How to hire a CFO and build a finance team

Bessemer’s best practices for hiring finance leaders and professionals at early- to growth-stage SaaS companies.

No startup founder achieves success and growth alone—finance leaders play a mission-critical role in laying the infrastructure for a startup's growth trajectory and help businesses weather all economic climates. Seasoned chief financial officers (CFOs) help a business ramp toward IPO, optimize treasury management, and even navigate major external crises, as we've seen with recent collapse of Silicon Valley Bank. But it's not always clear when and how to find the right finance leader.

Until that point, the founder is often the first person to do every job, from building and selling the product to budgeting available capital. The same goes for finance. The first founder priority is cash management—to make sure there’s enough runway to operate and decide how to use it most efficiently.

Eventually, the day-to-day and longer-term priorities of managing financial operations grow in complexity. As the stakes get higher, this function needs to be passed to the first finance hire. But how exactly should a founder approach hiring their first finance lead (e.g. vice president of finance or CFO)?

On Atlas, we spoke to four seasoned SaaS finance leaders, Operating Partner Jeff Epstein, and Bessemer's very own Vice President of Talent Miia Laukkarinen, to provide founders with best practices on when to hire their first head of finance, how to approach that search, and the frameworks for successfully building a finance team.

The two sides of the house: controllership vs. FP&A

Before a founder makes their first finance hire, it’s important they understand several key distinctions in the common functions and backgrounds in the industry in order to identify the right candidate. And it all comes down to the different duties of accounting and finance professionals.

“In a finance team, a founder must recognize there are two sides to the house—financial planning and analysis (FP&A), which is more about analytical business partnering, versus controllership, which is more about getting the books right,” said Julian Lange, CFO at Upvest. “Not a lot of people are good at both.”

“The job of a controller is to keep the trains running on time,” said Betty Kayton, Fractional CFO at Bastille Networks. “And keeping the trains running on time means that the CEO doesn’t need to worry about the back-end of the company, so the CEO can focus on the product, customers, and team.”

While the differences might not be clear from the outside, it’s commonly understood on finance teams that the two sides of the house are pretty distinct in their backgrounds and how they prefer to work. “The people are almost from different planets,” remarked Julian of Upvest. “For instance, FP&A people are ok with the 80/20 rule, while controllers and accountants usually want to get things 99% right.”

- Accounting professionals oversee historical financial data and prepare key financial statements—including the profit and loss (P&L) or income statement, balance sheet, and cash flow statement. Typically certified public accountants (CPAs), many accounting experts come from audit backgrounds, and others from in-house roles at larger firms. Controllership roles fall under accounting.

- Analytical professionals focus on preparing for scenarios that could happen in the future. Their work is often more strategic in nature, involving modeling and projections, and many come from backgrounds in investment banking or business operations. In-house finance roles are often titled and focused on FP&A.

Signs it’s time to hire a finance lead

When should a founder hire a finance lead––and more importantly, how will they know it’s time to bring one on full-time?

“The right time to bring on a full-time finance lead is typically when the business is becoming more complex,” said Christopher Kitching, CFO at Databook. “When the business starts to evolve at scale, through launching new departments and making step function leaps in hiring, it’s typically a sign that it’s time to hire a finance leader.”

In addition to the added complexity, the stakes get higher as companies see increased revenue and spend. “In finance, at any point of the journey, usually you add to the team when you have more complexity or the numbers get bigger,” Julian of Upvest added. “If I’m spending a few million on a cost item, it’s probably worth someone looking into it. That person will quickly pay for themselves.”

In practice, business complexity can look like expanding into new geographies; hiring more functions, such as marketing and customer success; selling additional products or services; building more corporate entities; using customer relationship management (CRM) software such as Salesforce; and needing more production sites. Complexity tends to happen around the $5 million to $10 million annual recurring revenue (ARR) mark, Chris added.

But some founders can manage without an in-house finance lead even longer: “In my experience, it happens closer to $20 million of ARR,” said Ivan Makarov, vice president of finance at Webflow.

