Drugs in a Virtual World: The rise of digital health solutions in clinical trials

In 2017, we proposed that entrepreneurs have an expansive opportunity to sell digital solutions to an often-neglected healthcare client—biopharma. At the time, pharma tech represented only 3% of venture dollars in digital health. Now, three years later, the Pharma IT landscape looks drastically different. The appetite for pharma tech services is on the rise, creating a surge of emerging companies. In particular, point solutions addressing major challenges in clinical trial management now flood the estimated $50 billion clinical trials market. These tools enable clinical trial research to become faster, cheaper, and more accessible (see Andy Coravos’ comprehensive map of this software ecosystem).

Many of the tailwinds we identified in 2017, such as shifting regulatory regimes and increased pharma IT spend, are continuing to pick up speed. This has created a market for new biopharma and pharma IT leaders to establish themselves in 2020, amid the threat of a global pandemic.

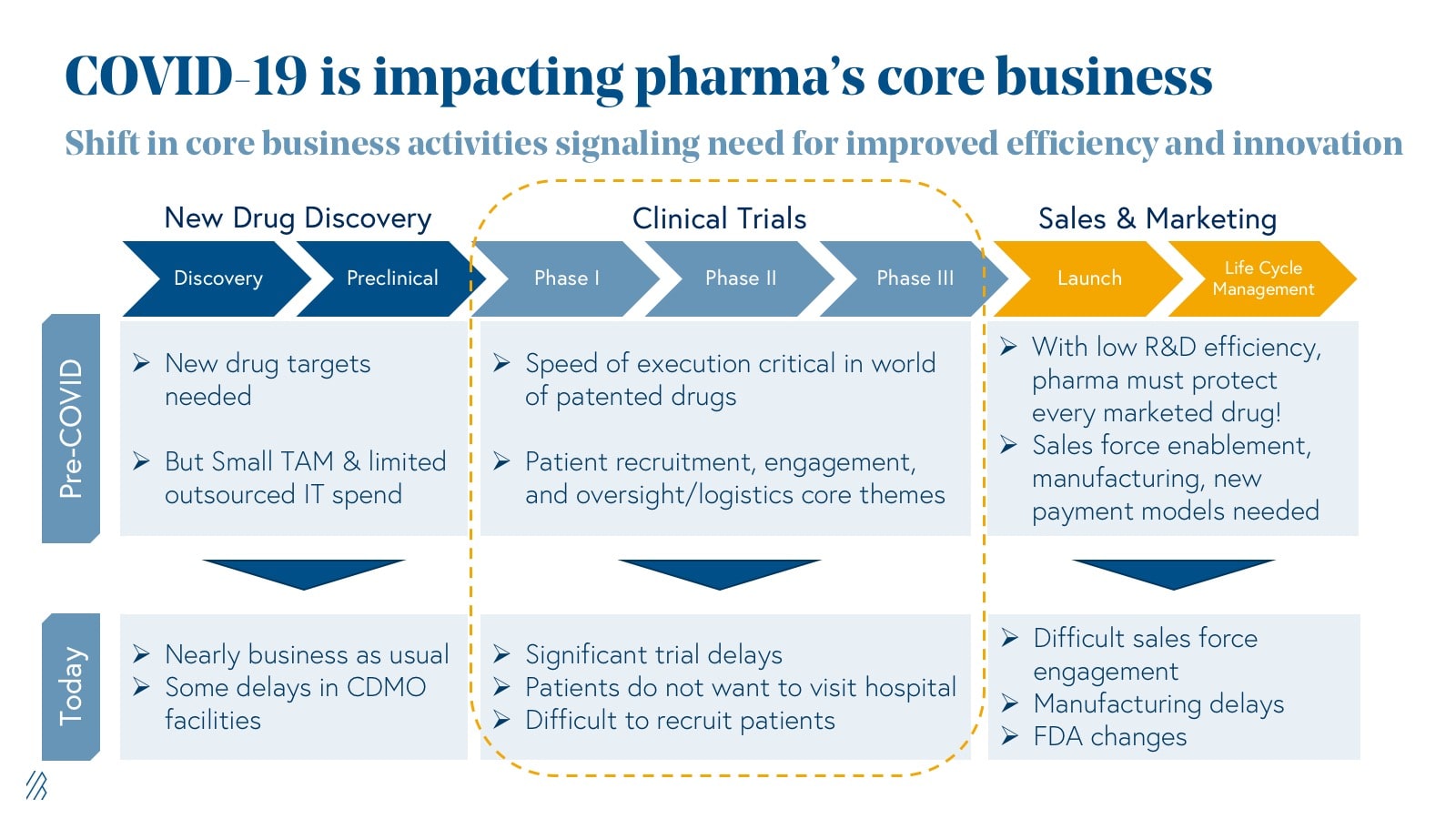

The greatest entrepreneurial opportunities live across the clinical trials value chain; the COVID-19 macroenvironment has highlighted procedural inefficiencies and technological disparities in trial administration. An emerging class of startups now has the opportunity to revamp clinical trials as digitization becomes an urgent priority within the pharma industry.

Although we remain interested in speaking to entrepreneurs building businesses in other pharma IT domains (e.g., drug discovery engines, sales and marketing tools, and digital therapeutics), we focus on clinical trials in this roadmap considering the urgent and unique window of opportunity the current pandemic presents.

The impact COVID-19 has on the core business of pharmaceuticals

A high-level analysis of clinicaltrial.gov data from 2000 to 2018 shows an impressive 34% CAGR growth in the utilization of digital products in clinical research. Adoption of connected digital products lays the foundation for the discovery of novel trial endpoints and biomarkers, and the creation of new, virtual trial formats (more on this later).

