How heat pumps can decarbonize global heating and cooling

New innovations in hardware and installation can turn this legacy technology into a widespread renewable energy solution.

Heating and cooling make up 50% of total energy consumption worldwide, and market studies estimate the heating and cooling market size at $1.4 trillion and counting. To decarbonize this massive industry, we're going to need a wide range of solutions, including thermal energy storage, nuclear energy, geothermal energy, green hydrogen, and heat pumps.

Heat pumps are a renewable energy alternative to traditional boilers and furnaces. In broad strokes, heat pumps simply transfer heat from one place to another, making them two to three times more efficient than boilers, which directly generate heat by burning fossil fuels.

More specifically, a heat pump uses a small amount of electric energy to absorb energy from low-temperature heat (found in the surrounding air, water, or even ground) into a refrigerant fluid, which has unique properties that enable it to absorb and release heat efficiently. When the refrigerant fluid heats up, it turns into a gas. The pump compresses the gas, heating the refrigerant even further, and transports it to the location that needs to be warmed. The refrigerant is then allowed to condense and expand, which releases heat to the surrounding environment. Heat pumps are fully reversible, meaning they can both heat and cool buildings.

As the global energy sector races to achieve net-zero carbon emissions by 2050, heat pumps offer a promising solution for energy consumers worldwide. Heat pumps have the potential to reduce global carbon dioxide (CO2) emissions by at least 500 million metric tons in 2030—that’s equivalent to the aggregate CO2 emissions of all cars in Europe each year.

As we discussed in our Climate and Energy Software Roadmap, heat pumps are crucial pieces to the climate puzzle. In this article, we’ll explain what a heat pump-powered future looks like, including how heat pumps work, the tailwinds to widespread adoption, and how we anticipate the heat pump value chain progressing in the years to come.

How energy consumers use heat pumps today

Residential and industrial settings use heat pumps as a more climate-friendly alternative to fossil fuel-based boilers and furnaces. The International Energy Agency (IEA) estimates that by 2050, 2.6 billion people will live in areas with substantial heating and cooling needs that could be addressed by heat pumps. Today, single-family homes typically buy one or a handful of heat pumps to service their property, and apartments and multi-family buildings often have several heat pumps running as part of a centralized HVAC system.

Heat pumps can also replace fossil fuel-based boilers in factories. Here, heat pumps can recover waste heat, which accumulates as wastewater or as compressed and exhaust air. This waste heat is then converted for use in downstream heating, cooling, drying, air conditioning, finishing, and processing. Different types of industrial processes require different ranges of heating temperatures:

|

Examples of industry applications |

Technological readiness |

|

|

Below 100° C |

• Paper de-inking •Food and beverage blanching, scalding, concentration, tempering, smoking •Chemical bioreactions •Metals electroplating, phosphating, chromating, purging •Textile bleaching •Wood cocking, staining, pickling •General washing and cleaning |

Conventional, widely commercially-available |

|

100° C - 150° C |

• Paper bleaching •Food and beverage pasteurization, sterilization, boiling •Chemical concentration, boiling •Textile drying, washing •Wood drying |

Commercially-available, or late-stage R&D in progress |

|

150-200C |

•Paper boiling •Food and beverage evaporation •Chemical compression, thermoforming •Plastic injection molding (sometimes +200C) •Textile coloring •Wood gluing |

R&D and prototyping in progress |

|

+400° C |

•Iron and steel production •Ferrous and non-ferrous metals (+1000C) |

Technical research phase, very few if any commercial pilots |

Drivers behind the current interest in heat pumps

Although they have been around since the 1970s, heat pumps have experienced a recent increase in global sales. Almost 3 million heat pumps were sold in Europe in 2022, amounting to an annual increase of 40%. In the United States, heat pump sales exceeded fossil fuel-based heating systems for the first time in 2022. Several tailwinds are driving this momentum:

1. Energy crisis and the relationship between electricity and gas prices. Heat pump demand and innovation are correlated with conventional energy prices (i.e. fossil fuels). When gas prices declined in the 80s & 90s, heat pumps fell out of fashion, since it became cheaper to use gas boilers. In 2022, however, when gas prices shot up due to the Russian invasion of Ukraine, demand for heat pumps surged. Looking to the future, natural gas prices are estimated to remain stable or increase through 2050, while electricity prices are estimated to decrease. As a result, heat pumps will become more attractive in the long run, given their efficiency can be up to 2-3x that of a conventional natural gas boiler. We can measure attractiveness using the electricity-to-gas price ratio. Across many global regions this ratio is expected to decrease, favorably benefitting heat pump uptake.

