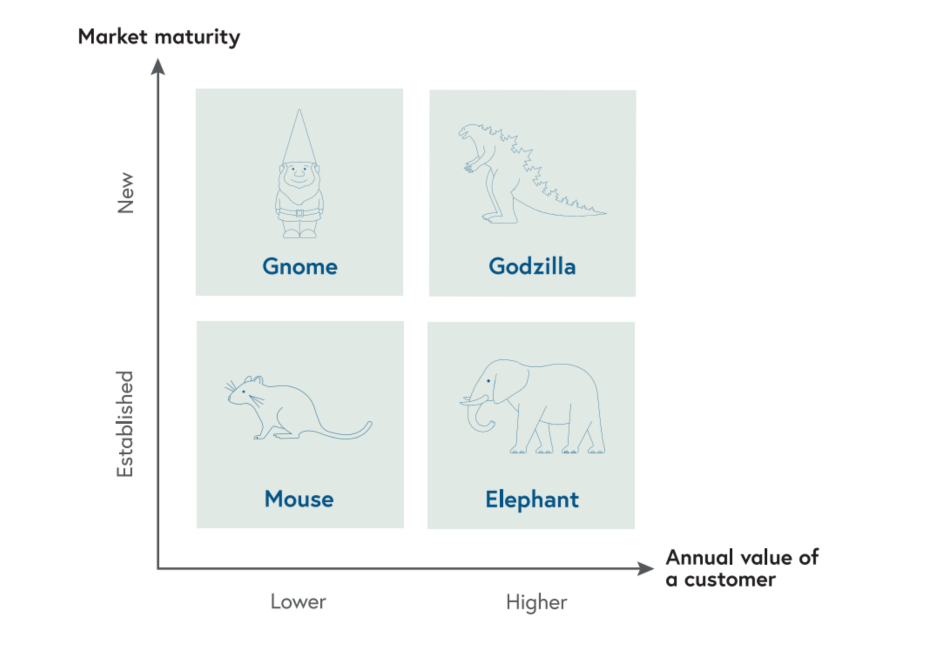

Gnome or Godzilla? B2B SaaS archetypes to help you pick the right price model

A framework for finding the right revenue model.

Picking a revenue model is the hardest step on a founder’s pricing journey. You need to corral busy stakeholders from every corner of the business. You don’t have robust customer data to inform the decision. And myriad intertangled factors make it dizzyingly complex. But here’s a secret that helps everything fall into place: How you charge is more important than how much you charge.

While both hold importance, selecting your initial revenue model may be one of the most profoundly important decisions you will make as founder. Deciding to charge per seat or implement value-based pricing might make the difference between the IPO track and deep financial trouble.

In this article, we’ll help you discover which of the four B2B SaaS pricing archetypes your company fits and explain how this should inform your approach. Then we’ll guide you through how to select your pricing model, and finally, how to set your price level.

Godzilla, gnome, mouse, or elephant—Which price archetype is your business?

There’s no one-size-fits-all approach to pricing. After all, you wouldn’t feed a mouse the same foods (or quantities) as an elephant. The best approach for your business depends largely on two factors:

- Market maturity: Are you creating a category, or does your product target a mature market with one or more incumbents?

- Annual value of a customer: What is the expected annual value of each account?

Based on your answers to these two questions, you can figure out which pricing archetype below represents your business and what that means for the best way to conduct your pricing discovery process.

You serve a mature market that understands your product well and you compete with several mature incumbents. Given the relatively low value of customers, you likely rely on an inbound or inside-sales-led go-to-market motion with a fast sales cycle.

How to approach pricing initially: Your product team should lead the charge, and primarily focus on understanding willingness to pay (WTP) based on comparable products. Since there’s an abundance of comparable offerings, it’s likely you’ll make a fairly accurate guess on your initial price, but you should still revisit and optimize over time.

How to optimize pricing over time: Given the low ACV and high customer count, this should be a data-intensive exercise. It’s helpful to have a BI or analytics person working on the trends. Particularly in self-serve models without a sales process to infer feedback from, conversion data becomes the most reliable insight into customer behavior.