Despite this traction, most of these digital tools have been relegated to evidence-generating studies and have yet to garner widespread adoption from Big Pharma in FDA-defined development stage trials. Entrepreneurs we’ve spoken to in this space have faced inertia from corporations who are often unwilling to take on the risk of new clinical modalities, especially when these new methods face regulatory grade uncertainty and fail to fit within existing “gold standards,” also known as trial design best practices accepted by the FDA.

Beyond the obvious, why now?

The last few months have been a watershed moment for many industries due to COVID-19; for pharma, there are three key reasons why now is the time to restructure the clinical trial paradigm:

-

The preferences of clinical research participants are changing, driving stakeholders to build more virtual, patient-centric approaches.

In an April Association for Clinical Research Professionals (ACRP) survey, 80% of clinical research participants indicated that they were unwilling to visit the trial site for study appointments. Will clinical research pivot to a completely virtual model in the years to come? Unlikely, but based on conversations we've had with biopharma companies, a hybrid-approach with virtual and on-site capabilities will endure going forward. Beyond the obvious short-term benefits of limiting the risk of COVID-19 exposure for trial participants, reducing the frequency of site visits can have long-term benefits around convenience and alleviating safety concerns, particularly for patients from vulnerable clinical populations. And for pharma, this ultimately means a broader patient pool to enroll in their trials. As a result, the connected solutions that can enable a seamless remote experience for patients and clinical operations teams have a unique opportunity to demonstrate value during these unprecedented times and subsequently become a standard for pharma companies using their services. Specifically, these newer models are enabling pharma to increase patient willingness to enroll in trials, maintain a relationship with enrolled patients to reduce trial drop-out rates, increase the diversity of patients enrolled in a trial, and unlock geographies where COVID-19 restrictions are dampened. Given these benefits, we anticipate pharma embedding virtual, patient-centric strategies in their clinical trial designs and taking a hybrid virtual/in-person approach well beyond the COVID-19 pandemic to reduce costs and lengthy trial timelines.

