December 2, 2025 6:00pm EST

Speakers: Allie Stephens and Mira Amin

At Bessemer, we believe venture capital thrives in an apprenticeship model. For almost twenty years, we’ve been fortunate enough to bring on three to four bright, ambitious, and aspiring investors each year to join the program as a foray into their careers.

While there are skills and lessons you can learn in school, many elements of venture capital, such as developing investment judgment, sourcing emerging new startups, and refining roadmaps for the future, are uniquely learned on the job by engaging with entrepreneurs and experienced investors.

Analysts typically join our selective, two-year program directly from their undergraduate studies or soon after. The program is based in our New York office, but analysts will collaborate on projects with Bessemer partners across the globe and work with emerging founders and exceptional operators.

Our partners and the broader investing team provide hands-on training to gain the foundational skills for your investing career, mentorship on the art of the industry, and invaluable experience. Our analysts are critical, valuable members of the team; they participate in our weekly partnership meetings and make a tremendous impact on the firm.

Analysts are oftentimes the first touchpoint startup founders have with Bessemer. They play a role that requires an enterprising spirit, empathy, and a deep understanding of what makes a business work under the hood.

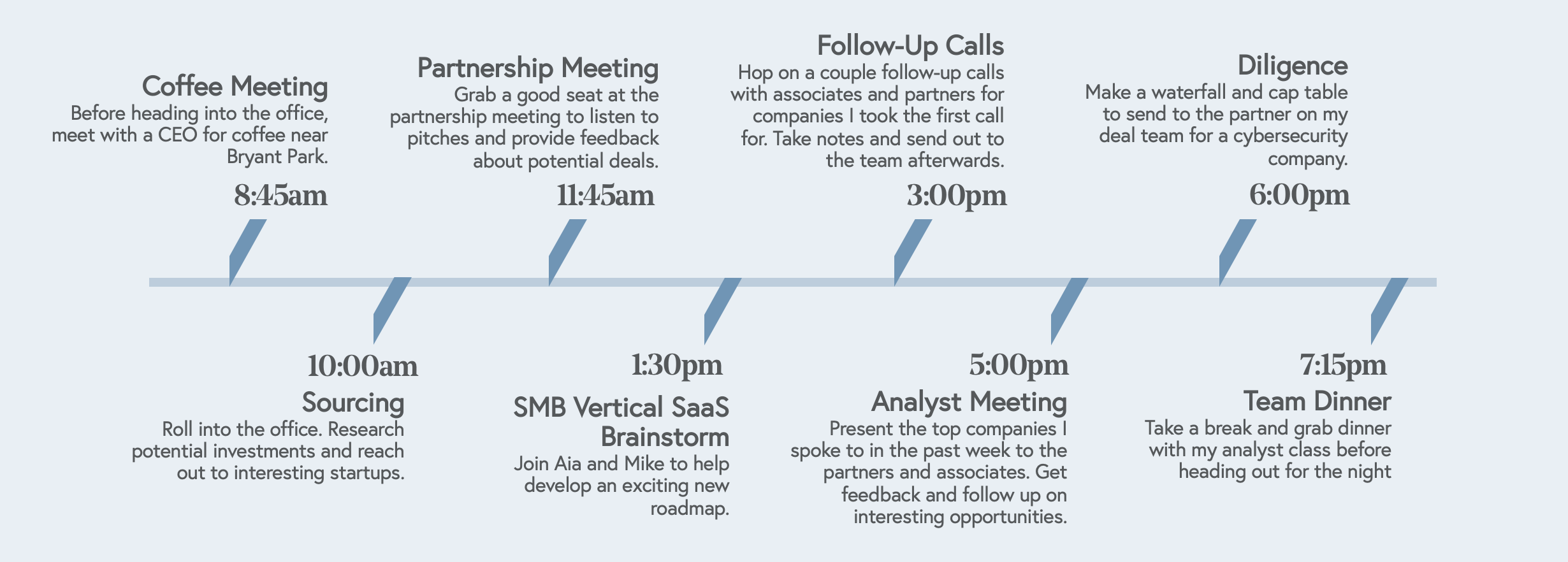

A day in the life of an analyst

Your daily schedule and responsibilities include sourcing new investment opportunities, deep research in the diligence, roadmap, and deal-making processes, and working alongside Bessemer team members to help our portfolio companies flourish. The skills and experience you gain in this program are foundational to your career. Whether you pursue additional opportunities at Bessemer or elsewhere, your Bessemer analyst experience will be formative and open endless possibilities.

We’re excited to announce that applications are now open for our 2027 Summer Analyst positions! We’re seeking talented undergraduate or five-year master’s students expecting to graduate between spring and summer 2028.

Our application process is rolling: applications are reviewed as they come in, and the window will close once we’ve received a sufficient number of strong candidates. Early applications are encouraged for full consideration. Learn more in our info sessions below!

