Consumer AI's tipping point

Trends, opportunities, and predictions for "Consumer Earthquakes" in the AI era.

Consumer earthquakes don’t happen in isolation—they come in waves. And when they arrive, they feel sudden and unpredictable, reshaping industries and influencing how we connect, live, and play—seemingly overnight. But in hindsight, the rise of these consumer tech giants follows a clear pattern: a breakthrough or new distribution channel and a product experience so compelling its growth compounds on its own.

We’ve seen this before in previous generations of consumer innovation. For example, Pinterest and Airbnb didn’t succeed in a vacuum; their success was predicated on generational circumstances where technological innovation and consumer behavior collided to create billion-dollar businesses at unprecedented speed. These companies share two defining traits:

- Jaw-dropping product experiences that are better, cheaper, easier, and more beloved than the competition

- Viral adoption—turning users into advocates and growing organically, even in the absence of paid marketing (achieving a positive resting growth rate)

We believe we’re on the brink of a new wave of consumer earthquakes, this time driven by AI-native products. Startups like Anthropic, Perplexity, and DeepL are creating experiences so magical and differentiated that they’re garnering considerable organic adoption. This suggests that AI advancements could serve as both the seismic force creating new product possibilities and the distribution vector, paving the way for the next generation of consumer juggernauts.

The question now isn’t whether AI can generate viral consumer moments, but whether these moments will translate into sustainable businesses with long-term defensibility. In this report, we break down the key drivers of new opportunities in consumer AI, the expanding and emerging company categories where we see the greatest potential, and the market conditions that will define the next generation of breakout consumer companies.