You serve a mature market that understands your product well and you compete with several mature incumbents. Given the high value of customers, you likely rely on an outbound enterprise sales motion with long lead times.

How to approach pricing initially: Pricing should be a collaborative exercise between sales and finance, with some healthy tension from product and engineering teams. The most successful teams understand that they’re capturing qualitative data from their direct and indirect sales channels, and creating systems to interpret this data. Other invaluable resources include win/loss data from your sales team, analyst reports from Forrester and Gartner, and enterprise software benchmarks. Since there’s an abundance of comparable offerings, it’s likely you’ll make a fairly accurate guess on your initial price, but you should still revisit and optimize over time.

How to optimize pricing over time: Sales and finance teams will often find themselves at odds in early-stage price optimization cycles. Sales is incentivized to produce results and may try to hang revenue misses on price, but also has real-world feedback from prospects. Finance needs to be the filter and judge which data points are most indicative of larger trends.

Your market is unfamiliar with your product and not yet aware of your company. There are likely some adjacent companies, but those may confuse customers more than clarify your offering.

How to approach pricing initially: Your product team should lead the charge. You should get comfortable in experimentation mode for a long while, then plan to do a price reset grounded in analytics down the road. Conjoint analysis and Van Westendorp’s Price Sensitivity Meter can also be useful guidance. Given the lack of market comps, it’s likely you’ll be fairly far off on the initial price. That’s okay—just make sure you have an iterative mindset and refine over time.

How to optimize pricing over time: Evaluate the value you provide to end users while also determining how the buyer perceives value. Given the small ACV, run experiments to find an optimal price (e.g. raise prices to see if you still earn more even with more churn, or introduce new tiers or add-ons, etc.). Continue running conjoint analysis and monitoring your price sensitivity meter to understand changes in willingness to pay over time as your features evolve and the competitive landscape changes.

Your market is unfamiliar with your product and not yet aware of your company. There are likely some adjacent companies, but those may confuse customers more than clarify your offering. Given the high value of customers, you likely rely on an outbound enterprise sales motion with long lead times.

How to approach pricing initially: You should facilitate a deeply collaborative model between sales and product, typically with finance playing referee. Working iteratively, you should proactively search for a market-clearing price through sales discounting, then capture and systematize the information you discover. ROI analysis and proof-of-concept with design partners can also be helpful tools. Given the lack of market comps, it’s likely you’ll be fairly far off on the initial price. That’s okay—just make sure you have an iterative mindset and refine your pricing over time.

How to optimize pricing over time: Sales will develop the most accurate picture of what value proposition and price point resonates with customers, based on their prospecting conversations. It’s important to implement structure to capture and evaluate incoming data in an unbiased and longitudinal way. Consider assembling a customer advisory board to get your highest potential clients a sense of what great-fit companies are willing to pay for.