-

Cost-effectiveness and trial efficiency are paramount in a time when COVID-19 places additional financial pressure on drug developers.

The estimated cost of bringing one drug to market ranges from an estimated $1 billion to $2.6 billion and the rise in R&D costs has far outpaced the rise in FDA drug approvals over the past two decades. Shifting research participant preferences and safety requirements in the current macro environment exacerbate one of the primary drivers of high costs—trial delays.

At the height of the pandemic, an April survey conducted by the Association of Clinical Research Professionals indicated that 77% of ongoing trials were delayed or directly impacted by COVID-19 and 31% of trial sites feared complete closure. These delays can amount to significant losses (ranging from $600,000 to $8 million per day), and as such, several sponsors are being forced to leverage digital tools (e.g., e-consent, telemedicine) to sustain their operations.

Although COVID-19 specific trial delays are a temporary source of inefficiency, they expose a more permanent truth that digital tools can generate cost savings in the form of reduced investigator fees, site monitoring costs, patient travel costs, and improved patient retention. In the long term, virtual trials promise an even greater efficiency benefit: virtually enabled trial endpoints that are more robust and more flexible than the current standards may open the door for faster data readouts and statistical power to enroll fewer patients.

Even as many sites resume operations, 84% of respondents to a June survey in Informaconnect's Decentralized and Clinical Trials Report 2020 plan to increase their use of decentralized/virtual or hybrid trials in the next two years.

For many industry leaders we’ve spoken to, further adoption of virtual trial tech is also a form of contingency planning; they’re motivated by the underlying fear of a “second wave” that could halt in-person trials once again, a fear that is also materializing in real-time. With more time to strategize, pharma leaders are likely to iterate on COVID-19 crisis responses with new, efficient hybrid models in the coming months.

-

Lastly, the regulatory landscape is changing, encouraging the adoption of software-enabled clinical trials.

One of the major barriers to digital transformation in trials has been a lack of guidance around endpoint definitions and the utilization of novel data sources. Although there is still much progress to be made, the FDA has demonstrated a willingness to begin tackling these barriers through policy partnerships with organizations like the Clinical Trials Transformation Initiative (CTI) and Transcelerate. These partnerships are helping to drive innovation through initiatives that bring together members of the clinical research industry and provide actionable steps for modernizing patient experience, information sharing, and drug safety.

In 2017, the Cures Act and Digital Health Innovation Action Plan made important strides in clearing drug-device combination products and other solutions incorporating digital health tools. In recent years, the FDA has also released guidance for submitting real-world evidence and real-world data documents in clinical studies, and the agency continues to encourage the use of technology that ensures the safety of patients during the pandemic.

The race for a coronavirus vaccine has exposed the inefficiencies in our system's drug development process and has inspired new legislation.

For example, the proposed Cures 2.0 Act details not only long term recommendations to prevent future pandemics but also offers solutions to diversify participants of clinical trials. By expanding Medicaid reimbursements, enabling the FDA's adoption of digital tools and services, and broadening the recruitment of these trials, legislators hope to make clinical trials more accessible to serve people from different backgrounds, races, genders, and orientations.

In addition, the FDA has the opportunity to make systemic changes across the value chain by encouraging organizations to decentralize their trials, adopt digital health technologies to aid in testing, further expand the role of real-world evidence in drug approval, and collaborate with innovative startups to improve outcomes.

Just as regulatory bodies have made important strides in relaxing constraints on telemedicine reimbursement to make care more accessible, the FDA continues to pave a path for clinical trial innovation going forward. The companies that play an active role in shaping these policies will be the greatest beneficiaries of this shifting paradigm.

Given these industry tailwinds due to COVID-19, pharma IT leaders are now better positioned than ever before to serve their clients. Similar to enterprises quickly adopting cloud solutions, we believe these new clinical trial methodologies will become standard practices in a post-COVID era.