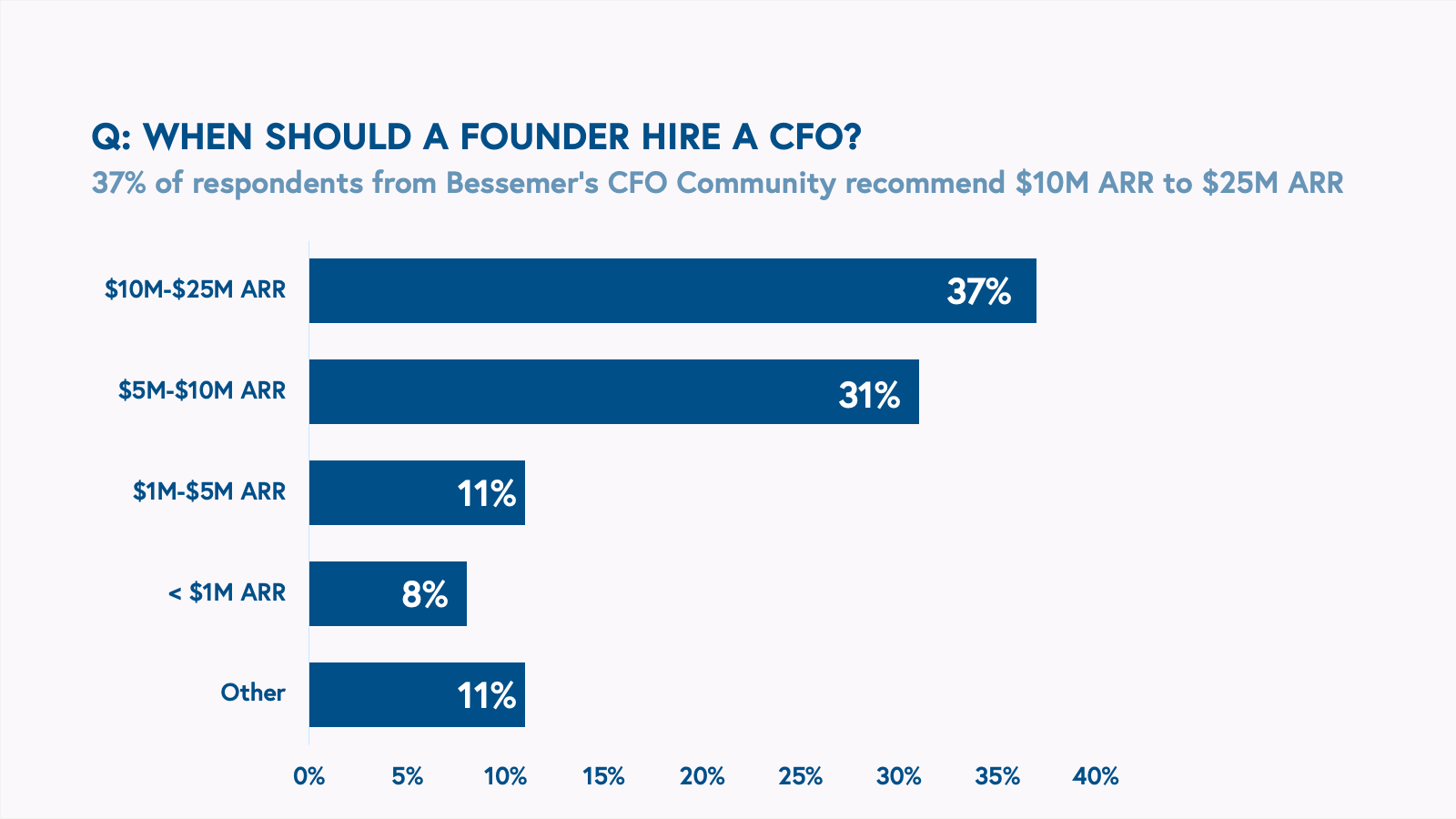

The right time and the level of the finance leader depends on many factors. 37% of respondents from Bessemer’s CFO Community said $10 million to $25 million of ARR is the sweet spot to bring on a CFO. Many also posited that the first hire should be a vice president (VP)-level role, instead.

“The return-on-investment (ROI) of hiring a finance lead is very quick, even in simple things like compliance and building the foundation of the house,” Ivan of Webflow added. “At that point, you have a general idea of what the company is going to look like in the next few years.”