Selecting a price metric

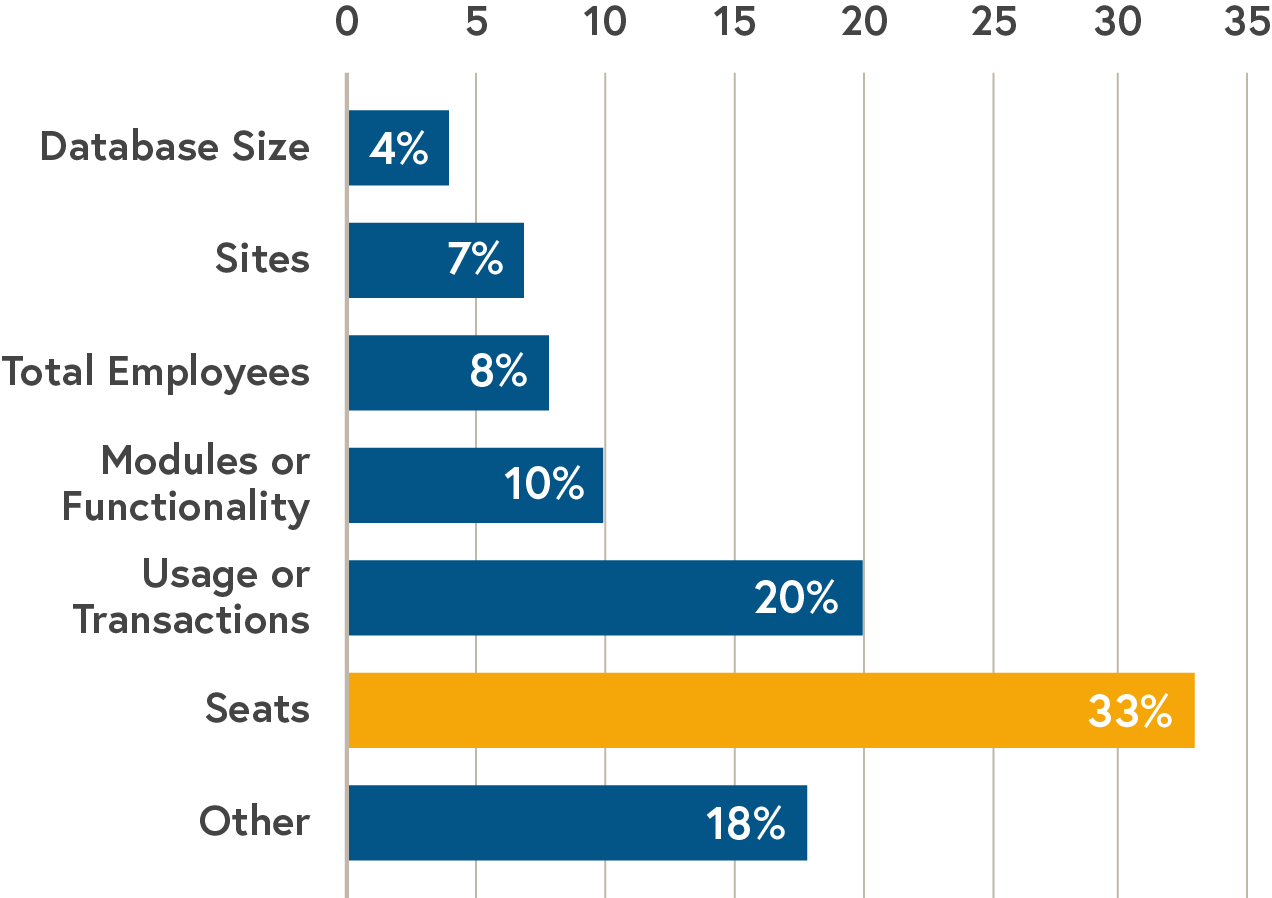

Now that you understand how to conduct pricing research based on your company’s archetype, it’s time to select your model. The last decade has seen an evolution past the standard per-seat pricing model that dominated the early days of software sales.

In 2011, almost half of all software companies charged per seat. By 2019, this number has decreased to 33%. There are now a plethora of new pricing options that allow companies to more closely capture the value they deliver.

Popularity of various pricing metrics in 2020

[Source: KeyBanc 2019 [SaaS Survey]](https://www.key.com/kco/images/2019_KBCM_saas_survey_102319.pdf)

The upside of charging per seat is that it’s common and well-understood by procurement departments, which tends to lead to shorter sales cycles. But the downside is that it can discourage wider adoption in an organization since it costs more to onboard new users.

For many businesses, the price model will be an easy choice—a natural extension of the service or solution you provide. However, many early-stage companies must choose between several viable pricing models. Making very intentional choices will pay dividends down the line.

Over the past year, we’ve seen a surge in usage-based pricing trends. Dive into our thinking about this model here.

Common pitfalls to avoid

Not every company is going to get their pricing model correct on the first try—and that’s okay. There is a certain degree of experimentation that’s unavoidable. However, being thoughtful about which initial model you choose will save you headaches down the road.

When you pick your pricing model, trade-offs are inevitable. These come in two main flavors:

- Is your model simple (for ease-of-use) or complex (to accurately capture nuance)?

- Does your model favor your company or your customers?

Ideally, you want to strike a balance in the needs of both parties with a model that is appropriately complex without being over-engineered. Here are some common pitfalls to avoid at each point.