We have identified five areas of opportunity for emerging players to demonstrate differentiated value and play an indispensable role in ushering in this new age of clinical trials. These opportunities include decentralized trials, patient recruitment, remote patient monitoring, real-world evidence/virtual control arms, and supply chain optimization.

Opportunities for innovation across the clinical trial value chain

1. Decentralized clinical trial designs

Startups that facilitate decentralized clinical trials are gaining market traction as these companies decrease the dependence on costly, inconvenient, and homogenous in-person patient interactions.

We have already discussed how both patients and sponsors stand to gain from a decreased reliance on physical trial sites, and startups in this first category are providing an alternative to these sites. By doing so, they allow for the decentralization of clinical trial procedures, allowing them to occur virtually or in the patient’s home.

As Craig Lipset, former Head of Innovation at Pfizer, points out, decentralized trials aren’t new. However, we’ve seen a marked increase in willingness to consider these decentralized trials given the current pandemic alongside emerging regulatory tailwinds.

We have encountered three (not mutually exclusive) subcategories of companies innovating in this space:

- End-to-end clinical trial managers that are participant-facing and conducting trials in the home (e.g., Lightship, Science37);

- Startups that leverage community doctors to be more engaged in clinical trial management to diversify the pool of principal investigators (e.g. Elligo, TrialSpark);

- Platform-as-a-service technologies that integrate previously siloed portions of the value chain onto a centralized platform (e.g., Medable, Y-Prime).

Clinical trial management companies in the first two subcategories tend to find greater success when taking a highly selective approach to therapeutic areas of focus. Successful companies cater to indications where the gap between in-person and at-home data collection is minimally invasive to outcomes reporting. For example, disease areas that require higher patient touchpoints and complex data analysis (e.g., oncology) make it difficult to deploy a virtual at-home approach. On the other hand, dermatology and behavioral health are examples of therapeutic areas where it is relatively low-risk to conduct trials virtually.

Platform-as-a-service companies in the final subcategory present a compelling value proposition given the proliferation of digital point solutions in recent years; they also help pharma companies consolidate best-in-class digital tools to enable a more virtual, engaging patient experience. The most successful companies will find ways to convert bespoke solutions to scalable platforms that can be deployed quickly and generate predictable recurring revenue.

2. Revamped patient recruitment strategies

Patient recruitment startups are leveraging proprietary data and applications of AI/ML to cost-effectively find and enroll trial participants.

Patient recruitment remains the most expensive and difficult portion of a clinical trial, accounting for up to 40% of all trial expenditure. Eighty percent of clinical trials fail to meet enrollment deadlines and recruitment accounts for 30% of delays for Phase III studies. These figures reflect the challenge of using traditional marketing channels (e.g., social media, billboards, telemarketing, etc.) to target and enroll patients. Relying on Key Opinion Leaders and principal investigators at an academic site to find patients who meet specific inclusion/exclusion criteria is also becoming increasingly complex and competitive. As discussed previously, delays in recruitment can ultimately result in millions of lost revenue each day by delaying a drug’s time-to-market, causing stakeholders to seek out innovative recruitment strategies.

These alternative participant recruitment strategies are being spearheaded by a bottoms-up approach that leverages access to patient data (e.g., medical records) and applications of AI/ML to selectively target promising patient candidates based on medical history and demographic data rather than hoping a particular trial site’s patient population will surface qualified candidates. These solutions reduce recruitment costs and diversify patient pools. Several start-ups in the space, including Deep6 AI, Mendel.ai, TriNetX, are gaining traction as sponsors are prioritizing platforms that promise unique access to patients, particularly if the data asset is proprietary in its access to rich, longitudinal patient clinical history.

Successful patient recruitment companies provide the ability to access a comprehensive breadth and depth of patient data. Vendors that can achieve geographic scale and establish lasting partnerships with EMR vendors will inevitably be able to recruit patients more effectively. This is especially true given the variability of data quality in medical records and often requires teams with clinical expertise to abstract and annotate this data so that it can be used for scalable technologies.