Three key drivers of consumer innovation

1. Decreasing model costs

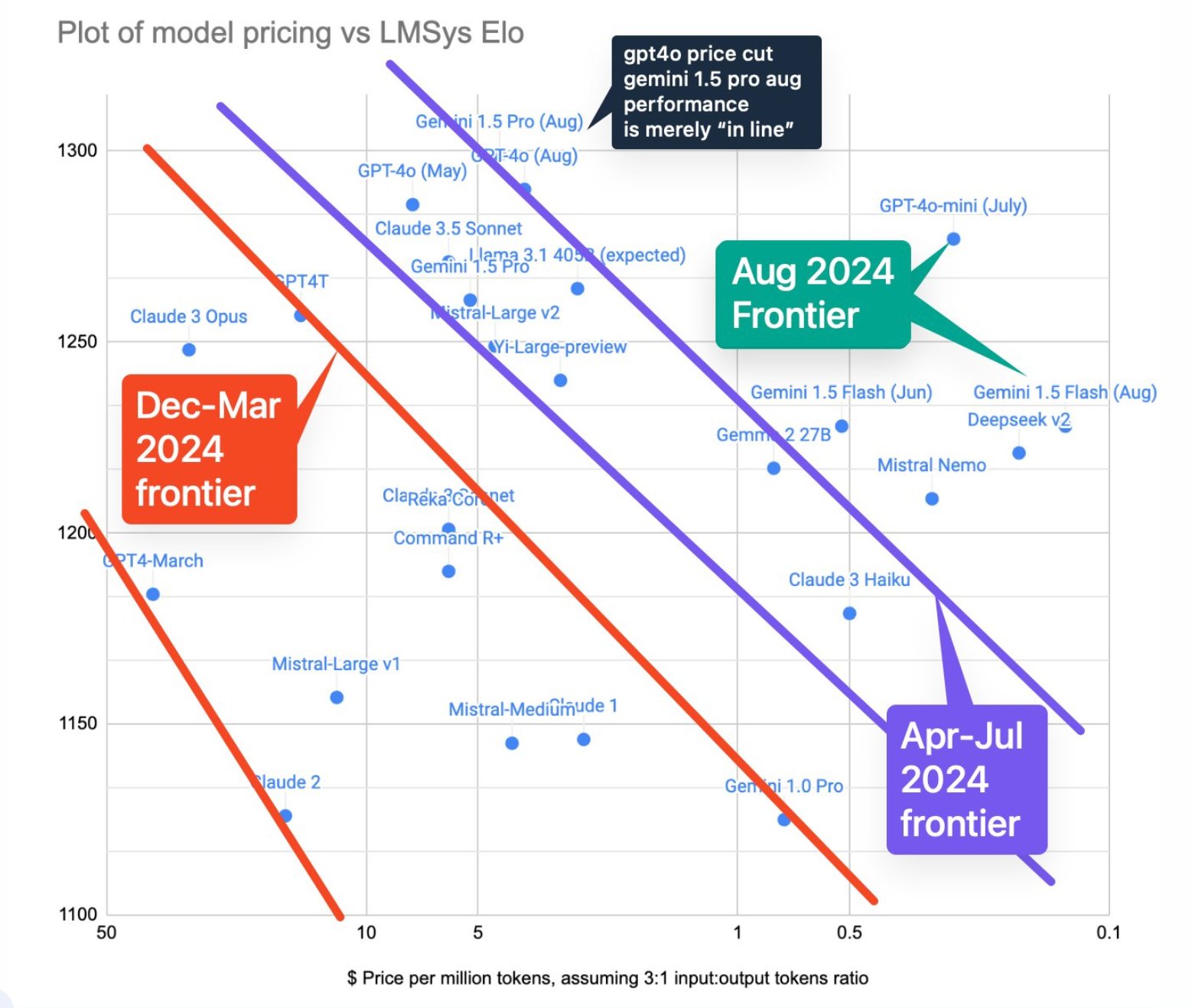

Foundational model costs continue to decline as OpenAI, Anthropic, Grok, and other leaders compete for market dominance (as shown in the graphic below).

Since ChatGPT-4 was released in March of 2023, the cost of a token on the model has decreased by 85 percent to 95 percent and OpenAI’s Head of API product expects this trend to continue.

B2B AI companies often have ACVs in the tens or hundreds of thousands of dollars, allowing them to spend heavily on foundation models, even when prices were higher. It’s consumer companies, with their much lower-value customer interactions that stand to benefit most from further price decreases. Specifically, we predict that lower model costs will enable more consumer companies with ad-supported, subscription, or usage-based pricing models to become gross margin positive over time.

2. Advancements in multimodal and real-time models

Recent multimodal foundation models have demonstrated step-change performance improvements across key capabilities such speech recognition and voice generation (OpenAI, Rev, Eleven Labs), and image and video (Black Forest Labs, RunwayML, Google’s Veo). Companies like Fal.ai are also making it easier for developers to use multimodal models. Among the many trends these changes are driving, we’re seeing these models open the door to build new tools that turn both consumers and prosumers into empowered creators.

In addition to new and advancing capabilities, real-time models like Open AI’s Realtime API product are significantly reducing the latency of multimodal models. Having access to foundation models that can operate in real time or near real time will allow consumer companies to launch more services that replace highly manual tasks (i.e. scheduling doctors appointments via a voice AI that operates in real time).

3. The rise of sophisticated AI agents

OpenAI’s o3 has recently demonstrated significantly improved performance on complex reasoning tasks—advancements that open the door for companies to automate nuanced consumer experiences that typically require human interaction. As foundation model reasoning improves, we will likely see application-layer AI agents able to handle more complex tasks.

For example, OpenAI’s recently launched Operator, an AI agent designed to autonomously perform web-based tasks, which enable users to automate actions that require a connection to the web such as ordering groceries. Perplexity has also announced an assistant product that automates tasks like making a dinner reservation or setting a reminder.

We’ve also seen the emergence of tools like Zep AI and Zetta that give agents “long-term memory,” so they can hyper-personalize user interactions and continually customize experiences based on a specific user’s behavior and stated preferences. “The more you use the product, the more tailor made the product becomes for you,” explains Scott Belsky. "The actual UI and defaults and functionality of the product will become more of what you want and less of what you don’t.”

Five consumer AI categories on the rise

We see these trends creating significant untapped opportunities in several consumer segments. Here’s where we see the most potential right now:

1. AI-enabled professional services for consumers

The emergence of mobile internet enabled the democratization of services in logistics and transportation. With increased adoption of smartphones in the 2010s, companies could create marketplaces with sufficient scalability (and therefore liquidity), and charge consumers an affordable price for services. Private cars became Uber. Food and grocery delivery services became Doordash and Instacart.

We expect to see a similar consumer trend in the coming years—this time enabled by AI. Foundation models allow companies to build AI solutions that process data from consumers, facilitate interactions through conversational interfaces, and trigger workflows to automate key tasks for consumers. In the future, AI could address core and supporting workflows typically done by professionals such as travel agents, financial advisors, fitness instructors, etc.