2. Growing policy support - Since heat pumps are still more expensive upfront than conventional boilers, current adoption is highly dependent on governments and regulations incentivizing purchases. In the United States, the Inflation Reduction Act (IRA) provides a host of specific heat pump incentives. For instance, the law provides manufacturers with $10 billion in tax credits that can go towards heat pump implementation. The IRA also provides residents a separate tax credit of up to 30% of the cost of purchasing and installing a heat pump (up to $2,000). In Europe, the European Commission recently enacted a plan to install 2 million heat pumps per year through country-by-country incentives and tougher energy efficiency requirements on buildings. The European Union also has a specific Heat Pump Action Plan to facilitate heat pump adoption through additional financing options and dedicated partnerships with the private sector.

3. Consumer consciousness. The past two decades have seen a drastic increase in sustainable mindsets across consumers and corporations. The initial wedge was solar panel installation across residential, commercial, and industrial properties. Next up, heat pump adoption is also becoming an important component of the broader electrification movement. We even see a few parallels (described below) as to how heat pump market penetration could follow the incredible solar panel penetration the market has witnessed over the past several years.

Opportunities in the heat pump value chain

The heat pump value chain consists of three parts: (1) Heat pump device original equipment manufacturers (OEMs); (2) Installation and financing; and (3) Post-installation operations and maintenance.

1. Heat pump device OEMs

As mentioned, heat pumps have been around for the last 50+ years, and while there hasn't been as much innovation on the device level, we're still excited by new hardware innovations that enable easier installation. Physical constraints can make heat pump deployment infeasible, since heat pumps can be quite large, with residential units about the size of a refrigerator and some industrial units ten times that. Retrofitting older buildings and factories, which have complex legacy wiring and energy systems in place, can therefore be especially difficult.

A new crop of market entrants is tackling these problems with heat pumps that are smaller, cheaper, and more modular. On the residential side, startups are building new heat pumps that can be easily fitted into window sills and sleeker units that can fit into smaller apartments. Within industrial applications, heat pumps have been around for some time but have historically been bulky, difficult to install, and cost- and energy-inefficient. For example, AtmosZero is replacing traditional boilers (typically using fossil fuels or inefficient electric heating coils) and working on novel heat pumps that use heated air to generate steam.

Winners in the industrial heating space will likely be those developing smaller heat pumps that can be more easily installed within facilities without causing prolonged downtime. Companies could also look to integrate innovative commercialization strategies that reduce the upfront capex required and shift the purchase of a heat pump to a recurring opex expense through as-a-service offerings and earn additional revenue through post-installation service and maintenance. Gross margins will also need to be scalable and focused on keeping bill of material (BOM) and inventory costs low.

Perhaps the biggest value add will be the eventual technical achievements needed to unlock temperatures between 100-250° C or more at scale. Necessary achievements include developing more environmentally-friendly refrigerants, creating new compressors that can achieve higher temperature capabilities, reducing the number of process steps within a heat pump set-up, enabling pumps to more easily heat to varying temperature degrees, and developing optimal heat exchangers for a variety of settings and applications within a broader factory setting.

Another difficulty with scaling heat pump device level buildout is a complex supply chain. Legacy suppliers in the industry are still grappling with long lead times to build and ship heat pumps due to material shortages exacerbated by COVID-19. Ample opportunities exist for new startups to enter the market with lower cost structures and supply chain innovation to reduce component lead times. For example, fast-growing heat pump marketplaces are leveraging their status as high-volume buyers to negotiate more favorable wholesale contracts with manufacturers to obtain heat pumps faster.

