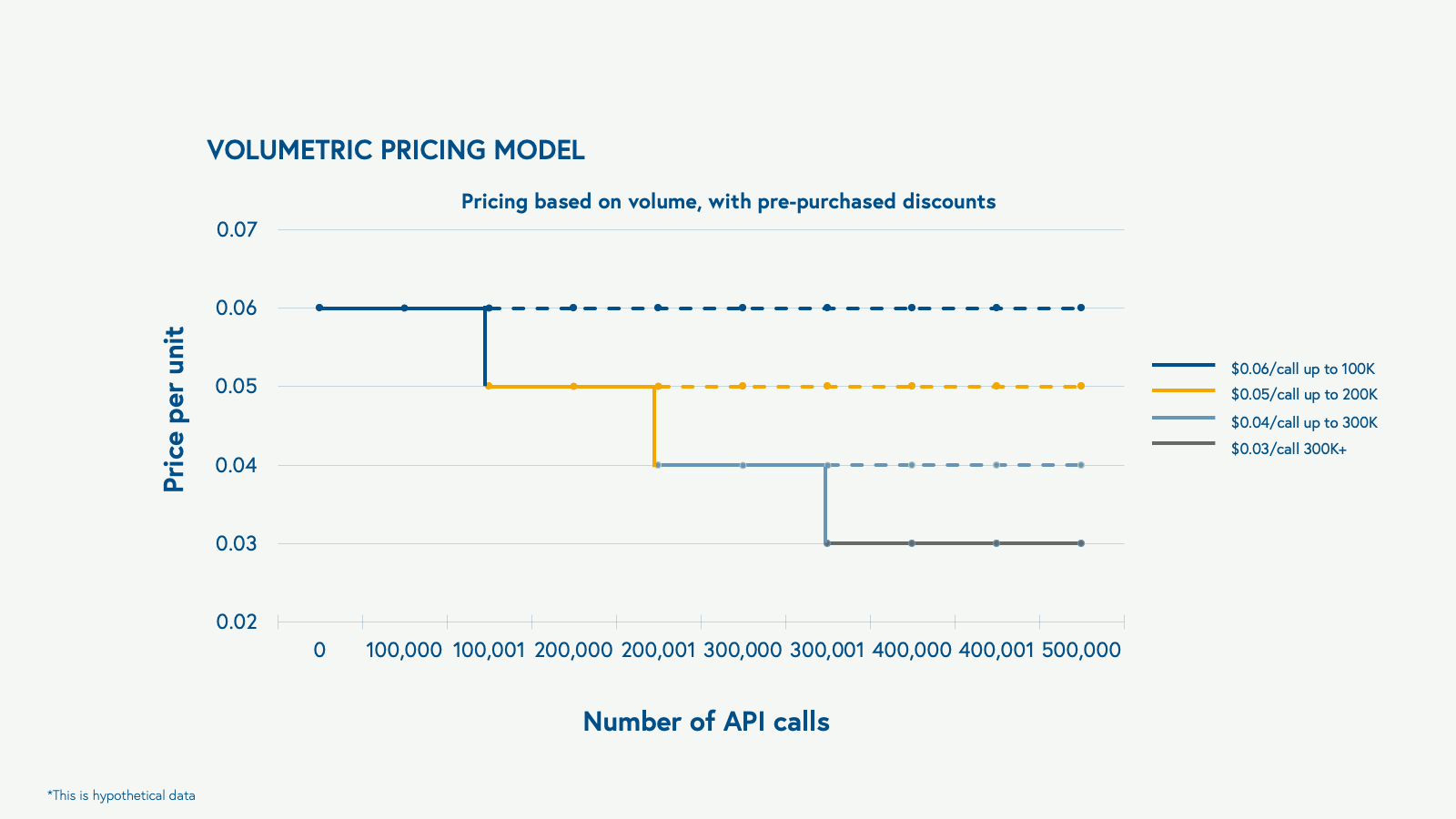

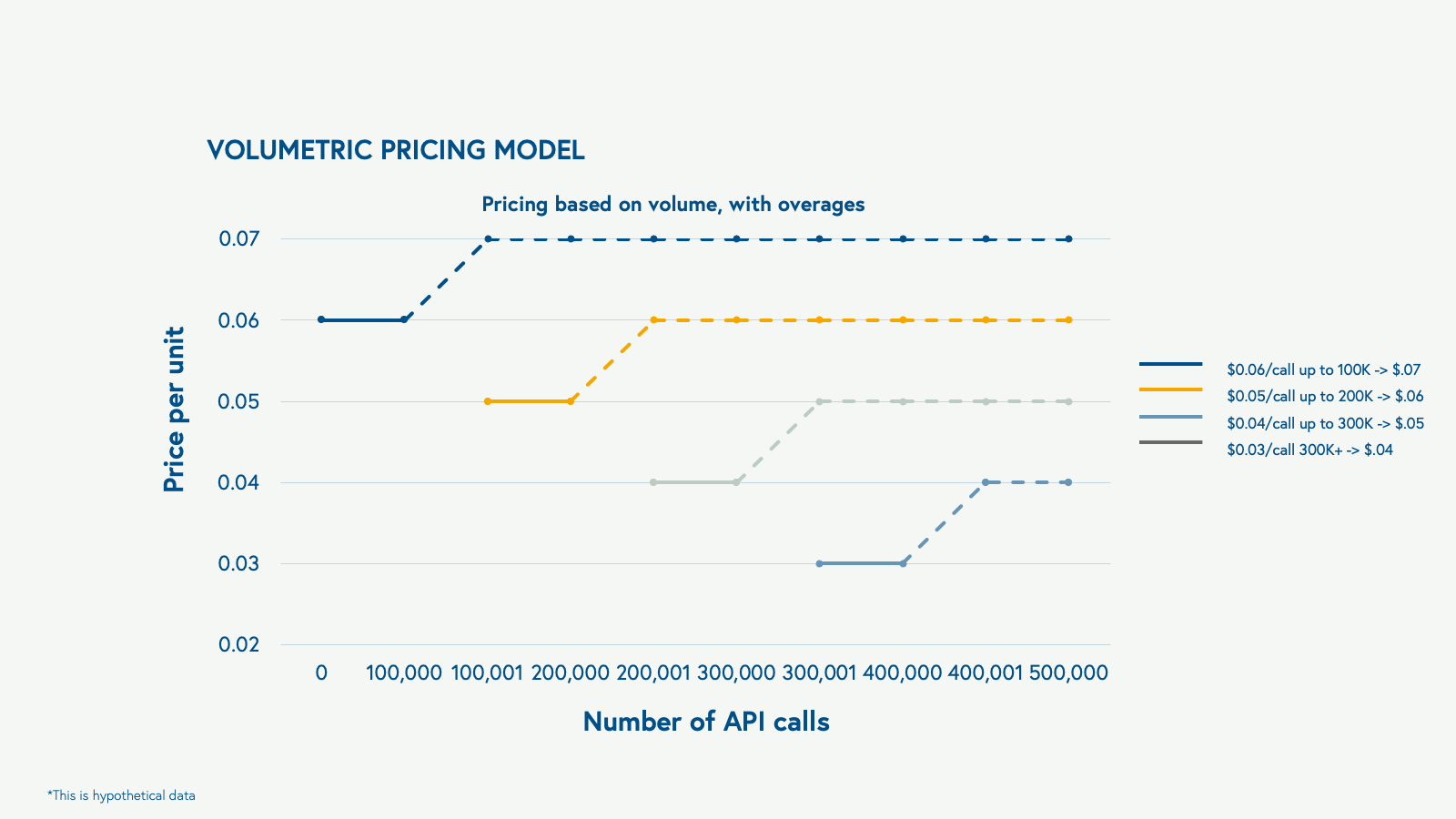

In a usage-based volumetric model, customers purchase an allowance based on their expected use of the product. Then, when the customer exceeds usage allowance, the pricing rate changes. This usually takes the form of a discount, but it can also take the form of an overage fee. A common example of a usage-based volumetric pricing model is cell phone data plans—you have a certain monthly allowance, then you’ll be charged more if you exceed that allowance. The same often goes for API businesses. For example, with Twilio’s pricing model, price per unit (e.g. API call) declines with volume.

Example of a volumetric pricing model with pre-purchased discounts

- In the hypothetical case above, the volumetric plan begins at $0.06 per API. After 100,000 APIs, the staircase discount model kicks in if a higher volume is pre-purchased (e.g. price per unit decreases with volume).

- For instance, if a customer averages 150,000 API calls a month, they might opt to pre-purchase the higher volume at 200,000 API calls to lock in the discounted rate, safeguarding them from seasonal spikes and potential overages.

Example of a volumetric pricing model with overages

- In the hypothetical case above, the volumetric plan begins at $0.06 per API, but if a higher volume isn’t pre-purchased, the customer must pay an overage rate of $0.07 per API call (e.g. price per unit increases with volume).

- For instance, if a customer averages 95,000 API calls a month, they may not opt to pre-purchase a higher volume rate.

- In the case the business gains traction or experiences a seasonal or unexpected spike, and their API calls grow to 125,000 API calls per month, they would pay that elevated fee for the additional volume.

Advantages and disadvantages of a volumetric model

A volumetric model assures a minimum spend regardless of usage, meaning both company and customer can forecast budget with more predictability. If you’re using a usage-based volumetric model with discounting, you can use those discounts as an incentive to increase usage. For example, let’s say a customer prepays for 10 seats at $15 per month and pays $20 per month for additional active users. If they have a month where they have 17 active users, this experience may encourage them to prepay for more seats the next month to save money.