Some consumer startups have already gone to market with professional services including Duckbill, a copilot that helps users manage their calendars, make appointments and reservations, refill prescriptions, and other “life admin” tasks; and Ollie.ai, which creates custom meal plans and grocery lists for busy parents.

2. Next generation marketplaces

While AI has the potential to fully automate certain services, there are many industries where AI would be better suited to route humans to services. We anticipate the rise of a new generation of marketplaces where AI helps users find or access services offered within the marketplace. Additionally, marketplaces may use automation to reduce friction between demand and supply. One example is Indigo, a marketplace that connects home buyers, agents, and sellers and uses AI to streamline document creation for buyer agreements and offers, among other tasks.

3. Social experiences and generative gaming

In the past few years, online games and social experiences have started to converge: online games have become full-fledged social platforms and more and more consumer experiences/products look and feel like games (more on these trends here). Now, as consumers become more accustomed to interacting with AI, we predict that AI will permeate more of these game-like online social experiences.

We think this will set the stage for a wave of UCG-driven products that offer a new level of interactivity for users. Users will be able to more easily auto-generate new worlds through text, image, and/or video (with models like Decart, for example) and interact with both humans and AI. New platforms may start off with just AI interactivity, and then layer in social features over time, as was the case with past waves of gaming.

4. Shopping and product discovery

We anticipate a wave of new companies entering the product search, styling, and fit space that will provide a higher level of accuracy and personalization to consumers compared to what currently exists.

Today, product discovery remains a cumbersome process. Users are often forced to rely on manual filters and sorting options, which are plagued by poorly tagged metadata and other issues. We’re already seeing some companies address these limitations through AI-enabled natural language search.

For instance, our portfolio company Perplexity recently introduced a shopping feature that allows users to conduct product searches through a text interface. Similarly, AI-powered fashion engines like Daydream and Plush are aiming to further streamline the process by delivering context-aware personalization on nuanced search queries.

In addition to text search, we’re also seeing some early multimodal solutions for product discovery. For example, Doji enables users to create AI-generated lookalikes so they can virtually “try-on” products instead of relying on images of models. In stark opposition to static product listings, these experiences are immersive and user-centric, and can provide a truly personal shopping and styling experience as a result.

Companies could take personalized search a step further by making it possible for consumers to create their own products. Currently, RaspberryAI enables fashion designers and brands to create custom clothing designs using generative AI. However, future products could pass on creative control to the consumer. While product creation in this segment is nascent, many AI tools are prioritizing consumer autonomy, and we expect that to inspire shifts in markets like fashion, interior design, and digital content creation.

5. Creation and productivity tools designed for consumers

The creator community is already massive. Twenty-seven million Americans currently identify as creators, according to one survey. With the increasing democratization of consumer products that amplify or substitute skills, we expect the creator community will grow further and markets for prosumer tools will surpass expectations.

One example is text-to-app platforms such as Create.xyz, Bolt and Lovable. Previously, prototyping a software application required domain expertise and a significant time investment. Now, taking an app from idea to reality can happen in minutes regardless of the user’s technical expertise. As the barriers to software development fall, we’ll likely see more people experimenting and building personalized software for personal and professional use cases.

Similarly, the availability of video and audio foundation models (i.e. Moonvalley, Runway, Sora) and AI-driven editing tools (i.e. Kaiber) could reduce the expertise, time, and capital investments typically required to produce television and film from start to finish.

Democratization of tools increases consumer autonomy

Early activity suggests that consumer AI startups will fuel a drastic democratization of tools and services once reserved for professionals and the very wealthy. From building mini-apps without technical expertise to designing clothing to getting professional services via AI, new AI products will give consumers unprecedented autonomy and allow them to access experiences that would otherwise be too expensive, too time-consuming, or require expertise.

We’re looking for companies that are solving existing consumer problems through exceptional AI-driven automation, offering solutions at radically lower price points than non-automated alternatives, and making traditional enterprise software capabilities available to individuals and end users. We’re excited to see this once-in-a-generation consumer era take off, as entrepreneurs are reimagining the ways we all live, play, and connect differently with the power of AI.

If you’re working on an AI application for consumers, we would love to hear from you! Please reach out to someone on our team or sign up for AI insights at bvp.com/ai.