Another signal that it’s time to hire a finance lead: when companies are preparing for an audit, a fundraise, or both, said Chris of Databook. “To get through an audit, companies need someone who can manage the audit firm and establish the right accounting methodologies, such as revenue recognition, Chris added. “That’s where an in-house finance leader with a deep understanding of business drivers can be helpful.”

Equally important is the ability to make accurate cash flow projections—that’s something investors want to see. If a founding team is unable to make accurate cash flow projections within a year, quarter, or six-month period, it’s likely time for them to begin searching for a finance lead. And working with an outside bookkeeper or financial software hits a hard limit when complexity increases and institutional knowledge is paramount.

“One big consideration is, how experienced are the founders on fundraising?”, said Julian. “I’ve seen a lot of founders underestimate how that works and how much time it takes.”

“At some point, the business tips into a zone where it becomes too complicated for a handful of people or one person to do it as a part-time, five hours a week, ‘let me just tinker with this model to know what the cash flows are,’” Chris added.

“If you’re a first-time founder, you probably want a finance lead sooner rather than later,” said Julian. “Every mistake you make, an investor basically says ‘no thank you,’ and it’s costly.”

What to look for in a finance lead

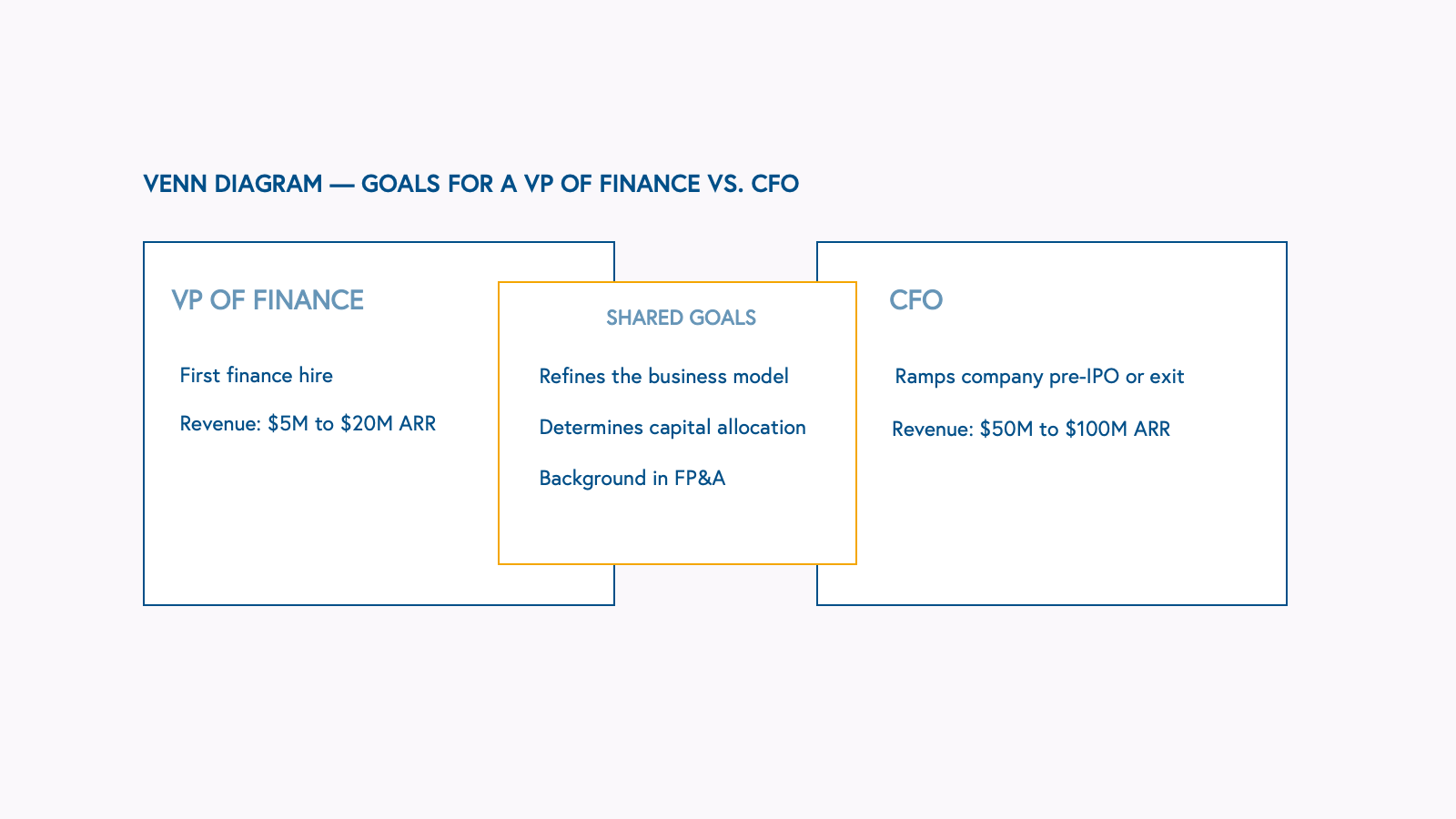

Don’t expect to hire a CFO right out of the gate: it’s actually much more common for early-stage startups to hire a head of finance or VP of finance at the Series A or B stage, before a CFO, said Miia Laukkarinen, VP of talent at Bessemer Venture Partners. “When you start generating enough demand and revenue to require a team, you will need a head of finance to help you prioritize where to invest and what’s most lucrative from a financial perspective,” said Miia.

“A head of finance is very hands-on, leads fundraising with the CEO, and often manages an accountant only, or one to two people as the company grows closer to the scale that requires a CFO,” Miia added.

A CFO can help with the same things a head of finance focuses on, but at a bigger scale, Miia explained. When a company’s ARR is in the double digits, and approaching triple, that’s when founders need a CFO to oversee a full-fledged team of accountants and FP&A experts.

“When there are only three or four people from leadership in the room, the CFO is one of them—the VP of finance is generally not,” Betty explained. “The VP of finance is more transactional than a CFO, maybe also running FP&A. But the VP of finance usually isn’t the one the CEO calls when the CRO suddenly resigns.”

Reminder: The CFO title comes with strings attached