If you’re selling a product that requires you to pay hosting costs and you don’t want spikes from customers, a model where a spike costs extra can protect your company financially. To mitigate the experience for customers, be sure to provide clear warnings if they’re close to receiving an overage fee (e.g. an email that says “Hey you’ve used 80% of your allowance for the month, and will be charged extra if you surpass 100%.”)

A downside of a usage-based volumetric model is that customers may be unhappy to pre-pay for something that they’re not able to use fully. Like a gym membership, the same charge is incurred whether they made full or scant use of what they paid for. What's more, customers may also be frustrated if they sit on the border of two tiers and end up having to pay the higher cost—for example, if there’s a discount for 200 users and they have 187.

Another point to consider is transparency—the thresholds of a discount curve may be confusing for customers, especially if the pricing model is subject to the discretion of individual salespeople. If customers compare their costs with their peers and find a discrepancy, this may undermine their trust.

3. Bundling usage-based model

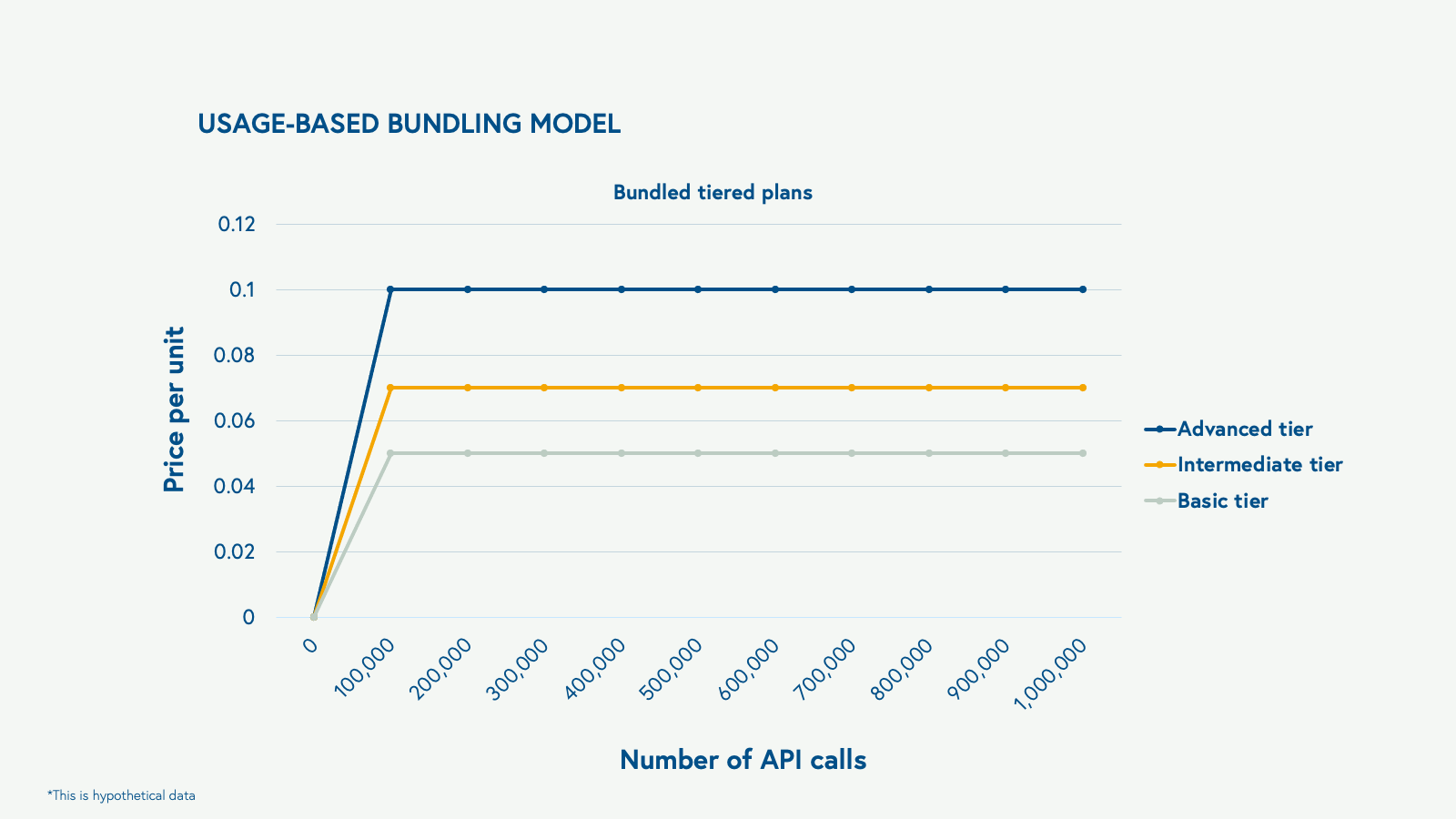

In a usage-based bundling model, the price per unit of use gets more expensive at higher tiers to reflect more features included. For example, the price per API may increase at higher usage tiers, since each tier of usage comes with premium functionality or features.