2. Installation and financing

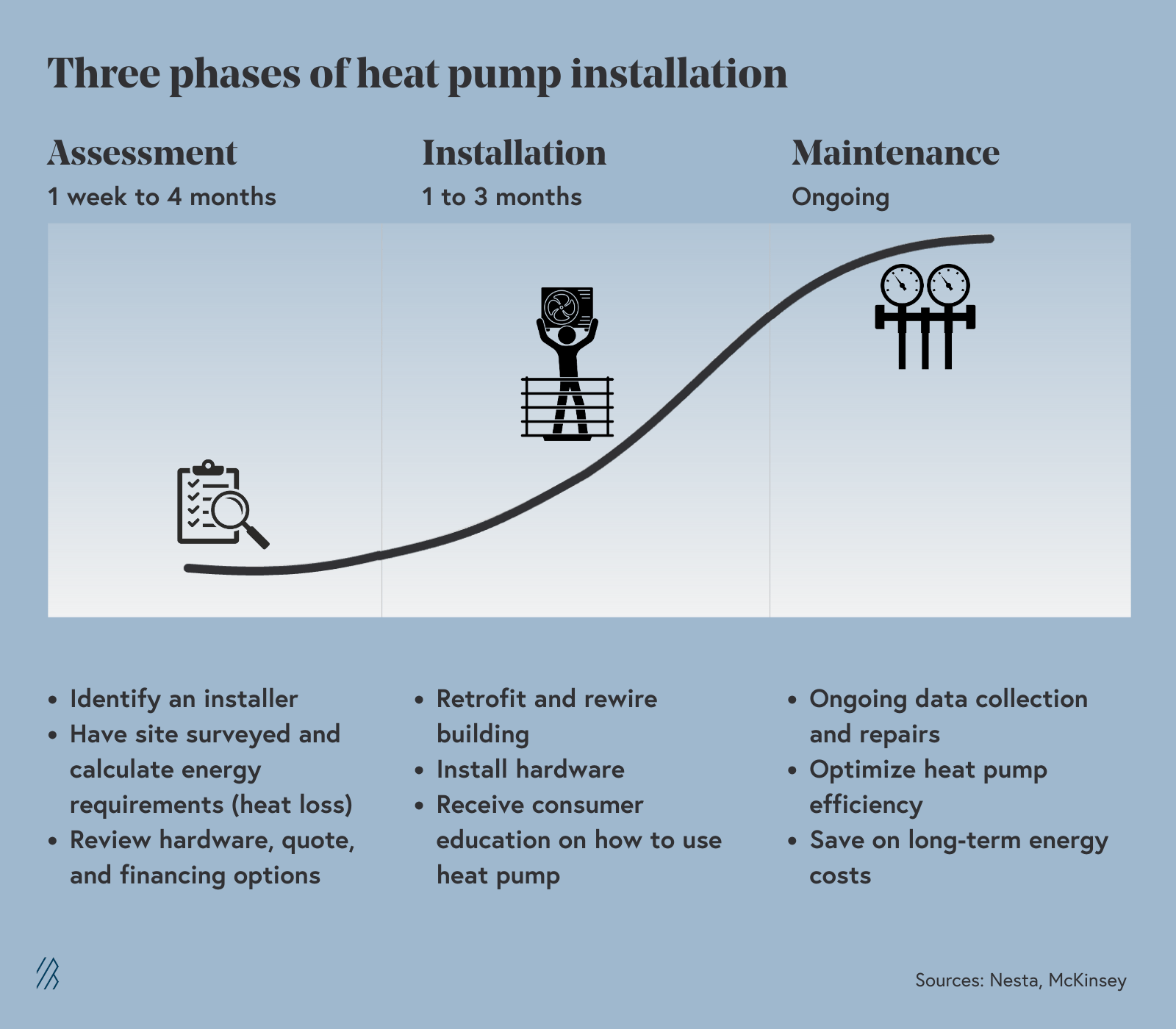

A key opportunity in the heat pump value chain lies in improving the installation and financing process. Indeed, heat pumps are expensive upfront investments ranging from $5,000-$20,000 for residential customers and over six figures for industrial customers. Financing challenges are especially acute in the United States where state and national government policies have only recently introduced incentives at a broad scale.

To make matters worse, heat pump installation is time-consuming and cumbersome. Typically installation involves a manual, physical inspection to kick off the process followed by several weeks of device procurement and installation waiting times. Retrofitting older buildings requires even more time-consuming and expensive pre-installation work to make buildings compatible with heat pumps (i.e. rewiring, plumbing upgrades). Due to a severe shortage of qualified HVAC technicians capable of installing heat pumps, installation is often delayed.