Beyond building the tech capabilities and scale necessary to identify patient cohorts, companies must have a deep understanding of core therapeutic area(s) and how this data translates into long-term replicable patient recruitment use cases.

3. Remote patient monitoring solutions

Once patients are recruited for trials, remote patient monitoring (RPM) solutions provide the technology that can make decentralized trials a reality.

To make clinical trials more accessible and effective in a virtual setting, remote patient endpoint monitoring technologies can collect, structure, and analyze trial participant data. The promise is huge: more consistent monitoring at-home may enhance a clinical trial’s statistical effect size, reducing the number of patients needed for any given trial with quicker data to demonstrate a drug’s efficacy and safety. However, few of today’s technologies are considered “regulatory grade”, limiting the willingness for pharma to adopt outside of exploratory clinical trial endpoints that don’t move the needle on recruitment requirements. However, as trials become more virtual, we anticipate that these types of RPM solutions will become ubiquitous to enable monitoring in the home. This adoption will also allow RPM players to build up sufficient evidence to present “regulatory grade” data to the FDA. Coupled with previously noted regulatory momentum, we are optimistic that remote monitoring solutions can quickly match the current “gold standard” in endpoint collection.

The recent activity of Big Tech players like Google and Apple in wearables technology has generated a lot of buzz around remote patient monitoring, but it has also blurred the lines between devices that merely provide biometric data capture versus those that can be effectively used in a clinical trial.

To date, these high profile wearables have captured data that is extremely limited in its clinical trial utility, no matter how consumer-friendly they are. We see an opportunity to develop tools on top of these patient-friendly devices to deliver robust, clinically validated, data-driven actionable insights and, in some cases, build novel regulatory-grade biometric data collection technology.

Elektra Labs, Healthmode, Koneksa Health and Evidation are prime examples of companies that are quantifying and standardizing the data collected on connected devices for clinical trials. Given the plethora of devices on the market, success here is contingent upon high interoperability, a deep understanding of the relationship between the device’s biometric data collection capabilities and the relevant clinical trial endpoints for a particular disease, and collaborative biopharma partnerships.

4. Virtual control arms and real-world evidence platforms

Virtual control arms and real-world evidence (RWE) platforms alleviate the burden of patient recruitment - saving time, costs, and potentially lives in the process.

For many years, pharma companies have turned to “real-world evidence” (RWE), or synthesized collections of EMR data, claims data, and other proprietary data sets, to help them understand the safety and efficacy of drugs in the “real world” outside of a clinical trial setting. Historically, RWE has been championed for a variety of use cases including clinical trial design, health economics and outcomes research (HEOR) to define reimbursement strategy with payers, and even new drug target discovery. However, the pressure to bring drugs to market faster has also led to the emergence of a newer use case for RWE within clinical trials to simulate a trial’s “control arm” — the placebo group of a clinical study.

By using a statistically equivalent virtual control arm (effectively eliminating the placebo group), trials will require significantly fewer patients to enroll in clinical trials which will expedite timelines. Plus, patients with severe illnesses won’t be subjected to a placebo, potentially increasing their willingness to participate. The most sophisticated companies working on virtual control arms will assist pharma companies in wading through uncharted regulatory territory, ensuring that their “virtual control arms” meet stringent statistical rigor to mirror a true placebo arm, and preventing inadvertent bias of patients in the active (drug) arm to report a drug effect simply because they know they are not receiving a placebo.

Although we do not believe that real-world evidence (RWE) will completely replace the need for control arms in the near term, when used effectively, RWE and virtual control arms offer the potential of a triple threat – faster clinical trials, higher quality data, and greater statistical power.