It’s also important to note that the CFO title often comes with strings that a less senior finance title doesn’t. “I see plenty of CFOs at 20-people and 30-people companies,” said Ivan. “But CFOs come in with certain expectations, and oftentimes it’s a challenge to give them the resources they ask for.”

For example, one common request is equity: CFOs tend to demand more equity ownership than a VP of finance would.

To ensure the right long-term CFO fit, founders might consider hiring a CFO or finance lead in a contract-based position for the first few months, and if it goes well, that person can be brought on full-time, Ivan suggested. The rise of the “fractional CFO” is more common, especially in a market where startups and high-growth businesses must focus on preserving operational efficiency. (Read more about fractional CFOs below in our section on how to search for a finance leader.)

The right background: accounting or FP&A?

Experts in our portfolio agree that if founders have to pick between an accounting expert and an FP&A expert for their first finance hire, it’s best to go with an FP&A expert. That’s because it’s often harder for accountants to learn how to master forward-thinking, strategic planning-oriented work, than it is for finance professionals to learn accounting.

Better yet, an FP&A-oriented finance lead can hire a controller to oversee accounting. “A VP of finance typically has a controller reporting to them,” said Ivan. “I haven’t seen it the other way around.”

And, startups can be a challenging environment for accounting experts to learn in. “Candidates with audit and accounting backgrounds sometimes have trouble making decisions with imperfect information,” Julian added.

Another advantage of hiring an FP&A expert first is their ability to make sense of the business. “If you hire someone with an FP&A background first, they can work with the founding team to help build the business model,” said Ivan.

Three popular backgrounds for FP&A-savvy finance leads are investment banking, consulting, and business operations (BizOps). These lines of work involve building financial models and explaining them to stakeholders. The right VP of finance can map out the business on spreadsheets, help founding teams decide where to take risks, and hire a controller to help close the books and prepare for taxes.

While an FP&A background certainly works as a rule of thumb, the ideal first finance hire has strengths where a company’s co-founders don’t. “If the founders are strong on strategy, you don’t necessarily need someone to contribute a lot on the strategy side,” said Ivan. “If it’s the reverse, then it’s good to hire someone strategic.”

But the single most important quality in a finance lead isn’t a hard skill—it’s actually a soft one: the ability and willingness to challenge founders.

“Finance leaders bring reality into the room,” said Ivan. “They can challenge the founders, who might feel invincible after a fundraise. They help bring a different perspective that’s based in facts—the most recent data.”