Applications for our 2026 Full-Time Analyst program are now closed. If you’re interested in joining our full-time analyst team down the line, keep an eye out for future openings. Applications for 2027 roles may launch in September 2026 if positions become available. We would be seeking talented students graduating with a bachelor’s degree (or a combined Bachelor/Master’s program) in Winter 2026 or Summer 2027. We look forward to meeting outstanding candidates in the next cycle.

Join us for an engaging recruitment event designed for students and early career professionals interested in venture capital. Hear directly from our team as we share insights into the world of VC, Bessemer’s unique investment strategy, and pathways to success in the industry. Take advantage of this chance to discover career opportunities with a global leader.

Speakers: Allie Stephens and Mira Amin

Speakers: Allie Stephens and Mira Amin

Join us for an exciting event where you’ll gain firsthand insight into the world of venture capital and learn how a global firm approaches investment decisions. The program will begin with an introduction to Bessemer, followed by a live demonstration from our investment team using a “mock founder call.” You’ll also have an opportunity to participate as we evaluate a hypothetical investment together, simulating real-world venture analysis. At the conclusion of the call, students are welcome to stay for a Q&A session about Bessemer, our 10-week Summer Analyst Program, and full-time analyst opportunities.

Speaker: Libbie Frost

Speakers: Darsh Patel and Grace Dai

Join us for an informational session to learn about the exciting analyst opportunities at Bessemer. If you’re looking to discover more about our 2027 analyst programs, this event is for you. During the session, the analyst program manager will provide valuable information about the application timeline, hiring process, and best practices for making your application stand out, followed by a Q&A session. Through this event, we hope that you will gain the knowledge and confidence necessary to feel great upon hitting that submit button on your application. Don’t miss out on this opportunity to set yourself up for success!

Speaker: Allie Stephens

Speaker: Allie Stephens

Keep an eye out for more details and updated dates. We look forward to meeting you and sharing more about what makes Bessemer’s team and analyst experience unique!

We receive a high volume of email requests from students seeking various engagements with Bessemer Venture Partners. While we value your enthusiasm, we unfortunately are unable to accommodate individual internship requests or coffee chats outside of our formal recruiting process at this time. However, if you have questions about our application process, please contact recruiting@bvp.com.

When you join Bessemer’s Analyst Program you become part a close-knit community of investors, experts, and operators who are on the cutting edge of technology and are shaping category-defining companies.