As mentioned, real-world evidence is not a new category within pharma IT, and 90% of pharma companies already have an internal team dedicated to RWE. As enthusiasm builds for the well-trodden use cases of RWE, we anticipate bold pharma leaders to deeply explore virtual control arms. However, the "teenage" maturity of this category, which continues to grow and mature, also means that emerging platforms must be multifaceted and perform a careful balancing act. Successful platforms cannot expect to win by only providing infrastructure for virtual control arms, but must closely collaborate with pharma partners as they highlight this novel use case while simultaneously addressing the existing RWE use cases that sponsors have come to expect from a provider in this category.

For any RWE player, a clearly-defined strategy around data ownership and the application of that data is critical for making headway in what is now a crowded pharma analytics ecosystem. The majority of RWE companies built to date focus on oncology data (e.g., Flatiron, ConcertoAI, Tempus, Syapse, COTA). An emerging set of startups are tackling therapeutic areas outside of cancer. Companies like Verana Health are aggregating and making sense of existing clinical data sources whereas companies like RDMD, Blackfynn and Holmusk have taken the approach of creating novel and differentiated data sets for specific disease areas. For the former group, the most successful platforms establish a competitive moat through their ability to aggregate and annotate data sources in a clinically relevant way, whereas the latter group can gain long-term traction by demonstrating the uniqueness of a robust data set.

Furthermore, some companies are enabling information exchange and connecting existing data sources (e.g. HealthVerity, Datavant), while others are providing differentiated analytics SaaS platforms that forego data ownership all together (e.g. Aetion, BHE). Being “regulatory grade” as an RWE platform is table stakes, but actively engaging in the shaping of FDA policy around using this data and having a calculated data partnership strategy are strong signals for long-term growth potential.

5. Supply chain optimization

The advent of digital innovation in clinical trials and a renewed focus on domestic manufacturing will make supply chain optimization a high growth market going forward.

The clinical trial supply chain lacks a central platform to house inventory and orders, forecast patient inventory requirements, and manage the distribution of samples from a trial to the appropriate lab sites creating an ineffective and painful process for trial sponsors.

Due to the lack of digital infrastructure, close to 95% of trials are delayed by at least one month, costing sponsors up to $8 million per day. Considering these challenges, we expect pharma to build more innovative solutions to improve and automate supply chain processes, and make them more flexible to accommodate decentralized trial designs.

More specifically, there is a large opportunity to connect the various stakeholders involved in trials and to improve upon existing manufacturing execution systems (MES) – systems used to track and document the transformation of raw materials to finished goods. Drug manufacturing is poised to rapidly modernize as regulation spurred by COVID-19 is emphasizing increased control and resilience in pharmaceutical supply chains, adding to existing tailwinds from the rise of digital B2B marketplaces for supply chains across many verticals.

Companies like Slope, 4G Clinical, and Apprentice are a few of the startups we see leading the charge in providing data-driven supply chain management solutions. Their platforms connect sites, clinical operations, and vendors with real-time patient data, enabling sites to manage resupply and patient inventory, and clinical operations to gain supply chain visibility. Successful supply chain optimizers will achieve strong network effects as they work with more vendors and sites, and replace generic legacy infrastructure with specialized tools designed with clinical trial administration in mind.

What to expect next

In short, there has never been a better time to be building digital health solutions for clinical trials. The shift of every industry, including biopharma, to cloud computing has only just enabled these technologies that will radically change the trial landscape. We are in a leapfrog moment for digital clinical trials akin to the scientific revolution that gene editing and immunotherapy spurred for your biotech partners, and the time to capitalize on the opportunity is now.

The next three years will not only manifest greater adoption of these technologies, which the COVID-19 crisis has helped catalyze, but it will mark a shift in the way we think about clinical research altogether. We are excited to continue learning from, connecting with, and partnering with the trailblazers that are best suited to reinvent clinical trials. If you’re building something to make the drug development process less costly, more efficient, and more timely for our new virtual world, we want to hear from you. (Email Andrew Hedin at ahedin@bvp.com)