How finance teams add value

Once founders make their first finance hire, they might start to think about building a full team. But before they start planning additional headcount, they’ll need to get clear on how a finance team can help their business drive revenue and set up strategic growth initiatives.

The invaluable benefit of having an in-house finance team is that it equips founders with experts who understand how the business makes money. As much as an outside bookkeeper or fractional CFO can try to help, they’ll never understand monetization as well as a finance executive who works full-time with the founder and other functional leads. That’s especially helpful for product visionary-type founders who aren’t finance- and operations-oriented.

Finance teams help founders in four lesser known ways:

1. Implement accounting controls.

The excitement in incorporating a company is about the prospect of building and scaling a viable business—not preparing for tax season. Finance professionals can help startup founders with the less appealing yet critical elements of corporate governance, such as implementing accounting controls.

Controls are procedures that act as checks and balances on all monies in and out of the company, with the end goal of ensuring accurate financial statements. Examples of common controls include double-entry bookkeeping, third-party audits, and policies on cash disbursements and reimbursements.

“Founders often underestimate the importance of accounting controls,” said Ivan of Webflow. “But keeping tabs on checks, invoices, and receipts actually helps companies move faster.”

2. Refine unit economics.

Unit economics draw a direct line from company investment in a product/initiative to the revenue generated, dollar per dollar.

“I would simplify it as, mathematically, can we start defining in some way or another why these activities matter and why they’re productive and lead towards profitability in the medium- to long- term?”, explained Chris.

Finance teams are integral to making sense of unit economics through identifying and reporting insights on what’s driving ARR growth and retention, as well as where lucrative customers are based geographically.

“The other thing is, you should have a clear view of monetization,” Ivan added. “Even if in the early days you’re optimizing for adoption, you should understand how you can monetize your users.” (To learn more about monetization, read our thought leadership on usage-based pricing and sign up for our free B2B SaaS Pricing course.)

3. Measure success with metrics and dashboards.

Finance teams are responsible for equipping founders with the data they need to make informed decisions about how to allocate capital and grow.

“Allocating capital correctly is a key value that a CFO can bring to the discussion, and what I mean by that is, ‘OK, so we’re a $15 million company—how much should we be investing into R&D vs. sales, marketing, and customer success?’,” Chris explained. “Those are important questions that a pure product person wouldn’t know.”

To help companies understand the true, indirect, and overhead costs of generating revenue, finance teams can own the process of selecting and measuring key performance indicators (KPIs), such as customer acquisition cost (CAC), customer lifetime value (CLTV), CAC payback, and cohort retention.

4. Liaise with investors.

Finally, finance teams help founders view their business through the same lens investors use. “You have to evaluate businesses today in terms of P&L and cash flow statements, because that’s how investors are thinking,” said Ivan. Working with a finance lead regularly to look at these numbers can help set founders up for success when they’re trying to raise venture capital.

In addition to building a classic three-statement financial model—including an income statement, balance sheet, and cash flow statement—finance experts can model different scenarios and help founders plot the best use of their runway until their next fundraise.

What to look for in a CFO

When Bessemer Operating Partner Jeff Epstein surveyed 36 CEOs on what they expect of their CFO, he received answers ranging from accurate financial reporting and risk management, to maintaining strong relationships with board directors and capital providers. Still, three essential traits stood out as recurrent themes:

- 51% of CEO respondents expect their CFOs to be strategic thought partners. That means having a right-hand confidant to talk through possible scenarios and important decisions. “I expect my CFO to be my business partner and sounding board,” said Dev Ittycheria, president and CEO of developer software company MongoDB. “If I don't want them in the room for important business decisions, then they are the wrong person. Their insight, experience and intuition are things I should value.”

- 32% mentioned they look to their CFOs for values-driven leadership. In practice, the CFO is expected to carry the company’s culture, and sometimes even lead certain departments, such as human resources and compliance. ”High performance leadership teams are grounded in trust, transparency, and teamwork,” said Kevin Johnson, former president and CEO of Starbucks. “I expect all executives, including the CFO, to model these behaviors and represent the values of the company. As with any leadership member, the CFO contributes significantly and amplifies the purpose and culture of an enduring business.”