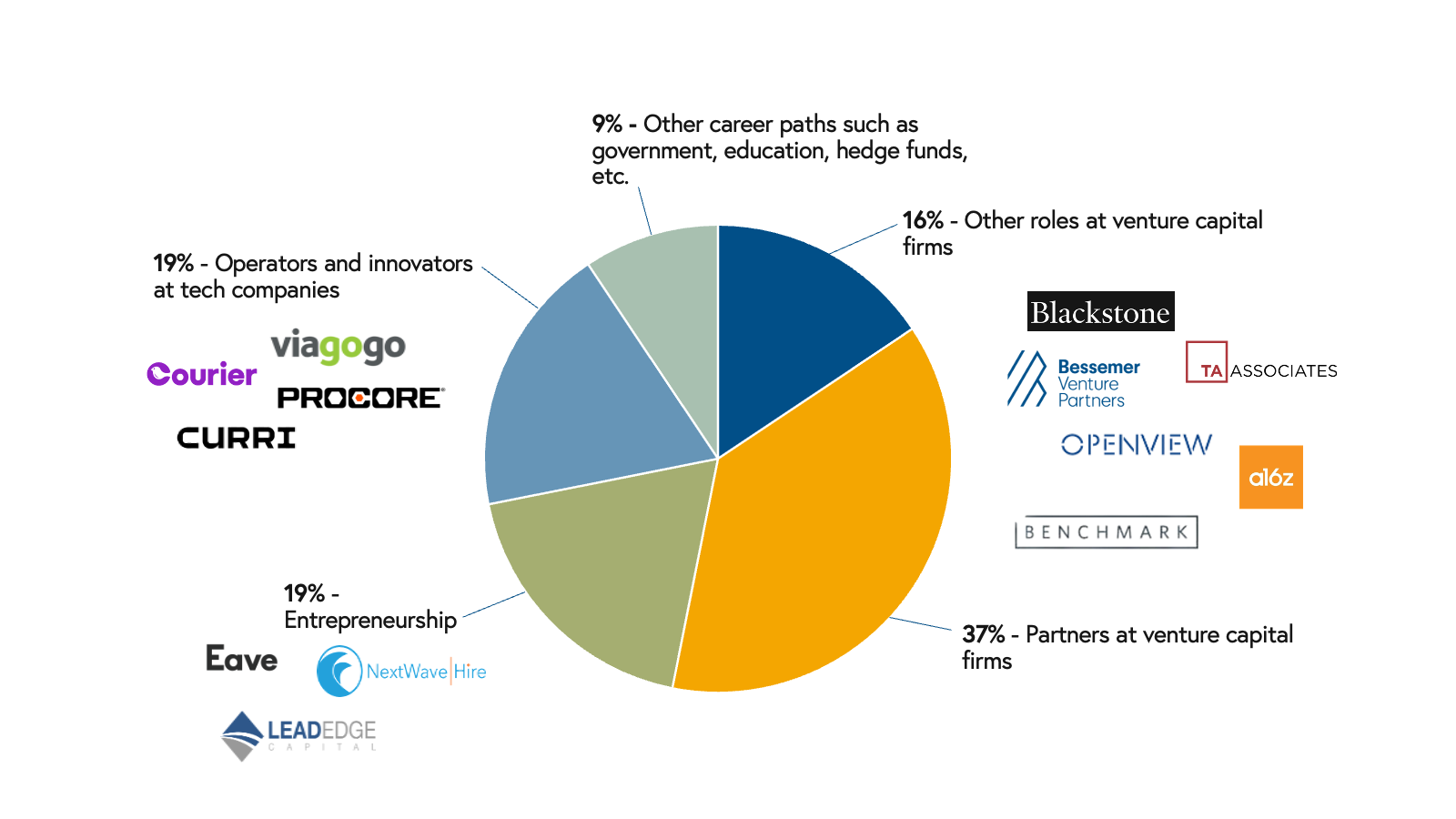

Former analysts have gone on to take senior roles at Bessemer, join later-stage firms in venture and private equity, start their own funds, and join or found startups.

Twitch: Mackey Craven created an Alexa Tracker which helped him source Twitch, the live streaming platform. After a few “near-death” experiences after Twitch pivoted from Justin.TV, the startup eventually saw amazing growth among gamers. By 2014, Twitch was acquired by Amazon for $970 million and positioned itself as a platform where culture thrives and gamers, entertainers, and even politicians continue to congregate.

Truebill: In 2019, after countless attempts to get someone else on the team to join a call, Alexandra Sukin sold Kent Bennett on a meeting with brothers by blood and founders by choice, Haroon and Yahya Mokhtarzada. And after two years of following the company closely before and during the COVID pandemic, Alexandra had deep conviction that Truebill was going to change how consumers thought about their monthly spending. Bessemer invested in Truebill’s Series C and D before the company was acquired by Rocket Companies for $1.275 billion in December 2021.

MindBody: Believing that vertical software could enable small to mid size businesses in the health and wellness space, Brian Feinstein went down the INC 5000, eventually finding this solution for yoga studios, salons, and spas. We first invested in the San Luis Obispo-based company in 2010, and by 2018, MindBody was acquired by Vista Equity. (However, Brian continues to use the tool when booking the occasional workout class!)

Diapers.com: In 2007, Mitchell Green tracked the founding team over the course of nine months and persuaded the Bessemer partnership to pursue e-commerce. Eventually, the parent company changed its name to Quidsi and sold to Amazon for more than half a billion dollars in 2010.

Wikia/Fandom: Once again, known for his tenacity, Mitchell Green cold emailed Jimmy Wales of Wikipedia fame about a dozen times before the founder agreed to host us for a meeting in St. Petersburg, Florida, where he was based at the time. In 2006, Bessemer led the $4 million early-stage investment.

“Bessemer’s analyst program was the perfect training for a career in venture capital. The opportunity to meet with hundreds of startups across a variety of stages and sectors provided an extraordinary breadth of knowledge and pattern recognition. This was the foundation upon which the rest of my career at Bessemer was built.”

“My time in the program helped me develop foundational investor skills from sourcing to diligence to supporting portfolio companies. But most importantly, it helped me hone my intuition. The funny thing about venture capital is that it is full of paradoxes. It’s comprised of exceptions and outliers yet pattern recognition is critical. I’m constantly trying to strike a balance between being opportunistic and being roadmap driven.”

“The program is a great opportunity to gain a holistic education on the fundamentals of tech startups—things like team building, product strategy, and go-to-market approaches. Having since moved into an operating role at a portfolio company, I’ve found that examining top performing startups as an analyst has given me insight on best practices across a range of business functions and the tools to implement them.”

“The Bessemer Analyst Program was the perfect launchpad for my career in the startup world. I learned the fundamentals of what makes companies valuable and how to think strategically about growth. What makes BVP unique is a track record and culture with a lineage that dates back to the very inception of venture capital, and an exceptionally thoughtful process for developing perspectives and newly shaping markets — from SaaS to frontier technology.”

“There is truly no better place to gain this hands-on experience than at Bessemer – I had immense ownership and autonomy in my work while also getting mentored by and working closely with some of the best partners in the venture world. And as I’ve gone on to work in other sectors and other roles, I have realized that it’s the “intangibles” I gained at Bessemer – the hustle, the judgment, the first principles thinking – that have continued to serve me really well.”

“A lot of what I learned to do is how to take calculated risks, how to assess risk,” she explains to the Wall Street Journal. “If there’s high risk but the reward is high, it might be worth it…What is the risk-reward of being patient versus being aggressive? That’s something I definitely take with me.”