How to set your price level

After you’ve landed on a revenue model, it’s time to set the actual price. If you’re serving a mature market, having ample competitors can feel daunting. But you’ll also get the benefit of many comparable products to gauge your market’s willingness to pay.

If you’re a category creator, you’ve got a much less straightforward path. You’ll have less data to inform your decisions, so you need to launch with a best guess and continuously refine over time based on market feedback.

Here are three approaches you can use to refine your pricing:

- High ACV price searching: Set a high initial price point and then discount until you start to hear customers say “yes.”

- Discovering new segments: Set high initial price, win a few deals, then realize another segment exists that wants a lower-priced product (whom you may upsell later to a higher-priced product).

- Starting low: Set initial price at lower-than-expected willingness to pay (WTP) and drive adoption and lessons by removing price as a reason for rejection.

Let’s take a look at an example of a mature market and a category creator to illustrate how setting the pricing level can play out.

Case study: Spot-on initial price in the well-established developer tools marketplace

Company B sells an innovative developer tool. With more than 22 million developers worldwide, the number of tools, platforms, and open-source projects vying for developer mindshare has grown exponentially. While this makes it difficult to stand out, it also provides a rich dataset on a developer’s willingness to pay (WTP).

They had an incredibly successful free product and were ready to launch a premium, paid offering. They leveraged comparables and feedback from users of the free version of their product to arrive at a nearly spot-on first price. They began by looking at the ecosystem for developer tools to get a broad sense of what their target persona would accept in the market.

Next, they launched a Van Westendorp price survey which asked users of their free product some direct pricing questions. When the responses indicated consumers wanted to pay a lower price than what they were comfortable charging, the team realized they needed to increase the perceived value of the base package. They decided to delay the launch of the paywalled product until a critical feature could be developed.

Next, they launched a conjoint analysis and used Conjoint.ly, a pricing research tool, to help validate their assumptions around packaging and pricing. This process informed how customers would be divided into the tiers and which premium features would help drive conversions.

When they launched their premium product with a tiered model, the acceptance rate they had modeled hit the nail on the head. They were able to predict average contract value (ACV) within $50, which was incredibly helpful for accurately forecasting revenue.

Case study: Starting low lead this category creator to an eventual 20x increase

Company X is a Godzilla company launching an AI-augmented Customer Success tool.

They anchored their initial price point at roughly $500 per month. Over the course of the next two years, based on positive signals from the broader market, they incrementally raised the price to $1,500 per month and ultimately $10,000 per month.

One day, the CEO received a note from a newly signed customer who had just inked a $100K+ annual contract. The customer had forwarded an email with their original quote from three years ago in which the customer had scoffed at the same product’s $500 price point, feeling it was too high.

While comical in retrospect, the fact that this customer ultimately converted at a 20x increase to their original quote shows the power of tailwinds in emerging categories. When customer conviction in the broader technology category dramatically increases, category creators reap the benefit. A better product marketing operation, product improvements, and discovering new segments all contributed to the massive success of the gradual price increase.

Stay in learning mode—pricing is a process

Pricing is not a one-time exercise. If you can create a continuous feedback loop across all parts of the organization, you’ll systematically capture more value to efficiently grow your business. The ongoing upkeep will look different for different archetypes.

To recap: Mice, rely on data. Elephants, listen to finance. Gnomes, run experiments. Godzillas, ask sales. And for all, continue to revisit and revise.

Ready to get smarter about pricing?

This is the second article in a 7-part course where we share insights, case studies, and revenue-generating frameworks to optimize your pricing strategy. If you prefer to get bite-sized lessons delivered right to your inbox each week, sign up for the course below.

Dive into the rest of the course:

- The four ironclad laws of B2B SaaS pricing that can boost your revenue up to 32%

- ‘One-size-fits-all’ is really ‘one-size-fits-none’: How to segment your customer base for more precise pricing & packaging

- Upsell & cross-sell caveats—plus how one B2B SaaS company revamped pricing for an ultra-successful land-and-expand play

- Why pricing deserves as much iteration as product development—and how one multibillion-dollar public tech company does it

- Five pros and four cons of usage-based pricing—and why it was a no-brainer for Courier’s CEO