- 28% look for integrity. The integrity founders look for in CFOs is just as much about accurate reporting as it is about a strong moral compass and comfort making disclosures. “Character matters in all leadership roles, but especially in the CFO,” said James Guyette, former CEO of Rolls-Royce North America. “They must have a sterling reputation with the board, the management team, auditors, investors, and the industry community at large. It's all about trust.”

How to search for a finance leader

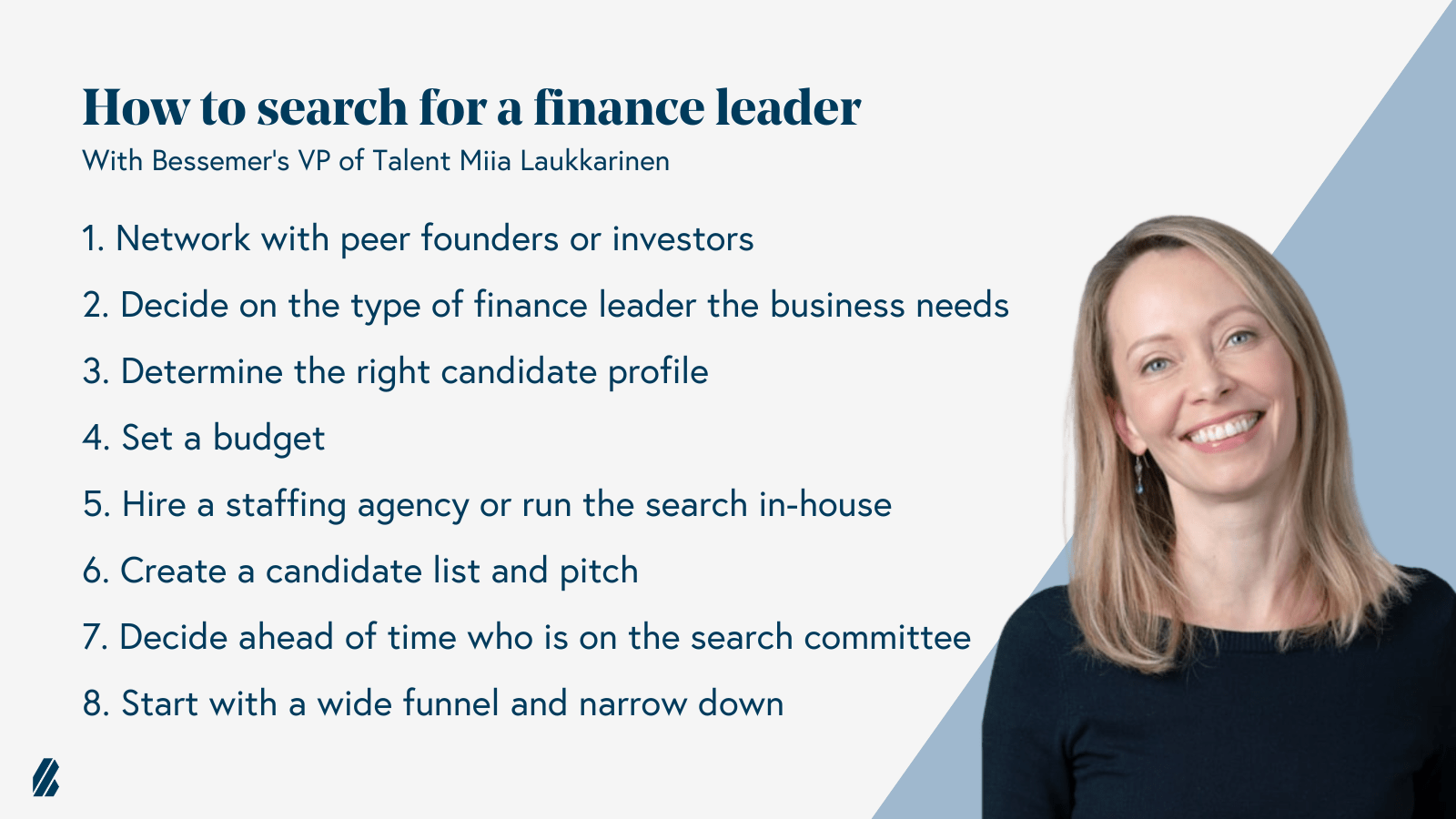

When founders feel it’s time to bring on a full-time finance leader, there are a number of best practices that can make the process easier:

- Network with peer founders or investors. This is especially important for early-stage founders, who likely don’t have an in-house recruiting team yet.