The good news is that once a heat pump is installed, the long-term energy savings can make heat pumps more cost-efficient than boilers for many buyers, thanks to a pump’s increased efficiency, reduced reliance on high gas prices, and energy savings. But even so, it might be years before a homeowner or industrial facility sees a return on their heat pump investment. Fortunately, recent studies like those conducted by McKinsey point to payback periods for heat pumps decreasing up to 40% thanks to decreasing electricity costs.

When it comes to heat pump installation, a number of B2B SaaS companies are targeting HVAC installers to make heat pump installation in residential and commercial buildings faster and easier. We think there’s a massive opportunity for newer companies to offer lightweight and high-margin approaches to facilitate installation. We’ve already seen this in the solar industry where Aurora Solar pioneered the use of satellite imagery to easily enable solar installers to inspect properties and design solar offerings remotely. The challenge when it comes to heating and cooling is that much of the assessment of where and how to install a heat pump requires detailed understanding of a home’s internal systems, as well as estimation of accurate cost savings for customers to make the sale. On the residential side, we’re excited about solutions that can help heat pump installers automate designs and proposals for customers to identify the highest value prospects and more successfully convert them into sales. On the corporate side, we’re excited by approaches that allow properties to find the best retrofit candidates by measuring pre- and post-energy efficiency impact, estimating retrofit costs and returns, and managing the process of contractor engagement.

Another subset of companies is offering full-stack services for heat pump installation, owning the relationship with both installers and consumers. These may provide both consumer-oriented and technician-focused solutions, offering customers a tool that helps identify the best heat pump for them and connecting them with a trained installer while boosting technician productivity via enhanced customer acquisition and equipment sourcing tools. A number of full-stack residential electrification software companies also use heat pumps as a wedge into whole-home electrification, building long-term relationships with customers that they plan to leverage for solar, EV, and other clean energy upgrades. Though such full-stack solutions should pay careful attention to their margins, they benefit from the ability to serve multiple players in the value chain and potentially expand across other distributed energy resources.

Finally, given the often high initial costs of heat pumps, a number of companies have been integrating or building standalone financing solutions to make heat pump installation affordable for customers. Some companies are offering loan plans through partner lenders to cover high upfront costs. Others are providing heat-pumps-as-service offerings that enable homeowners to “rent” or pay for heat pump use in recurring installments, mimicking models used by Enpal for solar adoption.

3. Operations and maintenance

After successful installation, operations and maintenance are crucial to ensure continued efficiency, performance, and longevity of HVAC systems. The lack of useful software to manage residential and industrial energy can hamstring the attractiveness of getting a heat pump installed in the first place. The urgency of this problem is highlighted by initiatives such as the European Union’s Fit for 55 legislative package, which recently added legislation to establish an emissions trading scheme to reduce emissions coming from the building sector.

A number of the startups building in this space are blending hardware and software while wrapping their products in improved user interfaces. For example, Pulse Industrial sells a hardware device that captures steam heating data and an accompanying software platform with AI and ML tools to analyze and extract value from this data. Other companies offer pure SaaS solutions that enable residential and commercial building managers to measure and optimize the efficiency of heating and cooling devices across their properties by leveraging hard-to-access data from HVAC equipment and the grid. These solutions then optimize HVAC systems to minimize emissions and energy use and ensure that they run only when necessary. In addition to a new wave of companies focusing on sustainable design and electrification, startups building tools to measure and optimize existing building systems will play a crucial role in enabling the built environment to meet emissions reduction and cost savings goals.

A world with more heat pumps

Decarbonizing global heating and cooling at scale will require a multi-faceted approach. We’re excited about the role heat pumps will play, particularly when it comes to leveraging commercial-ready technologies that can address low-to-medium range temperature applications immediately. Other interesting solutions we’re tracking include the use of hydrogen and thermal storage technology for use in high-temperature industrial applications.

As previously discussed, many climate technologies have longer return profiles than traditional VC-backed companies and not all models may be fit for venture funding at the initial stages. Some of the most promising technologies being pioneered in this industry (e.g., industrial heat pumps capable of heating > 200C at scale) may remain in R&D pilot phases for some time. Nevertheless, we remain deeply excited to follow along on the progress these companies will make and look forward to backing companies that start on the path to plausible commercialization.