Example of a bundled tiered model

- In this hypothetical case above, there are three bundled tiers with different prices per unit given customers’ access to certain products and features:

- Basic tier ($0.05/call)

- Intermediate tier, which includes additional features ($.07/call)

- Advanced tier, which includes even more additional features ($0.1/call)

- In main cases, businesses shift to a custom-pricing strategy for enterprise accounts as they reach higher volumes or more personalized applications of the product.

Advantages and disadvantages of a bundling model

A usage-based bundling model provides lower entry price for basic buyers, which allows it to support a strong product-led growth strategy. The tiered system creates a clear upgrade path because as a software vendor serves a customer in more sophisticated ways, these customers not only extract more value from the platform, but the cost to deliver on the service may be increasingly more expensive given computing costs. This tiered system also allows companies to monetize highly regulated or more sophisticated use cases, such as Snowflake, Servicenow, and New Relic. Similarly, if you have a low-value feature, but you want customers to use it because you spent money to develop it, then bundling this feature can be a great option. This model can also be a helpful structure to create a “landing offering” for smaller customers to try and get hooked on the product.

One disadvantage of a usage-based bundling model is that it carries some significant overhead—you need to study your customers’ differentiated needs to appropriately bundle (e.g. give as much a way for “free” but determine the right threshold for monetization). It’s not quite as simple to set up as, say, a linear model. Furthermore, gating basic features may disincentivize customers from giving a solution a try.

SendGrid case study: The value of customizing a pricing model

While linear, bundling, and volumetric models offer three ways SaaS businesses can build their pricing strategy, the reality is that for many businesses, depending on the market, product, and customer segment, businesses may pick up a combination of different features from all three.

Case in point: SendGrid, the customer communication platform for transactional and marketing email, went public in 2017 and then was acquired for $3 billion in 2018 by Twilio. (During that time, SendGrid was led by CEO Sameer Dholakia who is now a Partner at Bessemer.) SendGrid leveraged a combination of bundling and volumetric models where customers unlocked coveted features at higher tiers. In SendGrid’s case, one example of a bundled feature was providing a dedicated IP address only to the Pro tier and above. The dedicated IP enabled a brand to build trust and an email “reputation” with the email inbox providers (like Gmail and Yahoo). Alternatively, lower tiers, like the Free and Essential plans, had businesses share IP pools, and email reputation might be impacted by those in the pool with you. This proved to be such a “killer feature” that some customers would choose the Pro plan just to get the bundled, dedicated IP capability.

In addition to gated features, SendGrid also had minimum volume amounts per tier (e.g. 50,000 emails per month). If a customer sent fewer, they still paid the full monthly recurring revenue (MRR) regardless. However, if a customer sent above the allotted tiered volume, there would be additional fees. In fact, overages accounted for a material percentage of SendGrid’s revenue. With this in mind, it’s common for pricing teams to consider if a business should keep or cut overage policies, as there are trade offs to both decisions. (This is where pricing strategy is an art and a science as these decisions must be made within context to the market and customer segment.) For example, some customers preferred to spend significantly higher rates in the couple months per year where volumes spiked, versus paying a little bit more each and every month.

In this case, allowing for flexibility in your pricing packages, especially for growing customers, is key to unlocking higher net dollar retention rates over time, too. Knowing that an existing cohort will grow meaningfully because of their consumption and growth is music to the ears of any executive leadership team. SendGrid had a net dollar retention rate (NDR) ranging from ~115% to 125% every year—in terms of benefits, that consumption-driven NDR translated to 1) a greater ability to accurately plan expenses, because the company had greater revenue predictability and 2) simply having a more manageable “go get” number (or “net new ARR number”) for the year.

Countless founders owe usage-based pricing their success

It’s hard to ignore the numerous usage-based pricing success stories. Seven of the nine most valuable IPOs in recent years have used usage-based pricing—names like Twilio and Snowflake. Companies that use usage-based pricing average a 137% net dollar retention. For many, usage-based pricing provides a golden opportunity to grow at the speed of your customers’ successes. However, we cannot overstate the importance of approaching your pricing model with the utmost of thoughtfulness—and not hopping on the trend for the trend’s sake. If you can do that though, and bring a carefully reasoned strategy to the model, then you may be the next usage-based pricing success story.