- Decide on the type of finance leader the business needs. FP&A-focused, controller-oriented, or a multi-talented “Swiss Army knife” candidate? Is the business mature enough to benefit from a CFO, or is it better suited to start with a VP of finance?

- Set a budget. It’s a best practice for founders to identify a range and upper limit in advance, informed by market data.

- Either hire an agency to run the search or run it in-house. As a backup option, founders can lean on the talent and platform teams at the venture capital firms that back them.

- Create a candidate list and pitch. This is where founders get to identify their most exciting candidates and craft compelling messaging about the opportunity in their startup.

- To run a smooth and effective search process, decide ahead of time who is on the search committee. For example, founders searching for a CFO might want to take feedback from their existing VP of finance with a grain of salt.

- Start with a wide funnel and narrow down. It’s not unusual for recruiters to target 150-200 candidates and funnel it down to 20 serious considerations, and that’s before the final four to seven that a hiring team will choose between. Ideally, a CEO won’t meet with more than three or four contenders, Miia explained.

“In a competitive talent market, you’re not going to find the perfect candidate who checks all the boxes,” said Miia. “Instead, make a list of ten bullet points of what you’re looking for in the ideal hire—three to four bullet points should be “must-have” qualities, while the rest are “nice-to-haves,” said Miia.

Also, prepare for a months-long search. Realistically, it can take three to four months to find the right finance leader—sometimes even longer. But that doesn’t mean companies can’t be doing business-critical finance work in the meantime.

CFO search case study: Webflow

When conducting a CFO search, it’s a great idea to get a head start on building financial controls and processes. That’s what Ivan did at Webflow: as he was interviewing, Webflow hired a fractional CFO to support the company during the search and a few subsequent months, too. That way, Webflow was able to de-risk its lack of a full-time CFO.

This approach was more expensive up front, because fractional CFOs tend to work on an hourly basis, but paid off in the long term: the fractional CFO had done a year’s worth of work in a few months, Ivan said. That person helped establish a chart of accounts, oversee departmental accounting, and set up systems that set Ivan up for success. Most importantly, it kept Webflow’s leadership from worrying about the long-term damage of operating any longer without a long-term finance game plan. “I highly recommend this approach if the business can afford it,” he added.

Some seasoned fractional CFOs, like Betty Kayton of Bastille, recommend hiring a fractional CFO from day one. “Fractional CFOs help founders avoid making costly mistakes from the start,” said Betty. “It’s best to have a fractional CFO until founders are ready to hire a full-time finance lead, and it’s usually a sign to make the transition when you’re either spending 75% of more of a full-time salary on your fractional support, or are expecting, in the near future, substantially increased operational or financial complexity.”

Parting thoughts: the finance function learning curve

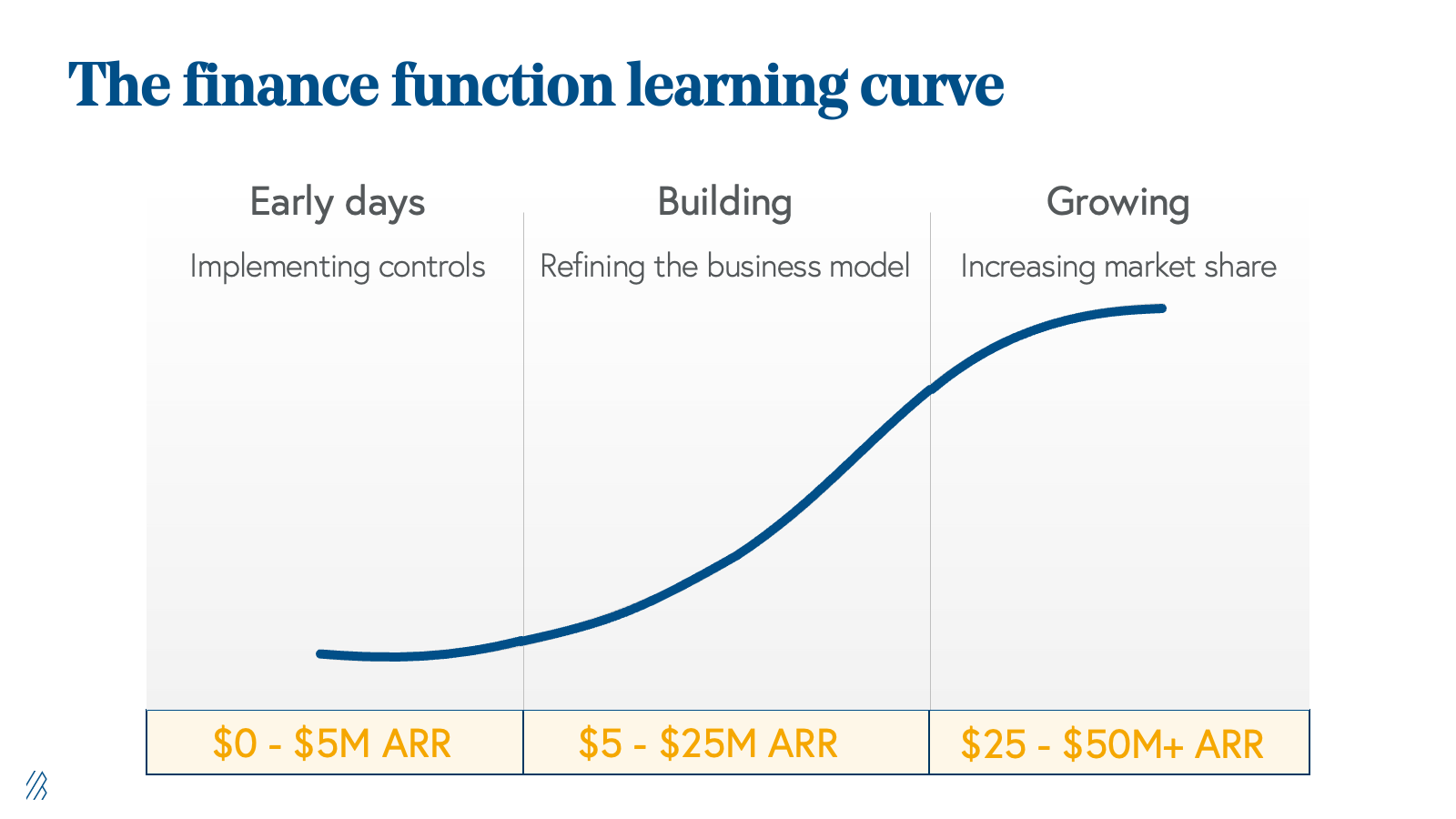

Building a finance team is an exciting business milestone: it means a company is taking on more challenges than it had before. The right mix of full-time finance professionals can help make the risky and uncertain process of company-building more predictable than it would otherwise be. And a finance team isn’t just for growth-stage enterprises: there’s a role for financial analysis at every step of a founder’s journey. Here’s how dedicated finance hires can make an impact:

Early days ($0 - $5 million ARR)

In the earliest stages of building a company, finance experts can help put controls and processes into place, ensuring that there’s a robust record of monies in and out. Accounting professionals in particular will clean up the books and close them on a timely, regular basis. It can help in the future to hire a bookkeeper or fractional CFO and select a fintech stack. These tactics can take place as early as day one.

Building ($5 - $25 million ARR)

When a business shifts from simple to complex—through the addition of product lines, production sites, sales regions, or corporate entities—it’s time to bring on a full-time finance lead. The right hire can help founders build a budget, refine the business model, measure unit economics, model possible scenarios, and help make strategic decisions about where to invest resources. SaaS companies usually think about bringing on a full-time finance hire between $5 million and $25 million of ARR.

Growing (≥$25 - $50 million ARR)

As a business scales and even considers an exit, a CFO can prepare a business for its later stages and manage public scrutiny. The right CFO can serve as a strategic thought partner to a founding team. Most importantly, they’ll be a voice of data-driven reason in the boardroom, unafraid of challenging different stakeholders. SaaS companies typically hire a CFO when they've surpassed $50 million of ARR–sometimes even waiting until $100 million–though some industry experts say it’s possible to hire a full-time CFO even earlier.